Gold tracks sideways as ‘higher for longer’ gains traction

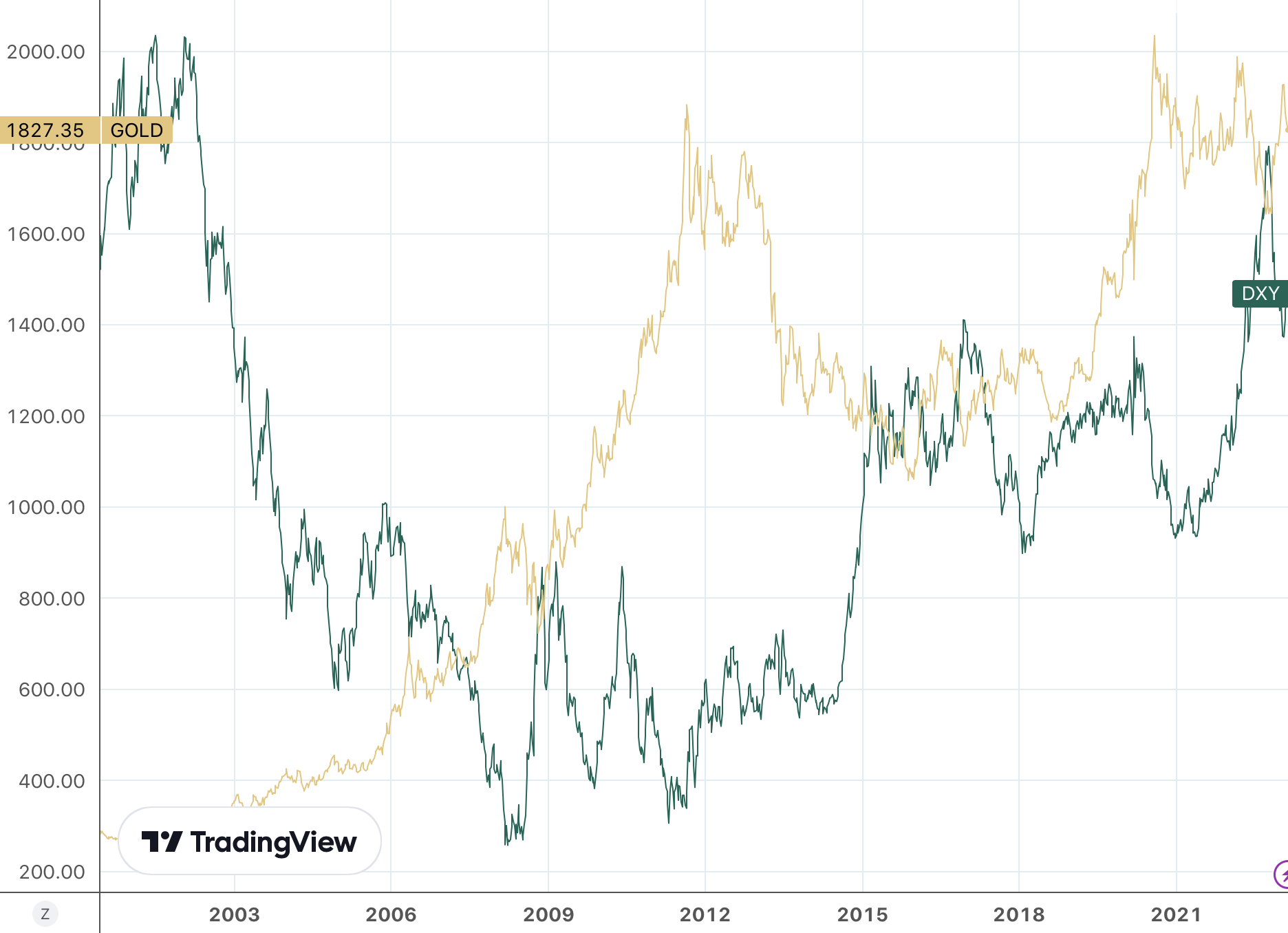

Holmes advises investors to take advantage of the gold-dollar inverse correlation

(USAGOLD – 2/23/2023) – Gold is tracking sideways this morning as the ‘higher for longer’ scenario gained traction, the dollar weakened slightly, and the markets weathered the release of January’s FOMC minutes no worse for the wear. It is up $2 at $1830. Silver is up 5¢ at $21.65. US Global Investors Frank Holmes advises investors to exploit the inverse correlation between gold and the dollar. The time to accumulate gold, he says, is during periods of dollar strength.

“Gold,” he continues in an advisory posted yesterday, “is nearing its strongest buy signal in four months as the US dollar eases off a rally that’s carried the greenback to its highest point since early January. According to the 14-day relative strength index (RSI), gold was at its most oversold level since October 2022 at the end of last week, indicating it may be time to consider buying in anticipation of mean reversion.… Gold is currently about 6% off its 2023 high of just under $1,960 an ounce, under pressure from the dollar, which has made gains against a basket of world currencies on economic data that all but guarantees additional rate hikes. Unemployment sits at 3.4%, the lowest reading in more than half a century, giving the Federal Reserve the go-ahead to continue its fight against inflation.”

US Dollar Index and Gold

(2000-present)

Chart courtesy of TradingView.com • • • Click to enlarge