Monthly Archives: March 2023

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“George Bernard Shaw famously observed that he knew three types of economists. Those who were brilliantly right. Those who were brilliantly wrong. And those who taught. Judging by her tenure at the Federal Reserve’s helm and her advocacy now as Treasury Secretary of a super-sized budget stimulus package, it would seem that Janet Yellen falls into Mr. Shaw’s brilliantly wrong category. For this, the country is likely to pay dearly.”

Desmond Lachman, economist

1945

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

SVB failure raises a question: who gets to create dollars?

Financial Times/Brendan Greeley/3-16-2023

USAGOLD note: Seems like it is all too easy to create dollars, but that, in the end, is the nature of the fiat money system.

Greatest hedge fund manager of all time says to gift your kids gold to get them started investing

Yahoo!Finance/Henry Slater/3-14-2023

USAGOLD note: A good many of our clients have been doing this for years…… Dalio gives gold coins to his grandchildren every birthday and holiday.

‘Net worth of median household is basically nothing,’ says Carl Icahn. ‘We have some major problems in our economy.’

MarketWatch/Mark DeCambre/3-14-2023

USAGOLD note: According to Bank Rate, 56% of Americans could not cover an unexpected $1000 bill.

Powell’s legacy risks being tarnished more by SVB collapse

Bloomberg/Rich Miller/3-15-2023

USAGOLD note: A number of gold market analysts have cited trust in the central banks as a key factor in the periodic gold rushes reflected on the long term gold chart. We would add that it is not just SVB that’s to blame. The breakdown by most accounts is system wide with more failures already in the pipeline. As such it is not only a failure of supervision, as this article contends, but a failure in overall monetary policy.

Daily Gold Market Report

Gold loses ground after encountering resistance at $2000

Fund, institutional interest signals sustained rally in yellow metal, says FT

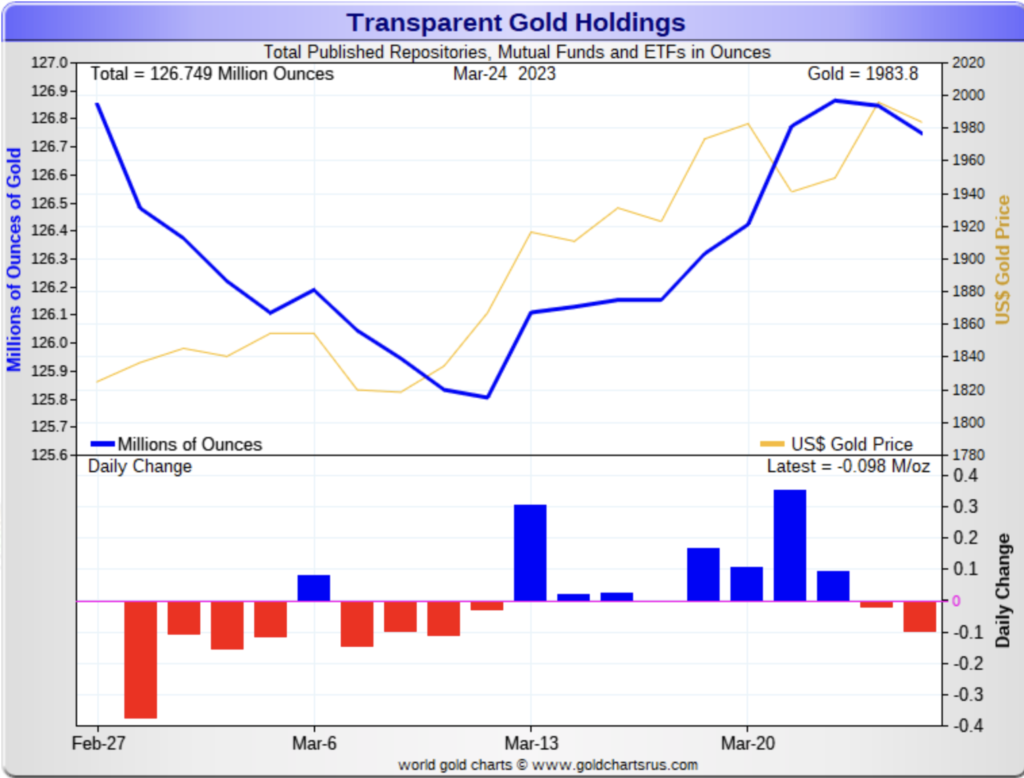

(USAGOLD –3/27/2023) – Gold lost ground this morning in what looks to be a technical sell-off after encountering resistance at the $2000 level. It is down $23 at $1957. Silver is down 19¢ at $23.12. Financial Times reports this morning that traders in futures contracts, options, and exchange-traded funds are signaling a sustained gold rally in the weeks ahead that will potentially break all-time highs, and stay there.

“Suki Cooper, precious metals analyst at Standard Chartered, said in the days immediately following the collapse of SVB and Signature there was a massive increase in ‘tactical’ positioning as traders looked for assets considered safe havens in times of crisis,” says FT. Such capital mobilizations on the part of funds and institutions, we will add, have served as a catalyst in the past for higher prices. Similarly, CNBC posted an article calling for all-time highs in the gold price soon. One analyst, CMC Markets Tina Teng, predicted a price of $2500 to $2600 on further declines in the US dollar and bond yields.

Chart courtesy of GoldChartsRUs.com

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“A lot of people come to me asking how they can get rich quick…It’s the most disturbing question I get. Why? It’s the wrong question. It tells me that they don’t have the foundation of financial intelligence required to use their money well if they do – somehow – become wealthy. This is because most people don’t understand that, when it comes to being rich, it’s not about how much money you make. It’s about how much money you keep.”

Robert Kiyosaki

Daily Reckoning

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fed’s battle plan for inflation shredded by financial turmoil

Bloomberg/Catarina Saraiva and Craiig Torres/3-13-2023

USAGOLD note: Nothing alters Fed tightening policies faster than a financial crisis…… And it did so as if it knew it was coming – rolling out a major rescue plan within 48 hours of SVB’s collapse. Economist Nouriel Roubini warned yesterday of “endless inflation.”

The policy compromises needed to resolve the SVB implosion

Financial Times/ Mohamed El-Erian/3-12-2023

“In a narrow sense, it demonstrates that even seemingly small banks can pose systemic risks. In a broader sense, it illustrates the inherent trilemma of the ongoing monetary policy regime change. Namely, the challenge for the Federal Reserve to simultaneously deliver on both its 2 percent inflation target and the employment part of its dual mandate while ensuring financial system stability.”

USAGOLD note: El Erian is among the first to weigh in on the Fed’s options now that something has actually broken. All the concerns registered here and elsewhere about the Fed’s policy conundrum are coming to a head. Nothing has changed. If the Fed goes neutral on rates, or heaven forbid, raises them, more SVBs are likely to surface. The return of quantitative easing is a distinct possibility. If it doesn’t tighten monetary policy (as originally planned), inflation will likely settle in for the long run.

Goldman Sachs no longer expects the Fed to hike rates in March, cites stress on banking system

Reuters/Scott Murdoch and Carolina Mandl/3-13-2023

USAGOLD note: There was already considerable moral hazard built into banking philosophy. Sunday’s rescue package – especially the Fed’s taking in the banks’ underwater bond positions at par instead of market – will solidify it for a long time to come.

Moody’s cuts outlook on U.S. banking system to negative, citing ‘rapidly deteriorating operating environment’

USAGOLD note: The same problem that brought down SVB – an underwater bond portfolio – is present in a large swathe of the banking industry making this bank crisis much different than anything that preceded it. Moody’s is right to sound the general alarm.

Government bonds held at banks may be ‘toxic asset’ of next financial crisis, fund manager says

MarketWatch/Vivien Lou Chen/3-15-2023

USAGOLD note: Who would have believed that US Treasury securities would ever be viewed as toxic? Yet here we are……

Why Ray Dalio says SVB collapse is a ‘canary in the coal mine’

MarketWatch/William Watts/3-15-2023

USAGOLD note: A view similar to that of Blackrock’s Larry Fink featured below – two of Wall Street’s top money managers forecasting the same future. Dalio is a long-time advocate of gold ownership.

Larry Fink raises spectre of ‘slow rolling crisis’ after SVB failure

Financial Times/Brooke Masters/3-15-2023

USAGOLD note: Fink says rapidly raising rates was the first domino to drop, SVB the second. More could follow. FT points out that Fink’s annual client letter is required reading among corporate executives.

Goldman Sachs no longer expects the Fed to hike rates in March, cites stress on banking system

USAGOLD note: Amazing how quickly sentiment can change…… Will the doves perch at the Fed?

Daily Gold Market Report

Next DGMR Monday 3/27/2023.

_____________________________________________________

Gold trades cautiously lower ahead of crucial Fed policy meeting

Fed balance sheet surges almost $300 billion in week one of bailout program

(USAGOLD –3/21/2023) – Gold is trading cautiously lower ahead of crucial FOMC deliberations amidst what many investors see as the early stages of a full-blown banking crisis. It is down $11 at $1970. Silver is down 8¢ at $22.55. Fed chairman Powell is likely to face stiff questioning at his Wednesday press conference on the inflationary implications of a rescue plan JP Morgan predicts will add $2 trillion to the Fed’s balance sheet.

“Federal Reserve Total Assets surged $297 billion last week to $8.639 TN, in one week reversing four months – and over half – of recent QT (quantitative tightening). A $10 TN balance sheet by year end would not be surprising,” says Credit Bubble Bulletin’s Doug Noland in his regular Saturday update. “I appreciate that officials last weekend believed they needed to ensure all SVB and Signature depositors to stem a potential systemic bank run. Just as the Bernanke Fed had justification for opening the floodgate for unprecedented money printing… Where does it all end? For one thing, the Fed’s balance sheet will be getting much larger. I’ll assume global central bank balance sheets will also inflate.”

Federal Reserve total assets (balance sheet)

(millions of dollars as of 3/17/2023)

Source: United States Federal Reserve • • • Click to enlarge

US capitalism is ‘breaking down before our eyes’, says Ken Griffin

Financial Times/Harriet Agnew, Laurence Fletcher and Patrick Jenkins/3-14-2023

USAGOLD note: For well-known reasons, creative destruction and the fear of losses are essential to the market process. Banks are in the unique position of capitalizing on their profits and socializing their losses. Bad things happen when Humpty has nothing to worry about.

SVB collapse forces rethink on interest rates

Financial Times/Katie Martin and George Steer/3-13-2023

USAGOLD note: Sunday’s rescue package created a 180 degree reversal in rate prospects, inflation expectations, and market outlook. The suddeness of the change reinforces our long-standing advice to diversify with gold and silver for asset preservation purposes and stay diversified.