The Fed may provide as much as $2 trillion in liquidity relief for banks after the SVB collapse, JPMorgan says

MarketsInsider/Filip DeMott/3-17-2023

“‘The usage of the Fed’s (Bank Term Funding Program) BTFP is likely to be big,’ JPMorgan analysts said.”

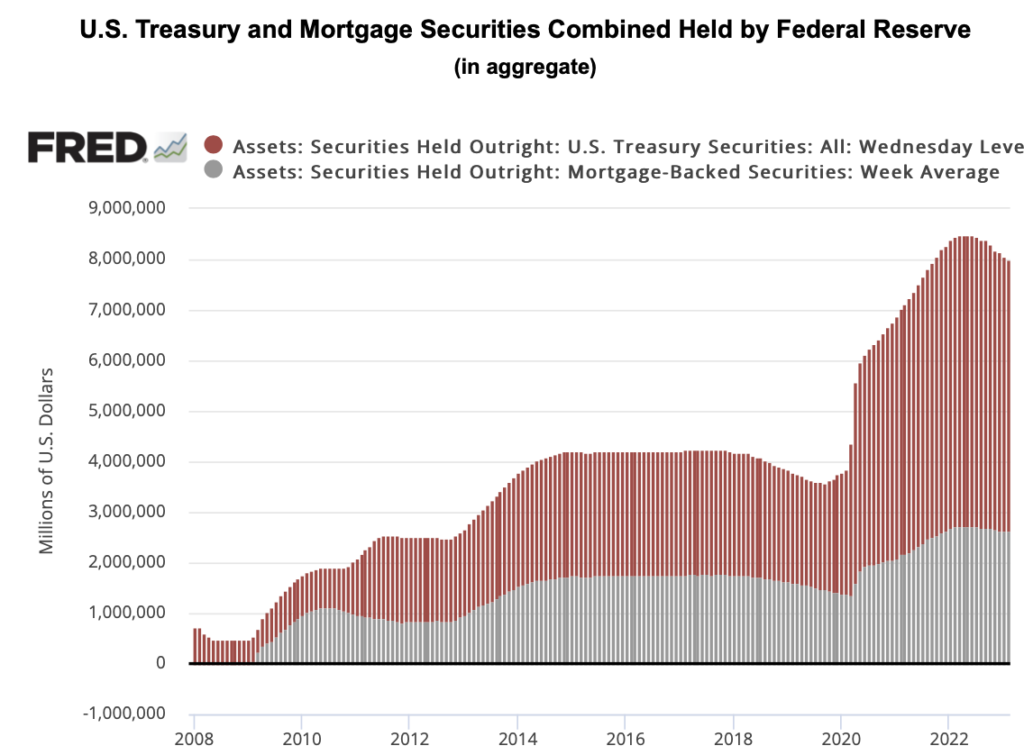

USAGOLD note: We blinked a couple of times when we saw that number……Unless the Fed accounts for the new liquidity injection differently, the $2 trillion amounts to a 25% addition to its balance sheet (from $8 trillion to $10 trillion.) I don’t think most investors know the scope of this bailout.

Sources: St. Louis Federal Reserve [FRED], Board of Governors of the Federal Reserve System

This entry was posted in Today's top gold news and opinion. Bookmark the permalink.