Daily Gold Market Report

Gold edges higher as investors digest sustained tightening, financial headwinds

The rate deterrent no one is talking about

(USAGOLD – 3/9/2023) – Gold edged higher as investors continued to digest the prospect of sustained monetary tightening and accompanying financial headwinds. It is up $4.50 at $1821. Silver is up 8¢ at $20.18. Gold Newsletter’s Brien Lundin believes there is a major deterrent to sustained Fed tightening, and it is one that does not get a lot of attention.

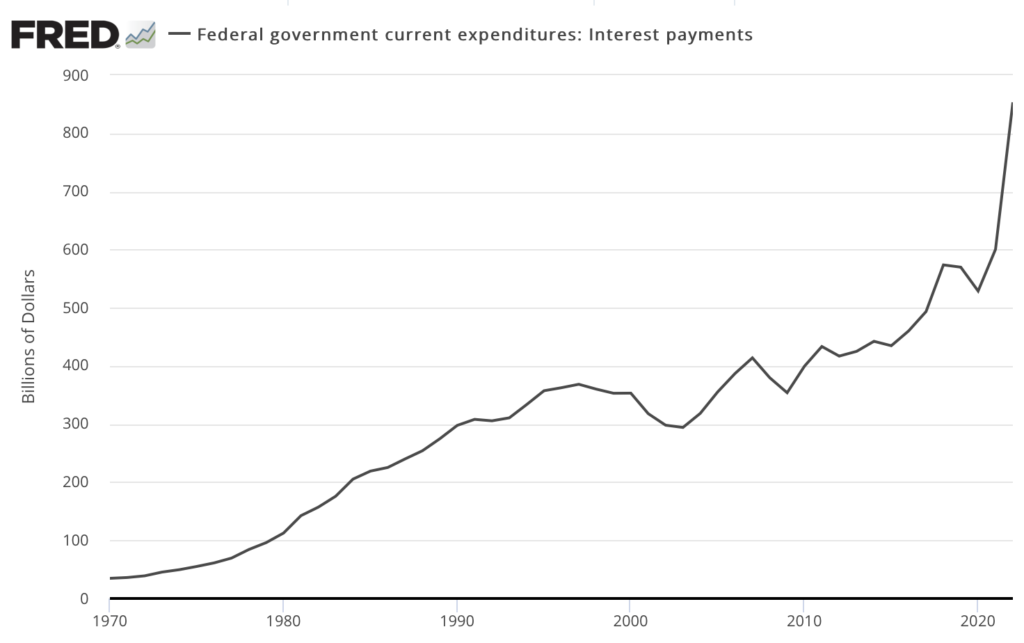

“[We will] be paying over $1.75 trillion in interest costs on the federal debt if rates get into the range now being forecast (5.5%),” he points out in a recent advisory. “I don’t think it will happen, because it can’t. And I’m amazed that no one else is talking about this right now. Regardless, they’ll find out soon enough. With the latest official estimates of federal interest expenses at a breathtaking $852 billion, we’re going to cross the $1 trillion threshold very soon. I think that’s going to make headlines. When it does, it will illustrate the trap the Fed is in, and I think metals prices will begin to rise even before this happens.” [Source: Gold Newsletter]

Interest paid on the national debt

(Annual)

Sources: St. Louis Federal Reserve, U.S. Bureau of Economic Analysis