AFTERNOON UPDATE

Gold, silver push convincingly higher, part of broad-based commodities rally

‘Silver is the canary in the gold mine and will probably go first.’

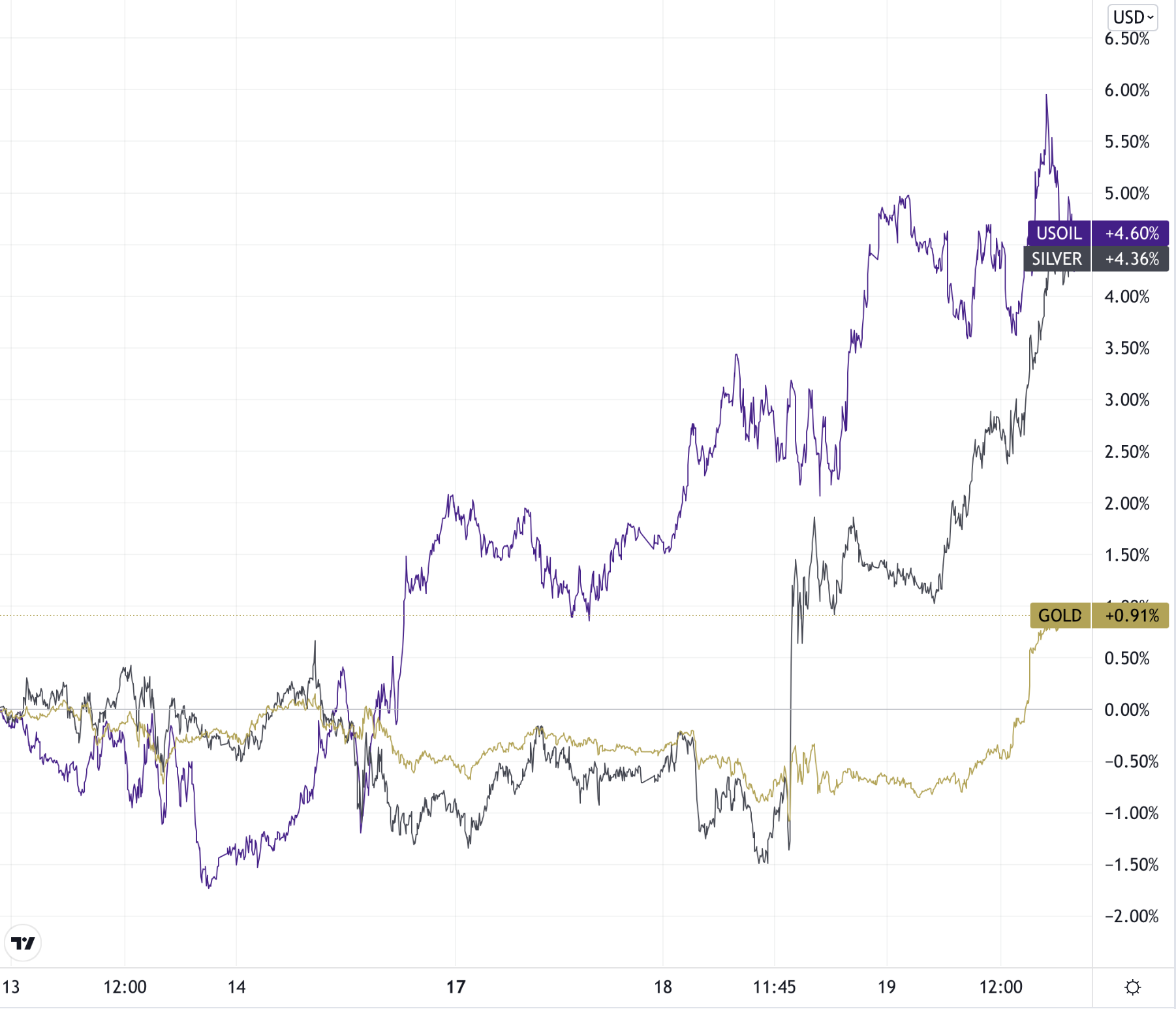

(USAGOLD – 1/19/2022) – Following silver’s lead yesterday, gold pushed convincingly through resistance levels around $1830 today as part of a broad-based commodities rally. Silver is up another 3% (+70¢) at $24.23. Gold is up $28 at $1843. Some analysts, as reported yesterday, believe that a recovery in Chinese industrial production is pushing the rally in commodity prices. Precious metals, some feel, have lagged the inflation building in the economy and are now beginning to play catch up. A weaker dollar and falling bond yields contributed to precious metals’ upside. Equity Management Academy takes a somewhat different tack on the commodities rally, saying that it is driven by oil and that oil, in turn, is driven by the prospect of war in Ukraine.

“A combination of factors is shaking the foundation of supplies across the board,” it concludes in a report released his morning. “Gold and silver could explode. Silver is the canary in the gold mine and will probably go first. Silver is the most undervalued asset in the world. It’s clear that the Fed is not in control of inflation, and it’s still unclear if this inflation is going to be temporary or long term. Once you raise prices it is very difficult to lower them later. There’s a lot of uncertainty in a lot of areas. … Gold and silver are both poised for a major move up. If Gold takes out $1874, then the next high would be the $1920 area. If Gold goes beyond that, it would test $2062.”

Gold, silver and oil prices

(% gains, 5-days)

Chart courtesy of TradingView.com • • • Click to enlarge

We will be posting occasional afternoon updates only for the next few weeks.

Please stay tuned.