Author Archives: News

Gold demand trends Q2 2023 – World Gold Council

––World Gold Council/Staff/8-1-2023

“Central bank buying slowed in Q2 but remained resolutely positive. This, combined with healthy investment and resilient jewellery demand, created a supportive environment for gold prices.”

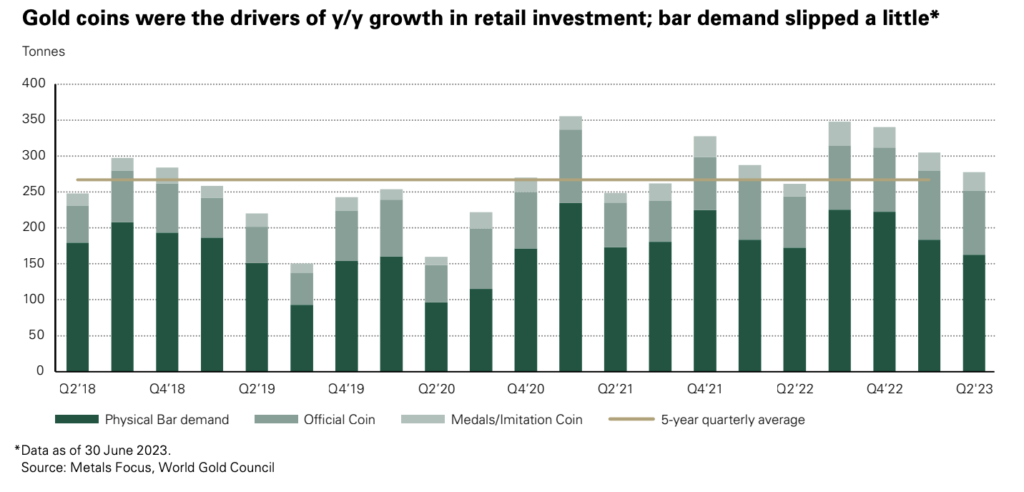

USAGOLD note: Bar and coin demand increased by 6% year over year in the second quarter.

Chart courtesy of World Gold Council

‘Eye-popping’ $1 trillion third-quarter borrowing need from U.S. Treasury raises risk of buyers’ fatigue

MarketWatch/Vivien Lou Chen/8-1-2023

USAGOLD note: This article details some of the problems accompanying this enormous issuance of government debt. It was published before Fitch’s downgrade announcement.

Young, rich Americans don’t trust the stock market, so they’re turning to alternative assets

Yahoo! Finance/Jeannine Mancini/7-31-2023

“Based on a survey conducted by Lansons, it was found that less than 10% of the entire American population has invested in alternative assets. However, among the younger generations, there is a more significant interest in alternative investments, with 30% of Gen Z and 25% of millennials either investing in such assets or possessing knowledge of platforms that facilitate these investments.”

USAGOLD note: One of the alternatives mentioned is gold.

Most of what we’ve heard about the yuan dethroning the dollar is from the West. Here’s what China’s actually said about it.

MarketsInsider/Huileng Tan/7-31-2023

USAGOLD note: Important insights at the link……

Traders brace for $102 billion wave of Treasury bond sales

Bloomberg/Liz Capo McCormick/7-31-2023

USAGOLD note: The new bond sales come at a time when the Fed, Japan, and China are no longer buyers. What happens if support doesn’t materialize?

China’s gold consumption reaches 555 tons, rising 16.4% in the first half of 2023

USAGOLD note: China’s appetite for gold grows as its middle classes gain wealth……Note the strong gain in bullion bar demand, a sign that Chinese investors are buying gold as a safe haven.

Who wants to keep hiking rates on the FOMC and who doesn’t?

Bloomberg/Steve Matthews, Kyungjin Yoo and Dave Merrill/7-25-2023

“After more than a year of solid agreement that higher interest rates were needed, differences among policymakers have started to deepen as they weigh when to stop hiking and how long to keep rates elevated.”

USAGOLD note: The politics of economics at the Fed broken down. A good lead in to today’s rate decision and press conference……

Everyone thinks the Fed’s rate hike next week will be the final one — except the Fed

MarketWatch/Greg Robb/7-21-2023

USAGOLD note: Several analysts have come forward over the past month to state their belief that inflation is down but not out – in a lull rather than full remission. If that proves to be the case, the Fed could be chasing the inflation rate for many months to come.

‘Something very strange’ explains why a US recession has been delayed

Yahoo!Finance/Matthew Fox/7-20-2023

USAGOLD note: How Wall Street analysts, with an ocean of data sources available to them, missed this important trend is equally strange.

High-yield bond exodus gathers pace as 10% drains from funds

Yahoo!Finance-Bloomberg/Olivia Rainmonde/7-14-2023

“Investors have pulled more money out of US junk-bond funds than from any other asset class so far this year, according to a report by Bank of America.”

USAGOLD note: It’s not just the return on your money, but the return of your money that’s important.

India ties up with UAE to settle trades in rupees

Reuters/Arpan Chaturvedi/7-15-2023

USAGOLD note: Is cutting transactional costs the real reason for this new arrangement?

Man uncovers more than 700 gold coins on his cornfield: ‘Most insane thing ever’

National Post/Chris Knight/7-10-2023

USAGOLD note: To give you an idea of the value, the hoard includes eighteen 1863 $20 Liberty gold coins with an estimated auction value of $100,000 each.

Countries repatriating gold in wake of sanctions against Russia – study

USAGOLD note: There has been a notable decline in London vaulted gold, according to the LBMA. Gold repatriation removes bullion from the leasing pool, which has acted as a drag on the gold price in the past. “We did have it held in London,” said one central banker, “but now we’ve transferred it back to [our] own country to hold as a safe haven asset and to keep it safe.”

Wall Street’s soothsayers have rarely been so bewildered about what’s next

Bloomberg/Denitsa Tsekova, Carly Wanna and Lu Want/7-8-2023

“Up and down Wall Street, forecasters were caught flat-footed by how the first half of 2023 unfolded in financial markets. That seems to have rattled their faith in what the winning playbook for the rest of it should be.”

USAGOLD note: This is a generation of Wall Streeter’s that was taught not to fight the Fed almost as religious dogma. But a new wave of investors out in the financial hinterlands is fighting the Fed with unpredictable results.

China continues to de-dollarize reserves as gold stockpile climbs for 8th straight month

Yahoo!Finance/Filip DeMott/7-7-2023

USAGOLD note: China now holds 2330 tonnes of gold in reported official reserves. The official data, though, does not reflect gold held at its state banks. Yahoo cites China’s bid to “erode” the global dollar hegemony and as a hedge against “growing economic and geopolitical uneasiness.”

Zoltan Pozsar re-emerges

Bloomberg/Tracy Alloway, Joe Weisenthal and Alex Harris/6-30-2023

USAGOLD note: An intriguing retrospective of Pozsar’s career and an overview of his Bretton Woods III theory at the link above. Pozsar, who recently departed Credit Suisse previously held positions at the New York Fed and the IMF. He has now launched his own enterprise, Ex Uno Plures

Strong economic data turns recession fears into recession doubts

Yahoo!Finance/Josh Schafer/6-28-2023

“Consumer attitudes remain resilient,” Jefferies US economist Thomas Simons wrote in a note on Tuesday. He added: “There are storm clouds on the horizon, but the consumer is growing tired of the expectation that a recession is imminent.”

USAGOLD note: It is mind-boggling how quickly economic sentiment can turn……In our view, the best approach to portfolio design is to diversify and hold on for the long run rather than chasing Wall Street’s confused twists and turns. As you might have suspected, we see gold as an integral part of that diversification. “A change of fortune,” says Ben Franklin, “hurts a wise Man no more than a change of the Moon.”

Short and Sweet

Gold, vanadium, europium reveal the existence of a mysterious particle

“Atomo de oro”/Galarza Creador

“To observe the Majorana fermions,” reports Mining.com, “a team of physicists from the Massachusetts Institute of Technology, the Institute of Technology at Delhi, the University of California at Riverside, and the Hong Kong University of Science and Technology, scientists designed and built a material system that consists of nanowires of gold grown atop a superconducting material, vanadium, and dotted with small, ferromagnetic ‘islands’ of europium sulfide, which is a ferromagnetic material that is able to provide the needed internal magnetic fields to create the Majorana fermions. When the researchers applied a tiny voltage and scanned the surface near the islands, they saw signature signal spikes near-zero energy on the very top surface of gold that, according to theory, should only be generated by pairs of Majorana fermions.”

This must have been what Ben Bernanke was talking about years ago when he said he didn’t understand gold. [Smile] Gold’s allure, to be sure, is a mystery to some, but for those who understand the ever-present dangers imposed by the money printing press, the only mystery is why so few own it.

____________________________________

Image attribution: Galarza Creador, Atomo de oro, CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Looking to hedge your portfolio against the mysteries of current monetary policy?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Chaos Kings — the traders who make fortunes from disaster

Financial Times/Katie Martin/6-27-2023

USAGOLD note: This review of Scott Patterson’s book Chaos Kings is an entertaining read we think you will enjoy.

Gold production up an anemic 1% in 2022

World Gold Council/Krishan Gopaul/6-23-2023

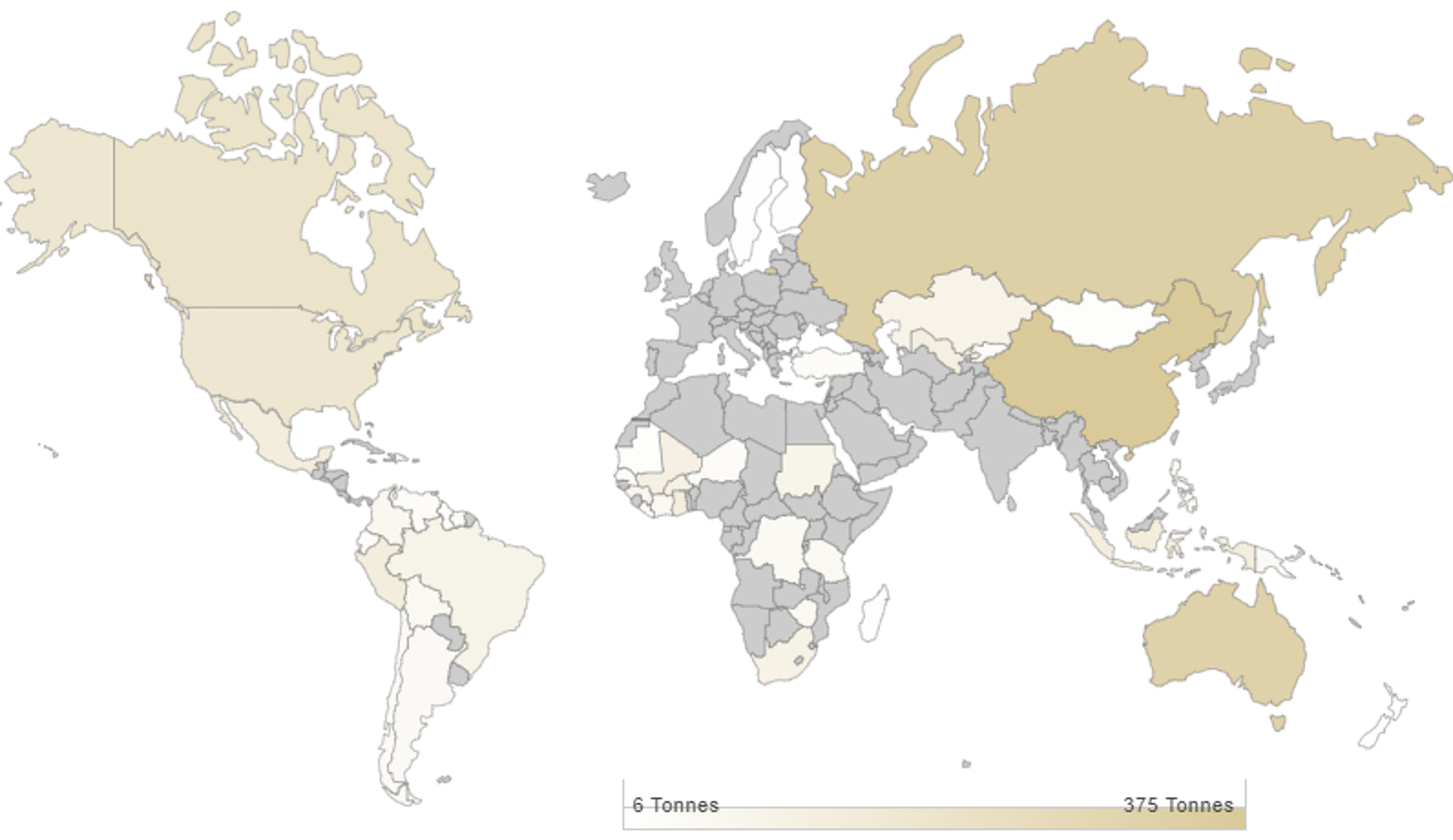

“According to Metals Focus’ latest estimate, global gold production in 2022 was 3,628t. This is 1% higher y/y.…The latest country-level data shows no change amongst the five largest gold producing nations compared to 2021. China remains the world’s largest gold producer, followed by Russia, Australia, the United States and Ghana.”

USAGOLD note: An anemic showing on the supply side of the gold fundamentals’ equation at a time of record global demand.

Gold mine production by country (2022)

Map courtesy of World Gold Council, Data source: Metals Focus • • • Click to enlarge