Monthly Archives: February 2022

German central bank doesn’t rule out gold revaluation

The Gold Oberver/Jan Nieuwenhuijs/2-15-2022

USAGOLD note: More deep thinking on the uses and abuses of gold from Jan Nieuwenhuijs …… The European Central Bank already marks its gold holdings to market. The United States should do the same, as should each central bank in the EU. Going the route JN suggests would do wonders for the gold mining industry. Under such circumstances, it would be in the business of furnishing the central banks with what would then become perhaps the single most important asset on their balance sheets.

The Fed nominees: Corks on the water

The New York Sun/Seth Lipsky/2-14-2022

USAGOLD note: Seth Lipsky goes to the heart of the matter in this New York Sun editorial. Though we are sympathetic, there is little hope that the monetary system will be anything other than fiat for the discernible future. Putting oneself on the gold standard remains the best option for dealing with the situation as it is.

Investors take shelter in cash as central bank fears shake markets

Financial Times/George Steer/2-15-2022

USAGOLD note: Not everyone, apparently, thinks cash is trash …… Goldman, according to FT, is advising its clients go overweight in cash and underweight in corporate bonds. The Wall Street bank also came out recently with a client advisory saying gold would go to $2150 over the next 12 months.

Gold moves marginally higher in early trading

Commerzbank sees gold breaking through the $1900 mark and ‘climbing beyond’

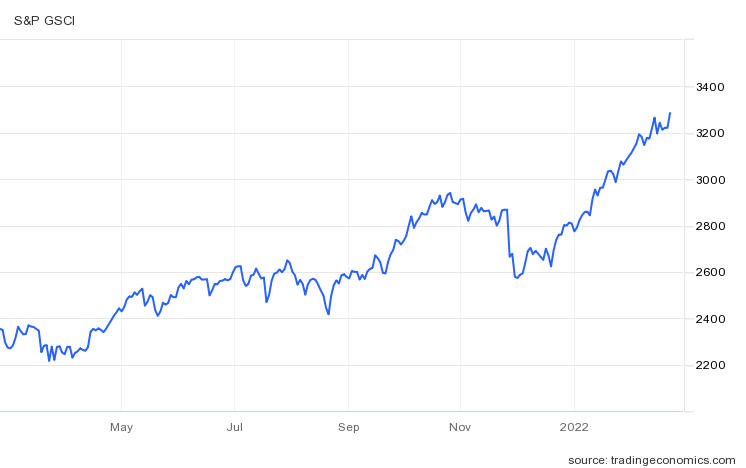

(USAGOLD – 2/23/2022) – Gold moved marginally to the upside in early trading as markets weighed the global response to Russia’s Ukraine incursion along with the impact of sanctions and related commodity supply disruptions on the global inflation rate and central bank monetary policy. It is up $5 at $1905. Silver is up 19¢ at $24.34. The new concerns about commodity pricing come at a time when investors are already “pumping more money into commodities than at any time in the last decade,” according to a Bloomberg report this morning.

S&P Goldman Sachs Commodity Index

(One-year)

Chart courtesy of TradingEconomics.com

As suggested here yesterday, though gold and silver’s reaction to the actual invasion has been muted, we should not overlook both metals trading at important psychological barriers – $1900 for gold and $24 for silver. “Given that the situation in Ukraine is deteriorating further and a military conflict cannot be ruled out,” advises Germany’s Commerzbank in an update released this morning, “we believe the gold price is likely to quickly regain the $1,900 mark and then continue climbing beyond it.” One of the tenets of technical analysis is that once resistance is broken, it often becomes support.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“My studies of the 17 major financial crises since the founding of the Republic reveal that over-optimism is an important driver of the bubbles that eventually become busts. As the legendary investor, Sir John Templeton, once said, ‘The four most dangerous words in investing are ‘This time is different.’ Such was the mind-set that real estate prices could only rise (2008), dot-com companies would forever grow and be profitable (2001), or that the Russian government would never default (1998). “

Robert F. Bruner,

The Hill

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Fed should hold immediate meeting to end asset purchases, Summers says

Yahoo!Finance/Chistopher Antsey-Bloomberg/2-11-2022

“Former Treasury Secretary Lawrence Summers said that the Federal Reserve ought to hold an immediate meeting to end its quantitative easing program — now scheduled to end next month — to underline its determination to tame inflation.”

USAGOLD note: It is highly doubtful that the Fed will follow Larry Summers’ advice. Summers continues to channel former Fed chairman Paul Volcker, who 40 years ago advocated and deployed policies similar to what he now recommends. The Fed is miles away from reintroducing Volkerism. That said, the real value in Summers’ public posture from an investor’s standpoint is in his rendering of cause and effect. “It is nothing short of preposterous,” he says, “that in an economy with 7.5% inflation, that in an economy with the tightest labor market we’ve seen in two generations, that the central bank is still as we speak growing its balance sheet.”

‘There’s no clean way out’ for spoiled malcontents

“The clan over the years ‘matured’ and turned unruly. Myriad severe development issues are increasingly on full display. The halcyon sandbox days are over for good, replaced by a confluence of insecurity, greed, and now constant infighting. To be sure, rich Uncle’s years of lavish generosity fostered a bunch of spoiled malcontents. The lax benefactor has come to realize he can no longer finance all the dysfunction and is desperate to craft a plan for exiting the relationship without unleashing mayhem. Some have structured their lives to stand on their own, while others’ very survival is at stake. All have developed bad habits, with some succumbing to deadly addictions. One camp says, ‘it’s time to get on with our lives without being further warped by all this charity money.’ Another is threatening to do harm to themselves. There’s no clean way out. Uncle fears calamity and harbors serious regret.”

Doug Noland

Credit Bubble Bulletin

Does the Fed still believe in the efficacy of monetary policy?

The Carson Report/Joe Carson/2-11-2022

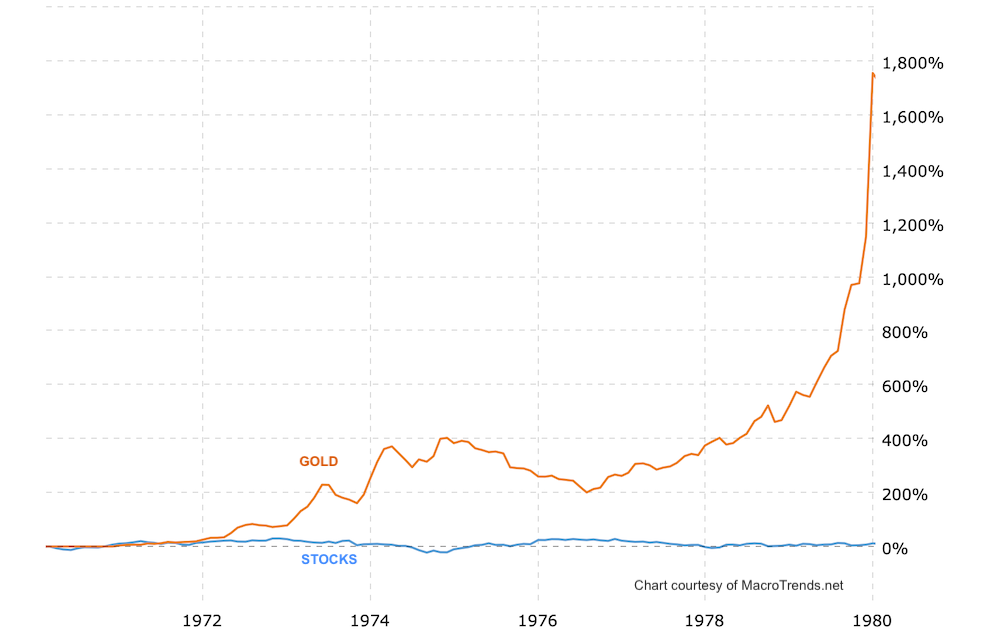

“A student of inflation cycles finds similarities between the 1970s and the current inflation cycle. Supply shocks sparked both cycles. In the 1970s, policymakers’ fear of the negative trade-off between fighting inflation and triggering more unemployment kept policy too easy for too long, extending the inflation cycle and ending with a hard landing.”

USAGOLD note: A very hard landing, as a matter of fact. In the meanwhile, gold went from $35 in 1970 to $875 in early 1980, while stocks languished. (See chart.) Joe Carson is a highly regarded economics analyst formerly at Alliance Bernstein and other investment banks.

Gold and stocks

(%, 1970s)

Waning stockpiles drive widespread global commodity crunch

Financial Times/Neil Hume and Emiko Terazano/2-13-2022

USAGOLD note: Scattered remnants of Team Transitory will be hard-pressed to advance the narrative following this report posted yesterday at Financial Times. “The problem,” says FT. “is particularly acute in metals.” Many contracts are trading on the LME in backwardation.

Gold down in muted reaction to Russian annexation of Ukraine provinces

Roubini sees a future for gold as an option in the new 60/40 portfolio

(USAGOLD – 2/22/2022) – Gold sold off moderately this morning in a muted reaction to Russia’s military annexation of two provinces in Ukraine and consequent sharply higher energy prices. It is down $1.00 at $1904.50. Silver is up 26¢ at $24.28. Some will see this morning’s tepid reaction as a case of selling the fact, but we should not overlook both metals trading at important psychological barriers – $1900 for gold and $24 for silver. Too, this morning’s sideways pricing raises an interesting question as to how much of gold’s rally over the past three weeks has to do with geopolitics and how much of it has to do with inflation and the impact of future Fed policy. In our view, one has fed off the other in that the invasion is likely to have a significant impact on the price of energy.

Gold price

(30 days)

Chart courtesy of TradingView.com

In an analysis posted on The Mint website this morning, Columbia University economist Noriel Roubini says that inflation will rewrite the rules of investment, particularly the 60/40 rule, i.e., the traditional portfolio consisting of 60% stocks 40% bonds. “The task for investors,” he says, “is to figure out another way to hedge the 40% of their portfolio that is in bonds.” He lists “three usable options for hedging the fixed-income component of a 60/40 portfolio” – inflation-indexed bonds, real assets like real estate and infrastructure, and gold. “Gold and other precious metals,” he says, “tend to rise when inflation is higher.” Gold, he adds, “is also a good hedge against the kinds of political and geopolitical risks that may hit the world in the next few years.”

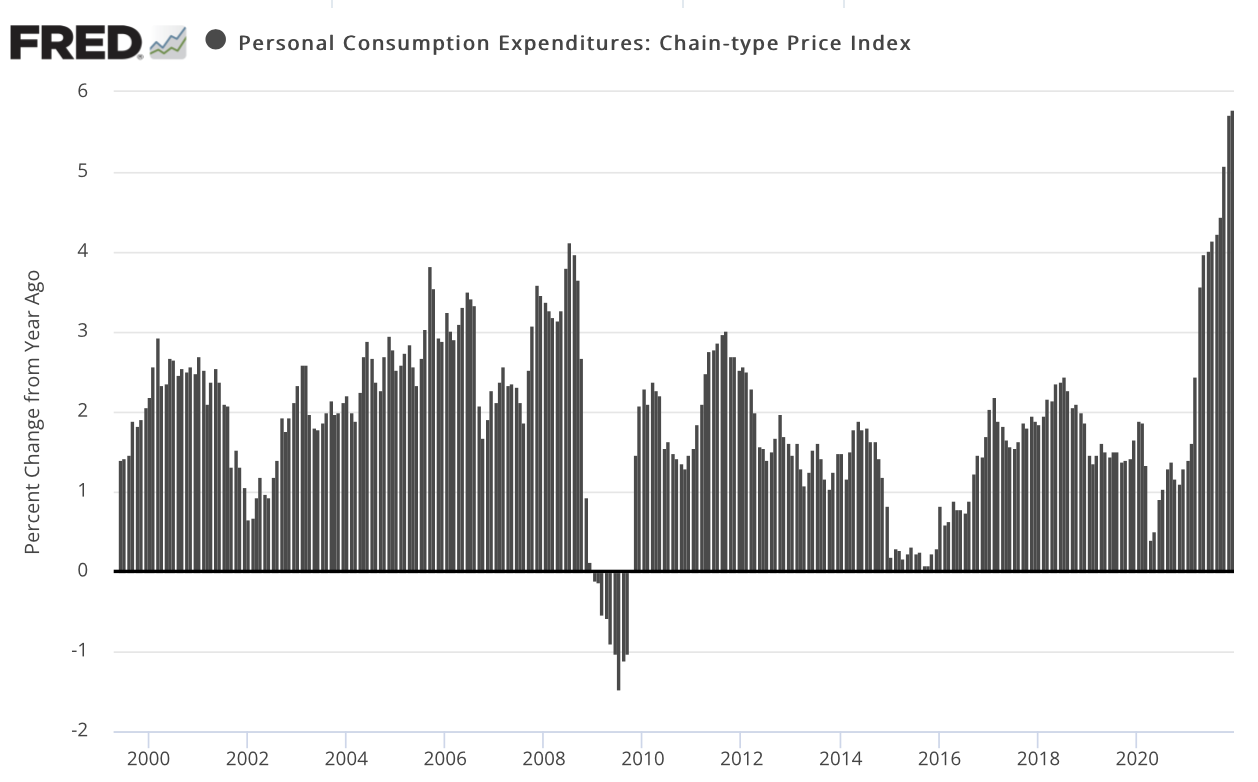

Another U.S. inflation guage is heading even higher

Bloomberg/Vince Golle/2-19-2022

“Federal Reserve Chair Jerome Powell and his colleagues in the coming week can expect to see their key inflation metric accelerate to a fresh four-decade high last seen when Paul Volcker led the U.S. central bank.”

USAGOLD note: The Personal Consumption Expenditure Index will go to 6% for January from 5.8% in December, according to a survey of Bloomberg economists. More indication is moving from transitory to entrenched. Consensus opinion has it, however, that the Fed is unlikely to go higher than a 0.25% hike in the Fed funds rate at its meeting in March.

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Economic Analysis

Gold outperforms stocks and bonds as traders seek haven assets

Financial Times/Neil Hume/2-19-2022

USAGOLD note: Over the past week, a narrative has developed around gold that it could become a primary beneficiary whatever policy direction the Fed takes. That, some say, is the reason for gold’s strong showing thus far this year. If the Fed fails to tighten sufficiently, inflation rages, and gold goes on a tear as a currency hedge. If it tightens too much, the prospect of credit failures and black swan events moves front and center, and gold goes on a tear as a safe-haven alternative. Hume’s article emphasizes the latter, citing strong inflows at gold ETFs comparable to previous times “when recession fears were at the front of investors’ minds.”

Beware the algorithms driving up oil prices

Financial Times/Gillian Tett/2-10-2022

USAGOLD note: In modern-day financial markets, the madness of machines is just as big a worry as the madness of crowds with their programming subject, as Tett points out, to the same frailties as their human creators. While algorithmic trading has driven up oil, many analysts see it as a factor driving down gold. Just as reversing the oil open interest could dramatically reverse the price of oil, so too could it reverse the price of gold – and perhaps we saw the first signs of that on Friday.

Jeffrey Gundlach says the Fed is ‘obviously behind the curve,’ will raise rates more than expected

USAGOLD note: With the amount of leverage in the system, as noted here on Friday, something could break in a major way if the Fed gets overly aggressive. Margin debt on stocks, for example, is at record levels (Nearly $600 billion and 50% higher than it was in 2008 just before the credit crisis). One need not be a Wall Street analyst to guess what might happen once investors begin liquidating those positions. And that is in only one small corner of the leverage universe.

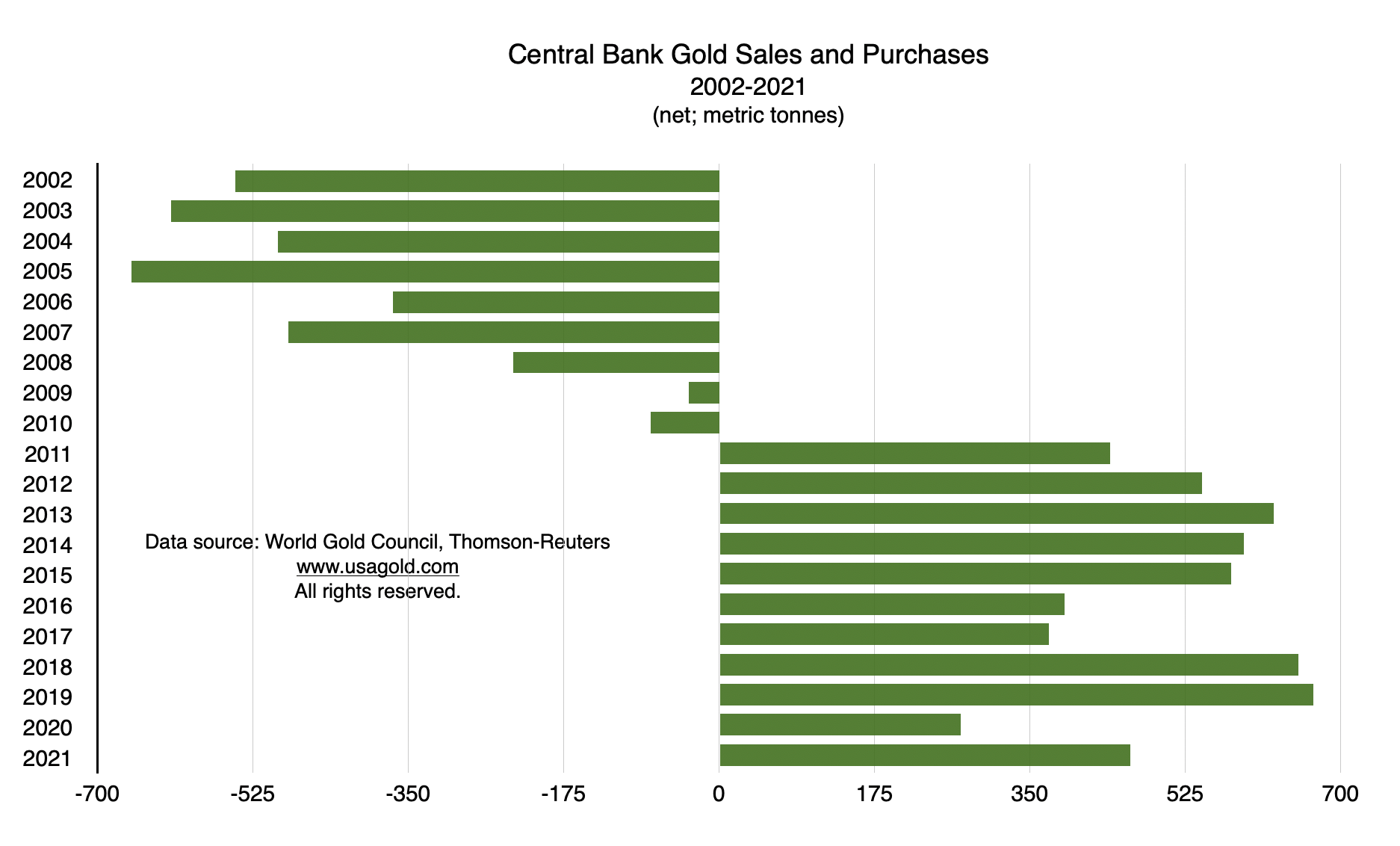

Tackling inflation: Poland to purchase more gold to boost its reserves

“Mr Glapiński said he intended to buy another 100 tons of gold this year in a favorable situation, at the right time and in the right doses. The National Bank of Poland has already accumulated over 230 tons of gold.”

USAGOLD note: Last year, central banks as a group purchased 463 metric tonnes net. One hundred tonnes is a significant number, and part of a major trend in place since 2011. Central banks moving from net sellers of the metal up until 2011 to net buyers since represents an important shift in gold market dynamics.

Gold begins week on quiet note after last week’s sharp increase

Managed money piles into the yellow metal

(USAGOLD – 2/21/2022) – Gold is beginning the week on a quiet note after last week’s sharp move to the upside driven by inflation concerns and Russia’s threatened invasion of Ukraine. It is level this morning at $1899. Silver is down 11¢ at $23.89. Both metals are challenging important psychological barriers at $1900 and $24. Increased fund and institutional interest though might provide the impetus needed for a breakthrough.

“Managed funds,” says London’s City Index this morning, “piled into the yellow metal and were their most bullish on it in three-months but, looking at how prices rallied into the weekend, we strongly suspect net-long exposure is actually much higher than the delayed COT data suggests. The biggest threat to gold prices right now is a Russian retreat. And as that doesn’t look very likely then we expect dips to be bought and for an eventual break above 1900.”

Fred Hickey on Ukraine crisis and gold

USAGOLD note: Fred Hickey offers a thought on the limits of central banking worth filing for future reference. It’s not just the Ukraine crisis we need to worry about. The limitations apply across the boards.

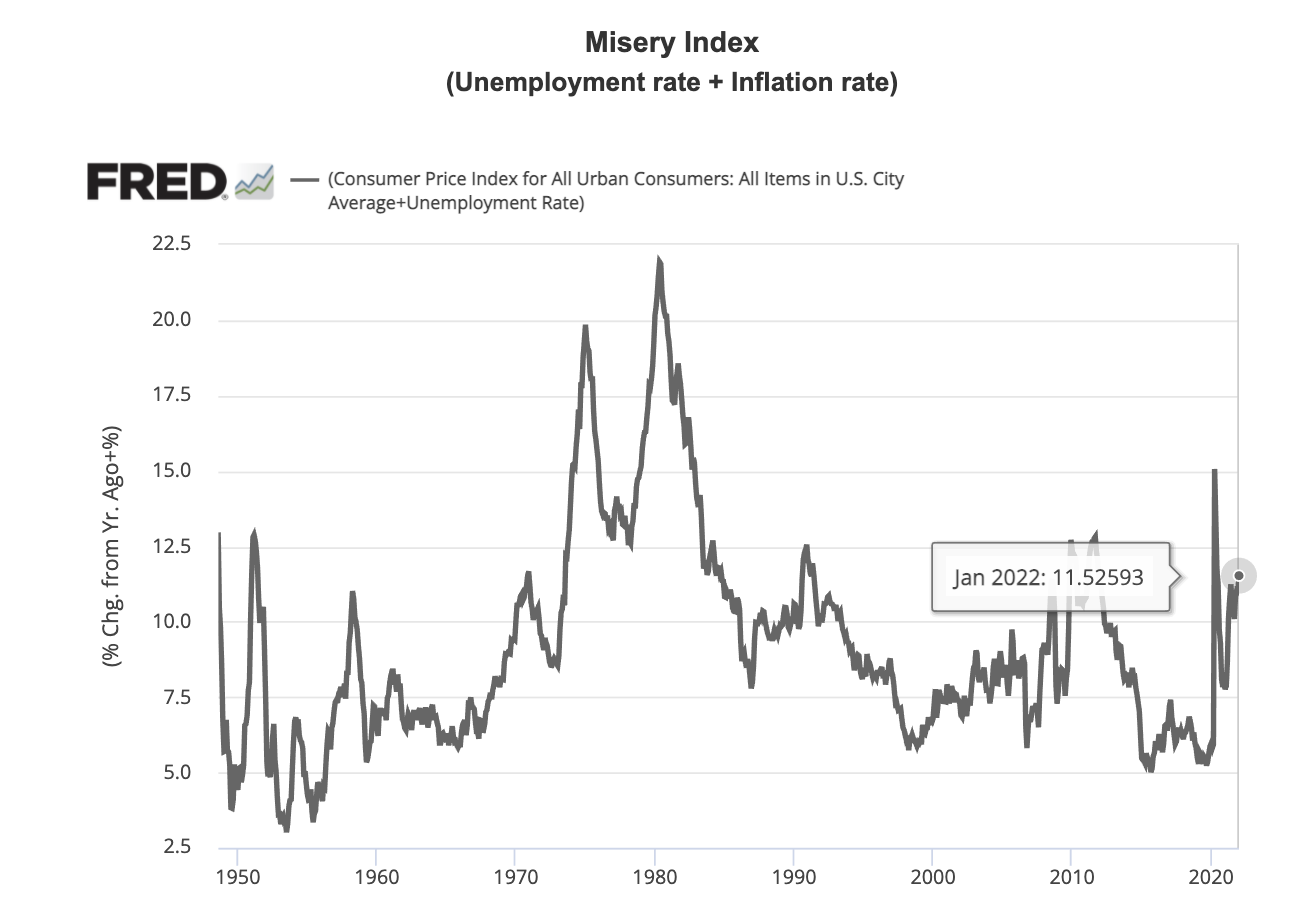

Biden’s Misery Index

Project Syndicate/Michael J. Boskin/2-17-2022

“Historically, the Misery Index seems to be correlated with electoral outcomes, with the party in power penalized when the index is high and rewarded when it is low.”

USAGOLD note: Although not dangerously high at this juncture, the Misery Index is trending higher and setting off all sorts of alarm bells at 11.5%. The election is still nine months out. By then, the MI could be much higher, or things could get better. Boskin, though, thinks it won’t get better unless the Fed miraculously engineers a lower inflation rate without a corresponding jump in unemployment – a prospect that might be even more daunting than inflation for the White House.

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics

Consumers face years of high energy prices, Big Oil CEOs warn

Reuters/Ron Bousso and Nerjus Adomaitis/2-9-2022

“Consumers should brace for years of high energy prices, heads of top oil and gas companies said, in what would pile pressure on governments struggling with spiraling inflation.”

USAGOLD note: Oil and/or gas are components in the pricing of just about everything, so central banks around the globe are not likely to be very happy about what this warning implies for the inflation rate down the road.

Surging inflation puts the Fed in an impossible situation

Bloomberg/Robert Burgess/2-10-2022

USAGOLD note: Even if the Fed raises rates a full percent, it will still put interest rates significantly below the inflation rate. Thus you really do get the worst of both worlds a “sharp slowdown” mixed with “hot inflation.” Too, the market is full of eddies, crosscurrents, and strong undertows driven by excessive leverage wherever the Fed might care to look. Beware the black swan ……