Monthly Archives: March 2023

The dark side of insuring all bank deposits: zombie banks

MarketWatch/Greg Robb/3-21-2023

“In light of concerns over more bank runs like the one on Silicon Valley Bank, commentators and government officials are discussing expanding the current $250,000 cap on deposit insurance or even insuring all bank deposits. But the proposal to insure all deposits strikes fear in the hearts of some bank experts for a simple reason: In the past, blanket insurance has led to the emergence of ‘zombie banks.'”

USAGOLD note: The problem with bailouts has always been propping up bad banks. This article cites “blanket” FDIC insurance covering all deposits, but it is the Fed, in this case, that is providing across-the-board coverage through its latest iteration of quantitative easing – SVB being the prime example. Powell doesn’t need Yellen and the FDIC to deliver the goods.

The end of moral hazard and the final chapter in the dollar’s debasement

Zero Hedge/Simon White – Bloomberg/3-23-2023

“A full guarantee of all bank deposits would spell the end of moral hazard and mark the final chapter of the dollar’s multi-decade debasement. It’s said the cover-up is worse than the crime. With the latest banking crisis in the US, it’s the clean-up that could end up doing far more lasting damage. The failure of SVB et al prompted the FDIC to guarantee that all depositors will be made whole, whether insured or not.”

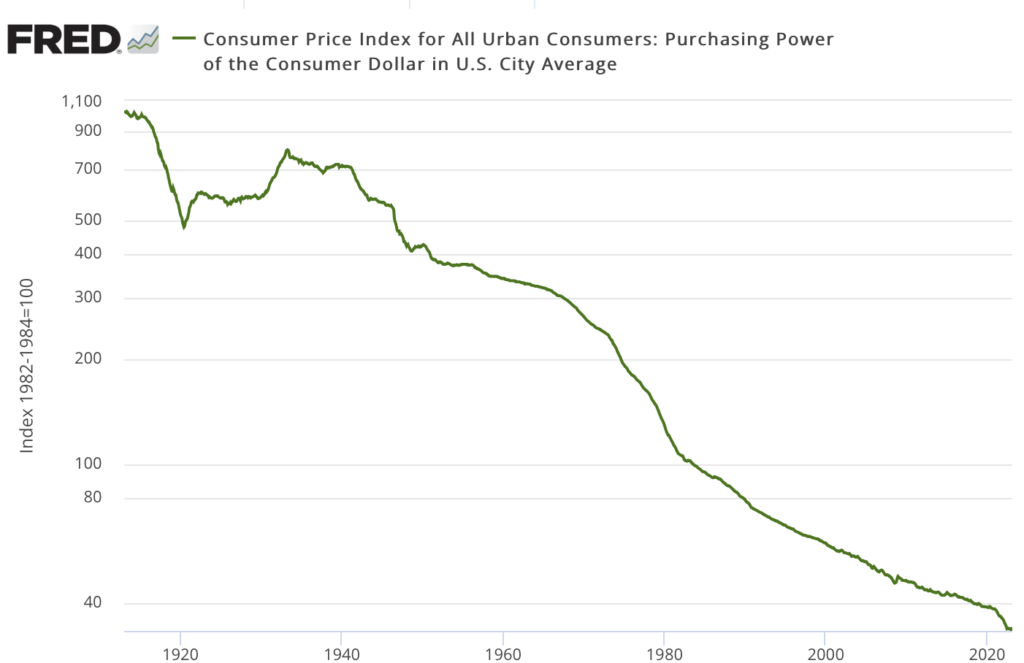

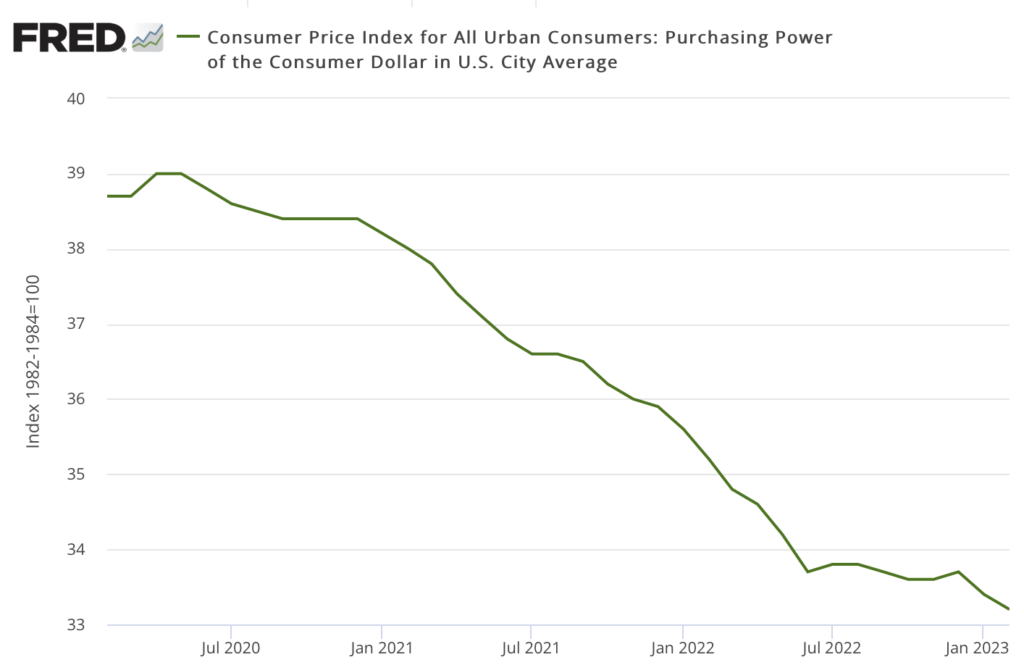

USAGOLD note: Much was said at the Powell press conference and the aftermatch about the Fed doing the right thing by stepping in to rescue the banking system. Precious little was said about its ramifications with respect to the stability of the monetary system and the value of the dollar. Bloomberg’s Simon White covers the back half of Fed policy, and connects the dots in this essay – a must-read. We post two charts below. The first shows the long-term debasement of the dollar since 1913 in log scale. The second illustrates that the long-term debasement is ongoing – an 8.6% decline since 2020.

Purchasing power of the US dollar

(1913-present, log scale)

Sources: St. Louis Federal Reserve [FRED], US Bureau of Labor Statistic

‘This is a risk confronting all banks,’ ex-FDIC chief Sheila Bair tells MarketWatch

MarketWatchJoy Wiltermuth/3-23-2023

USAGOLD note: By “unmarked securities,” we are guessing she means bonds held in bank portfolios that have not been marked to market, an accounting procedure that cloaks the true position of the banks. The fact that Credit Suisse failed for the very same reasons as SVB – underwater bond holdings that undermined its ability to return customer deposits – tells us that Bair’s concerns are valid.

‘Commodities are the only attractively valued asset class’ – Jim Rogers

themarketNZZ/Sadra Rosa interview of Jim Rogers/3-21-2023

“That is certainly one possible approach. I own silver and I expect to buy more silver and more hard assets in general, because historically, if you have inflation or chaos, the way to protect yourself is with real assets.”

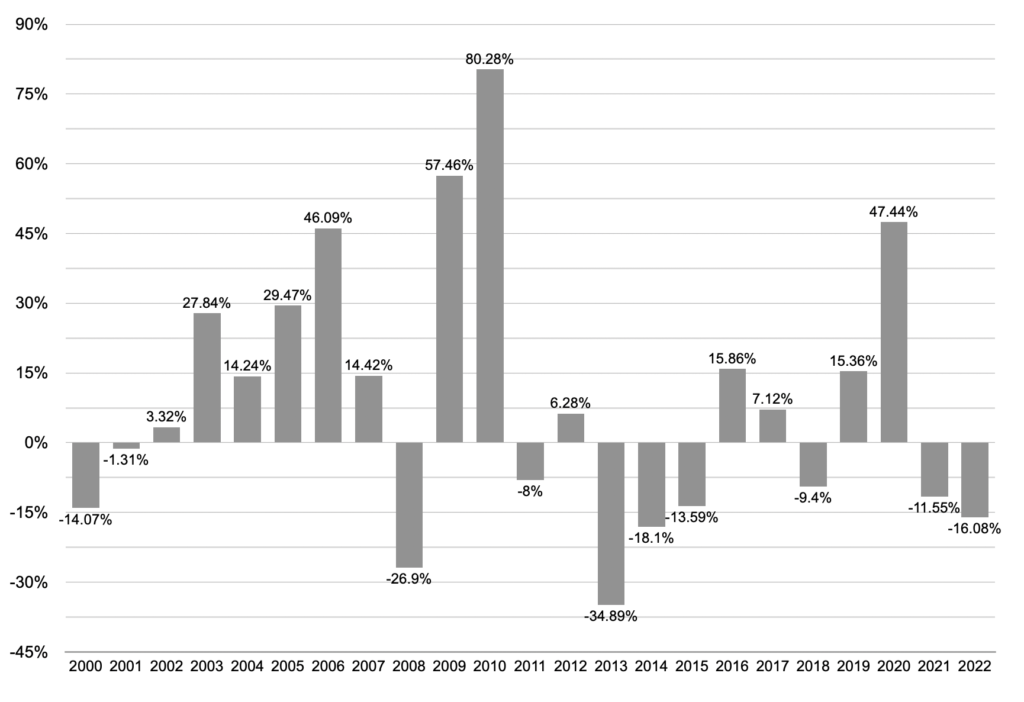

USAGOLD note: Rogers updates his thinking and outlook in the wake of bank failures and the Fed’s rescue plan. As you can tell from the chart below, when silver goes up, it can go up in a major way.

Silver: Average Annual Return

(%, 2000-2022)

Chart by USAGOLD • • • Data source: Macrotrends.net • • • Click to enlarge

Daily Gold Market Report

Gold trades sideways as it closes out an uneventful week

Silver is quietly on the rise ‘signaling a secular breakout’

(USAGOLD – 3/31/20230 – Gold is trading sideways this morning as it closes out an uneventful week. It is up $1 at $1984. Silver is up 2¢ at $24.02 and up 4% on the week. Quietly, silver has been on the rise. Though gold is the headline asset at the moment, silver has been the better performer – up 13.7% since the beginning of March compared to gold’s 7.9% gain. Investing Haven thinks silver is now “signaling a secular breakout.”

“it’s important to note,” it says in an article posted recently, “that the secular trendline is about to cross the 50% retracement… which is a significant milestone. Second, there is a physical supply crunch underway…These two factors combined suggest that a secular breakout is imminent, and investors who are positioned correctly could stand to benefit greatly. For those who are bullish on silver and are willing to take on some risk, the potential rewards could be significant.”

Average annual silver price

(1971-1922)

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net

Silver price

(1971-present, log scale)

Chart courtesy of TradingView.com

Fire

Credit Bubble Bulletin/Doug Noland/3-18-2023

USAGOLD note: The additions to the balance sheet amount to a very large pool of printed money sitting in the financial system waiting to be unleashed – eventually as price inflation, as we are seeing now. In this case, the Fed is likely to argue that it expects the money to be repaid and therefore removed from the money supply, but it is being loaned to banks that are insolvent or nearly insolvent and struggling to keep their doors open. How likely is it that these loans will be repaid? There is much to this bailout that needs to be explained. For instance, if and when the rescued banks pay off their loans will they receive back the underwater securities they put up as collateral– at par?

‘The Fed is broke – Gundlach likes gold, fears ‘expanding wars’ most

Zero Hedge/Tyler Durden/3-18-2023

USAGOLD note: This article will bring you up to date on Gundlach’s thinking…… “I think gold is a good long-term hold,” he concluded in the same CNBC interview. “Gold and other real assets with true value, such as land and collectibles.”

How bad is the banking crisis?

Markets Insider/Spriha Srivastava/3-20-2023

USAGOLD note: While Wall Street takes a ho-hum attitude, Main Street moves to protect savings, braces for another financial crisis.

Bank crisis survivors remember how fast the dominoes can fall

Bloomberg/Justin Lee, Kathering Greifend, Vildana Hajric and Isabelle Lee/3-20-2023

“Steve Chiavarone doesn’t want to scare anyone, but what he remembers most from the last banking crisis was how sure most people were that it wouldn’t happen.”

USAGOLD note: An inside look at what it is like to be on the front lines of the investment business during a financial storm…… Now, like then, the prevailing view is that the crisis will be contained. Some will see that attitude as an acute case of denial. We recall Queen Elizabeth’s query at the London School of Economics with respect to the 2008 financial crisis: “Why did nobody see it coming?…If these things were so large, how come everyone missed them?”

Daily Gold Market Report

Gold pushes quietly higher ahead of key reports due by the end of the week

Saxo Bank reports heavy capital flows into gold ETFs

(USAGOLD – 3/30/2023) – Gold pushed marginally higher this morning in quiet, uneventful trading ahead of a couple key reports due before the week is out – jobless claims later today and the PCE price index on Friday. It is up $4 at $1971. Silver is up 41¢ at $23.82. FX Empire’s Phil Carr says the recent pull-back in gold has to do with “end-of-quarter profit taking as traders square up their positions – ready to capitalize on precious metals’ next big move.” Saxo Bank reports seeing heavy capital flows into gold ETFs with almost $2 billion in net purchases over the past month, reversing months of selling.

Every hiking cycle over the last 70 years ends in recession or a financial crisis. ‘It’s not going to be different this time,’ Morgan Stanley strategist says.

MarketWatch/Steve Goldstein/3-17-2023

USAGOLD note: It’s because it is never different this time around that the prudent, long-term investor owns precious metals. Own metals, Sit back. Watch the show.

History of banking crises holds a warning for Jay Powell

Bloomberg/Niall Ferguson/3-19-2023

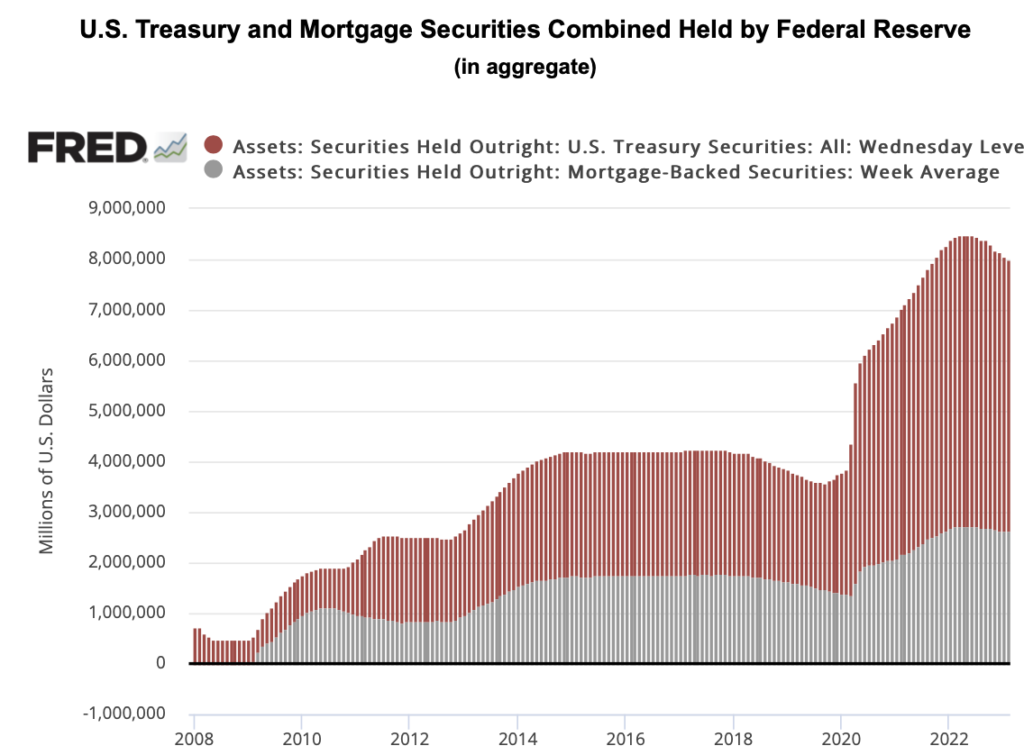

USAGOLD note: Ferguson points out that the Fed balance sheet expanded by $303 billion since the rescue plan was announced perhaps spelling the end of quantitative tightening. “Indeed,” he adds,” the BTFP might turn out to be just the latest iteration of Quantitative Easing. unless there is minimal take-up by banks.”

It’s unclear if central banks can contain the international banking crisis, analysts warn

USAGOLD note: Gold demand is throgh the roof and much of the buying is driven by depositors seeking a safe haven from a system wide crisis.

‘The window is closing fast on the Fed’

themarketNZZ/Christoph Gizinger interview of Marko Papic/3-17-2023

USAGOLD note: Papic says the best option at present is to be “long gold, commodities, and emerging markets.

Daily Gold Market Report

Gold takes a breather in quiet, uneventful trading

Morris says we’ve had four compelling times to buy gold in 100 years, and this is one of them

(USAGOLD – 3/29/2023) – Gold is taking a breather this morning in quiet, uneventful trading. It is down $6 at $1970. Silver is down 11¢ at $23.27. Over the past month, it is up 7.7% amidst lagging confidence about the financial system’s stability. Silver is up 11.2% over the same period. Byte Tree’s Charlie Morris says, “the next few years will be tricky for investors, and gold will have an important role to play in portfolios.”

“Over the past 100 years,” he says in a recent advisory, “there have been four compelling times to buy gold. In 1929 it proved to be a saviour ahead of the great depression. Then in 1969, it preceded the great inflation of the 1970s. In 2000, it cemented itself as the most liquid alternative asset of the 21st century in anticipation of the credit crisis. And just recently, gold is signaling strength ahead of what looks to be an emerging sovereign debt crisis.”

Gold price

(!834 to present, log scale)

Chart courtesy of TradingView.com • • • Click to enlarge

European regulators criticise US ‘incompetence’ over Silicon Valley Bank collapse

Financial Times/Laura Noonan/3-17-2023

USAGOLD note: One eurozone official called the US bailout of uninsured deposits “total and utter incompetence.”

Another chaotic week for banks marks the end of an era for the global economy

Bloomberg/John Authers and Isabella Lee/3-17-2023

USAGOLD note: The problem is systemic, hence costly, widespread, and probably enduring…… Authers and Lee explore the Fed’s options and what they might mean for markets in considerable detail. If the Fed decides to continue raising rates while unleashing massive liquidity to rescue the banking system, one cannot help but conclude that the inflation it fights with one set of policies, it creates with another – a hawk and a dove at the same time.

Things are only getting harder for the Fed

Financial Times/Kenneth Rogoff/3-18-2023

USAGOLD note: Rogoff explains that a great deal has changed since the financial crisis of 2008 – different times, different set of circumstances. The Fed’s inflationary chickens have come home to roost.

The Fed may provide as much as $2 trillion in liquidity relief for banks after the SVB collapse, JPMorgan says

MarketsInsider/Filip DeMott/3-17-2023

“‘The usage of the Fed’s (Bank Term Funding Program) BTFP is likely to be big,’ JPMorgan analysts said.”

USAGOLD note: We blinked a couple of times when we saw that number……Unless the Fed accounts for the new liquidity injection differently, the $2 trillion amounts to a 25% addition to its balance sheet (from $8 trillion to $10 trillion.) I don’t think most investors know the scope of this bailout.

Sources: St. Louis Federal Reserve [FRED], Board of Governors of the Federal Reserve System

Daily Gold Market Report

Gold inches higher as it attempts to recover from technical selling

Former FDIC head says all banks vulnerable to mark-to-market losses – small and large

(USAGOLD – 3/28/2023) – Gold inched higher this morning as it attempts to recover from technical selling that began at the $2000 resistance level. It is up $3 at $1962. Silver is up 1¢ at $23.17. Before the sell-off, gold had made impressive gains primarily on safe-haven buying spurred by concern about unsettling probems in the banking sector. The press touted those problems as residing mainly in the regional and community banks, but former FDIC head Sheila Bair believes the problem goes much deeper than that.

“We need to be mindful of all unmarked securities at banks — small, medium, and large,” she recently told MarketWatch. In short, the same circumstance that brought down Silicon Valley Bank – an underwater, illiquid bond portfolio – could also affect the larger banks. The subsequent collapse of Credit Suisse, which ultimately failed for the same reasons, adds considerably to her argument. A recent Columbia University study pegged the unrealized, mark-to-market losses in the banking system at $2.2 trillion, rather than the FDIC’s $620 billion figure advanced early in the crisis. Since the new rescue plan began, the Fed has added almost $392 billion to its balance sheet, which now stands at $8.73 trillion.

Federal Reserve balance sheet and gold

(Log scale, 2008-present)

Chart courtesy of TradingView.com • • • Click to enlarge