Monthly Archives: February 2022

How did the U.S. lose Russia?

Daily Reckoning/James Rickards/2-23-2022

USAGOLD note: Rickards thinks China will receive the benefit of Russia’s natural resources and the United States “could be paying the price for a long time to come.” Details at the link ……

Markets are saying Putin will get what he wants

Bloomberg Opinion/John Authers/2-24-2022

“It’s not often a day starts with quite such a jolt. I have many opinions about Russia’s invasion of Ukraine. The impact on markets is, personally, well down my list of concerns. But it’s my job to cover them, and this can be expected to have a big effect. Within Europe, this is the greatest negative shock to the international order since the end of the Second World War, and it will have profound consequences.”

USAGOLD note: Yet stock markets plummeted, then magically levitated significantly higher …… We referenced this Authers’ column in Friday’s DMR and repost it here for those who may have missed it. In it, we feel he hits closer to the mark than anything we’ve read so far as to how markets are reading the Ukraine invasion. “It might be best to take Thursday’s extraordinary rally as an opportunity to take a few profits and allocate something to cash or gold,” he writes in conclusion. “Some insurance during a situation that is very dangerous seems like a good idea.” In our many years reading Auther’s columns, we do not remember him ever making an outright recommendation to buy gold. Perhaps he senses that something does not add up in all of this. For the stock market, it is double sevens at every roll of the dice.

Gold rush is on. It’s not too late to get in.

Yahoo!Finance/Barron’s Bert Levisohn/2-19-2022

USAGOLD note: Barron’s deputy editor Bert Levisohn comes out bullish on gold – something that is not standard fare at the publication. If the move to $1900 indicates a new leg in gold’s long-term secular bull market, our sense is that it is in its early stages. The sitting bull is stirring ……

The case for commodities: ‘Super backwardation,’ structural demand and inventory shortages

Goldman Sachs/Audio interview+transcript/2-15-2022

“And even at these price levels, there is no indication we’re making any type of improvement in these imbalances. We’re not seeing the increases in supply. Nor are we seeing demand damage at these levels. What does that mean? The only cure for those imbalances is higher prices.”

USAGOLD note: The latest on commodities from Goldman’s Jeff Currie ……He sees the current turn to the upside as the start of a new super cycle in commodities – “the revenge of the old economy.”

Chart courtesy of TradingEconomics.com

Investors brace for central banks’ retreat from bond markets

Financial Times/Tommy Stubbington and Kate Duguid/2-19-2022

“The biggest buyers in bond markets are poised to become sellers, as central banks that have bought trillions of dollars of debt since the 2008 financial crisis start trimming their vast portfolios.”

USAGOLD note 1: If you are looking for background on how the quantitative tightening process might unfold, along with its implications for the global bond market, this Financial Times article is foundational. If central banks follow through with announced policy change, we stand at the brink of a paradigm change in monetary policies formerly in place for 13 years.

USAGOLD note 2: One London trader says the bond market is now trading in “cloud cuckoo land” – that the markets have not in any way priced in quantitative tightening. Another says that the Fed will be watching closely what happens with UK’s QT program as “quite a useful control experiment.” Somehow, we think those are two particularly important pieces of information for gold investors to digest.

USAGOLD note 3: A question lingers: How will governments finance their massive deficits once the biggest buyer of debt – their own central bank – exits the market? We have already seen early signs in bond yields as to what might occur. Yields could rise much faster than the market is now anticipating.

Source: tradingeconomics.com

Inflation – Cassandra speaks

Blain’s Morning Porridge/Bill Blain/2-17-2022

USAGOLD note: Blain has a way of getting things down to the real nitty-gritty …… Summoning Cassandra, the Greek soothsayer, he goes on to say that we “will see inflation rattle and roll markets for years rather than months” driven by a “vicious negative feedback loop of inflation reinforcement.”

Gold pushes back over the $1900 mark

World Gold Council finds gold holds gains once crisis fades from headlines

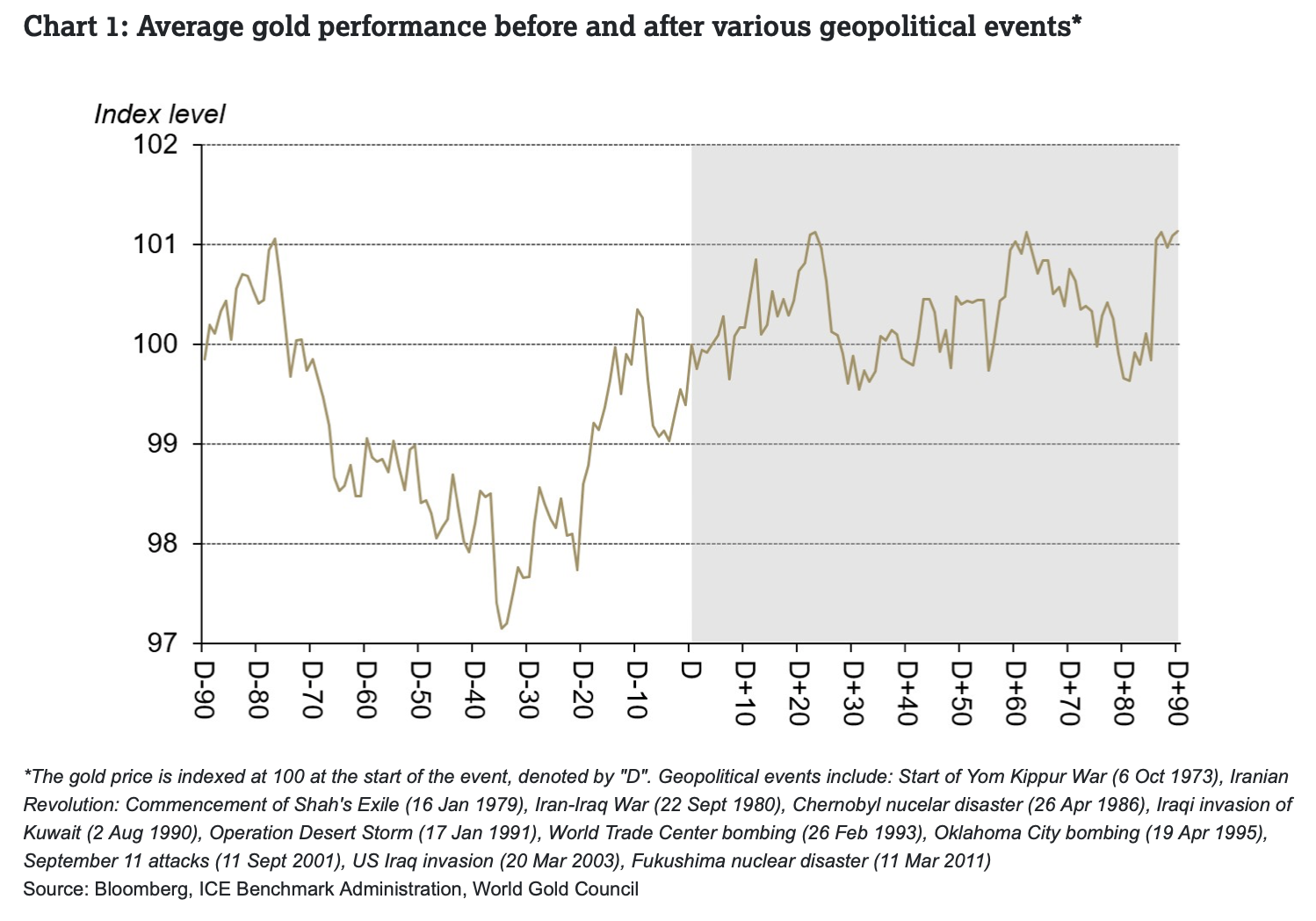

(USAGOLD – 2/28/2022) – Gold pushed back over the $1900 mark this morning as Russia’s invasion of Ukraine bogged down and whipsawed speculators returned to precious metals for safe-haven purposes. It is up $21 at $1912. Silver is up 16¢ at $24.48. Gold’s seesaw price performance since the invasion began raises an interesting question as to how much of gold’s rally over the past month has to do with geopolitics and how much of it has to do with inflation and the impact of future Fed policy. Equally important, will the gains stick once the conflict ends? The World Gold Council posted a short study over the weekend showing that gold has a long history of rising in response to major geopolitical events (listed below the chart) and, most importantly, holding those gains once the crisis fades from the headlines.

Chart courtesy of the World Gold Council • • • Click to enlarge

“[G]old has reacted positively to tail events linked to geopolitics,” writes Juan Artigas, WGC’s global head of research, “and, despite price volatility, tended to keep those gains in the months following the initial event. In addition, gold trades in a deep and highly liquid market, with collective volumes surpassing US$120bn a day on average and tight bid-ask spreads. All these, combined with the fact that bullion carries no credit risk, makes gold a sought-after safe haven asset.”

Stagflationary shock may be next for plunging stock markets

YahooFinance/Nikos Chrysoloras, Jan-Patrick Barnert and Ishika Mookerjee/2-24-2022

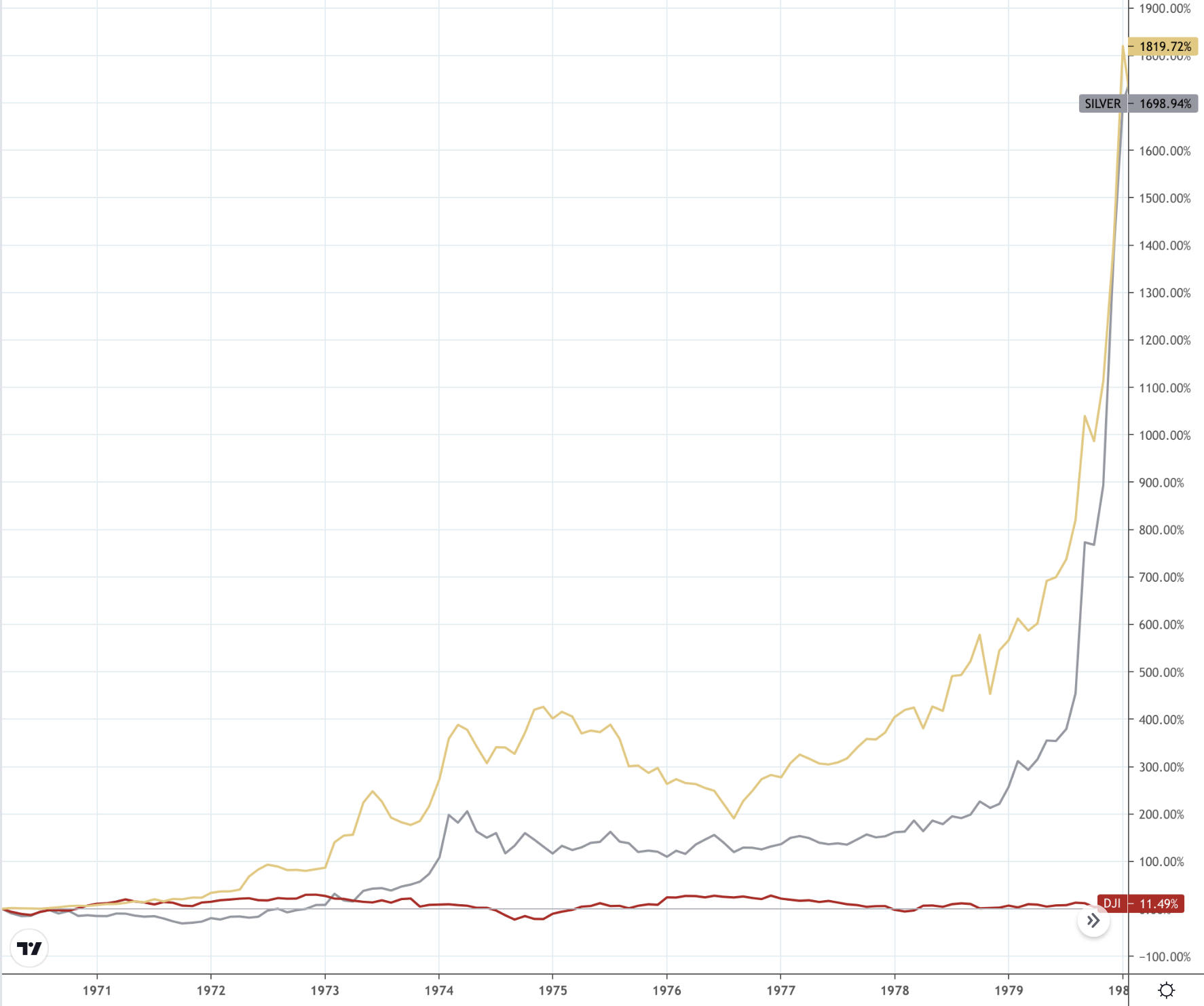

“Stocks across the world tumbled on the news, with major benchmarks in both Europe and the U.S. now firmly in correction territory and the Nasdaq 100 index entering a bear market. ‘The effects of recent events can therefore rightly be described as stagflationary — rising prices with declining economic activity,’ said Thomas Boeckelmann, head of portfolio management at Euroswitch, drawing parallels with the malaise that hit equity markets in the 1970s.”

USAGOLD note: In short, the bearish recent past may have been little more than prologue – an afternoon nap before deep hibernation. During the stagflationary 1970s, gold rose 1820%; silver rose 1699% and stocks rose 11.5%.

Gold, silver and stocks

(1970-1979)

Chart courtesy of TradingView.com • • • Click to enlarge

Zoltan Pozsar on why the Fed needs to spark a market crash to bring down inflation

Bloomberg/Tracy Alloway/2-17-2022

USAGOLD note: Scary to think that the only way the Fed can rein in inflation effectively is to induce an economic coma (including a financial crash), but that precisely is what Zoltan is suggesting. Why would the Fed go to so much trouble to save the economy from a pandemic only to blow it up to fight inflation? An inflation, by the way, it still claims is temporary.

Can Jay Powell build consensus at a divided Federal Reserve?

Financial Times/Colby Smith/2-16-2022

“’It is very telling to me that there is a lot of debate going on across the committee and there is no consensus about the appropriate pace of tightening,’ said Blerina Uruci, US economist at T Rowe Price. “It seems very much still up in the air.”

USAGOLD note: Colby Smith dissects the current politics of the apolitical Fed. In our view, the consensus is likely to form on the dovish side of the political ledger and likely to become even more dovish once the Biden administration’s new appointees are confirmed.

Bullion coin orders spike at U.S. Mint with silver market activity

Coin World/Paul Gilkes/2/12/2022

“The United States Mint kicked off 2022 with American Eagle silver bullion coin sales in January that are 4.7% higher than sales for the same period in 2021. Silver American Eagle sales in January to authorized purchasers worldwide reached 5,001,000 coins, compared with 4,775,000 coins in January 2021 and 3,846,000 coins in January 2020. Sales on Feb. 7, 2022, added another 480,500 American Eagle 1-ounce .999 fine silver dollars.”

USAGOLD note: The public has a very healthy appetite for silver bullion coins at current prices.

Zimbabwe highest rates may rise further, governor says

Bloomberg/Godfrey Marawanyika and Ray Ndlovu/2-17-2022

USAGOLD note: This article caught our eye in that too many in the financial media equate raising rates with a hawkish monetary policy, when it is only half the equation. In Zimbabwe, the overnight lending rate is 60%. Inflation is running at 60.7%, if current government data is to be believed, and it was as high as 322% just a year ago. So it is fairly evident that raising rates in Zimbabwe in and of itself has not kept a lid on the inflation rate. Meanwhile, Bloomberg reports, the Zimbabwe dollar trades at 230 to the U.S. dollar in the real market – almost double the official rate of 120 per U.S. dollar.

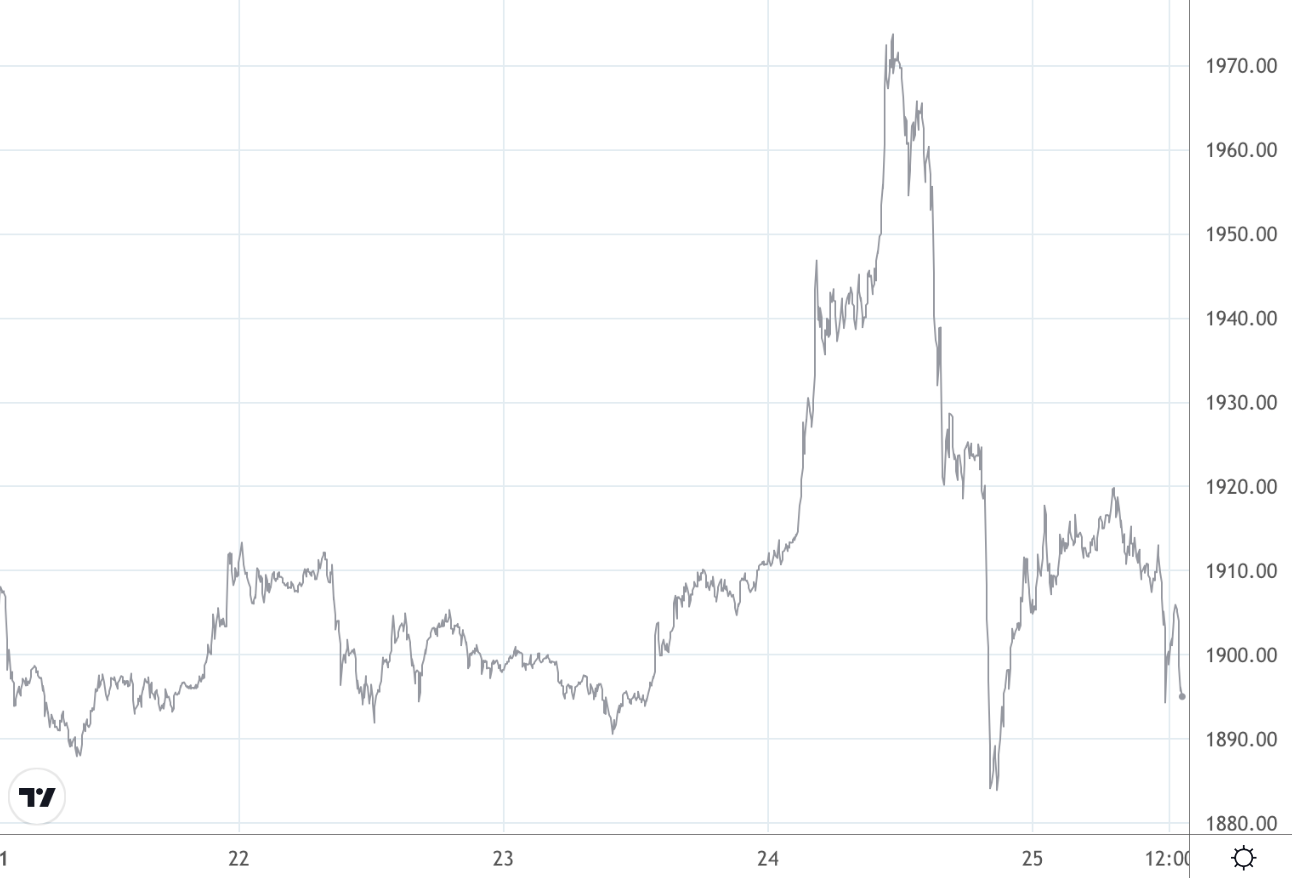

Gold weakens further after yesterday’s rocket launch and harmless fall to the sea

What was behind the rapid rise and fall?

(USAGOLD – 2/25/2022) – Gold weakened further this morning after yesterday’s rocket launch, which took the price to over $1970 before it fell harmlessly to the sea. It is down $13 at $1892 in early trading. Silver is down 14¢ at $24.15. Those perplexed by gold’s fickle run over the past two days might find the beginnings of an explanation (and some solace) in John Auther’s Bloomberg column this morning: A war that is increasingly looking more like a blitzkrieg than a lengthy war and soft sanctions unlikely, at least for now, to radically boost energy prices and inflation expectations.

Gold price

(Five-day)

Chart courtesy of TradingView.com

He quotes Columbia University’s Adam Tooze as saying: “President Biden announced a sanctions package against Russia that is specifically designed to allow energy payments to continue! What kind of sanctions are those?… These are sanctions designed not to sanction.” When the reality sunk in, gold, the bond market, and oil tracked back quickly to where they began the day.

All said, Authers does warn that Ukraine might not be the end of Russian ambitions and offers a recommendation likely to resonate among our readers: “It might be best to take Thursday’s extraordinary rally [in stocks] as an opportunity to take a few profits and allocate something to cash or gold. Some insurance during a situation that is very dangerous seems like a good idea.” In our many years reading Auther’s columns, we do not remember him ever making an outright recommendation to buy gold.

Billionaire investor Charlie Munger blasts speculative market culture

MarketsInsider/Theron Mohamed/2-16-2022

USAGOLD note: Munger rolls out the cannon.

On my mind: The long and winding road

Seeking Alpha/Sonai Desai-Franklin Templeton/2-15-2022

“Investor attention is now focused on the immediate challenge that central banks face in recalibrating policy against rising inflation. That’s a crucial issue. But we should pay even more attention to the perilous multi-year adjustment process that lies ahead, during which markets will have to relearn to price risk without the central banks’ ever-present safety net.”

USAGOLD note: Though we do not in any way wish to challenge Desai’s warning, we at the same time remind our readers that the last time the Fed launched quantitative tightening in 2017, it was forced to throw in the towel and resume Treasury and mortgage debt purchases in 2019. That’s not to say that history will repeat this time around. There was very little inflation to speak of in 2019. As Desai notes, “Markets seem to still be clinging to the mindset of the last ten years, when inflation was stuck at low levels and the Fed could afford to prioritize asset prices without compromising price stability. But the world has changed. High inflation has become a prominent economic and political problem, and the Fed cannot ignore it.”

Federal Reserve Balance Sheet

(Millions of dollars)

Source: tradingeconomics.com

Heineken chief warns cost inflation is ‘off the charts’

Financial Times/Alistair Gray/2-6-2022

USAGOLD note: You will recall that purchasing managers and manufacturers (producers) were the first to warn of the impending inflation at a time many economists had doubts. That makes this warning of runaway inflation from Heineken worthy of special consideration.

Larry Summers has a new inflation warning

MarketWatch/Jeffry Bartash/2-14-2022

USAGOLD note: Summers has received his share of headlines of late. He continues to pound home the message that the Fed is mired deeply behind the curve on inflation. Now he warns of “upward pressure on wages that won’t relent anytime soon.” His warning summons memories of the 1970s inflation spiral – higher inflation begetting higher wages, higher wages begetting higher inflation, etc.

Gold advances sharply as Russia invades Ukraine

‘Seismic’ market reaction pushes capital into precious metals, commodities

(USAGOLD – 2/24/2022) – Gold advanced sharply in overnight trading as Russia launched a full-scale invasion of Ukraine. It is up $61 at $1971. Silver is up 87¢ at $25.47. Energy, base metal, and key agricultural commodity prices all pushed significantly higher, igniting serious concerns about the global inflation rate – a prospect likely to factor into market dynamics for some time to come. Contributing to the flow of capital into safe-havens, gobal stock markets plunged with some European bourses dropping nearly 5% as this report is posted.

“The market reaction to these developments has been seismic,” Deutsche Bank’s Jim Reid told Markets Insider this morning. “A significant way the events in Ukraine will affect the rest of the world is regarding inflation, and even before we saw $100 a barrel oil overnight, that relentless rise in commodities showed no sign of abating.”

Bitcoin’s allure as the new gold fizzles during Ukraine tensions

Bloomberg/Sunil Jagtiani/2-21-2022

“Bitcoin’s price relative to gold has dropped to the lowest level since the middle of 2021. The standoff between the West and Russia over Ukraine is stoking risk aversion, hurting so-called digital gold as cryptocurrencies slide but supporting the traditional haven of bullion. One Bitcoin is now equivalent to about 19 ounces of the yellow metal, down from a peak of some 37 ounces in October.”

USAGOLD note: This is what happens when investors seek a true safe haven amidst economic uncertainty. They sell risk and they buy safety. And in keeping with our theme of the day: It is not just Ukraine driving the flow of capital.

Chart courtesy of TradingEconomics.com

Where we are in the big cycle of money, creditm debt, economic activity and the changing value of money

“History has repeatedly shown that people tend to have a strong bias to believe that the future will look like a modestly modified version of the past even when the evidence and common sense point toward big changes. I believe that’s what’s going on and that we are in the part of the cycle when most people’s psychology and actions are shifting from deeply imbued disinflationary ones to inflationary ones”

USAGOLD note: Ray Dalio weighs in convincingly on the entrenched side of the great inflation debate taking to task those who believe it to be transitory. “[N]ow most everyone,” he says, “is surprised that there is a lot of inflation. What is wrong with these people’s thinking? Where is the understanding of history and the common sense about the quantity of money and credit and the amount of inflation?” And to stretch the argument a bit, the connection between quantity of money and the price of gold?