Monthly Archives: February 2023

Headed for the tail

Hussman Funds/John Hussman/2-22-2023

“I intentionally use the phrase ‘run-of-the-mill’ to describe potential market losses of -30%, -55%, and -60%, because none of these estimates can be considered ‘worst case scenarios.”’ Historically, market cycles typically trough at the point where prospective S&P 500 total returns are restored to the greater of a 10% nominal return or 2% above Treasury bonds, so I lean toward expecting the -60% outcome. Nothing in our discipline relies on that outcome. Still, I believe it is not only possible but likely.”

USAGOLD note: Hussman’s latest …… As reflected in the quote above, he ranks among the most bearish forecasters.…… “Still, the deferral of consequences,” he writes, “is very different from the absence of consequences. My concern is for investors that may discover that the hard way.”

Central banks, recession ‘landing’ risks and why China is the issue to watch

Morning Porridge-Zero Hedge/Bill Blain/2-21-2023

USAGOLD note: Blain surveys what’s topmost on investors’ minds of late and arrives at a down-to-earth conclusion: “Uncertain times. I am keeping my gold positions in place.”

‘We haven’t left the bubble’

MarketsInsider/Linette Lopez/2-22-2023

USAGOLD note: Stocks are down about 6.5% over the past twelve months, yet, as this article suggests, bubble-complacency dominates investor thinking. A large chunk of the investment community believes fervently that the other shoe is not going to drop anytime soon, and if it does they will be able to get out with a few keystrokes. “Wall Street,” says Lopez, “will eventually have to open its eyes, take its fingers out of its ears, and watch this bear-market rally fall apart.” At that point, it is likely a crowd will gather at the door, frustrating assumptions of a quick exit.

Russia to suspend participation in nuclear arms treaty with US

Financial Times/Max Seldon, Anastasia Stognei, Henry Foy and Felicia Schwartz/2-21-2023

“Vladimir Putin has said Russia will suspend its last remaining nuclear weapons treaty with the US, a move western officials said spelt the end of the post-cold war arms control regime.”

USAGOLD note: Normally, we try to stay away from politics on these pages – even the international variety. At the same time, we recognize that politics can play a crucial role in the direction of markets, the impact of the war in Ukraine being a case in point. We post this article for the insights it provides on Vladimir Putin’s thought processes. A comment from Tatiana Stanovaya, a senior fellow at the Carnegie Endowment for International Peace, gave pause. “Putin,” she says, “really thinks Russia is at war with the west and the US, and Ukraine is just one episode in this confrontation.”

Daily Gold Market Report

Gold descends toward the $1800 level

Standard Chartered sees gold as ‘closing in on oversold territory’

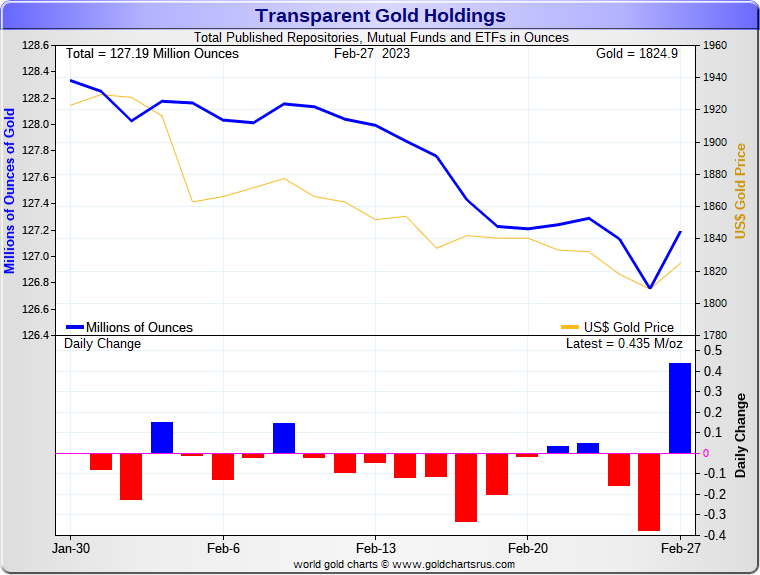

(USAGOLD – 2/28/2023) – Gold descended toward the $1800 level in today’s early going as it looks to close out what’s been an unforgiving month. It is down $8 at $1811.50. Silver is down 8¢ at $20.62. Gold’s month-lomg selloff began in early February when it ran into technical resistance at $1960 and gathered momentum as investors added worry about a more hawkish Fed to the mix. Standard Chartered’s Suki Cooper sees gold as “closing in on oversold territory” and puts the next support level at $1788. ETF outflows, she says in a client note cited by Kitco News, have been one of the culprits in gold’s retreat with a reduction of 20 metric tonnes thus far in February, “and 11 tonnes materializing in the last four sessions.”

Chart courtesy of GoldChartsRUs

Goldman sees Fed hiking by further 75 points on stronger growth

Bloomberg/Michael Heath/2-21-2023

USAGOLD note: Some will view this forecast as optimisitic. Some of the more hawkish Fed officials are calling for a 0.5% rate increase. The next FOMC meeting is a mmonth away. Much water will run under the bridge between now and then.

Investors have pushed stocks into the death zone, warns Morgan Stanley’s Mike Wilson

MarketWatch/Steve Goldstein/2-20-2023

USAGOLD note: History tells us that market panics are merciless.Wilson warns that the current frenzy is built on a Fed pause or pivot that isn’t coming.

China’s U.S. Treasury holdings hit 12-year low on rate hikes, tensions

NikkeiAsia/Yuto Saito and Iori Karate/2-17-2023

USAGOLD note: China’s liquidation of US Treasuries has been steady and aggressive. Its Treasuries holdings declined 17% in 2022. Japan Treasuries stockpile also declined 17% in 2022

Investors drop bets on falling US interest rates in face of stubborn inflation

Financial Times/Kate Duguid/2-16-2023

USAGOLD note: Speculators dart this way, then that, always with the hope that they catch a wave (and not go over a cliff)……Investors do their research, choose carefully, then commit for the long run, usually within the context of a balanced portfolio. Most of USAGOLD’s clientele fits in the second category.

Gold drifts marginally higher as it looks to close out a dismal February

Yellow metal gives back $140 of the $340 price gain since last November

(USAGOLD – 2/27-2023) – Gold drifted marginally higher in directionless trade this morning as it looks to close out what’s been a dismal month. It is up $2 at $1815. Silver is down 5¢ at $20.80. Saxo Bank’s Ole Hansen sees renewed dollar strength and a weaker bond market as the two primary factors providing headwinds for gold. The yellow metal, he reminds us by way of perspective, gained $340 in the rally that began last November, and has now given back $140.

“For now,” he says in an advisory posted Friday, “gold is likely to take much of its directional inspiration from the dollar and, until we see another rollover, gold will continue to look for support. Demand for gold remains uneven, but in the short term we anticipate that central bank demand will more than offset a continued lack of appetite from investors in the ETF market where total holdings continue to be reduced, down by almost 50 tons since early November when gold began its strong run-up in prices.”

Gold and silver prices

(One month)

Chart courtesy of TradingView.com • • • Click to enlarge

__________________________________

“Markets got ahead of themselves in terms of pricing in Fed cuts, Investors were betting that the Fed was going to get inflation down successfully and quickly. I think this process is going to take longer than people thought.” – Idanna Appio, First Eagle Investment Management, via Financial Times

Market cycles will endure as long as humans exist

“Four of the most dangerous words in the investment world are ‘It’s different this time.’ When people use them, what they’re saying is that the norms of the past no longer apply. . .Both these

Dr. MoneyWise says. . . . Old Ben Franklin said it best. “By failing to prepare, you are preparing to fail.” And I will add, we do not know when the next crisis will begin, but begin it will. And when it does, only two kinds of investors will be there to greet it: Those who prepared and those who did not.

Looking to prepare for the next turn in the economic cycle?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Favorite web pages

Black SwansYellowGold

A chronology of panics, mania, crashes, and collapses

–– 400 BC to present ––

Those who think it can’t happen here, or that it’s different this time around, should take note of the number of black swan events in American history alone. The record is formidable. Gold ownership is traditionally a form of battening down the hatches against these recurring storms and, for the minority who adhere to it, an effective and ever-ready defense. Historian Stanford University historian Niall Ferguson summed up what a good many were thinking in the wake of the 2008 meltdown when he said, “Those few goldbugs who always doubted the soundness of fiat money – paper currency without a metal anchor – have in large measure been vindicated. But why were the rest of us so blinded by money illusion?” Why indeed. . . And why is that blindness still at play in the current crisis?

A shift in fund flows from Japan will be felt around the world

Financial Times/Benjamin Shatil/2-20-2023

USAGOLD note: Is Japan headed in a totally new direction? Shatil, who is the head of Japan forex strategy at JP Morgan, says “sharp shifts in Japanese investor portfolios are also flashing amber.” Japan’s big institutions are capable of moving markets, so global money managers will be watching intently.

Joe Biden is running out of ammunition to fight the next oil crisis

Marketsinsider/Brian Evans/2-18-2023

USAGOLD note: A revealing look at the Strategic Petroleum Reserve and why its depletion is something to be concerned about. Evercore’s James West says that recent drawdowns, taking it to its lowest level since 1983, puts “undue stress on American resources and limits our ability to limit an oil price spike.” In other words, another oil crisis could spike the inflation rate.

Column: The government crackdown on crypto is well underway. Get out while you can

Los Angeles Times/Michael Hitzik/2-17-2023

USAGOLD note: Has the regulatory hammer dropped? One positive contribution the crypto industry made over the years was awakening a vast army of investors to the dangers inherent to the fiat money system and the merits of including a safe haven in one’s portfolio plan. Many of those investors, in our view, will migrate to gold as difficulties mount in the crypto sector.

Dan Loeb says CPI, jobs may have exaggerated economic strength

Bloomberg/Victoria Batchelor/2-18-2023

USAGOLD note: The question is whether the slew of reports indicating a hotter-than-expected economy will affect Fed thinking……The next FOMC meeting isn’t until March 21, so members have time to see how it plays out – “This job,” says Loeb,” is sometimes like a game of 3 card monte where the dealer tries to trick you into thinking you see the card.”

Related: Fed’s preferred inflation gauges seen running hot/Bloomberg/2-18-2023

Gold pushes lower in cautious trading ahead of PCE inflation numbers

Fidelity investment manager makes interesting adjustment in personal portfolio

(USAGOLD – 2/24/2023) – Gold drifted lower this morning in cautious trading ahead of PCE inflation numbers to be released later today. It is down $5 at $1820. Silver is down 26¢ at $21.12. The PCE index is expected to come in slightly higher than last month. Fidelity’s Becks Nunn says she has decided to add alternative investments, including gold, to her personal portfolio after the dismal showing of stocks and bonds over the past year.

“You need to consider what else you have in your portfolio,” she writes in an advisory published yesterday, “and whether you already have enough diversification. When I looked at my accounts holding report, I noticed my alternative investments sat at around 5%. I’ve now changed this so that I’m now roughly invested in 50% equities, 35% bonds and 15% weighted to property and gold. This feels about right to me as my investment horizon is still reasonably long. Of course, what’s right for you is something only you can decide.”

Chanos: ‘I’m not sure speculation is gone.’

themarketNZZ/Gregor Mast interview of Jim Chanos/2-11-2023

USAGOLD note: Wall Street’s biggest short seller is short specific stocks, but he has reservations about the market as a whole now trading 21x trailing earnings. “Seniment,” he says, “still seems pretty frothy to me.”

The great gold rush: Central banks in frenzy

Eurasia Review/Alex Gloy-Fair Observer/2-18-2023

USAGOLD note: Eurasia Review returns to a World Gold Council survey of central banks from last June – a revealing look at what is driving official sector interest in gold. It delivers insights especially interesting in light of developments since then. This article will appeal to readers who would like to dig a little deeper into the forces now at work in the gold market. Gloy’s credentials include stints at Deutsche Bank and Credit Suisse over a 35-year career with a focus on macroeconomic research.

Fed faces new inflection point amid troubling inflation data

Financial Times/James Politi/2/17/2023

USAGOLD note: This new infection point sounds a lot like the old inflection point……