AFTERNOON UPDATE

Gold continues inflation-induced advance

Some much-needed clarity on the nature of inflation and what it means for gold investors

(USAGOLD – 1/12/2021) – Upon release of today’s CPI number, gold initially paused then resumed the climb that began yesterday, tacking another $5 onto its price at $1827. Yesterday, it notched a $19 gain anticipating this morning’s report, which came in at a 7% annualized inflation rate. Silver is up 37¢ at $23.23.

The mainstream financial media is stuck on the Fed’s mantra that it can and will control inflation, even though it is running well ahead of the 2% target level. Those who buy food and gasoline, or happen to be in the real estate market, know full well that even the 7% number might be an illusion. The cost of living is rising, and the inflationary process is in full swing.

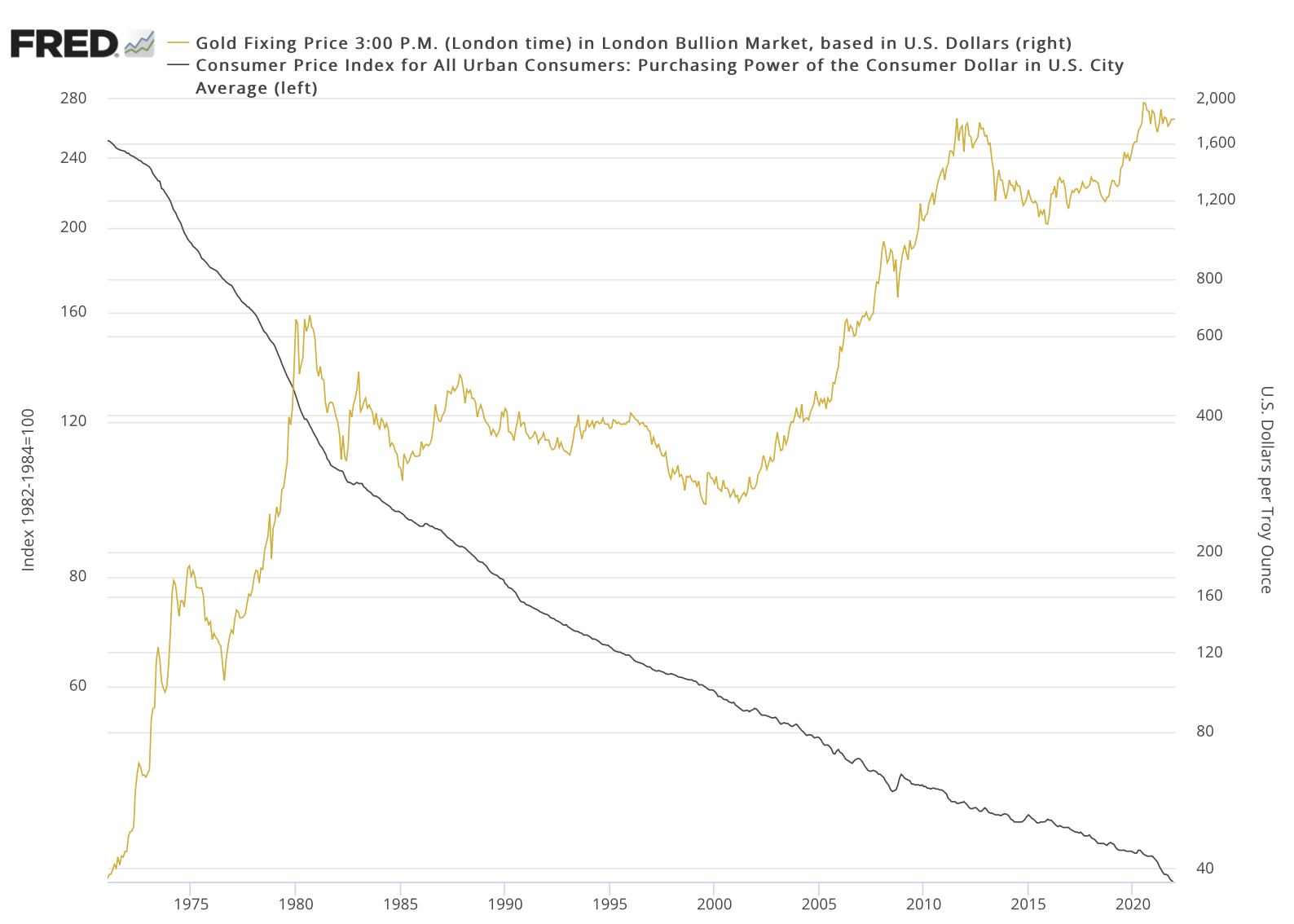

“The nature of inflation is widely misunderstood and misinterpreted,” writes analyst Dave Kranzler in an Investing.com overview, “‘Inflation’ and ‘currency devaluation’ are tautological—they are two phrases that mean the same thing. … Dollar devaluation has been occurring since the early 1970’s. The value of the dollar relative to gold (real money) has declined 98%. In 1971 $40,000 would buy a 4,000 square foot home in a good suburb. Now it takes $700,000 on average to buy that same home. Price inflation is the evidence of currency devaluation. The CPI is not a real measure of price inflation. The CPI is methodically massaged – starting with the Arthur Burns Federal Reserve (it was his idea) to hide the real degree of currency devaluation from all of the money that has been printed since 1971.”

Gold and the purchasing power of the U.S. dollar

(Log scale, 1971-2021)

Sources: St. Louis Federal Reserve, Bureau of Labor Statistics, ICE Benchmark Administration

Bridgewater Securities’ famed founder and investment manager Ray Dalio believes we are in an entirely new paradigm that requires a sea change in the way investors handle their money. During the Roaring 1920s, he says, you would want to own stocks and avoid bonds, but it was the polar opposite in the 1930s depression era. In the inflationary 1970s hard assets like gold were the place to be. In the disinflationary 1980s, financial assets were the place to be and hard assets were to be avoided.

“What should one do in this new paradigm?” he asks in a recent LinkedIn piece. “This paradigm is leading to a big shift in wealth and power. Naturally, as a global macroeconomic investor, the economic and market behaviors in this paradigm are top of mind. I think one should consider minimizing one’s ownership of cash and bonds in dollars, euros, and yen (and/or borrow in these) and putting funds into a highly diversified portfolio of assets, including stocks and inflation-hedge assets, especially in countries with healthy finances and well-educated and civil populations that have internal order.” Dalio is a long-time proponent of gold ownership.