Monthly Archives: March 2023

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“If we are lucky, the next Fed-caused downturn will cause only a resurgence of 1970s-style stagflation. The more likely scenario is the type of widespread economic chaos not seen in America since the Great Depression. The growth of cultural Marxism, the widespread entitlement mentality, and the willingness of partisans of various sides to use force against their political opponents suggests that this economic crisis will result in civil unrest that will be used to justify new crackdowns on individual liberty. Those who understand the causes of, and cures for, our current predicament have two responsibilities. First, prepare a plan to protect your family when the crisis occurs. Second, do all you can to spread the truth in hopes the liberty movement reaches critical mass so it can force Congress to make the changes necessary to avert disaster. Since the crisis will result in a rejection of the dollar’s world reserve currency status, individuals should consider alternatives such as gold and other precious metals.”

Dr. Ron Paul

Former Texas Congressman and candidate for president

Ron Paul Institute for Peace and Prosperity

Septermber 2018

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

The Fed’s trillion-dollar bridge to nowhere

The Hill/Andrew T. Levin/3-6-2023

USAGOLD note: An appropriate characterization …… Andrew Levin, an analyst with the Hoover Institution, says QE will end up costing taxpayers nearly $800 billion. (You can check out anytime you want but you can never leave.)

Inflation has yet to peak in most G-10 countries and ‘we are waiting for a proper market reality check’: BofA

MarketWatch/Vivien Lou Chen/3-3-2023

USAGOLD note: And it may require a new approach to investing, according to BoA. At some point, as we have said in the past, markets will need to adjust to the inflation reality and abandon the wishful thinking. The genie, as we all know, is difficult to get back in the bottle once its out.

Here’s why experts say Russia and China’s attempts to ‘de-dollarize’ global markets are going nowhere

MarketsInsider/Jennifer Sor/3-6-2023

“Russia’s attempts to combat the supremacy of the US dollar are unlikely to work, experts say, even as the country cozies up to China in a move to challenge the greenback with an alternative reserve currency.”

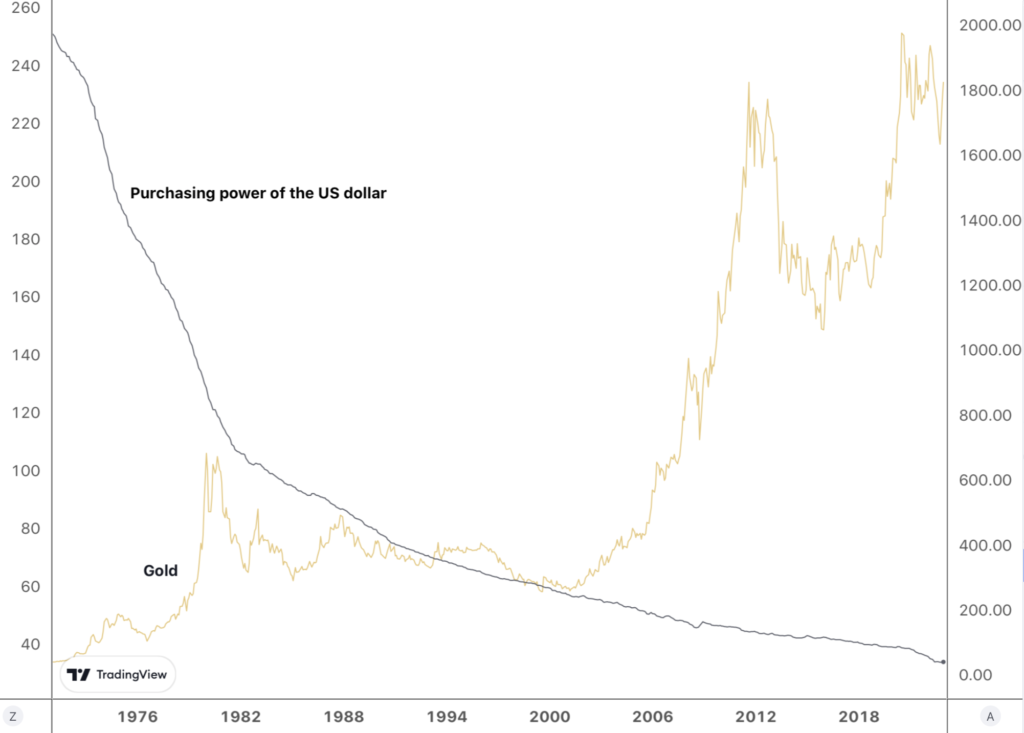

USAGOLD note: As our regular readers already know, we agree with this assessment, i.e., de-dollarization is going nowhere. That however is not the key issue for the average investor. The real problem is the constant depreciation of the dollar against goods and services over the long run. That needs to be properly hedged and that is what gold investors have accomplished since the gold and the dollar de-linked in 1971.

Gold and the purchasing power of the dollar

(1971-2022)

Chart courtesy of TradingView.com • • • Click to enlarge

Stocks aren’t the inflation hedge you think they are

Bloomberg/Merryn Somerset Webb/3-6-2023

“The truth is, says the latest Credit Suisse Global Investment Returns (a must-read for City people), is that once inflation reaches 8%, and is front and center in the minds of all price-setters and wage negotiators, it takes multiple years to revert to target. Thinking anything else is ‘overly optimistic.’ So, with inflation near or above 8% in a large number of developed countries, what is an investor to do?”

USAGOLD note: Somerset Web finds that stocks are a good hedge when inflation is low (4% or lower), but a bad hedge when it is high.

Daily Gold Market Report

Gold posts solid gains on bank crisis, rescue plan

Deutschebank’s Saravelos calls Fed plan a ‘new form of quantitative easing’

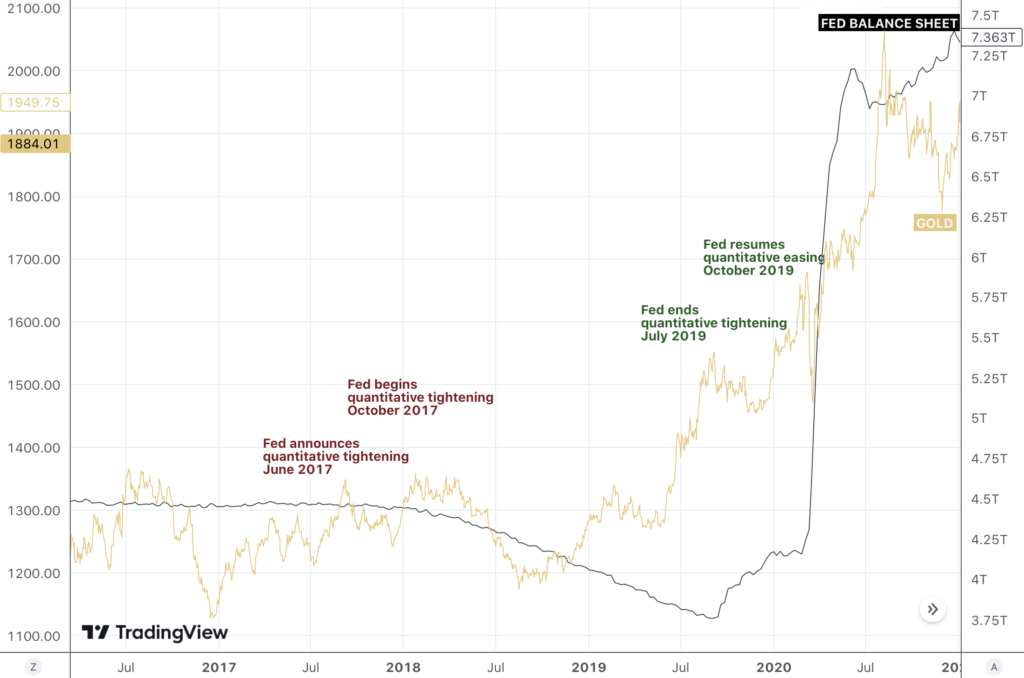

(USAGOLD –3/13/2023) – Gold posted solid gains for the second straight trading session as the Fed provided massive liquidity to ailing banks in an effort to forestall a system-wide bank crisis. It is up $30 at $1900. Silver is up 83¢ at $21.45. Deutschebank’s George Saravelos called the rescue a “new form of quantitative easing” in a Financial Times article this morning. In addition to the sudden injection of liquidity, gold is also reacting to the prospect of a rate pivot coming back into play. At the very least, it would be difficult to envision the FOMC raising rates under these conditions. It will take some time for the markets to fully sort out the implications of what the central bank and federal government put into play over the weekend,* but gold market analysts might look to the 2019 reinstatement of quantitative easing for guidance. (See chart below.)

“If the Fed is now backstopping anyone facing asset/rates pain,” says Rabobank’s Michael Every in a Bloomberg article this morning, “then they are de facto allowing a massive easing of financial conditions as well as soaring moral hazard. The market implications are that the US curve may bull steepen on the view that the Fed will soon actively pivot to line up its 1-year BTFP loans with where Fed funds rates then end up; or it may bear steepen if people think the Fed will allow inflation to get stickier with its actions.”

“So, if I have this right, the Fed will make loans on some of the collateral at a par valuation that is worth 40 percent less. Yikes.” – Jeffrey Gundlach, DoublieLine Capital

“More banks will likely fail despite the intervention, but we now have a clear roadmap for how the govt will manage them.” – Bill Ackman, Pershing Square

*Statement issued by the Federal Reserve Board of Governors yesterday.

Gold price and Fed balance sheet

(2016-2021)

Chart courtesy of TradingView.com • • • Annotations by USAGOLD • • • Click to enlarge

Larry Summers: US economy could hit an ‘air pocket’ in the coming months

CNNBusiness/Alicia Wallace/3-6-2023

USAGOLD note: Summers sticks with his recession call. “Hope for the best but plan for the worst, I think is the right advice,” says Summers.

Something ‘catastrophic’ could occur if US defaults even briefly

themarketNZZ/Christoper Gisinger interview of economist Megan Greene/3-3-2023

“So far financial markets have remained calm because a last-minute deal has always emerged to lift the debt ceiling. But default is now a much greater possibility.” – Megan Greene, Financial Times columnist

USAGOLD note: Polarized politics make a default possible, says Greene. She also spends considerable time on inflation and Fed policy.

The Russia-Ukraine war remapped the world’s energy supplies, putting the U.S. at the top for years to come

USAGOLD note: An unexpected benefit as long as it lasts……

Daily Gold Market Report

Gold turns sharply higher on unemployment report, sudden bank collapse

‘Gold doesn’t need a crisis to move higher, but it definitely loves a crisis.’

(USAGOLD – 3/10/2023) – Gold turned sharply to the upside after the Labor Department reported higher-than-expected unemployment. It is up $20 at $1852. Silver is up 50¢ at $20.64. The metals are also getting a boost from the sudden collapse of one California bank (SVB) and the potential collapse of another (SVB Financial Group). The banks’ problems were brought on, says Bloomberg, by holdings of “low-interest bonds that can’t be sold in a hurry without losses. So if too many customers tap their deposits at once, it risks a vicious cycle.” (In other words, a classic bank run.) “The faster you raise interest rates,” says Capitalight Research’s Chantelle Schieven in a recent Kitco News interview, “the faster something is going to give, that something is going to break. Gold doesn’t need a crisis to move higher, but it definitely loves a crisis.”

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Such moves would signal the beginning of the very last and most disruptive stage of the long-term debt cycle. So, watch central bankers’ actions – i.e., see if they increase their bond buying when interest rates are rising led by long-term interest rates and when the markets and economy are strong – because that action would signal that they are experiencing supply/demand problems. Also, watch the rates of change in the injections of these stimulants in relation to the effects they are having on the economy’s vigor because the more stimulants that are being applied per unit of growth, the less effective they are and the more serious the situation is. I know this all sounds crazy to you. It sounds pretty crazy to me, too. However, I have seen this confluence of circumstances leading to this sort of dynamic many times in my study of markets and economies over the last several hundred years and I experienced this dynamic myself (in 1970-80).”

Ray Dalio

Bridgewater Securities

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Argentina diary: ‘Come armed with $100 bills’

Financial Times/Harriet Agnew/3-4-2023

“‘Holding the local currency in an economy experiencing rapid inflation is rather like trying to descend an ascending escalator, or as Agustín Arias, owner of one of the country’s oldest estancias, El Bordo de las Lanzas near Salta in the north, puts it: ‘the prices go up in the lift and the salaries go up the stairs’.”

USAGOLD note: How to survive financially in a country where the inflation rate is almost 100%……The benjy is king.

Argentina Inflation Rate

(%, annualized)

Chart courtesy of TradingEconomics.com

Powell to talk to Congress about the possibility of more interest-rate hikes, not fewer

MarketWatch/Greg Robb/3-4-2023

USAGOLD note: The Fed chairman might hope to bring some clarity to the rate picture, but it is likely to be a rough week for markets. He testifies before the Senate on Tuesday and the House on Wednesday.

Roubini doubles down on crises warning

MarketsInsider/Jennifer Sor/3-3-2023

USAGOLD note: In this same interview with Australia ABC, Roubini urges investors to protect themselves by choosing gold and other inflation hedges.

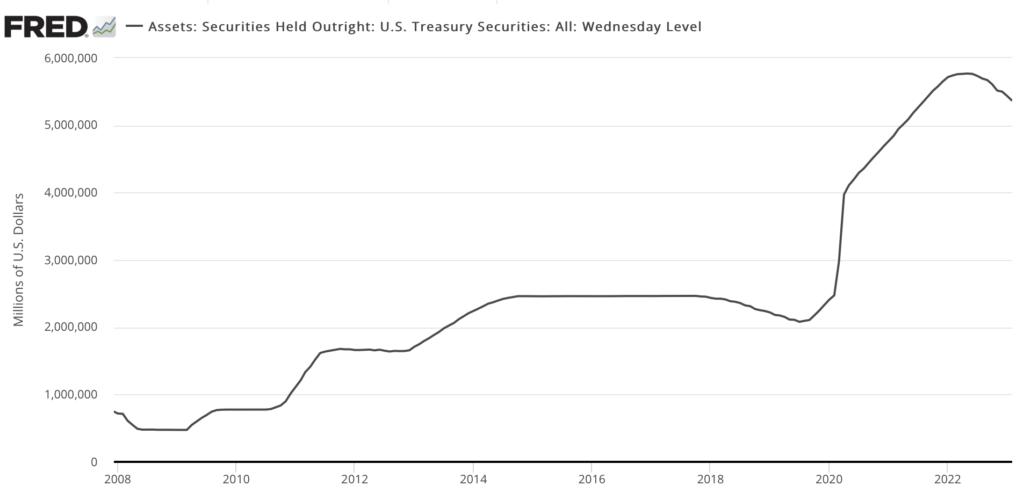

‘Tiny ticking time bombs’ threaten market – Art Cashin

MarketsInsider/Filip DeMott/3-3-2023

“The Fed has stopped being an aggressive buyer of US Treasuries. And if the Japanese people stop being an aggressive buyer, that’s going to force rates and yields higher too,.” – Art Cashin

USAGOLD note: With attention riveted on rates, Cashin says people are overlooking the problems posed by the Fed’s ongoing quantitative tightening program.

US Treasury securities held by the Federal Reserve

Sources: St. Louis Federal Reserve [FRED], Board of Governors of the Federal Reserve System (US)

Daily Gold Market Report

Gold edges higher as investors digest sustained tightening, financial headwinds

The rate deterrent no one is talking about

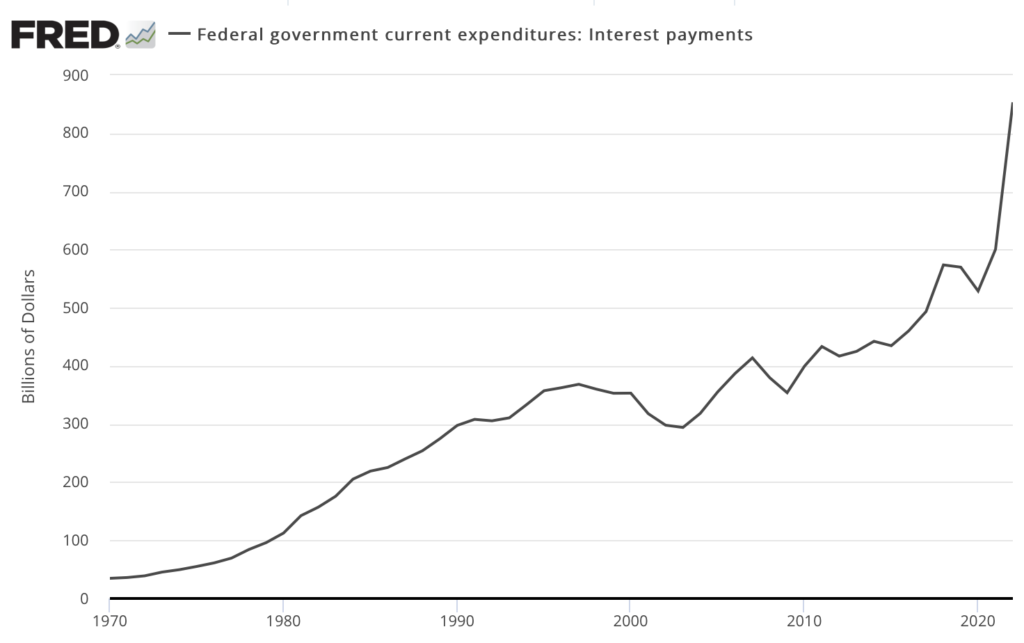

(USAGOLD – 3/9/2023) – Gold edged higher as investors continued to digest the prospect of sustained monetary tightening and accompanying financial headwinds. It is up $4.50 at $1821. Silver is up 8¢ at $20.18. Gold Newsletter’s Brien Lundin believes there is a major deterrent to sustained Fed tightening, and it is one that does not get a lot of attention.

“[We will] be paying over $1.75 trillion in interest costs on the federal debt if rates get into the range now being forecast (5.5%),” he points out in a recent advisory. “I don’t think it will happen, because it can’t. And I’m amazed that no one else is talking about this right now. Regardless, they’ll find out soon enough. With the latest official estimates of federal interest expenses at a breathtaking $852 billion, we’re going to cross the $1 trillion threshold very soon. I think that’s going to make headlines. When it does, it will illustrate the trap the Fed is in, and I think metals prices will begin to rise even before this happens.” [Source: Gold Newsletter]

Interest paid on the national debt

(Annual)

Sources: St. Louis Federal Reserve, U.S. Bureau of Economic Analysis

Client Testimonial

“Thank you! It has been a pleasure doing business with your Company! You’ve treated the small investor (me) just like you would a millionaire. Best wishes, and I hope I can make some purchases in the future.” – L.W., Savannah, Georgia

We also treat millionaires . . . well. . . like millionaires – whether they admit to being millionaires or not [smile].

We receive unsolicited testimonials like L.W.’s routinely. Please see our Client Testimonials page for more feedback, and be sure to visit the Better Business Bureau for even more in the way of FIVE-STAR reviews. Don’t do business with any gold company until you have checked it out.

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Interested in gold but struggling to find the right firm?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Only 37% have a positive view of the Fed

Gallup Poll/Jeffrey M. Jones/10-5-2022

USAGOLD note: This is an older Gallup Poll from October of last year we thought worth passing along. Only 37% of Americans believe that the Fed is doing a good job.

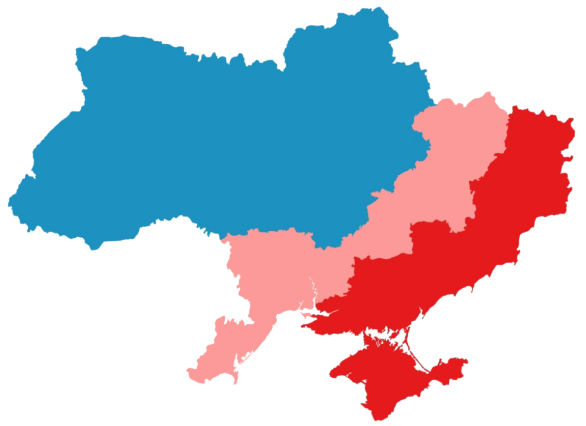

Expect Russia’s war in Ukraine to continue into 2024, with higher prices for oil, gas

MarketWatch/Rhys Williams/2-24-2023

USAGOLD note: Eight insights on how the war in Ukraine might impact the global economy in the future. Of particular interest is his prediction of a “Korea like frozen border” wherein “Russia keeps the Russian-leaning part of the Donbas, and the remaining part of Ukraine is allowed to join NATO and the EU.” With intractable resistance on both sides, he doesn’t see that happening though until well into 2024.

_________________

Map attribution: Daeva Trạc, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>, via Wikimedia Commons

Sleepwalking toward accidental conflict

Project Syndicate/Stephen S. Roach/2-27-2023

“With war raging in Ukraine and a cold-war mentality gripping the United States and China, there can be no mistaking the historical parallels [with World War I]. The world is simmering with conflict and resentment. All that is missing is a triggering event. With tensions in Taiwan, the South China Sea, and Ukraine, there are plenty of possible sparks to worry about.”

USAGOLD note: Roach says the three great powers (America, China and Russia) are “afflicted by a profound sense of historical amnesia.” From an investment standpoint, the main difficulty is assessing how the economy will be affected and how to position one’s portfolio to weather a geopolitical meltdown. Gold has always been a good thing to own in wartime.