Gold moves marginally higher in early trading

Commerzbank sees gold breaking through the $1900 mark and ‘climbing beyond’

(USAGOLD – 2/23/2022) – Gold moved marginally to the upside in early trading as markets weighed the global response to Russia’s Ukraine incursion along with the impact of sanctions and related commodity supply disruptions on the global inflation rate and central bank monetary policy. It is up $5 at $1905. Silver is up 19¢ at $24.34. The new concerns about commodity pricing come at a time when investors are already “pumping more money into commodities than at any time in the last decade,” according to a Bloomberg report this morning.

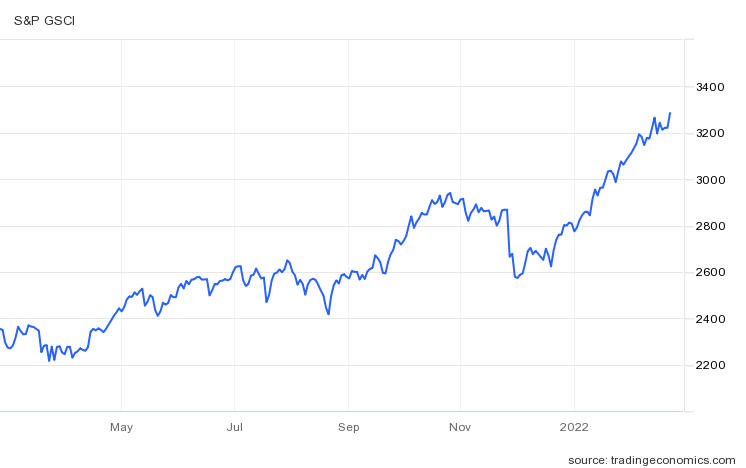

S&P Goldman Sachs Commodity Index

(One-year)

Chart courtesy of TradingEconomics.com

As suggested here yesterday, though gold and silver’s reaction to the actual invasion has been muted, we should not overlook both metals trading at important psychological barriers – $1900 for gold and $24 for silver. “Given that the situation in Ukraine is deteriorating further and a military conflict cannot be ruled out,” advises Germany’s Commerzbank in an update released this morning, “we believe the gold price is likely to quickly regain the $1,900 mark and then continue climbing beyond it.” One of the tenets of technical analysis is that once resistance is broken, it often becomes support.