Monthly Archives: January 2022

Don’t fight the Fed – Commodities may have gotten the message

BloombergIntelligence/Mike McGlone/1-4-2021

USAGOLD note: Bloomberg’s McGlone expects to see this flip-flop between gold and the commodities (most represented by oil) occurring under a deflationary scenario in 2022. His January Commodity Outlook details prospects for the range of commodities.

Byron Wien’s 10 surprises for 2022

Zero Hedge/Tyler Durden-Byron Wien/1-3-2021

USAGOLD note: Among Wein’s surprises for 2022, he says persistent inflation will become the dominant theme, the 10-year Treasury note will yield 2.75% (it’s 1.72% now) and gold will gain 20% increase as it “reclaims its title as safe haven for newly minted billionaires.”

Reflections on Greenspan’s ‘Irrational Exuberance’ Speech after 25 Years

Cato Institute/James A. Dorn/12-27-2021

“Greenspan began his speech by reminding us that ‘at root, money—serving as a store of value and medium of exchange—is the lubricant that enables a society to organize itself to achieve economic progress.’ Sound money (i.e., money that maintains its long‐run purchasing power), is the glue that holds a free‐market system together. In contrast ‘erratic money’ (i.e., wide variations in the quantity of money relative to the demand for money), distorts market price signals and the allocation of resources.”

USAGOLD note: Cato Institute’s Dorn revisits Alan Greenspan’s famous “irrational exuberance” speech in 1996 and applies the former Fed chairman’s observations therein to the present. “Asking the Fed to do too much,” Dorn concludes, “risks further politicizing the central bank, with the consequent loss of credibility.” Of late Greenspan has been a critic of Fed policy. In a note published last October, he reiterated the dangers referenced above. “Monetizing the debt,” he said, “cannot be a long-term solution, and increases in the money supply relative to the real goods and services an economy produces will eventually lead to higher price levels.” (For more, please see Alan Greenspan’s thoughts on inflation, 11/5/2021)

Jim Rogers: Next bear market will be ‘the worst in my lifetime’ — here are 3 assets he’s using for 2022 crash protection

Yahoo!Finance/Jing Pan/1-1-2022

“Rogers has long been a fan of commodities, and silver is one of his favorites. ‘The all-time high for silver is $50 an ounce; now it’s $23. Why can’t silver go back to its all-time high? That’s the way markets usually work,’ he says.”

USAGOLD note: Bullish on hard assets and bearish on stocks, it sounds like Rogers is setting up for a bout of inflation with traditional hedges contra cyclical to stocks. Rogers also likes copper, farm commodities, and fine art.

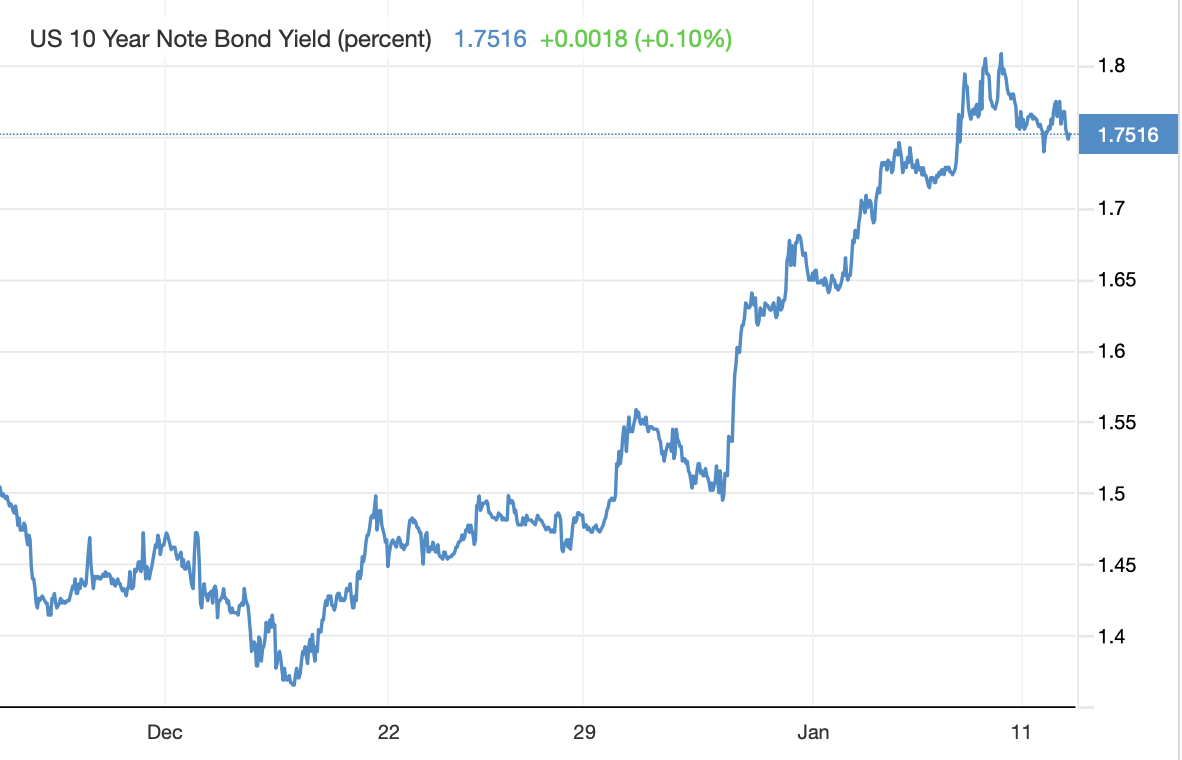

Wary global bond markets brace for the supply floodgates to open

Yahoo!Finance-Bloomberg/Garfield Reynolds/Liz Capo McCormick/James Harai, Masaki Kondo/1-10-2022

“While governments are set to pare borrowings as fiscal outlays ease, the $2 trillion drop in central banks’ net demand will provide a risky real-world test of how much private demand exists.”

USAGOLD note: It’s not just the United States that is pumping new-issue bonds into the marketplace. It’s happening globally. If the selling exceeds the buying, secondary market sell-offs are likely to force interest rates higher – just about everywhere at a time when inflation dampens demand. Those attempting to get ahead of the approaching whirlwind have already put yields on an accelerated trajectory.

Chart courtesy of TradingEconomics.com

AFTERNOON UPDATE

Gold continues inflation-induced advance

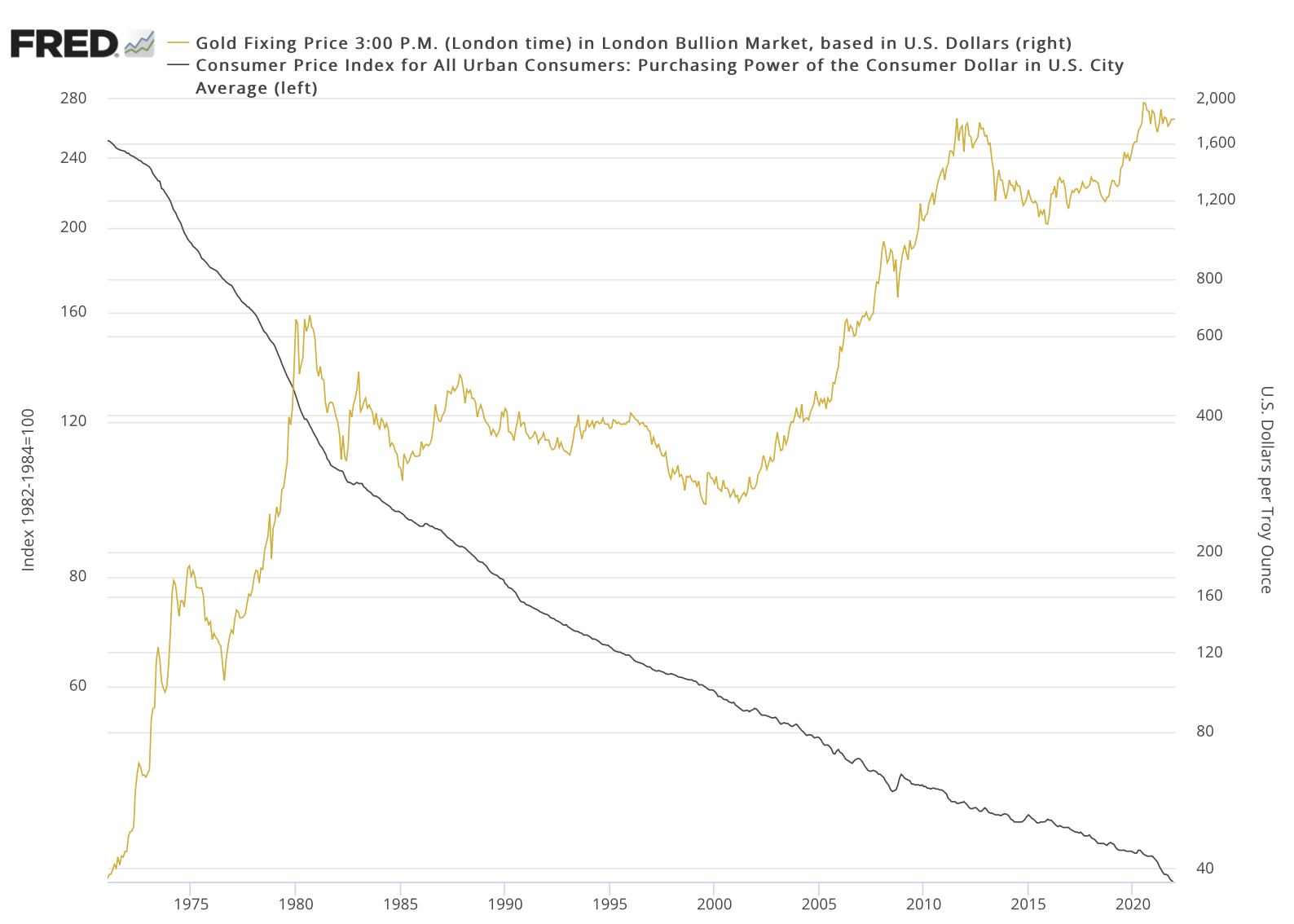

Some much-needed clarity on the nature of inflation and what it means for gold investors

(USAGOLD – 1/12/2021) – Upon release of today’s CPI number, gold initially paused then resumed the climb that began yesterday, tacking another $5 onto its price at $1827. Yesterday, it notched a $19 gain anticipating this morning’s report, which came in at a 7% annualized inflation rate. Silver is up 37¢ at $23.23.

The mainstream financial media is stuck on the Fed’s mantra that it can and will control inflation, even though it is running well ahead of the 2% target level. Those who buy food and gasoline, or happen to be in the real estate market, know full well that even the 7% number might be an illusion. The cost of living is rising, and the inflationary process is in full swing.

“The nature of inflation is widely misunderstood and misinterpreted,” writes analyst Dave Kranzler in an Investing.com overview, “‘Inflation’ and ‘currency devaluation’ are tautological—they are two phrases that mean the same thing. … Dollar devaluation has been occurring since the early 1970’s. The value of the dollar relative to gold (real money) has declined 98%. In 1971 $40,000 would buy a 4,000 square foot home in a good suburb. Now it takes $700,000 on average to buy that same home. Price inflation is the evidence of currency devaluation. The CPI is not a real measure of price inflation. The CPI is methodically massaged – starting with the Arthur Burns Federal Reserve (it was his idea) to hide the real degree of currency devaluation from all of the money that has been printed since 1971.”

Gold and the purchasing power of the U.S. dollar

(Log scale, 1971-2021)

Sources: St. Louis Federal Reserve, Bureau of Labor Statistics, ICE Benchmark Administration

Bridgewater Securities’ famed founder and investment manager Ray Dalio believes we are in an entirely new paradigm that requires a sea change in the way investors handle their money. During the Roaring 1920s, he says, you would want to own stocks and avoid bonds, but it was the polar opposite in the 1930s depression era. In the inflationary 1970s hard assets like gold were the place to be. In the disinflationary 1980s, financial assets were the place to be and hard assets were to be avoided.

“What should one do in this new paradigm?” he asks in a recent LinkedIn piece. “This paradigm is leading to a big shift in wealth and power. Naturally, as a global macroeconomic investor, the economic and market behaviors in this paradigm are top of mind. I think one should consider minimizing one’s ownership of cash and bonds in dollars, euros, and yen (and/or borrow in these) and putting funds into a highly diversified portfolio of assets, including stocks and inflation-hedge assets, especially in countries with healthy finances and well-educated and civil populations that have internal order.” Dalio is a long-time proponent of gold ownership.

U.S. Mint gold bullion sales soar

USAGOLD note: More direct evidence of the strong market for physical coins and bullion in 2021 despite rangebound prices. Silver eagle sales were also strong though lower by 6% from healthy 2020 sales.

US economy 2022 preview: Could the great asset and credit bubbles burst?

American Enterprise Institute/Desmond Lachman/1-3-2022

USAGOLD note: Lachman goes on to outline why we should be worried about the health of the financial system in 2022. He says economists now believe that the banks are much better positioned to weather higher rates than they were in 2008, but they are blind to the vulnerability of “unregulated hedge funds, private equity companies, insurance companies, etc.”

The last great inflation

The Epoch Times/Milton Ezrati/12-31-2021

USAGOLD note: Ezrati, an economist, thinks there are some differences between the 1970s and present, but that the overall “picture looks disturbingly like it did last time.”

The Fed’s doomsday prophet has a dire warning about where we are headed

Politico/Christopher Leonard/12-29-2021

USAGOLD note: Is this not where we are as 2022 dawns? Former president of the Kansas City Fed Thomas Hoenig says, “There is no painless solution. It’s going to be difficult. And the longer you wait the more painful it will end up being.” Under the circumstances Hoenig envisions, there will only be two kinds of investors – those who prepared and those who did not. The full article is worth the time spent at the link above.

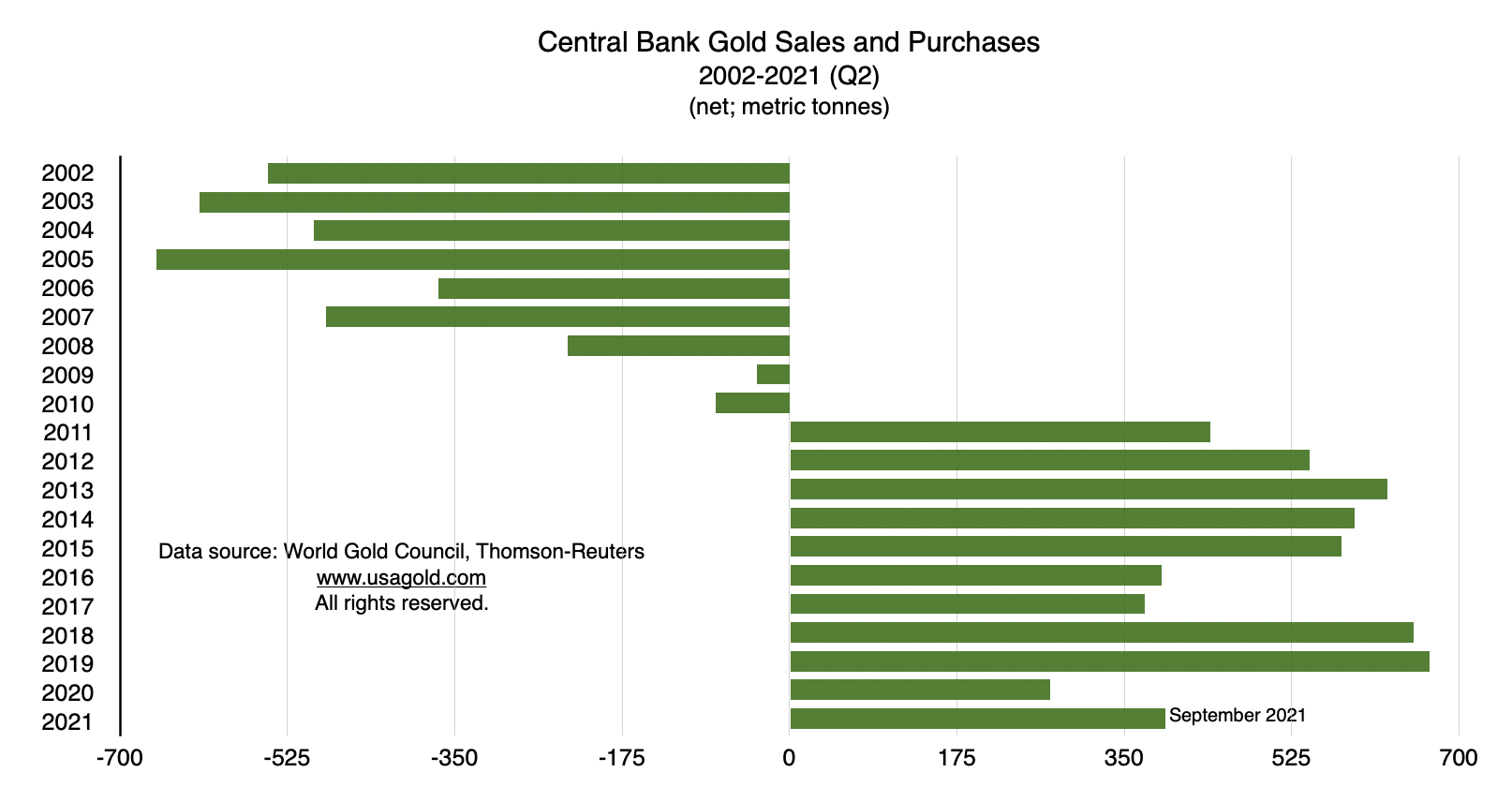

Central banks accelerate shift from dollar to gold worldwide

NikkeiAsia/Haruki Kitagawa/12-29-2021

“Central banks around the world are increasing the gold they hold in foreign exchange reserves, bringing the total to a 31-year high in 2021. Central banks have built up their gold reserves by more than 4,500 tons over the past decade, according to the World Gold Council, the international research organization of the gold industry. As of September, the reserves totaled roughly 36,000 tons, the largest since 1990 and up 15% from a decade earlier.”

USAGOLD note: And those numbers do not include what China has added to its holdings surreptitiously via proxy reserve acquisitions by its commercial banks. The mainstream media by and large gives credit to central bank acquisitions as supportive of the price. What it neglects is something not so obvious, i.e. their withdrawal from the market as sellers of the metal. That swing – from net sellers to net buyers – has had a profound impact on the metal’s fundamentals.

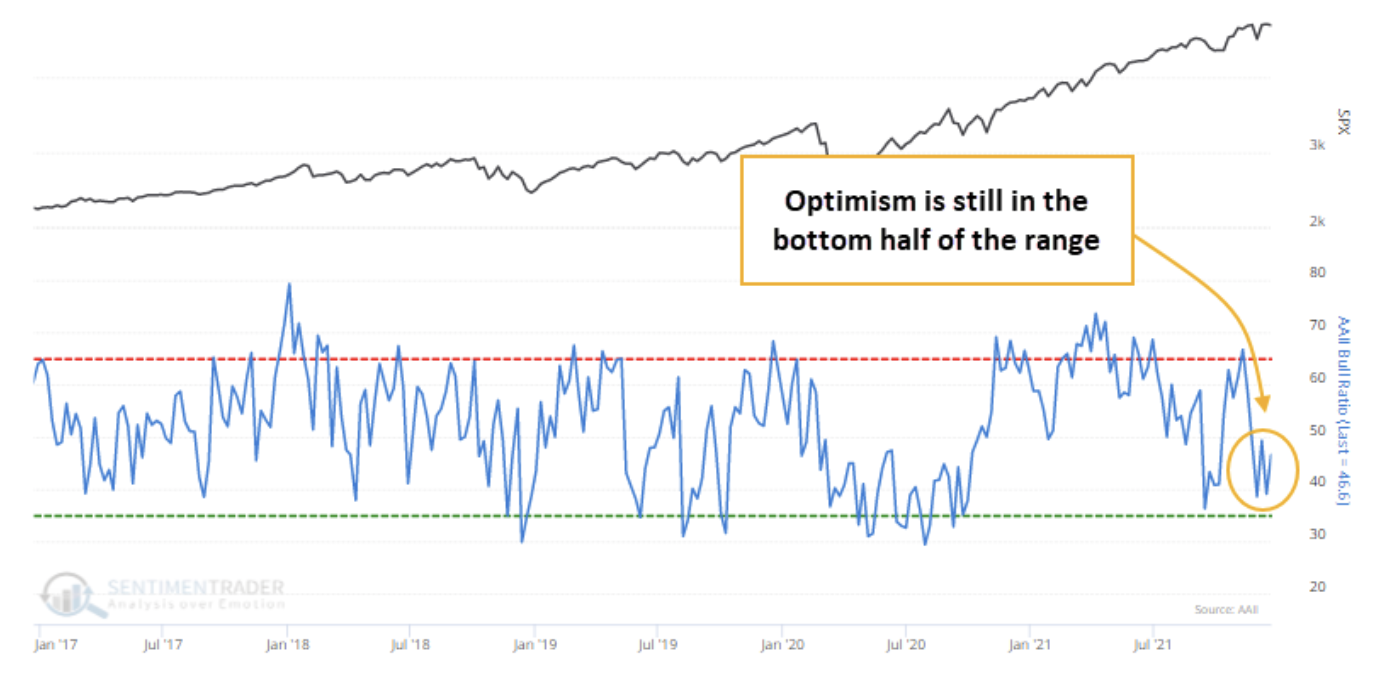

Despite gains and the holidays, investors are glum

SentmenTrader/Jason Goepfert/12-28-2021

“Not only is it unusual to see this behavior when the S&P 500 is holding near all-time highs, but even crabby people tend to turn more optimistic during the holidays. Not this year – this is only the 2nd year time the inception of the AAII survey that the Bull Ratio was negative for the first 4 weeks of December. Returns after similar behavior were mostly positive.”

USAGOLD note: Another indication of the peculiar market action these days – and, as Jason Goepfert shows, it’s not in just the gold and silver markets.

Bull Ratio

(American Association of Individual Investors)

Black = S&P 500 Blue + AAII Bull Ratio (last = 46.6)

Clouds over 2022

Project Syndicate/Nouriel Roubini/12-29-2021

USAGOLD note: The shifting sands of central bank policy, in our view, will become the major story in financial markets in the coming year. Roubini concludes, “Come what may, investors are likely to remain on the edge of their seats for most of the year.”

The perfect storm for gold

Gold-Eagle/Nick Barisheff/12-27-2021

“In December 1997, The Financial Times ran an article entitled ‘The Death of Gold.’ Since then, the gold price in US dollars has increased 519I% from $288 to $1,780. Today, after many political events and crises we have evidence of the continuous and in many ways spectacular growth of the gold price. This confluence of many current events is creating a perfect storm for gold to increase dramatically more than we imagined.”

USAGOLD note: This article by Nick Barisheff caught our attention because financial press gold naysayers are out in full force once again proclaiming the death of gold, even as storm clouds gather on the horizon. Given the record demand for gold coins and bullion over the past 12-months, we suspect that the reports of its death are greatly exaggerated.

Image attribution: MichaelKirsh, CC BY-SA 4.0 <https://creativecommons.org/licenses/by-sa/4.0>, via Wikimedia Commons

The Fed’s big lie that much of the world has bought into

Toronto Star/Frank Giustra/12-28-2021

USAGOLD note: A thought-provoking look at what’s been and what’s likely to be from a deep thinker who has made a fortune in the gold mining business. Giustra says we are living in a “collective delusion aided and abetted by a loosely aligned club of players.” This no-punches-pulled editorial is highly recommended ……

Gold’s turn to shine

Seeking Alpha/Adam Hamilton/1-1-2022

“Gold’s turn to shine again is nearing, with major bullish drivers aligning heading into this new year. The Fed’s vast deluge of new money remains intact despite QE tapering, continuing to fuel raging inflation. A new rate-hike cycle to fight that is looming, but gold has thrived during past cycles. This Fed tightening will weigh heavily on QE-levitated bubble-valued stock markets. As they fall, gold investment demand will surge. Gold mostly spent 2021 grinding sideways-to-lower in a high consolidation. That lack of upside progress left this leading alternative asset increasingly out of favor with speculators and investors alike as the year marched on. Heading into year-end midweek, gold was down 4.9% year-to-date. While psychologically-grating, maybe big gains needed to be digested after gold surged 18.4% in 2019 then another 25.1% in 2020.”

USAGOLD note: We often read about investor rotation from one asset class to another, and sometimes those rotations begin as a trickle that ultimately turns to a flood. The World Gold Council reports record coin and bullion investment demand in 2021. The trickle before the flood? Much will depend on what 2022 brings to the table, but the strong on-going worldwide demand for precious metals implies an uneasiness among investors not likely to be easily placated.

Dollar’s best days look numbered amid rush to front-run Fed

Bloomberg/Ruth Carson and Payne Lubbers/12-28-2021

USAGOLD note: In other words, the speculative tide may be set to turn against the U.S. dollar as 2022 unfolds. The Fed, one analyst points out, may prove to be “a bit more dovish than people were expecting.”

Gold: Good riddance 2021’s hangover and ‘inflation fail’

Bullion Vault/Adrian Ash/12-29-2021

USAGOLD note: When quantifying the long-term prospects for gold, it is sensible to keep things in perspective, as Adrian Ash does in this entertaining year-end review and outlook. In the end, gold is really portfolio insurance more than it is a speculative investment. On that score, its long-term value as a hedge against depreciating currencies is a matter of record.