Author Archives: News

Corporate bankruptcies and defaults are surging – here’s why

USAGOLD note: And we have more rate increases ahead of us……The bankruptcy numbers suggest a developing stagflationary economic scenario. “It’s not like one particular sector has had a lot of defaults,” said Moody’s Sharon Ou, “Instead it’s quite a number of defaults in different industries. It depends on leverage and liquidity.” The default problem has not received a lot of media attention.

The Treasury Department and the Fed have drained $150 billion in market liquidity since the debt ceiling deal

MarketsInsider/Filip DeMott/6-22-2023

USAGOLD note: The drain is accelerating. Half of it drain occurred over a three-day period around the time the Strategas report was published.

Distressed US commercial property assets rise to $64 billion

Bloomberg/John Gittelsohn/6-22-2023

USAGOLD note: Another $155 billion in commercial real estate is potentially troubled. This is one of several grey swans circling the pond.

Middle East oil prices soar amid Chinese trading frenzy

Yahoo!Finance/OilPrice.com/6-23-2023

“At a time when global recession concerns have depressed global oil prices to pre-Ukraine war levels, prices of Middle Eastern oil have skyrocketed on soaring demand from Asian refiners in China to Japan as the market takes stock of heavy trading by the industry’s biggest names this month.”

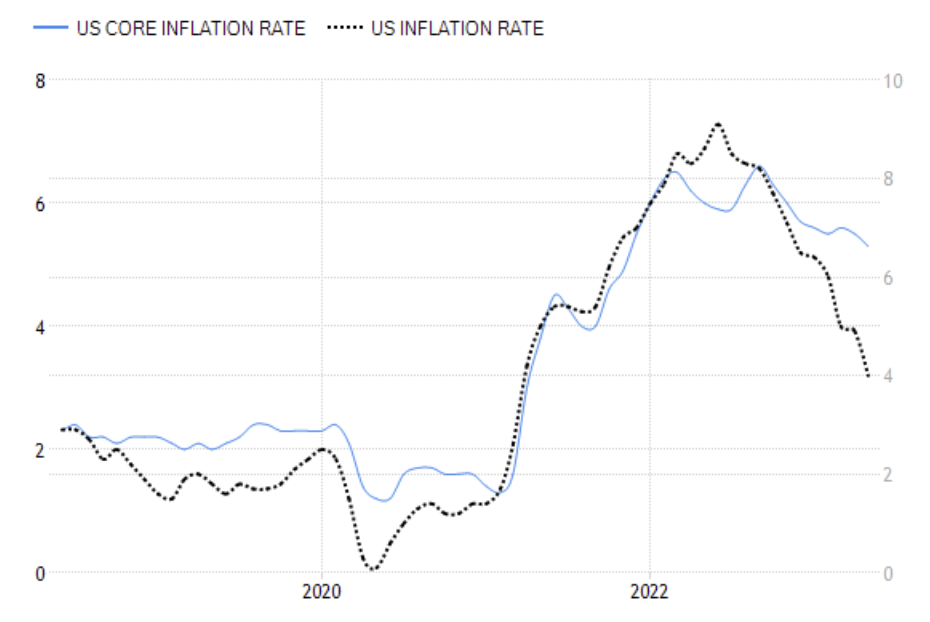

USAGOLD note: Depressed energy prices have been the key factor in keeping the headline inflation rate in check. With core inflation still running high at 5.3%, the Fed will be watching closely to see if this trend has staying power.

Chart courtesy of TradingEconomics.com • • • Click to enlarge

Investors keep bets on U.S. rates soon topping out, despite Powell’s hawkishness

Yahoo!Finance-Reuters/Davide Barbuscia/6-21-2023

USAGOLD note: Speculators are not buying Powell’s fire and brimstone……

China’s gold-buying boom is slowing sharply as economic woes hit retail demand

MarketsInsider/Filip De Mott/6-20-2023

USAGOLD note: Expanded only 24%? Given the Chinese people’s historic attachment to gold, most analysts will see the slowing demand at present as a lull in the dominant trend.

Fed research reveals biggest culprit behind US inflation spike

Bloomberg/Ana Monteiro/6-21-2023

USAGOLD note: God forbid the culprit would be the central bank and its wayward money-printing policies. We all knew that logistics added to the problem. A recent study by the San Francisco Fed puts a number on that contribution – 60% of the price surge. One doubts the printing press was taken into account.

Hedging failure exposes private equity to interest-rate surge

Bloomberg/Silas Brown, Abhinav Ramnarayan and Paula Seligs/6-20-2023

“Yet for all their savvy dealmaking, even the titans of private equity are getting caught out by the swift rise in interest rates — which is costing the companies they own billions in extra interest and threatens to push scores of them into default.”

USAGOLD note: Yet another sector facing the prospect of widespread default and imposing risks on the rest of the financial system…… Consider that their interest cost quintupled over the past 18 months.

Gold ETFs enjoy further net inflows in May

“Inflows into gold-backed exchange-traded funds (ETFs) turned positive for the year to date thanks to robust investor activity in May, the World Gold Council (WGC) has said. These investment vehicles recorded net inflows of 19.3 tonnes in May, the third monthly increase in a row. The total value of inflows stood at $1.66 billion.”

USAGOLD note: Positive ETF flows are one of the indicators gold market analysts consistently point to as a signal the secular bull market has resumed. Let’s hope it holds.

The National Debt Is Now More than $32 trillion. What Does That Mean?, courtesy of Peter G. Peterson Foundation

Goldman says markets are optimistic on pace of US infltion drop

Bloomberg/Joanna Ossinger/6-17-2023

“Inflation in the US won’t come down as quickly as markets are currently pricing, according to strategists at Goldman Sachs Group Inc.”

USAGOLD note: What bothers the Fed about the current inflation numbers is that core prices excluding food and energy, as shown below in the Fed favored inflation indicator, the PCE Index, are actually increasing even as the headline inflation rate continues to drop. Most of that drop, in fact, has to do with the drop in the cost of energy. The price of energy can accelerate suddenly and along with it other volatile sectors, though, and that is what is troubling the Fed. If it does, the rising cost will be tacked onto core prices

US Core PCE Index Annual Change

Chart courtesy of TradingEconomics.com

Computer-driven trading firms fret over risks AI poses to their profits

Financial Times/George Steer and Laurence Fletcher/6-15-2023

USAGOLD note: An existential threat emerges for algo-based trading systems: Instantaneous reaction to fake news. Hedge funds say they’ve erected defenses but the fake Pentagon image and subsequent instantaneous plunge in stocks proves otherwise.

Wall Street isn’t buying what Powell, economists are forecasting

Bloomberg/Jess Menton, Alexandra Semenova and Elena Popina/6-15-2023

“Defying the odds, the world’s biggest stock market has recouped all losses caused by the most disruptive monetary-tightening campaign in a generation. And not even recession warnings or fresh monetary threats from Jerome Powell are stopping fund managers as they join the big artificial intelligence-fueled rally.”

USAGOLD note: Such is what happens when market participants know that the central bank is caught between a rock and a hard place. Powell has consistently chosen to fly like a dove when things go south – the stuff of reputation. As for Wall Street, with big bets in place on either side of the rate divide, someone is going to get burnt – perhaps badly.

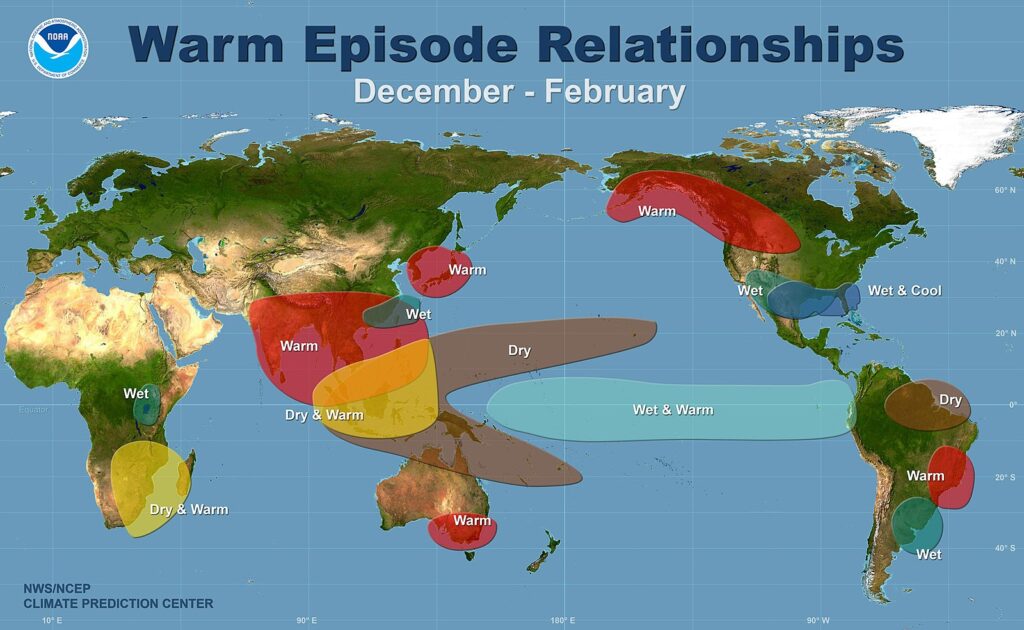

Return of El Nino threatens new levels of economic destruction

Bloomberg/Ben Sharples/Brian K Sullivan, Eric Roston and Adrian Leung/6-12-2023

“As the world struggles to recover from Covid-19 and Russia’s war in Ukraine grinds on, the arrival of the first El Niño in almost four years foreshadows new damage to an already fragile global economy.”

USAGOLD note: One economist says that with the world already dealing with inflation and recession risk, “El Nino comes at exactly the wrong time.” This article will bring you up to date on the economic impact of the El Nino weather pattern.

Hedge fund bond bears are relentlessly shorting Treasuries

Yahoo!Finance-Bloomberg/Ruth Carson/6-12-2023

USAGOLD note: According to the Wall Street Journal, Fed officials have signaled they will hold rates now before raising them again later this summer. If so, one wonders what purpose is served by a pause. We will know more later today……

The surprising uses of gold throughout history

USAGOLD note: Gold is money, but through its long history it has been used in a wide variety of applications from the sacred to the practical.

Will Argentina ditch the peso for the dollar?

Bloomberg/Ignacio Olivera Doll/6-8-2023

“The front-runner in the presidential race says he would make the greenback the official currency and “blow up” the central bank.”

USAGOLD note: This isn’t the first Argentina has considered replacing the peso with the dollar. To do so, however, is to pull the plug on the printing press. Argentina could go from inflationary disaster to deflationary disaster overnight.

Argentina inflation and US dollar exchange rate

Source: TradingEconomics.com

US banks prepare for losses in rush for commercial property exit

Financial Times/Stephen Gandel, Joshua Chaffin and Eric Platt and Joshua Oliver/6-5-2023

USAGOLD note: Something wicked this way comes…… And the banks see the signs.

Reserve Bank of India ups gold reserve 40% over past five years

EconomicTimes/Gayatri Nayak/6-8-2023

“The Reserve Bank of India’s gold reserves have risen by over 40% since it resumed the purchase of the yellow metal over five years ago. This shows gold has emerged as a strong hedge against inflation and also helped reduce dependence on the dollar to an extent. India’s central bank, unlike others, never sells its gold.”

USAGOLD note: At 795 tonnes, India has the ninth-largest gold reserve in the world. The World Gold Council reports that Indian households may hold as much as 24,000 to 25,000 tonnes of the metal.

India Gold Reserves

Source: TradingEconomics.com

To pause or not to pause? Fed officials divided ahead of critical June meeting

Yahoo!Finance/Jennifer Schonberger/6-8-2023

“Federal Reserve officials are divided on whether to raise interest rates at the central bank’s policy meeting next week.”

USAGOLD note: As we kick off Fed week, three FOMC members favor a hike, two a pause, four could go either way, and two have not commented, according to YahooFinance. The Fed meets for two days starting Tuesday with a rate announcement and press conference scheduled for Wednesday.