Gold tracks lower on Fed rate trajectory

Gold would have to be priced at $32,000/oz to cover Fed’s balance sheet

(USAGOLD – 2/21/2023) – Gold tracked to the downside in early trading as worries about the Fed rate trajectory continued to weigh on market sentiment. It is down $8 at $1836. Silver is down 8¢ at $21.81. Goldman Sachs’ chief economist Jan Hatzius predicts the Fed will raise rates another 0.75% by mid-year with no cuts until 2024. Analysts will be looking for clues on where the Fed might be headed in the minutes from February’s FOMC meeting to be released tomorrow.

In an article posted at Eurasia Review, macroeconomic analyst Alexander Gloy offers food for thought: “At the current price of $1,875 per ounce, US gold reserves are worth approximately $490 billion. In order to back all outstanding currency with gold reserves, the price of gold would have to reach $8,800 per ounce, roughly five times higher than it is today. If gold were to cover all money created by the Federal Reserve (which is equal to its current liability of $8.4 trillion) the price of gold would have to be upwards of $32,000 per ounce (nearly eighteen times the current price of gold).”

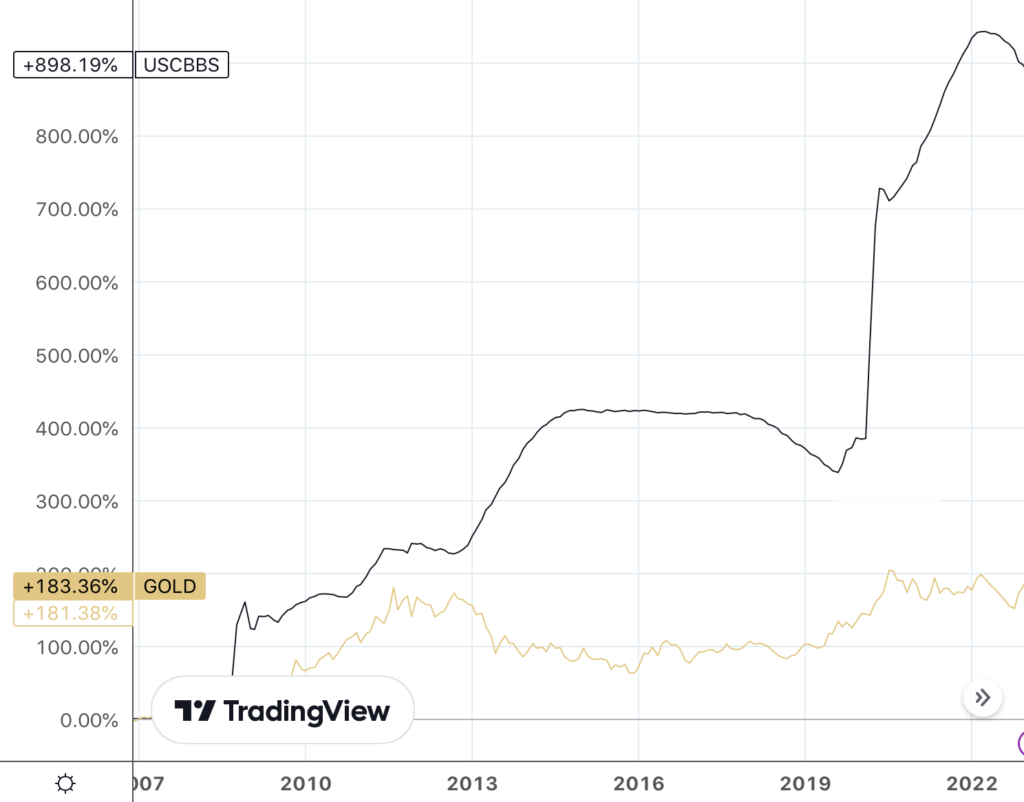

Gold and the Fed Balance Sheet

(%, 2007-present)

Chart courtesy of TradingView.com