Monthly Archives: March 2023

Inflation will remain high in volatile markets, warns hedge fund chief

Financial Times/Laurence Fletcher/3-2-2023

USAGOLD note: Another warning of persistent inflation, this time from Man Group’s Luke Ellis. “It will take a lot of years,” says Ellis, “before inflation is put to bed again. We’re in a different paradigm.”

Daily Gold Market Report

Gold drifts sideways after yesterday’s Fed-inspired cross-markets rout

‘Gold is often highly sought after in periods of economic and financial uncertainty’

(USAGOLD – 3-8-2023) – Gold drifted sideways this morning as it attempted to regain its footing after yesterday’s Fed-inspired, cross-markets rout. It is level at $1816. Silver is up 2¢ at $20.16. Markets have been in a quandary as to how the Fed would respond to the recent run of robust economic data. Fed chairman Powell put an end to the speculation yesterday, promising an aggressive policy to fight inflation. In an analysis released this morning, Wisdom Tree, the Dublin-based investment firm, warns of headwinds for gold but reminds us that those same headwinds create the need for a safe haven.

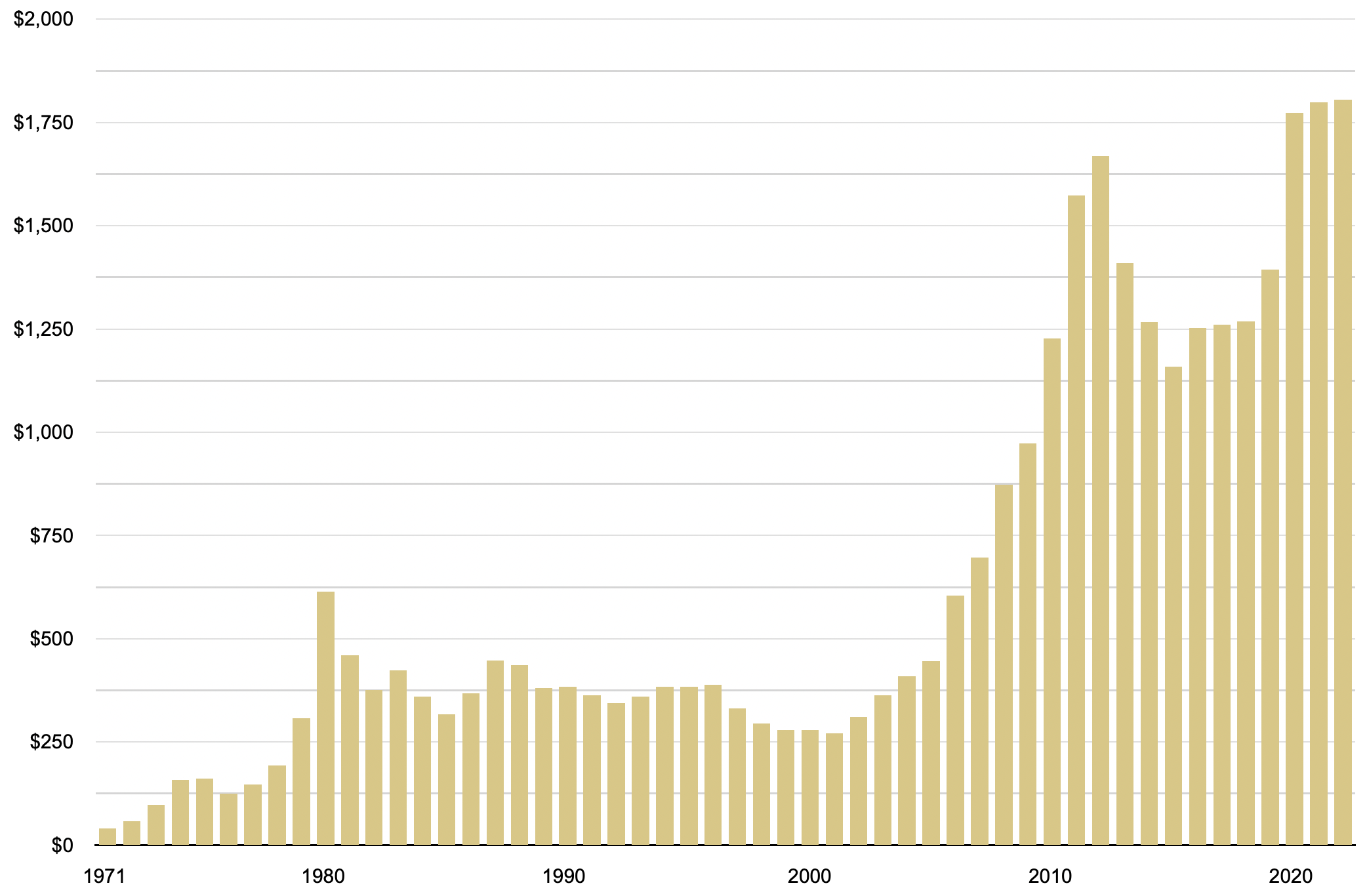

Gold average annual price

(1971-2022)

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“There are certainly forms of instability that have been introduced by algorithmic trading that will increase as we put more and more faith in these algorithms. The February 2018 flash crash was instructive. The culprit was a slightly esoteric exchange-traded product that has a rebalancing mechanism inside of it. And that rebalancing mechanism ended up destroying the product on one specific day when the market moved a little bit more than the product was designed to handle. The product was required to trade a lot of instruments in response to that move. But then those trades exaggerated a small move and it became a big move, which required more rebalancing—and everything spiraled out of control.”

Anonymous algo-trader

LOGIC

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Greenlight’s David Einhorn says he’s still ‘bearish on stocks and bullish on inflation’

MarketWatch/Joseph Adinolfi/3-1-2023

USAGOLD note: Einhorn is a long-time advocate of gold ownership……

Wall Street traders have lost much of their swagger

Bloomberg/Aaron Brown/3-1-2023

USAGOLD note: Brown bases his conclusions on a study of market traders conducted by the New York Fed, USC, and the University College of London. “[T]he trading community no longer has the strength to make fearless bets.” One wonders if the same shift has occurred among retail day traders.

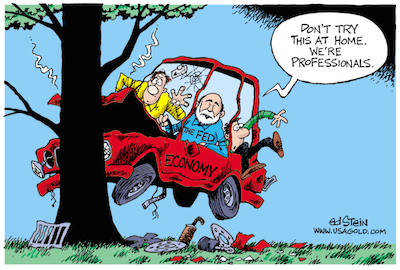

Fed’s credibility can’t take a soft landing

Bloomberg/Allison Schräger/3-1-2023

USAGOLD note: We are in the group that never really understood the value of inflation targeting. One wonders if the Fed puts much stock in it at this juncture as well. The measures required to bring inflation to target would throw the economy into financial and economic depression, so what’s the point of even discussing it?

Events of 2022 throw cold water on irrational exuberance

Financial Times/ Terry Duffy/3-1-2023

USAGOLD note: Words of wisdom from the CEO of CME Group.…… He sees a “whirlwind of geopolitical and economic hurdles” ahead and that expecting and planning for the unexpected could be “the differentiator” for investors.

Daily Gold Market Report

Gold trades marginally to the downside ahead of Powell testimony

‘High stakes’ testimony begins later today

(USAGOLD – 3/7/2023) – Gold traded marginally to the downside this morning as markets took to the sidelines ahead of Fed Chairman Powell’s two-day Congressional testimony beginning today. It is down $6 at $1843. Silver is down 15¢ at $20.97. This morning’s Financial Times characterized Powell’s testimony as “high-stakes” and his first public appearance since data releases “showed the central bank is still struggling to cool the US economy despite its year-long campaign of monetary tightening.” We should know more before the day is out, but for now, gold (and financial markets in general) looks to be on hold – albeit a wobbly hold.

The markets are alive with the sound of echo bubbles

Financial Times/Ruchir Sharma/2-27-2023

USAGOLD note: Some well-conceived, down-to-earth advice for stock investors from the chair of Rockefeller International……

The myth of the inevitable rise of the petroyuan

Bloomberg/Janier Bias/2-26-2023

“If you believe in conspiracy theories, the introduction of a petroyuan, and the ensuing collapse of the petrodollar, would be a first domino, potentially weakening the whole US financial system. Very serious stuff. A redrawing of the global economic map. The backdrop to crisis and wars. Astonishing as it is, the narrative is an illusion.”

USAGOLD note: An argument similar to our own made several times on this page. It’s the difference between sayin’ and doin’ and we are a long way off from the doin’– at least on any appreciable scale.

Here are four reasons to be wary of holding cash

MarketsInsider/Carla Mozee/2-26-2023

“Cash is no longer trash as its appeal grows with yields spiking and this year’s stock rally losing steam, but there are reasons for investors to be careful about shoving the bulk of their funds into that asset class, said one veteran market strategist.”

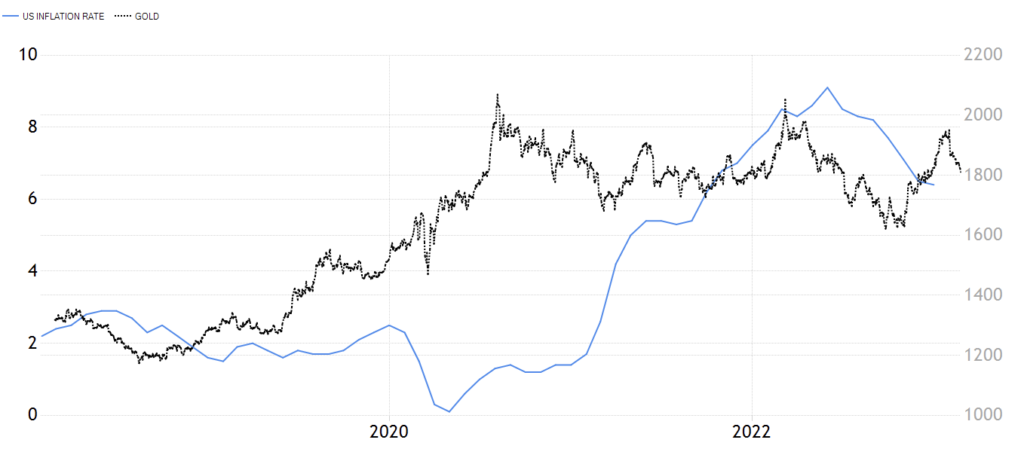

USAGOLD note: Most investors recognize cash’s vulnerability to inflation. RIverfront’s Sandler recommends stocks but is that a prudent alternative at a time when top-notch analysts are predicting a 30% (and in some cases more) decline from present levels? Traditionally, investors have turned to gold in an inflationary economy. It is routinely overlooked that since inflation achieved liftoff in mid-2020, gold has gone from the $1680 level to the $1800 level now (+7%) with a brief stop on two occasions near $2100. Over the same period, inflation has gone from zero percent to 6.4% now. (See chart below.) In short, gold thus far has kept pace with inflation. Note too, that gold may have anticipated inflation with its sharp rise from 2019 to August of 2020.

Gold and inflation

Chart courtesy of Trading Economics.com

The real impact of Russia’s invasion of Ukraine on commodities

MarketWatch/Myra Saefong/2-24-2023

“’Russia is a key supplier of many major commodities, but supply issues weren’t quite as catastrophic as some had expected following its invasion of Ukraine a year ago.”

USAGOLD note: A quick update on why commodities two-year upturn lost momentum from Marketwatch’s gold and oil specialist……

Goldman Sachs Commodities Index

Chart courtesy of TradingView.com

Daily Gold Market Report

Gold trades cautiously to the downside in follow-up to last week’s strong showing

Commerzbank thinks gold might have bottomed

(USAGOLD –3/6/2023) – Gold traded cautiously to the downside this morning in the follow-up to last week’s strong showing. It is down $6 at $1853. Silver is down 16¢ at $21.18. Germany’s Commerzbank sees last week’s rally as an indicator gold may have bottomed. “By the end of the month,” says the bank, “the expected rate peak had been pushed back into the autumn – what is more, it is now set to total almost 5.5%, which is around 70 bps higher than envisaged at the start of the month. Moreover, there is no longer any expectation of rate cuts this year. The price increase seen [last] week despite even higher interest rate expectations could indicate that the correction of the gold price is more or less complete and that the price may have bottomed out at the beginning of the week.” (Source: FXStreet)

Gold price

(Five days)

Chart courtesy of TradingView.com

Record-breaking global bond rally crumbles as fresh inflation fears grip investors

Financial Times/Kate Duguid, Harriet Clarfelt and George Steer/2-26-2023

“The record-breaking global bond market rally since the start of this year has fizzled out as mounting signs of persistent inflation force investors to reverse their views on the likely future path of interest rate rises.”

USAGOLD note: Adjusting to the “new” New Reality………

iShares 20+ Year Treasury Bond ETF (TLT)

Chart courtesy of TradingView.com

‘Bond King’ Jeffrey Gundlach warns against trying to prevent a downturn

MarketsInsider/Theron Mohamed/2-22-2023

USAGOLD note: Always good to stay abreast Gundlach’s thinking……… This article includes ten direct quotes from the widely-followed hedge fund manager. Preventing a downturn, he says, can result in something even worse down the road. On the hard landing, soft landing, no landing debate he offers some down home advice: “It won’t matter if it’s raining a half an inch an hour, or raining two inches an hour — in either case you need an umbrella.”

The guessing game: Ben Bernanke’s 21st century monetary policy

RealClearMarkets/CJ Maloney/2-24-2023

USAGOLD note: Bernanke’s legacy lives on at the Federal Reserve today – for better or worse. History will be the judge – particularly on his most enduring and far-reaching contribution, quantitative easing. Maloney takes a deep dive into the Bernanke Fed – and the impact it had then and now. Commenting on the Bernanke Fed, Jerome Powell said, “We crossed a lot of red lines that had not been crossed before.”

A number of inflationary forces will remain in place for a long time

themarketNZZ/Mark Dittli/2-23-2023

USAGOLD note: We haven’t heard much from William White in recent months. In this interview, The former chief economist at the Bank for International Settlements, brings us up to date on his thinking warning that the stakes are high for central banks. He asks: “What if all of a sudden citizens become convinced that the government is not delivering on its promises? Where does that lead in terms of democracy and faith in the system?”

Daily Gold Market Report

Gold pushes to higher ground looking to close out solid first week of March

China adds another 15 tonnes to its reserve holdings in January

(USAGOLD –3-3-2023) – Gold pushed to higher ground this morning as it looks to close out a solid first week of March. It is up $12 at $1850. Silver is up 18¢ at $21.16. It will surprise some to know that gold is up $40 (+1.9%) since Monday; silver is up 41¢ (+2.2%). Central banks picked up where they left off last year, adding more gold to their coffers in January. According to the World Gold Council, China added another 15 tonnes, while Turkey bought 23 tonnes. Societe General, the French bank, sees 2023 “as the beginning of the end to US dollar strength” and advises its clientele to continue “rebalancing” out of the dollar and into gold. “Gold,” it says, “will be a powerful protection against a falling USD.” (Source: FX Street)

US Dollar Index and Gold

(2000-present)

Chart courtesy of TradingView.com • • • Click to enlarge

The world’s most painful trade is finally ending as dollar peaks

Bloomberg/Ruth Carson/2-23-2023

“Investors say the dollar is on the way down because the bulk of Federal Reserve rate increases is over, and virtually every other currency will strengthen as their central banks keep tightening.”

USAGOLD note: If true, a declining dollar would likely be good for gold.

The Fed alone cannot bring inflation down

Financial Times/Claudia Sahm/2-23-2023

“Management of demand is not efficient in dealing with supply-driven price rises: fiscal policy must play its part.”

USAGOLD note: Sahm’s recommendations amount to more Keynesian sleight of hand and government intervention in the economy, as if the distortions already caused by these sorts of policies were not enough. We are reminded of Keynes’ comment towards the end of his life: “I find myself more and more relying for a solution of our problems on the invisible hand which I tried to eject from economic thinking twenty years ago.”