Monthly Archives: February 2022

Turkey to target ‘under the mattress’ gold in effort to bolster the lira

Financial Times/Laura Pitel/2-9-2022

“Turkey will expand its drive to lure savers back to the lira next week with a scheme aimed at bringing billions of dollars worth of ‘under the mattress’ gold into the banking system, the country’s finance minister told investors during a visit to London.”

USAGOLD note: Turkey’s ‘under the mattress’ scheme is voluntary. India launched a similar attempt to lure investors out of their gold positions that met with mixed success. We doubt this program will do much better given the ongoing problems with the Turkish lira and distrust of the country’s banking system. The price of gold in the Turkish lira has roughly doubled over the past year, and that did not happen in a vacuum: Caveat venditor – Let the seller beware.

Chart courtesy of TradingView.com

Fed rate hike will cause hyperinflationary Great Depression

USAWatchdog/Greg Hunter interview of John Williams/2-8-2022

USAGOLD note: Though we see a hyperinflationary depression as an outlier, we do think runaway stagflation is a legitimate concern. Williams says you can address the possibility of a hyperinflationary depression by “personally holding gold and silver.” The same worked well as a hedge during stagflationary1970s – a lesser version of Williams’ worst-case scenario.

Gold takes a breather from solid gains of past two days

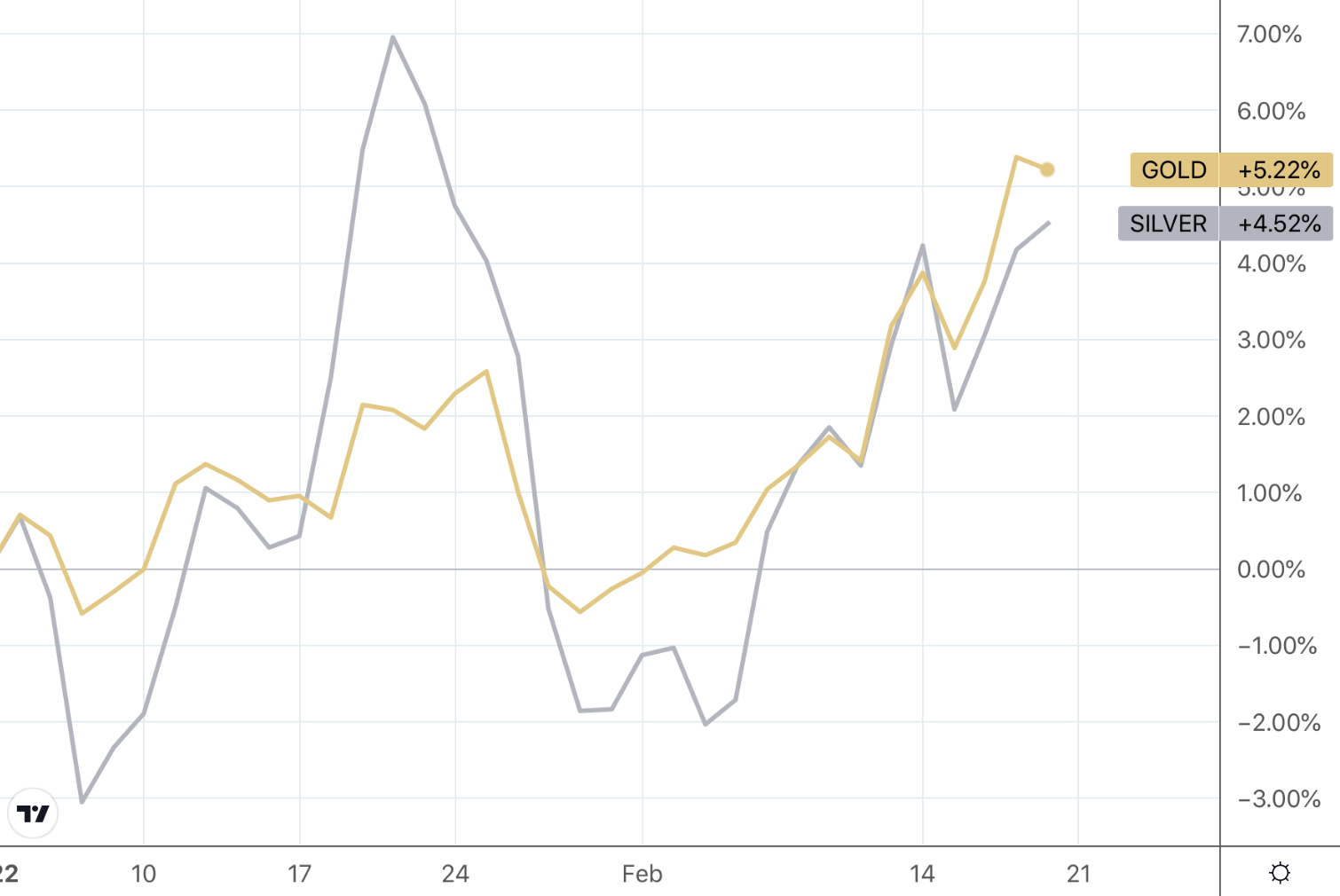

Gold up 5.22% year to date; silver up 4.53%

(USAGOLD – 2/18/2022) – Gold is taking a breather this morning after the solid gains of the past two days, even as the Russia-Ukraine crisis took a turn for the worse and St. Louis Fed President Bullard warned that inflation could spin out of control. It is level at $1900. Silver is up 25¢ at $24.13. Both are challenging important psychological chart barriers at $1900 and $24 respectively. Year to date, as of this morning, gold is up 5.22%; silver is up 4.52%.

Gold and silver

(%, year to date)

Chart courtesy of TradingView.com

“As many gold bulls remain confused about why gold isn’t already heading for $3,000,” writes Intelligent Investing’s Clem Chambers in a recent Forbes article, “the question really is, what can possibly stop it? The Federal Reserve’s tightening must be in the price, so all that is left is the open questions of European conflict and the length of time that inflation will run hot. The latter answer is inflation is going to run hot for a long time. I believe years. So what should the projection be? It’s unpleasant to think in terms of a major European conflict, but the impact on everything, including gold, will be tremendous if a conflict escalates.”

Fed and ECB still behind the inflation curve

Financial Times/Mohamed El-Erian/2-6-2022

USAGOLD note: In short, what is hawkish to some is dovish to others. El Erian sees the Fed hawkish tone as dovish in reality, which translates to higher inflation down the road. He says its positioning amounts to the “second policy mistake in as many years” – the first being the insistence that inflation was transitory for so long.

Frank Giustra – “I have always loved real, tangible assets such as gold, commodities and real estate.”

King World News/Frank Giustra/2-3-2022

USAGOLD note: We like to keep up with what Canadian billionaire Frank Giustra is thinking, so this King World News article was a welcome sight. Giustra runs through the gamut of investment possibilities and comes down solidly on the side of hard assets.

Soaring credit risk may be the canary in the coal mine for European assets

Bloomberg/Giulia Morpurgo/2-9-2022

“Surging risk in the European credit market is signaling tough times ahead, clashing with a calmer scene in equities. Measures of risk have soared for both investment-grade and high-yield borrowers after the European Central Bank’s unexpectedly hawkish tilt last week, even as a gauge of euro-area stock volatility has stayed below earlier peaks.”

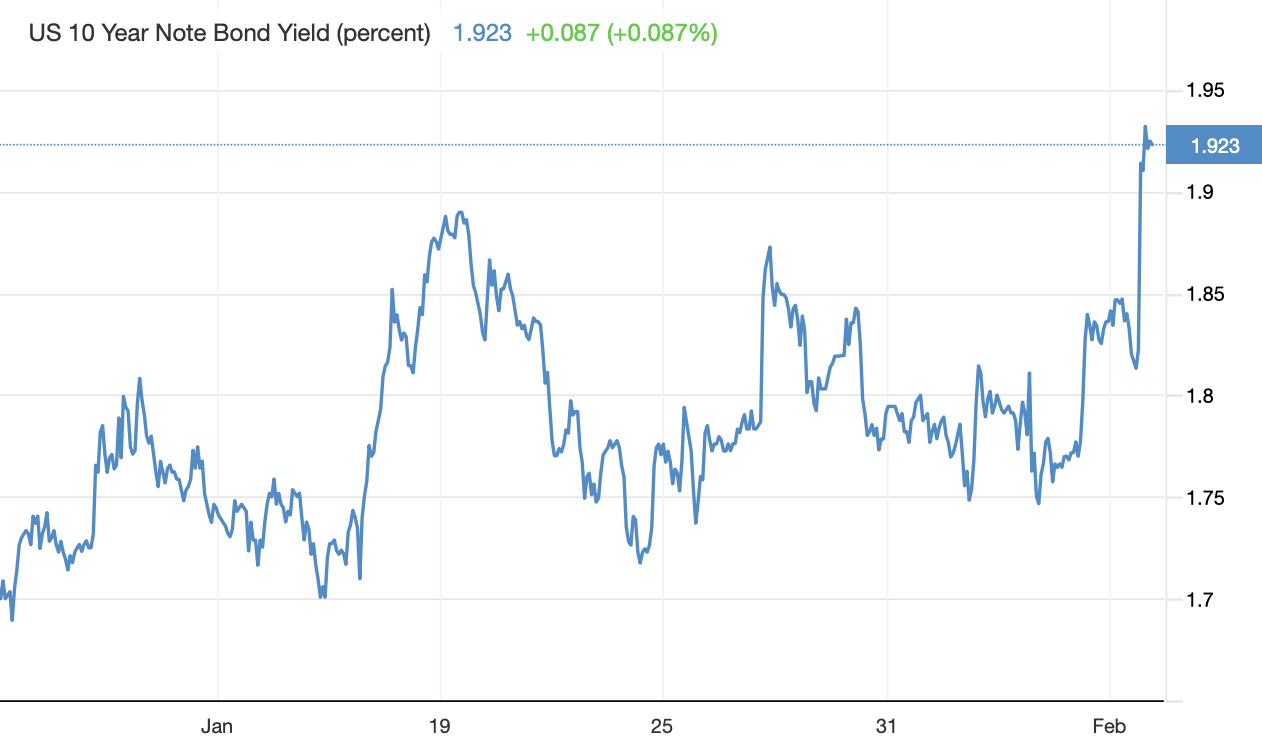

USAGOLD note: U.S. bond market woes echo in Europe, as the chart below shows. While the supply of bonds increases, driving up yields, the demand for gold increases alongside. The world needs a safe haven, and if bonds no longer fit the bill, capital is likely to migrate in gold’s direction.

Chart courtesy of TradingEconomics.com

Russia, China agree 30-year gas deal via new pipeline, to settle in euros

“Russia has agreed a 30-year contract to supply gas to China via a new pipeline and will settle the new gas sales in euros, bolstering an energy alliance with Beijing amid Moscow’s strained ties with the West over Ukraine and other issues.”

USAGOLD note: When you consider that global oil and gas revenues amount to nearly $6 trillion annually, this roughly $118 billion project, according to Reuters estimates, is small potatoes. However, the fact that invoices will settle in euros carries symbolic political value that reaches beyond the cash involved. Periodically, we get indications of other currencies making inroads into global dollar hegemony but they rarely amount to a real challenge to the greenback’s supremacy. At the same time, that edifice of demand has not deterred erosion of the dollar’s purchasing power over time. That is why a good many nation-states are turning to gold as a long-term hedge.

Gold pushes higher second straight day on Ukraine tensions, Fed concerns

Yellow metal hits highest level since May, once again knocking on $1900s door

(USAGOLD – 2/17/2022) – Gold pushed higher for the second straight day on reports of shell fire being exchanged on the Ukraine border and lingering concern about a rapidly rising inflation rate and the dangers imposed by signaled Fed policies intended to deal with it. It is up another $19 at $1890, its highest price since May when it last challenged the $1900 mark. Silver is up 19¢ at $23.84.

Gold price

(One year)

Chart courtesy of TradingView.com

We recall that early in the inflation cycle, it was industry purchasing managers and CEOs who provided early warning of inflation’s sudden arrival. With that in mind, we take special note of Heineken CEO Dolf van den Brink’s warning yesterday that in his 24-years in the beer business, he has never seen anything like the inflation the company is experiencing now. “Across the board,” he says, “we are faced with crazy increases.” (Financial Times, 2/16/2022)

Jeff Gundlach, the highly respected hedge fund manager, is concerned about the Fed’s response to hot inflation. “One thing we can all agree on is inflation just continues to surprise on the upside,” he recently told CNBC. “The Fed is obviously behind the curve. … It’s going to have to raise rates more than the market still thinks. My suspicion is they are going to keep raising rates until something breaks, which always happens.”

AFTERNOON UPDATE

Gold regains the momentum on Ukraine pullback doubts

Longer-term, inflation and Fed policies to combat it the more potent market drivers

(USAGOLD 2-16-2022 PM) – Gold regained the momentum today as Secretary of State Blinken expressed doubts about Russia’s claims of a pullback from Ukraine’s border, and financial markets reassessed yesterday’s false euphoria. It is up $15 at $1870. Silver is up 19¢ at $23.62. Still, the more potent underlying drivers in the gold market are the prospect of a sustained and rapidly rising inflation rate, and the dangers imposed by Fed policies intended to deal with it.

We recall that early in the inflation cycle, it was industry purchasing managers and CEO’s who provided early warning of inflation’s sudden arrival. It was with that in mind that we take special note of Heineken CEO Dolf van den Brink’s warning today that in his 24-years in the beer business he has never seen anything like the inflation the company is experiencing now. “Across the board,” he says, “we are faced with crazy increases.” (Financial Times, 2/16/2022)

The Wall Street Journal’s Nick Timiraos focuses attention on a nettlesome problem posed by the Fed taming inflation through reduction of its massive $8 trillion balance sheet. “This could be especially treacherous for markets,” he writes in an article posted this morning, “accustomed to a central bank that for the past two decades mostly used just interest rates, and tried to telegraph how fast it would raise them. Fed officials warn they can’t provide that same predictability this time.” We are reminded in all this of the old Ed Stein cartoon (shown above) first posted here during Ben Bernanke’s tenure at the Fed.

Anticipating anticipation

“One of the coolest things to watch in nature is a Starling murmuration. Starlings — which are small and not particularly intelligent birds — are somehow able to form these amazingly complex and beautiful airborne systems that are capable of extremely intricate flight patterns which shift and shape with near-instantaneous coordination. They do this apparently in response to threats; to thwart off and confuse predators. I’m fascinated by systems that display emergent properties such as murmurations. Where a network operating off simple behavioral rules can emerge complex, seemingly intelligent, behavior.”

USAGOLD note: A fascinating article … and the photo of starlings grouping themselves into the image of a gigantic bird is worth the visit alone. The comments section is an added bonus.…

BLS job revisions show every job report in 2021 was total garbage

MishTalk/Mish Shedlock/2-4-2022

“The BLS will counter that the error rate is tiny. It is, if you divide by the total number of jobs. … Yet, in the monthly gain-loss report, which every economist watches, the revisions are not only huge, but ongoing.”

USAGOLD note: Let me ask what has become one of the more enduring questions of our time: Is a market properly valued if it trades on statistical fiction?

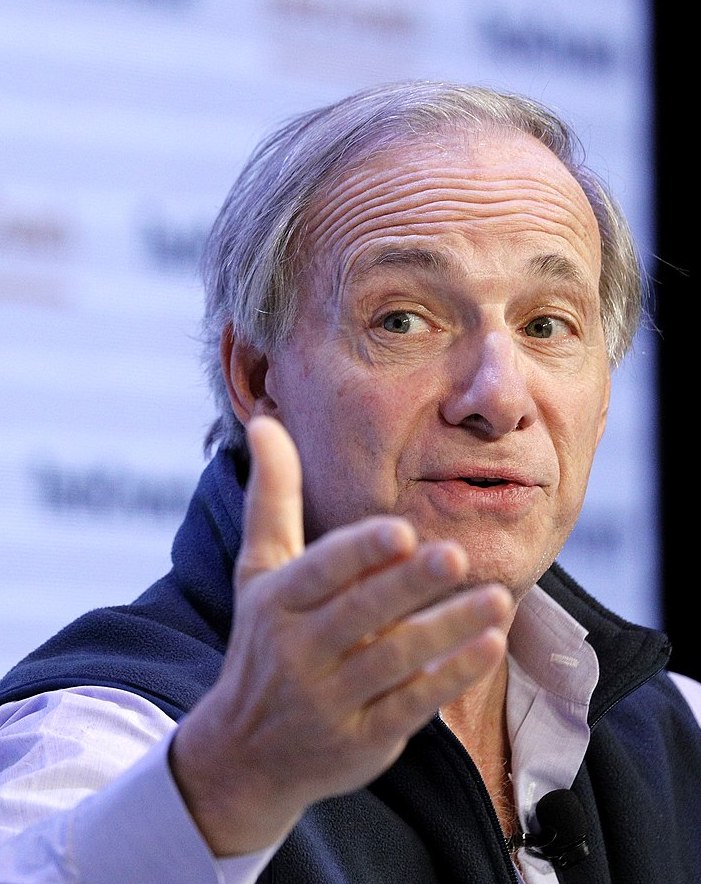

Billionaire investor Ray Dalio warns the easy-money era is over — and says the crypto craze is overblown

USAGOLD note: The latest from the intrepid Mr. Dalio, who continues to warn against holding cash and now, as an upgrade to the message, against too much debt. He relented on cryptocurrencies for a short period but is now back to where he started on the subject: They are not a long-term store of value. A long-time advocate of gold ownership, he has added transcendental meditation to his list of recommendations. Dail heads up Bridgewater Associates, the world’s largest hedge fund.

Fed influence, shaky forecasts, delayed decisions: How the Biden administration misread the inflation threat

USAGOLD note: That covers every catalyst except the real cause – very large federal deficits covered by very large quantities of printing press money. Now those chickens are coming home to roost. This article has all the appearances of an attempt to whitewash the role played by Congress and the White House in the current inflationary spiral. By saying that, we are not attempting to excuse the Fed’s role in the inflationary debacle.

No Daily Market Report today.

Please check back this afternoon, we may post an update if anything of interest develops.

A split Fed likely to zoom in on February data

NewsMax Finance/Reuters/2-14-2022

USAGOLD note: The apolitical Fed is looking very political these days if one reads between the lines in this NewsMax article. It used to be that Wall Street relied on the Fed to do what was best for the economy while resisting political pressure from either the White House or Congress. It seems, these days, that Wall Street is just as interested in easy money as the politicians. The motivation for that position is not difficult to discern. The Board itself, particularly with the new appointees weighed in the balance, comes down decisively on the dovish side of the ledger, and that should figure largely in investors’ long-term portfolio planning.

Wholesale prices rise 1% in January, up near-record 9.7% over the past year

“Prices at the wholesale level jumped twice the expected level in January as inflation pressures were unabated to start the year, the Labor Department said Tuesday. The producer price index, which measures final-demand goods and services, increased 1% for the month, against the Dow Jones estimate for 0.5%.”

USAGOLD note: Core producer prices rose 0.9% in January. The fast trip from low single digits to near double digits does not bode well for the future.

source: tradingeconomics.com

The weaponization of economics

Gavekal/Claudio Grass/2-3-2022

USAGOLD note: Grass pulls no punches in this critique of the economics profession. He says that it has not lived up to its potential because since the days of ancient Rome, it “has been held hostage by the political establishment, it’s been corrupted and co-opted, and the scientific method that was supposed to be at the core of it has long been replaced with skewed assumptions, biased methodologies and pseudoscientific maneuvering.”

Gold investors returning

Investing.com/Adam Hamilton/2-4-2022

“While gold has been grinding higher, it hasn’t soared yet despite raging inflation and rolling-over stock markets. The main reason has been the lack of investment capital inflows. But long-apathetic investors are starting to return, flocking back to gold exchange-traded funds as the US stock markets threatened a correction. That buying is a bullish gold omen, fueling upside momentum that will attract more investors.”

USAGOLD note: Hamilton treats in detail the early stages of funds and institutions’ return migration to the gold market.

Global bonds knocked as traders brace for central bank tightening

Financial Times/Adam Samson, Martin Arnold and Kate Duguid/2-4-2022

“Global government bonds underwent a fresh wave of selling on Friday as traders ratcheted up expectations that the world’s leading central banks will be forced to take more aggressive measures to tame inflation.”

USAGOLD note: The early stages of a tantrum? On Friday, the yield on the 10-year U.S. Treasury went over 1.9% for the first time since 2019.

Chart courtesy of TradingEconomics.com

‘It’s going to be a year where we are shocked by the volatility,’ BofA’s Savita Subramanian warns

CNBC/Stephanie Landsman/2-2-2022

USAGOLD note: Bank of America raises the warning flag …… A “sideways” market and a little volatility is probably tolerable in the collective mindset, but a declining market and much volatility would likely be a much more explosive mix.