Monthly Archives: March 2023

The Silicon Valley Bank crisis will force the Fed to slash rates by 100 basis points to prevent contagion, market guru says

MarketsInsider/Filip DeMott/3-10-2023

USAGOLD note: The opinion shall rain from the heavens…… MacDonald sees the Fed dealing with a crisis “across the entire ecosystem” of its own making.

‘Time to buy gold’: Tucker Carlson reacts to ‘second biggest’ bank failure in American history

Daily Caller/Harold Hutchinson/3-11-2023

“Fox News host Tucker Carlson said Friday that the collapse of Silicon Valley Bank was similar to a ‘bank run’ from 1929 and the collapse of the cryptocurrency exchange FTX.…’What it means is it could be time to buy gold and stockpile food.'”

USAGOLD note: The blunt, widely followed Mr. Carlson makes his views known…… He points out that the biggest banks lost $50 billion in market value after SVB’s collapse on Friday – a blow to those who hope further damage might be confined to smaller, regional banks.

Daily Gold Market Report

Gold vaults over $2000 mark in overnight trading, then reverses

Follow up to biggest single-day gain in recent memory

(USAGOLD – 3/20/2023) – Gold vaulted over the $2000 mark in overnight trading, reversed course back below $2000, and is now down $6.50 on the day at $1985. Silver is down 14¢ at $22.55. The overnight volatility followed on the heels of the Swiss National Bank’s controversial bailout of Credit Suisse and the announcement of new joint central bank measures to ease liquidity pressure on the international banking system. Gold is coming off its biggest single-day gain in recent memory (+$69) on Friday. On the week, it was up 6.75%; silver was up 10.7%.

“The Fed is broke,” says Wall Street notable Jeffrey Gundlach.”The Fed’s balance sheet is negative $1.1 trillion. There’s nothing they can do to fight any problems except for printing money.” He warns of a dollar collapse. “I think gold is a good long-term hold,” he adds, “gold and other real assets with true value, such as land, gold and collectibles.” [Source: Zero Hedge]

Gold and silver price performances

(%, 5-day)

Chart courtesy of TradingView.com • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“If we observe the empires of the world that have existed over the millennia, we see a consistent history of collapse without renewal. Whether we’re looking at the Roman Empire, the Ottoman Empire, the Spanish Empire, or any other that’s existed at one time, history is remarkably consistent: The decline and fall of any empire never reverses itself; nor does the empire return, once it’s fallen.”

Jeff Thomas

International Man

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

SVB’s collapse is what happens when an ‘everything bubble’ finally bursts

Markets Iinsider/Jennifer Sor/3-12-2023

USAGOLD note: The problem with the “everything bubble” bursting is there is no is nowhere to turn, unless, of course, one understands the logic of safe haven portfolio insurance. This article does a good job of the depth of the problem confronting investors featuring insights from Deutschebank.

‘Things tend to break’ when Fed gets aggressive

MarketWatch/William Watts/3-10-2023

“Analysts played down the threat to the U.S. banking system after the collapse of a regional lender Friday, but the failure of Silicon Valley Bank served to underline longstanding worries that the Federal Reserve’s aggressive series of interest rate hikes will eventually cause something in the world’s financial plumbing to break.”

USAGOLD note 1: We recall Jeffrey Gundlach’s warning about a year ago that the Fed will raise rates “until something breaks.” Well, it seems something has broken and the problem is systemic. The only question is what the will Fed do now.

USAGOLD note 2: In Friday’s Daily Gold Market Report, we posted an observation from Capitalight Research’s Chantelle Schieven made during a Kitco News interview before SVB’s collapse. “The faster you raise interest rates, the faster something is going to give, that something is going to break. Gold doesn’t need a crisis to move higher, but it definitely loves a crisis.” The metal gained $38 in Friday’s trading to close at $1870, as safe haven buyers returned to the market.

Silicon Valley Bank’s failure shines light on dangers lurking in higher interest rates

Financial Times/Brooke Masters/3-11-2023

USAGOLD note: A new and different kind of contagion……Instead of one bank creating a domino effect, we have a set of circumstances that could bring down any number of banks. The problem is ongoing, widespread, and difficult, if not impossible, to manage – a rate-driven sword of Damocles hanging over the banking system. Bloomberg reports that the FDIC warned last week that it is “a $620 billion risk lurking in the US financial system.”

The inflation picture get’s murkier

Project Syndicate/Jim O-Neill/3-9-2023

Daily Gold Market Report

Gold bolts higher as worry about the banking system persists

JP Morgan warns that the new Fed rescue package could carry a $2 trillion price tag

(USAGOLD – 3/17/2023) – Gold bolted higher in early trading as worry about the banking system persisted, and Wall Street braced for today’s $2.7 trillion in option expirations. It is up $24 at $1946. Silver is up 27¢ at $22.05. Bill Ackman, the well-known hedge fund manager, said that a $30 billion rescue package for First Republic thrown together by top Wall Street banks yesterday provided a “false sense of confidence” and “raised more questions than it answered.” He added that he is extremely concerned about a “financial contagion spinning out of the Fed’s control.” [Source: Bloomberg]

In something of a shocker, JP Morgan warned yesterday that the Fed may end up pumping as much as $2 trillion into the US banking system through its new Bank Term Funding Program. Degussa, the Swiss refiner, sounded the alarm about the new rescue package in a client advisory released this morning:

“How would the markets react to a sudden and enormous increase in central bank money pumped into the banking system and the Fed’s balance sheet expanding like never before? How will people react when the Fed cuts interest rates to prop up the banking system despite elevated inflation? And suppose confidence in the greenback, the world’s reserve currency, dwindles. What will happen to all the currencies essentially built on the US dollar?”

“It is high time to realize that the fiat US dollar monetary system faces tremendous challenges and that the risks of higher inflation and/or creditor defaults are increasing. Granted, this is an uncomfortable truth. However, holding at least some physical gold and silver is one possible solution to protect one’s portfolio from the vagaries of a fiat money system spiraling out of control.”

Stocks may crash 30% in 60 days as Americans run short of cash and investors jump ship, a markets guru says

MarketsInsider/Theron Mohamed/3-9-2023

USAGOLD note: MacDonald is the editor of “The Bear Trap Report.” He says there are “massive cracks” below the surface of the economy.

Powell’s comments unleash unsettling volatility

Economic Times/Mohamed A El-Erian/3-8-2023

“It really shouldn’t be this way, and it doesn’t need to be. Yet once again remarks by Federal Reserve Chair Jerome Powell fueled considerable volatility in markets that could risk both economic well-being and financial stability. It’s a phenomenon that not only highlights repeated policy slippages but also the lack of important structural and strategic underpinnings at the Fed.”

USAGOLD note: El-Erian has become a lead critic of the Powell Federal Reserve. In his view, the Fed chairman is playing with fire. In this essay he details where the Fed is going wrong.

Gold headwinds return

Wisdom Tree/Nitesh Shah/February 2023

“Despite some of the near-term setbacks for gold,” it says, “we should remember that the bond yield curve is the most inverted since the early 1980s. Gold has historically performed well during bear market flattening inversions. Historically, yield curve inversions are followed by recession (albeit with long lags). Markets are fearing that central banks could easily overdo the tightening in their inflation fight. Gold is often highly sought after in periods of economic and financial uncertainty as the metal presents strong defensive hedge qualities.”

“Despite some of the near-term setbacks for gold,” it says, “we should remember that the bond yield curve is the most inverted since the early 1980s. Gold has historically performed well during bear market flattening inversions. Historically, yield curve inversions are followed by recession (albeit with long lags). Markets are fearing that central banks could easily overdo the tightening in their inflation fight. Gold is often highly sought after in periods of economic and financial uncertainty as the metal presents strong defensive hedge qualities.”Investors bet on Europe’s inflation matching US in echo of financial crisis

Bloomberg/Greg Ritchie/3-8-2023

“For the first time since the global financial crisis, investors are betting long-term inflation in the euro area will match that of the US, underscoring the dramatic shift in the outlook for Europe recently.”

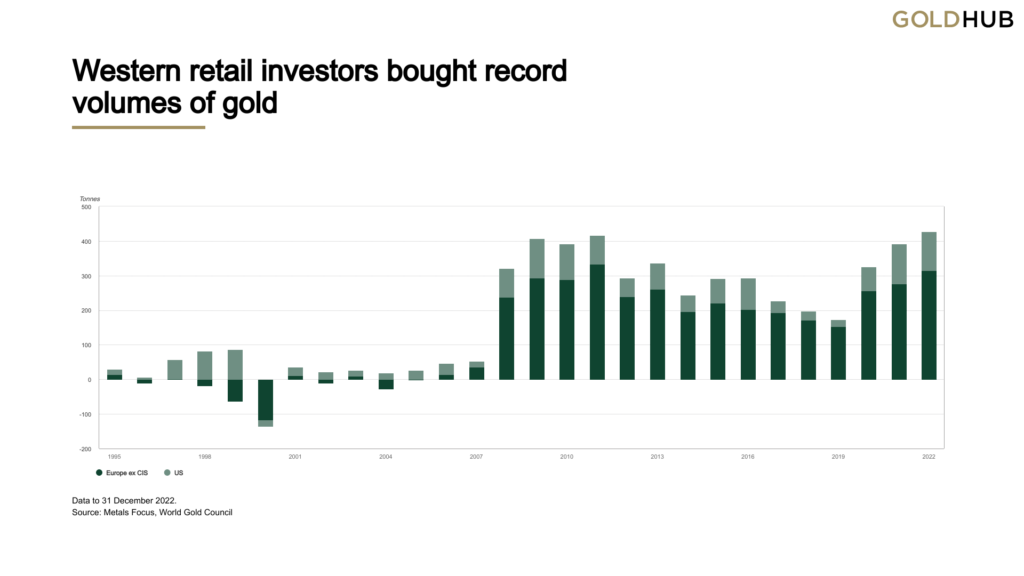

USAGOLD note: Gold demand in Europe has grown steadily over the past several years, particularly in Germany. A rising inflation rate would likely boost the already strong demand for physical metal.

Chart courtesy of the World Gold Council • • • Click to enlarge

Daily Gold Market Report

Gold edges higher as an uneasy lull settles over markets

Will Rhind: Crisis in confidence driving investors to ‘the most famous safe have in the world’

(USAGOLD – 3/16/2023) – Gold edged higher as an uneasy lull settled over markets. It is up $6 at $1927. Silver is up 24¢ at $22.09. John Authers makes an important point about the bank crisis in his Bloomberg column this morning – one that’s been overlooked in much of the analysis so far. The issre in the banking system thus far, he explains, has been one of liquidity, but that is only part of the problem banks face: “The logic of the Fed’s tightening campaign is that it will eventually create solvency issues for banks — as in, their customers won’t be able to repay loans.”

Granite Shares’ Will Rhind says the gold market is signaling the beginning of a broader crisis. “What we’re seeing,” he says in a Yahoo!Finance interview yesterday, “is just a classic crisis of confidence. And when you see a crisis of confidence, but particularly in our financial system and our banking sector, people rush for safe havens. And arguably, there’s no more famous safe haven in the world than gold. It’s one of the highest quality assets out there with no counterparty or credit risk. So in other words, gold can’t go bankrupt, unlike a bank, and that’s very appealing at this particular point in time.”

Cartoon courtesy of MichaelPRamerez.com

Daily Gold Market Report

Gold resumes uptrend amidst more turmoil at Credit Suisse

Dalio says gold coins are a great way to teach children about investments

(USAGOLD – 3/15/2023) – Gold resumed its uptrend this morning amidst more turmoil at Credit Suisse and persistent concern about the global banking system. It is up $16.50 at $1923. Silver is up 43¢ at $22.19. With the safety of bank deposits in question, savers are turning to gold coins and bullion as a savings alternative. Ray Dalio, the widely followed founder of Bridgewater Associates, the world’s largest hedge fund, sees gifting gold coins as a great way to teach children about finance and investing, according to a Yahoo!Finance article posted this morning.

“Another great feature of gold is that it’s essentially timeless,” reads the article. “Gold has been highly valued by people from all walks of life for thousands of years, and that doesn’t seem to be changing any time soon. As an investment, gold has also historically been a safe haven during times of economic uncertainty. This factor makes it one of the most popular long-term investments.” Dalio gives a gold coin to his grandchildren every birthday and holiday.

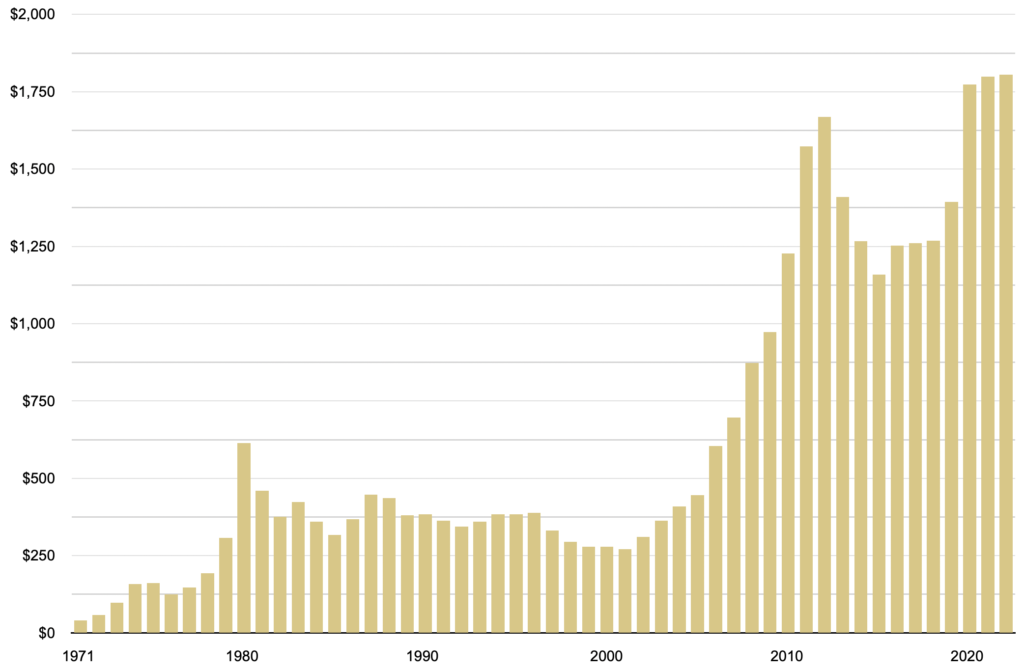

Gold average annual price

(1971-2022)

Chart by USAGOLD • • • Data source: Macrotrends.net

Good news on the economy could be bad news for markets

Financial Times/Karen Ward/3-7-2023

USAGOLD note: Central banks play a far more significant role in financial markets than their originators ever intended. To a large extent, the distortions introduced as a result have created an investment world essentially turned upside down and divorced from economic reality. Nobody, including the central banks, has a clue where we are headed.

Deepest bond yield since Volcker suggests hard landing

Bloomberg/Michael Mackenzie and Liz McCormick/3-7-2023

“As a result, the closely-watched spread between 2- and 10-year yields this week showed a discount larger than a percentage point for the first time since 1981, when then-Fed Chair Paul Volcker was engineering hikes that broke the back of double-digit inflation at the cost of a lengthy recession. A similar dynamic is unfolding now, according to Ken Griffin, the chief executive officer and founder of hedge fund giant Citadel.”

USAGOLD note: We should keep in mind that there is a lag between the time the yield curve inverts and the onset of a recession. We made the chart below interactive for those who would like to take a closer look at the lag times.

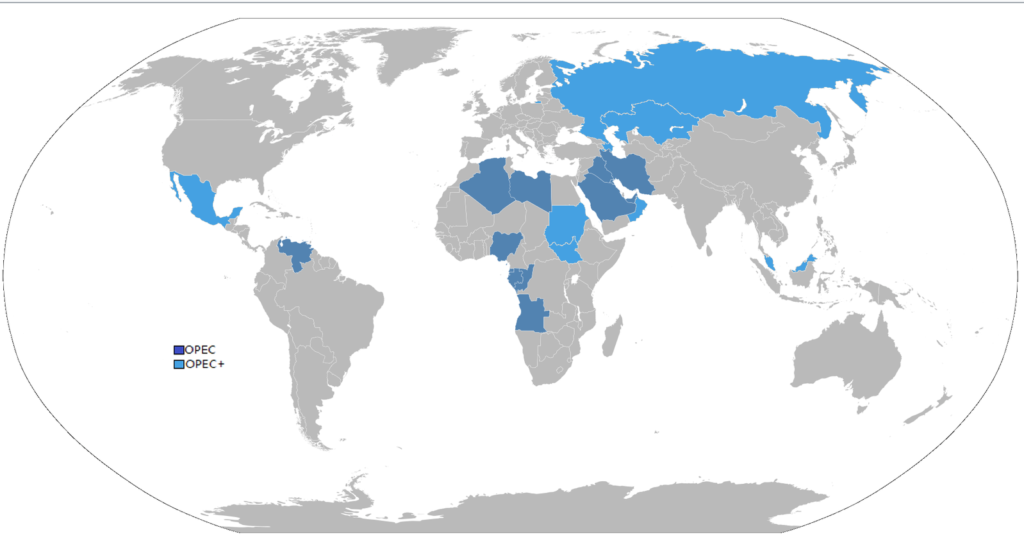

Oil executives warn of higher prices now that Opec is back ‘in charge’

Financial Times/Myles McCormick, Derek Brower and Justin Jacobs/3-8-2023

“The Opec cartel is back in control of the world oil market as the shale revolution peters out, according to a number of industry executives who warned of higher prices for crude in the year ahead.”

USAGOLD note: Since oil is a component in the pricing of just about everything, OPEC control of the oil market will make it even more difficult for central banks to contain the inflation rate.

____________________________

Image attribution:

Caspian Delta, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>, via Wikimedia Commons

Speak loudly because you carry a small stick

RIA Advice/Michael Liebowitz/3-8-2023

“The big question facing the Fed is whether they should increase the Fed Funds rate by 25bps or 50bps on March 22, 2023. If Jerome Powell cared for our advice, we would tell him to take the opposite approach of President Theodore Roosevelt. Speak loudly because your stick isn’t that big anymore.”

USAGOLD note: Patience with the Fed is beginning to wear thin as is its market clout……

Daily Gold Market Report

Gold takes breather after solid two-trading session run-up

Roubini says ‘gold has upside in this environment’

(USAGOLD – 3/14/2023) – Gold is taking a breather this morning after the solid run-up that saw it gain 4% over the course of two trading sessions. It is down $8 at $1908. Silver is down 4¢ at $21.82. Gold has yet to react to this morning’s mixed CPI release showing a 6% inflation gain (versus a 6.2% consensus expectation), with core inflation exceeding expectations at 5.5%.

In an interview yesterday at Stansberry Research, Stern School of Business’ Nouriel Roubini said we are only in the first few innings of a major debt crisis. “The real economy and financial economy,” he warned, “are contradicting each other, and the government created a mess of too much debt and now it becomes another leverage cycle all over again. The Fed has been doing backdoor QE, and the financial system is reckless… Everything was in a bubble two years ago. Even in a mild recession, the S&P is going to fall between 30% and 50%, and gold has upside in this environment.”

Gold price

(%, 3/10/2023 through 3/13/2023)

Chart courtesy of TradingView.com