Reflections on Greenspan’s ‘Irrational Exuberance’ Speech after 25 Years

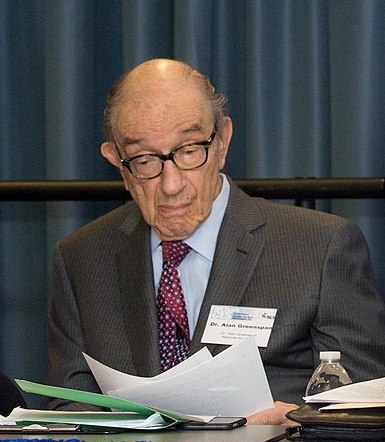

Cato Institute/James A. Dorn/12-27-2021

“Greenspan began his speech by reminding us that ‘at root, money—serving as a store of value and medium of exchange—is the lubricant that enables a society to organize itself to achieve economic progress.’ Sound money (i.e., money that maintains its long‐run purchasing power), is the glue that holds a free‐market system together. In contrast ‘erratic money’ (i.e., wide variations in the quantity of money relative to the demand for money), distorts market price signals and the allocation of resources.”

USAGOLD note: Cato Institute’s Dorn revisits Alan Greenspan’s famous “irrational exuberance” speech in 1996 and applies the former Fed chairman’s observations therein to the present. “Asking the Fed to do too much,” Dorn concludes, “risks further politicizing the central bank, with the consequent loss of credibility.” Of late Greenspan has been a critic of Fed policy. In a note published last October, he reiterated the dangers referenced above. “Monetizing the debt,” he said, “cannot be a long-term solution, and increases in the money supply relative to the real goods and services an economy produces will eventually lead to higher price levels.” (For more, please see Alan Greenspan’s thoughts on inflation, 11/5/2021)