The end of moral hazard and the final chapter in the dollar’s debasement

Zero Hedge/Simon White – Bloomberg/3-23-2023

“A full guarantee of all bank deposits would spell the end of moral hazard and mark the final chapter of the dollar’s multi-decade debasement. It’s said the cover-up is worse than the crime. With the latest banking crisis in the US, it’s the clean-up that could end up doing far more lasting damage. The failure of SVB et al prompted the FDIC to guarantee that all depositors will be made whole, whether insured or not.”

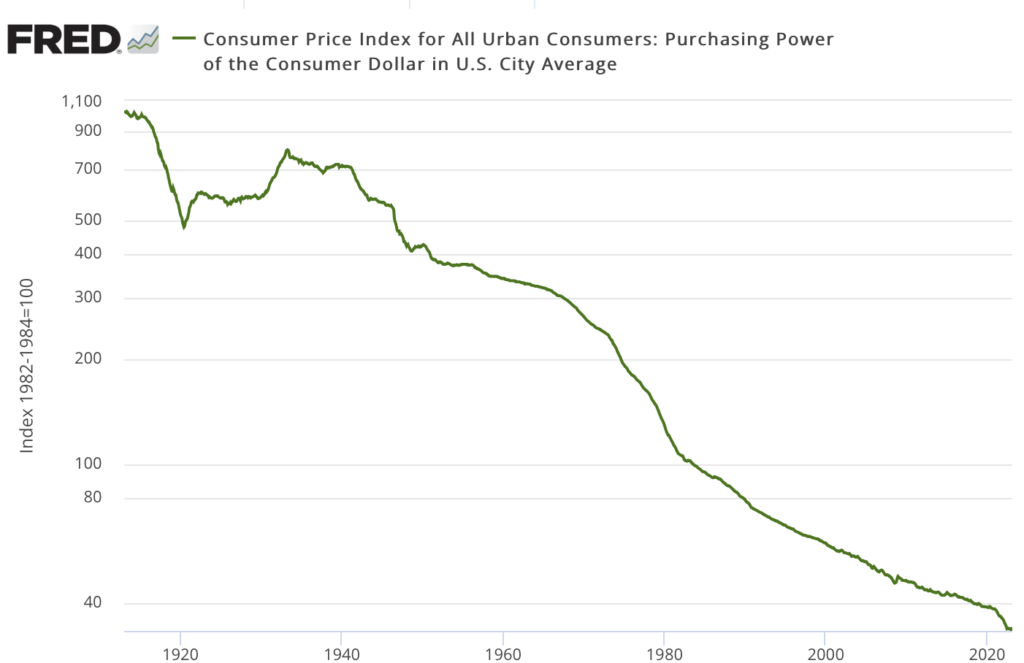

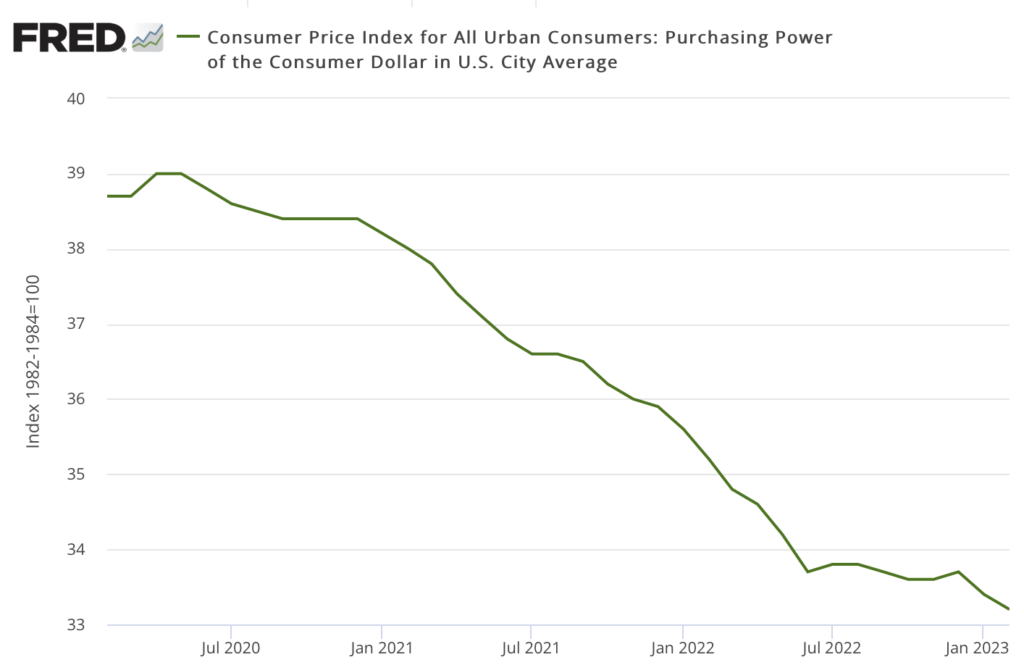

USAGOLD note: Much was said at the Powell press conference and the aftermatch about the Fed doing the right thing by stepping in to rescue the banking system. Precious little was said about its ramifications with respect to the stability of the monetary system and the value of the dollar. Bloomberg’s Simon White covers the back half of Fed policy, and connects the dots in this essay – a must-read. We post two charts below. The first shows the long-term debasement of the dollar since 1913 in log scale. The second illustrates that the long-term debasement is ongoing – an 8.6% decline since 2020.

Purchasing power of the US dollar

(1913-present, log scale)

Sources: St. Louis Federal Reserve [FRED], US Bureau of Labor Statistic