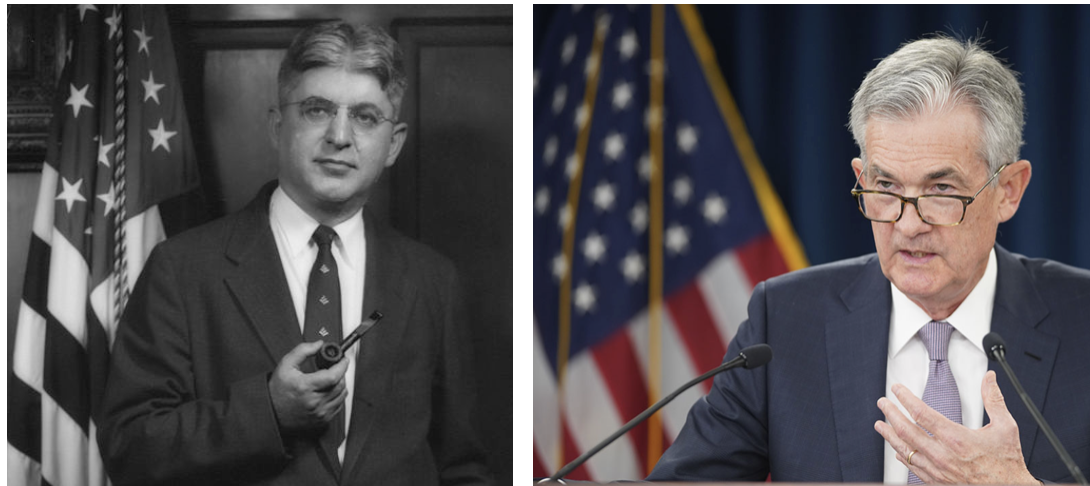

History of banking crises holds a warning for Jay Powell

Bloomberg/Niall Ferguson/3-19-2023

USAGOLD note: Ferguson points out that the Fed balance sheet expanded by $303 billion since the rescue plan was announced perhaps spelling the end of quantitative tightening. “Indeed,” he adds,” the BTFP might turn out to be just the latest iteration of Quantitative Easing. unless there is minimal take-up by banks.”