Monthly Archives: February 2023

Will investors follow central banks into gold

Seeking Alpha/Van Eck/2-15-2023

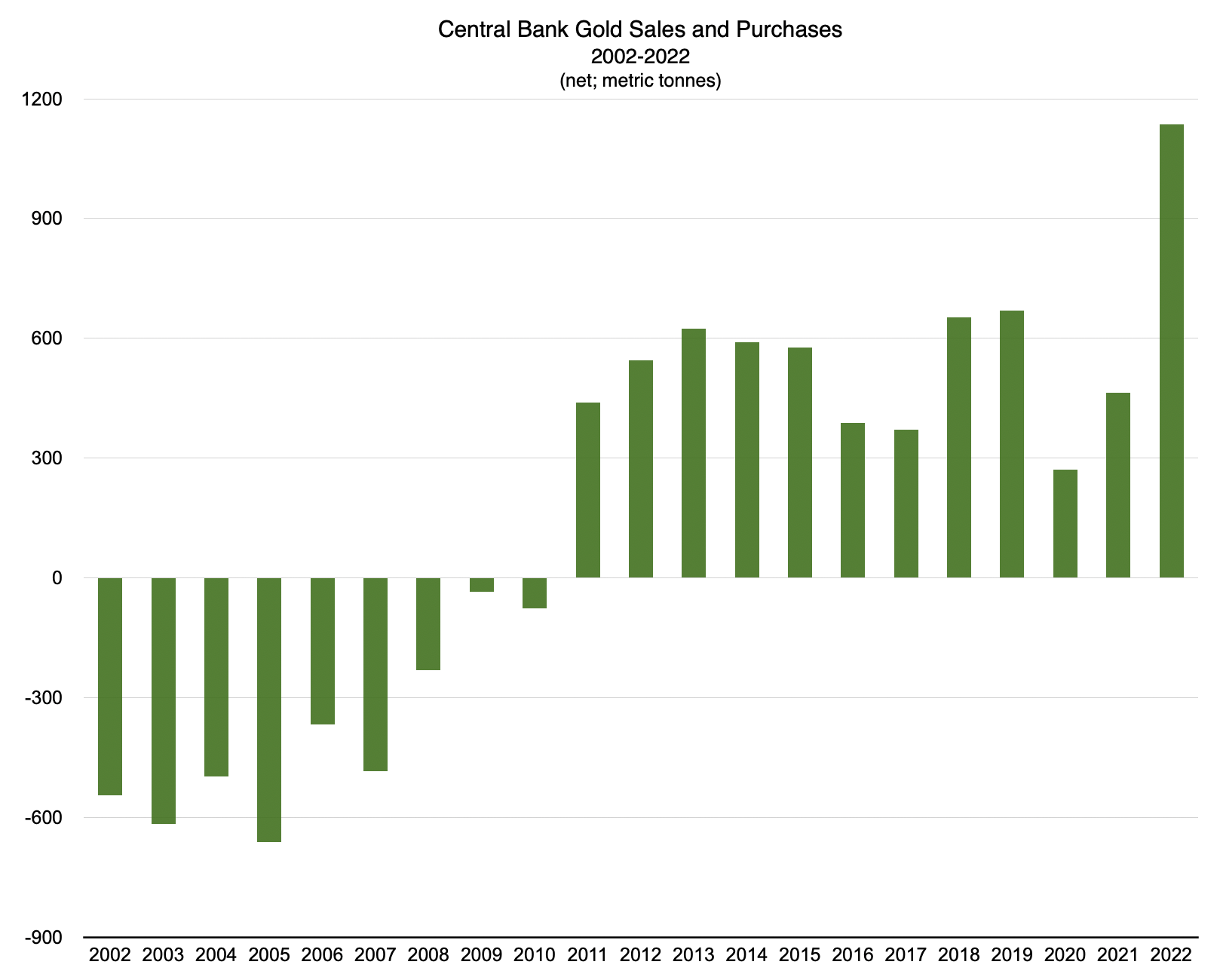

“During our most recent quarterly webinar, we said that it feels as if investors need to be ‘scared into’ owning gold. What we meant is that most investors seem uninterested in gold until things get ugly. Well, things got really ugly last year, and central banks took note, so you may say that they, too, got scared into owning gold, accelerating their purchases to record levels. Could the attitude of central banks towards gold be paving the way for investors more broadly?”

USAGOLD note: The time to buy gold is when things are quiet, not when they get ugly. That is precisely what the central banks have been doing over the past couple of years, and are doing now.

Chart by USAGOLD [All rights reserved] • • • Data Source: World Gold Council

Gold tracks sideways as ‘higher for longer’ gains traction

Holmes advises investors to take advantage of the gold-dollar inverse correlation

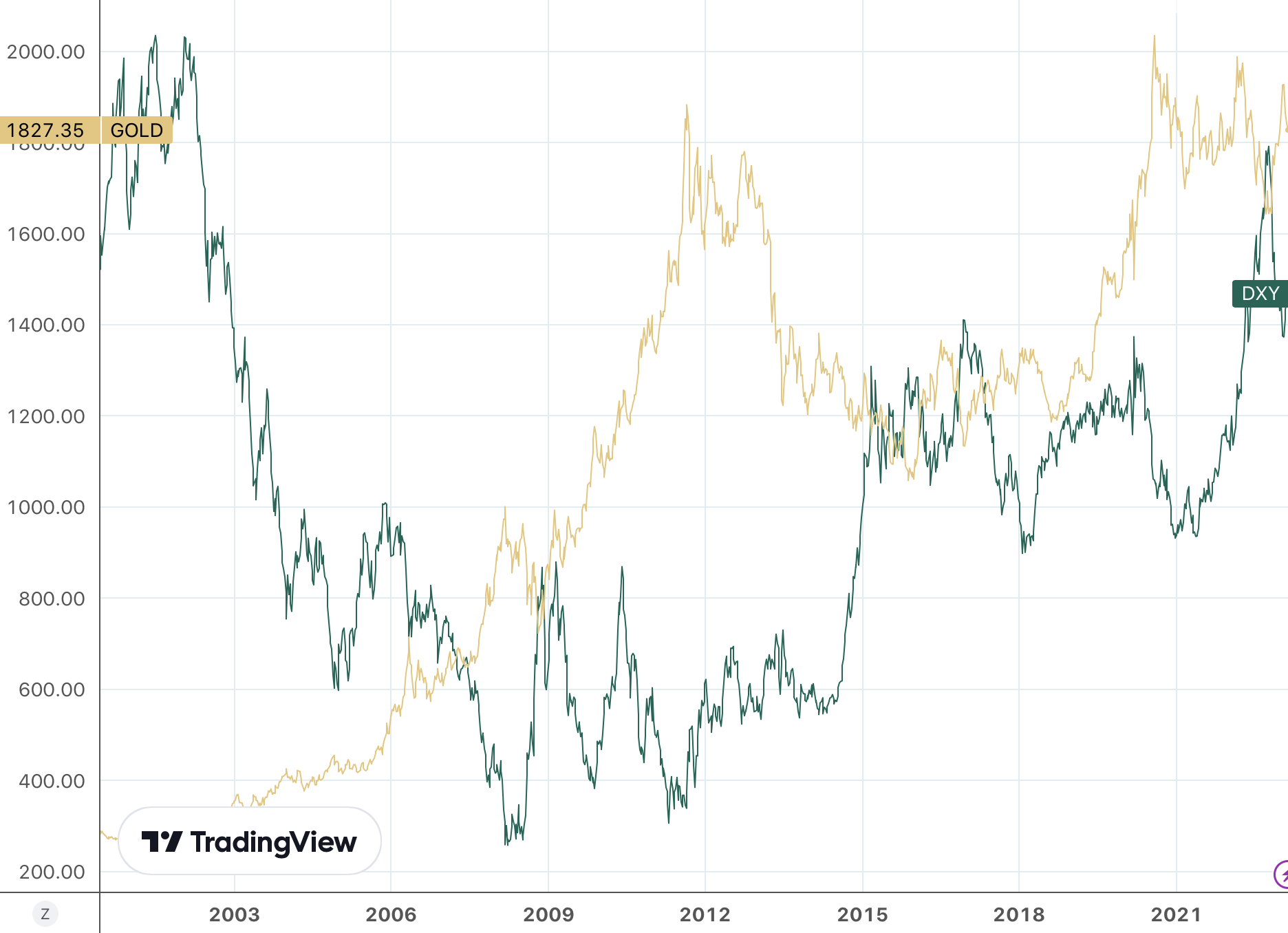

(USAGOLD – 2/23/2023) – Gold is tracking sideways this morning as the ‘higher for longer’ scenario gained traction, the dollar weakened slightly, and the markets weathered the release of January’s FOMC minutes no worse for the wear. It is up $2 at $1830. Silver is up 5¢ at $21.65. US Global Investors Frank Holmes advises investors to exploit the inverse correlation between gold and the dollar. The time to accumulate gold, he says, is during periods of dollar strength.

“Gold,” he continues in an advisory posted yesterday, “is nearing its strongest buy signal in four months as the US dollar eases off a rally that’s carried the greenback to its highest point since early January. According to the 14-day relative strength index (RSI), gold was at its most oversold level since October 2022 at the end of last week, indicating it may be time to consider buying in anticipation of mean reversion.… Gold is currently about 6% off its 2023 high of just under $1,960 an ounce, under pressure from the dollar, which has made gains against a basket of world currencies on economic data that all but guarantees additional rate hikes. Unemployment sits at 3.4%, the lowest reading in more than half a century, giving the Federal Reserve the go-ahead to continue its fight against inflation.”

US Dollar Index and Gold

(2000-present)

Chart courtesy of TradingView.com • • • Click to enlarge

Fischer’s teaching will influence central banks for many years to come

Financial Times/Robin Wigglesworth/2-16-2023

USAGOLD note: A revealing inside look at the intellectual origins of modern central banking……

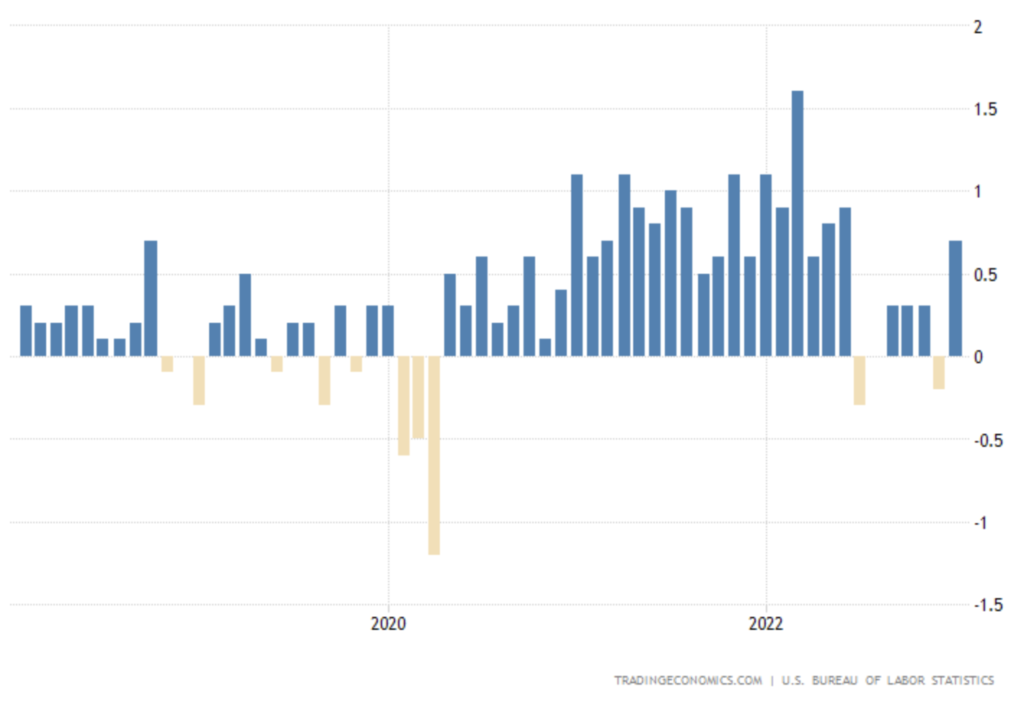

Wholesale prices surge again in sign U.S. inflation is unlikely to ease quickly

MarketWatch/Jeffry Bartash/2-16-2023

“U.S. wholesale prices jumped 0.7% in January to mark the biggest gain since last summer, offering further proof that inflation is sticky and unlikely to decline rapidly. Economists polled by The Wall Street Journal had forecast a 0.4% increase.”

USAGOLD note: More surprising news on the inflation front (for those who ignore the connectionn between money creation and inflation.)

Producer Price Index

(%, Monthly)

Stocks face ‘meaningful’ downside risk amid ‘complacent’ markets: JPMorgan

MarketWatch/Vivien Lou Chen/2-15-2023

USAGOLD note: Another no punches pulled warning from a top Wall Street investment firm……Only this time from its clientele. 68% said they would be sellers in the coming days/week, according to a survey conducted by the firm.

Gold pushes to higher ground on light short covering, bottom fishing

Standard Chartered sees fading headwinds for gold

(USAGOLD – 2/22/2023) – Gold pushed to higher ground in early trading on what looks to be a combination of light short covering and some investor bottom fishing. It is up $8 at $1845.50. Silver is up 11¢ at $22.02. Standard Chartered, the German investment bank, says gold’s headwinds have begun to fade.

“We would gradually add exposure to gold (especially those who are underinvested),” it says in an advisory reported at FXStreet, “given that XAU/USD is starting to look oversold. Moreover, central bank demand remains strong and we expect that to continue supporting gold prices. The rebound in real yields and the USD is likely to level off, in our view, fading headwinds against gold. The bright metal can also serve as an attractive hedge against short-term volatility due to geopolitical tensions.”

Couldn’t resist passing along Ramirez’ latest:

Cartoon courtesy of MichaelPRamirez.com

The inflation boogeyman now hides in services

Bloomberg/John Authers/2-15-2023

USAGOLD note: Though services, as Authers points out, are the driving force behind the current inflation rate, we should not dismiss the anecdotal evidence from supply managers who report higher prices for goods that go into the production process. Should the price of finished goods begin to rise again, those increases will be in addition to the already high cost of services.

The barbarous relic

Comerica Wealth Management/John Lynch/2-13-2023

“While the fundamental strategies driving the move higher in gold can be disputed between its use as an inflation hedge or a safe-haven asset, the technicals are indisputable – momentum is strong, and flows are mild – suggesting further gains ahead.”

USAGOLD note: Lynch starts with John Maynard Keynes’ famous description of told as the “barbarous relic” which he says questioned its usefulness as an investment. However, Keynes’ wasn’t talking about gold as an investment in that context, but as a national asset backing the value of the currency. That said, Lynch goes on to paint of picture of gold that shows it as anything but a barbarous relic. He focuses on the longer-term trends.

Solving the puzzle of high inflation, weak growth and low unemployment

The Hill/Nicholas Sargen/2-15-2023

USAGOLD note: A solid overview of where we are now and how we got here……

Investors need to prepare for era of ‘big government’, Bank of America says

Financial Advisor/Karen DeMasters/2-13-2023

USAGOLD note: Quinlan says that big government will build up higher levels of debt creating “distortions” investors with which investors will be forced to contend. “The next five years are not going to be as easy for investors as the last decade,” he cautions.

Gold tracks lower on Fed rate trajectory

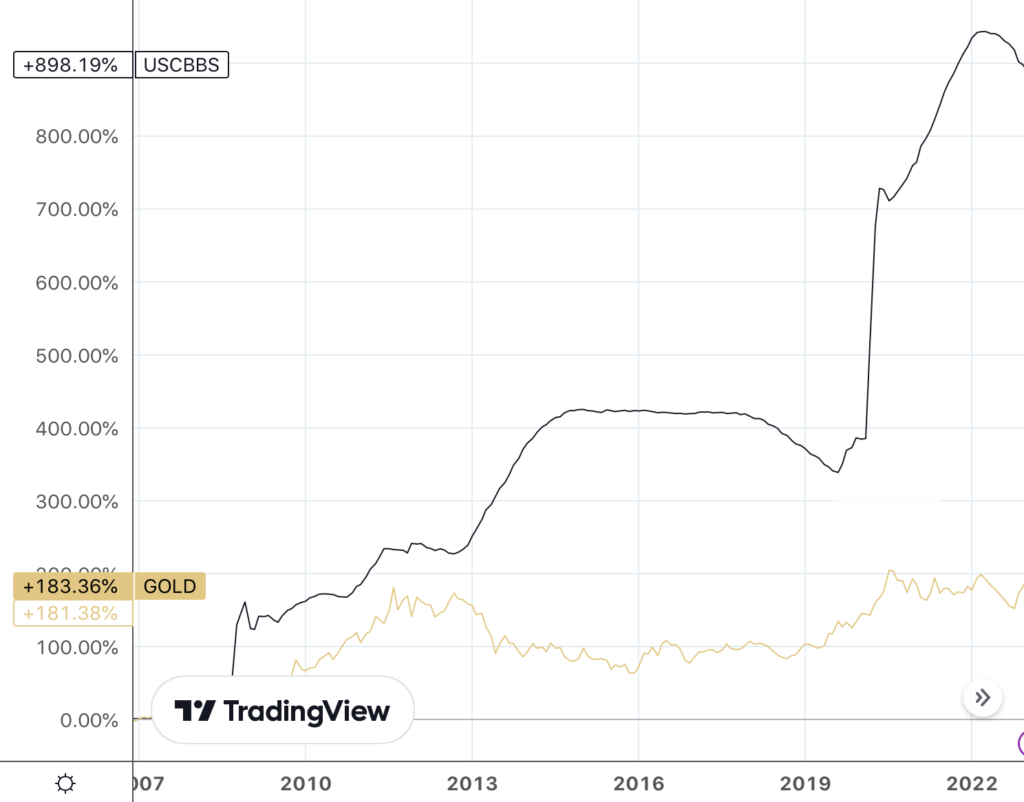

Gold would have to be priced at $32,000/oz to cover Fed’s balance sheet

(USAGOLD – 2/21/2023) – Gold tracked to the downside in early trading as worries about the Fed rate trajectory continued to weigh on market sentiment. It is down $8 at $1836. Silver is down 8¢ at $21.81. Goldman Sachs’ chief economist Jan Hatzius predicts the Fed will raise rates another 0.75% by mid-year with no cuts until 2024. Analysts will be looking for clues on where the Fed might be headed in the minutes from February’s FOMC meeting to be released tomorrow.

In an article posted at Eurasia Review, macroeconomic analyst Alexander Gloy offers food for thought: “At the current price of $1,875 per ounce, US gold reserves are worth approximately $490 billion. In order to back all outstanding currency with gold reserves, the price of gold would have to reach $8,800 per ounce, roughly five times higher than it is today. If gold were to cover all money created by the Federal Reserve (which is equal to its current liability of $8.4 trillion) the price of gold would have to be upwards of $32,000 per ounce (nearly eighteen times the current price of gold).”

Gold and the Fed Balance Sheet

(%, 2007-present)

Chart courtesy of TradingView.com

Morgan Stanley strategists say stocks ignore Fed, earnings reality

Bloomberg/Farah Elbahrawy/2-13-2023

USAGOLD note: In other words, the stock mania continues unabated…… As the old Wall Street saying goes, they do not ring a bell at the top. Once the scramble to get out begins, things could deteriortate rapidly. Previously, Wilson predicted the S&P 500 will hit bottom between 3000 and 3300 – an almost 30% drop from where we are now.

The latest from John Paulson on gold, fed policy, currencies, stocks and more

Alain Eldann Interviews/Interview of John Paulson/2-12-2023

USAGOLD note: Paulson offered this answer in response to why nation states are switching from holding dollars in their reserves to physcial gold. Of course, the appreciation Paulson states is not confined to nation-states, but applies to anyone who owns gold. He believes that we are at the beginning of a long term gold uptrend. He advises, “you’d be better off keeping your investment reserves in gold at this point.”

There’s a new inflation warning for consumers coming from the supply chain

CNBC/Lori Ann LaRocco/2-13-2023

USAGOLD note: Some will recall that long before rising prices began to show up in the Labor Department’s consumer price index, purchasing managers warned of persistent price increases in the supply chain.

The stock market is wishing and hoping the Fed will pivot — but the pain won’t end until investors panic

MarketWatch/Satyavit Das/2-6-2023

USAGOLD note: The above is one of three “p’s” Das believes “may be relevant for 2023.” The other two are “persistence” and “pain.” He says inflation is unlikely to fall to central bank targets (2%-4%) “for some time.” Needless to say, the realization of such could cause turmoil in financial markets around the globe.

Gold up marginally as dollar firms; investors worry about Fed rate trajectory

Gilbert sticks with his $2428 forecast, but says support must first hold at $1845-50

(USAGOLD – 2/20/2023) – Gold is up marginally this morning as the dollar firmed and investors continued to worry about the Fed’s rate trafectory. It is up $1 at $1846. Silver is down 2¢ at $21.79. Market analyst Avi Gilbert welcomes gold’s recent pullback as the “set-up” for his forecasted $2428 target. He says support, though, must first hold in the $1845-50 region.

“As long as that support holds,” he says in an advisory posted at Seeking Alpha. “I am expecting a rally over the coming weeks. Should that rally take shape as an 5-wave structure, which adheres to our Fibonacci Pinball structure, then we will have to prepare for a break out in gold over the coming month, which will next point us north of $2,100SPX and quite rapidly. However, if the next rally is corrective in nature or if we see a sustained break of $1845/50 support, then it opens the door to the potential that this pullback/consolidation will take us several more weeks, and can potentially take us down to test the $1735/1,780 region.”

Ukraine war turns Russia into a nation of gold bugs

Financial Times/Anastasia Stagnel and Lelie Hook/2-11-2023

“After Russian President Vladimir Putin announced the country’s invasion of Ukraine last February, Natalia Smirnova’s phone started ringing off the hook. The financial adviser’s Russian clients were panicking. ‘Should I buy gold?’ one asked her. ‘If worst comes to worst, at least I can bury it.’”

USAGOLD note: War and inflation have a tendency to do that. Of course, the urge to accumulate is not confined to Russia alone. Demand for gold among private investors in Europe is also on the rise.

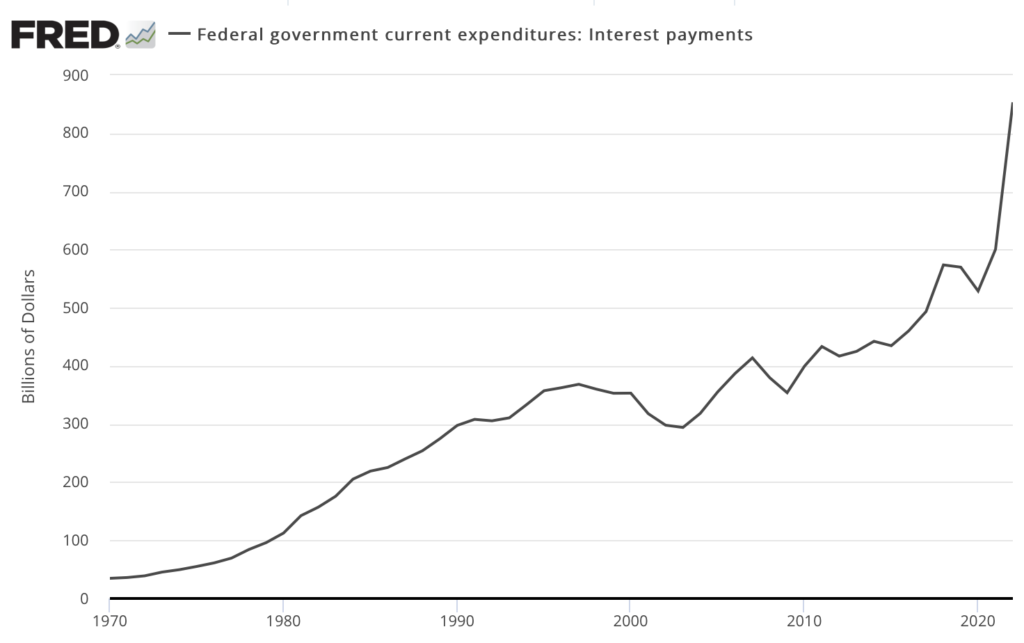

At the current pace, interest on US government debt will soon hit one trillion dollars.

MishTalk/Mish Shedlock/2-5-2023

“A word about owing [the national] debt to ourselves. Apparently debt does not matter because we owe it to ourselves. Ridiculous.”

USAGOLD note: As Shedlock points out, it won’t be long until interest on the national debt hits $1 trillion. To put that number into perspective, the federal government’s revenue for 2022 was $5 trillion. At $1 trillion, interest payments would consume 20% of revenue. (As an aside, government expenditures were $6.5 trillion in 2022, leaving a $1.5 trillion deficit.) Interest payments on the national debt are now $853 billion. In what might be an advanced case of wishful thinking, Janet Yellen recently told the Wall Street Journal that interest rates have indeed gone up but that the Treasury Department assumes “interest rates would move back toward more normal levels.”

Sources: St. Louis Federal Reserve [FRED], US Bureau of Economic Analysis

After Thailand became ground zero in the Asian financial crisis, the baht achieved a long-running stability

Financial Times/Ruchir Sharma/2-11-2023

USAGOLD note; Sharma begins this retrospective with a mention of the 1998 Asian currency crisis that began in Thailand.. As Sharma points out, Thailand’s crisis set off a global contagion that spread to other emerging countries, prompting world leaders to intervene to slow its advance. We note with interest that on the same day Financial Times posted Sharma’s article, Bloomberg ran a report warning that “the devaluation run in emerging markets is just getting started.”

Soaring energy bills shock struggling consumers around the globe

Bloomberg/Alice Kantor and Ainsley Thomson/2-10-2023

USAGOLD note: Soaring energy costs globally undermines the argument that inflation is under control. What we are experiencing now might be a pause in the dominant trend. The inflation genie, as it is often said, once out of the bottle, is difficult to put back in.