Wary global bond markets brace for the supply floodgates to open

Yahoo!Finance-Bloomberg/Garfield Reynolds/Liz Capo McCormick/James Harai, Masaki Kondo/1-10-2022

“While governments are set to pare borrowings as fiscal outlays ease, the $2 trillion drop in central banks’ net demand will provide a risky real-world test of how much private demand exists.”

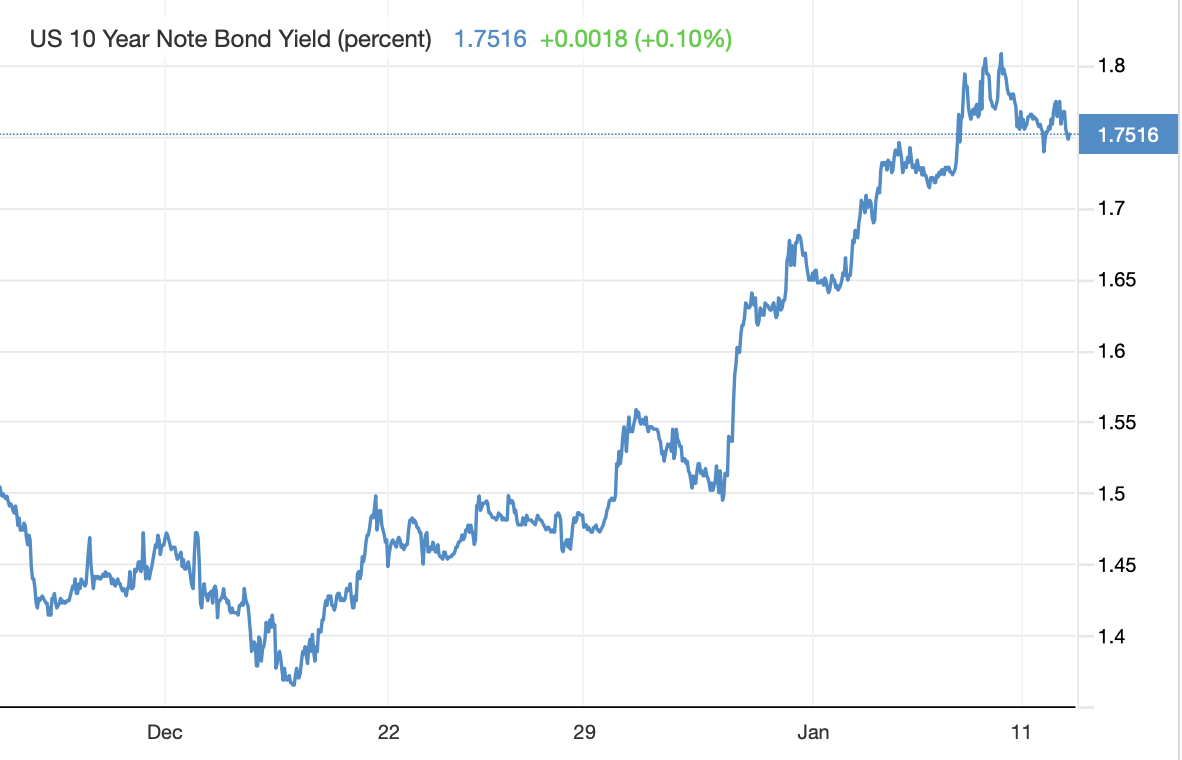

USAGOLD note: It’s not just the United States that is pumping new-issue bonds into the marketplace. It’s happening globally. If the selling exceeds the buying, secondary market sell-offs are likely to force interest rates higher – just about everywhere at a time when inflation dampens demand. Those attempting to get ahead of the approaching whirlwind have already put yields on an accelerated trajectory.

Chart courtesy of TradingEconomics.com