Daily Gold Market Report

Gold Gains Momentum Following Fed’s Rate Hold

Markets Anticipate Rate Cuts and Lower Inflation

(USAGOLD – 12/14/2023) Gold prices are continuing upwards this morning even as the European Central Bank continues to hold interest rate steady. Gold is trading at $2038.71, up $10.97. Silver is trading at $24.13, up 32 cents. Gold prices increased by over 1% yesterday following the U.S. Federal Reserve’s announcement of a potential end to its interest rate hikes and the possibility of rate cuts in the coming year. Spot gold rose to around $2,027 per ounce. The Federal Reserve maintained current interest rates, with projections suggesting a decrease by the end of 2024. The Fed’s recognition of diminishing inflationary pressures and expectations of interest rate cuts led to a drop in yields and the dollar, boosting gold and silver prices. The dollar index fell 0.6%, making gold more affordable for international buyers. Market expectations now lean towards a 60% chance of U.S. rate cuts by March 2024. This scenario enhances the attractiveness of gold. Federal Reserve Chair Jerome Powell noted that inflation has eased without a significant increase in unemployment, though the full impact of monetary tightening may not be fully realized yet. Recent data showed stable U.S. producer prices in November, signaling a continued decrease in factory-gate inflation. Gold’s future movements could be influenced by upcoming policy meetings of the European Central Bank and the Bank of England. Meanwhile, prices of silver, platinum, and palladium also experienced increases.

Daily Gold Market Report

Growing Blockchain Tokenization of Assets

A Potential Risk to Financial Stability

(USAGOLD – 12/13/2023) Gold prices are flat as the marketplace is quiet just ahead of the end of the FOMC meeting. Gold is trading at $1982.86, up $3.32. Silver is trading at $22.64, down 13 cents. The Bank of England (BOE) has recently raised concerns about the growing trend of asset tokenization on blockchains. The BOE’s Financial Stability report highlights that while banks are increasingly positive about using crypto technologies for tokenizing money and real-world assets, this rise in asset tokenization could lead to greater systemic risks in the financial environment. “Tokenization, the process of issuing a digital representation of an asset, is a growing part of the crypto ecosystem and is forecast to become a $10 trillion market by 2030, according to asset management company 21.co,” reported by CoinDesk. These risks include increased interconnectedness between crypto and traditional financial markets and direct exposure of systemic institutions. Although the current risks are limited, the BOE emphasizes the need for continuous monitoring and global cooperation in regulation to manage potential cross-border spillovers and market fragmentation.

Daily Gold Market Report

Pandemic’s Psychological Impact

Disconnect Between US Economy and Public Sentiment

(USAGOLD – 12/12/2023) Gold prices are flat with the consumer price index report for November coming in at up 3.1%, with the core rate (minus food and energy) coming in at up 4.0%. Gold is trading at $1981.58, down 37 cents. Silver is trading at $22.85, up 3 cents. Reuters published an article citing a Chicago Federal Reserve study that found a disconnect between the U.S. economy’s performance and public sentiment since the onset of the COVID-19 pandemic in spring 2020. Researchers noticed a decline in optimism for economic outcomes, a change from the historical correlation between economic conditions and consumer and small business sentiment. Possible reasons include higher price levels and altered unemployment expectations. The pandemic’s psychological impact and its influence on economic behavior, has cut deep. In its Stress in America 2023 report last month, the APA said the country was “recovering from collective trauma” that may be rooted in the pandemic but has sources far beyond it, including economic ones.

Daily Gold Market Report

China’s Economic Downgrade

A Deep Dive into Soaring Debts and Global Impacts

(USAGOLD – 12/11/2023) Gold and silver prices have slightly decreased in early trading on Monday in the U.S. Recently, the short-term chart positions for both metals have worsened, particularly for silver. Gold is trading at $1992.68, down $11.99 cents. Silver is trading at $22.88, down 12 cents. Attributed to the country’s soaring government debt and sluggish economy, Moody’s lowered its outlook for China’s sovereign bond rating from stable to negative. Government debt is a growing global concern, statistics from the IMF are showing alarming levels of debt in various economies: the Euro Zone at 85% of GDP, Britain at 98%, the US at 150%, and Japan at 263%.

Daily Gold Market Report

World Gold Council: Gold Outlook 2024

The Global Economy Faces Three Likely Scenarios In 2024

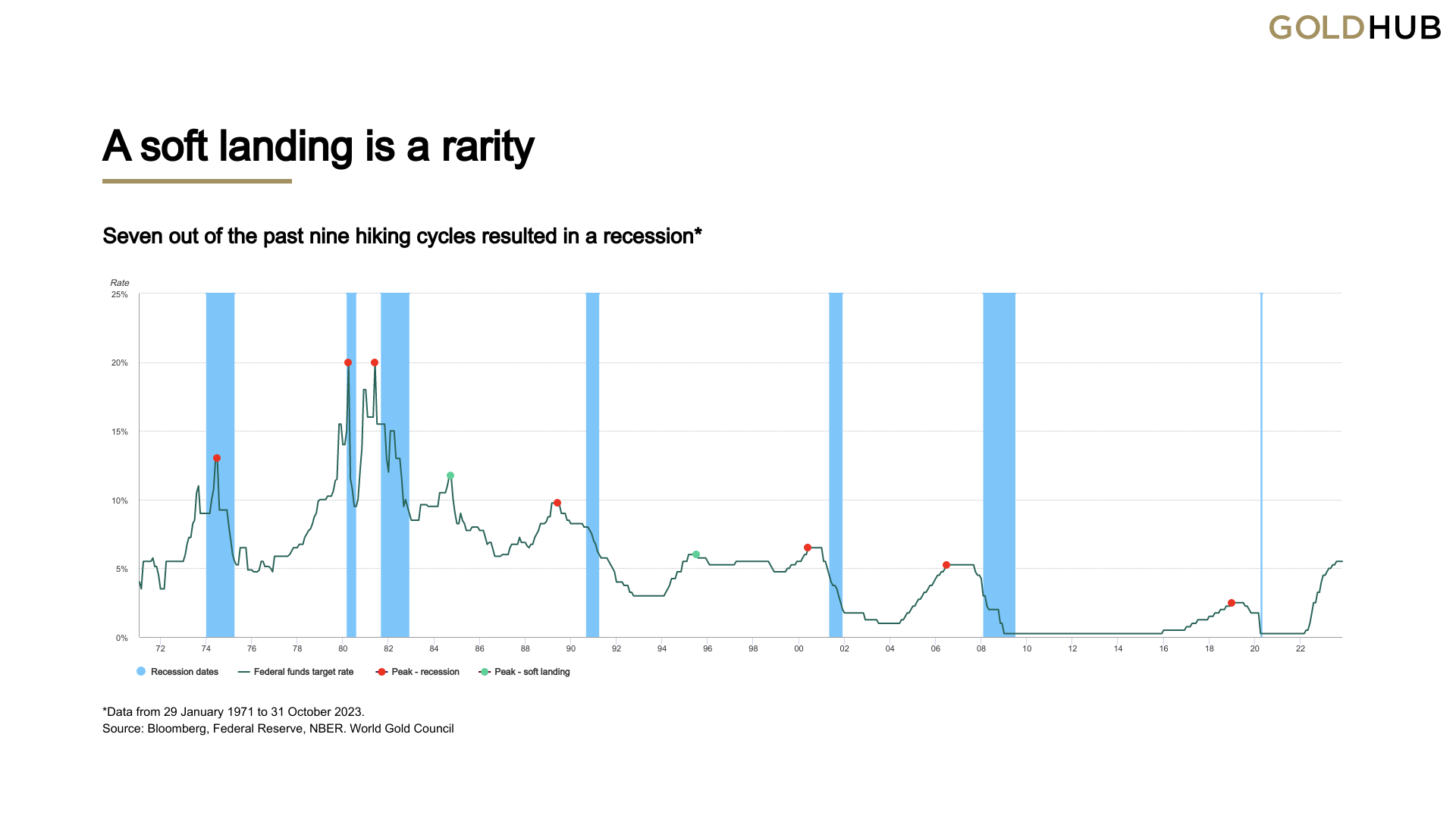

(USAGOLD – 12/08/2023) The gold market is experiencing significant downward pressure due to the U.S. economy’s unexpected surge in job creation, which is concurrently reducing the unemployment rate. Gold is trading at $2,010.15, down $18.32 cents. Silver is trading at $23.35, down 45 cents. The “Gold Outlook 2024” report by the World Gold Council presents three potential scenarios for the global economy in 2024: a soft landing with moderate economic slowdown and stable to slightly decreasing gold prices; a recession, where gold may rise in value as a safe-haven asset; and a less likely no landing scenario, with continued economic growth and persistent inflation, where gold’s behavior could vary based on inflation rates and investor sentiment. Each scenario reflects different impacts on gold prices, influenced by economic conditions and market responses.economic conditions and investor behavior.

While the markets lean towards the Federal Reserve achieving a soft landing, this outcome is challenging to attain. In the past five decades, the Fed has only successfully managed a soft landing twice in nine tightening cycles, with the remaining seven leading to a recession. This trend is expected, as prolonged higher interest rates typically exert pressure on financial markets and the broader economy.

Daily Gold Market Report

Global Gold-Backed ETFs

A Mixed Picture in November with North American Gains and European Losses

(USAGOLD – 12/07/2023) Gold prices are slightly up this morning, eyeing resistance at $2,050 per ounce, coinciding with signs of stabilization in the U.S. labor market, as the quantity of American workers seeking first-time unemployment benefits shows little change from the previous week. Gold is trading at $2,035.21, up $9.66 cents. Silver is trading at $23.91, up 1 cents. In November, gold-backed ETFs saw decreased outflows compared to October, according to the World Gold Council. Global ETFs had net outflows of $920 million and a physical holding reduction to 3,236 tonnes. Despite this, AUMs increased by 2% to $212.2 billion, aided by gold prices exceeding $2,000 per ounce. North American ETFs reversed a five-month trend of redemptions with net inflows of $659 million, while European funds continued to see withdrawals for the sixth consecutive month, attributed to high opportunity costs and strong local currencies. Asian funds experienced modest inflows.

Daily Gold Market Report

Anticipating U.S. Rate Cuts in 2024

Market Expectations Versus Economic Realities

(USAGOLD – 12/06/2023) The gold market is experiencing a resurgence in purchasing activity due to a notable slowdown in the U.S. labor market last month, as reported by recent figures from the private-sector payroll company ADP. Gold is trading at $2,031.75, up $12.39 cents. Silver is trading at $24.22, up 6 cents. US businesses advertised 8.7 million job vacancies in October, down from 9.6 million in September, according to the labour department’s Job Openings and Labor Turnover Survey released on Tuesday. Business Insider also reported that layoffs also have remained an unfortunate reality of 2023, continuing pace with the cuts made at dozens of companies toward the end of last year. While markets are pricing in a high likelihood of rate cuts by May 2024, the actual evidence to support this, such as a slowdown in employment and core inflation, is not yet apparent as these a lagging indicators. Employment reports, including the monthly report from the Bureau of Labor Statistics, indicate healthy employment gains, suggesting that the Fed may not be inclined to signal cuts yet. The resolution of strikes by the Screen Actors Guild and United Auto Workers positively impacted non-farm job gains, and there is an expectation of a rebound in the service sector in November, although this rebound is projected to stay below the long-term average. The overall sentiment is that while there are expectations of rate cuts in 2024, more significant evidence of an economic slowdown is needed for these to materialize.

Daily Gold Market Report

Gold Prices Ride a Rollercoaster

Surge and Dip on Fed Rate Speculations

(USAGOLD – 12/05/2023) Gold prices are trading lower this morning after much volatility yesterday. Gold is trading at $2,028.54, down 88 cents. Silver is trading at $24.43, down 8 cents. Gold prices experienced significant fluctuations yesterday, initially surging to ~$2140/oz then retracting back to $2020/oz, in response to evolving market expectations regarding U.S. Federal Reserve interest rate policies. After Federal Reserve Chair Jerome Powell’s comments suggested potential rate cuts, gold briefly hit a record high before declining due to reassessed expectations and a strengthening dollar. Despite this volatility, gold has been on an upward trend, gaining about 12% since early October and up ~11% YTD. This rise is attributed to both a demand for safe-haven assets following the Hamas attack on Israel and anticipation of looser U.S. monetary policy. Central bank purchases have also bolstered gold prices, offsetting reductions in exchange-traded fund holdings. Investors are now closely watching U.S. jobs data this week for further insights into the Fed’s monetary policy decisions.

Daily Gold Market Report

Historic M2 Decline and Its Impact on Gold Prices

A New Era for Investors?

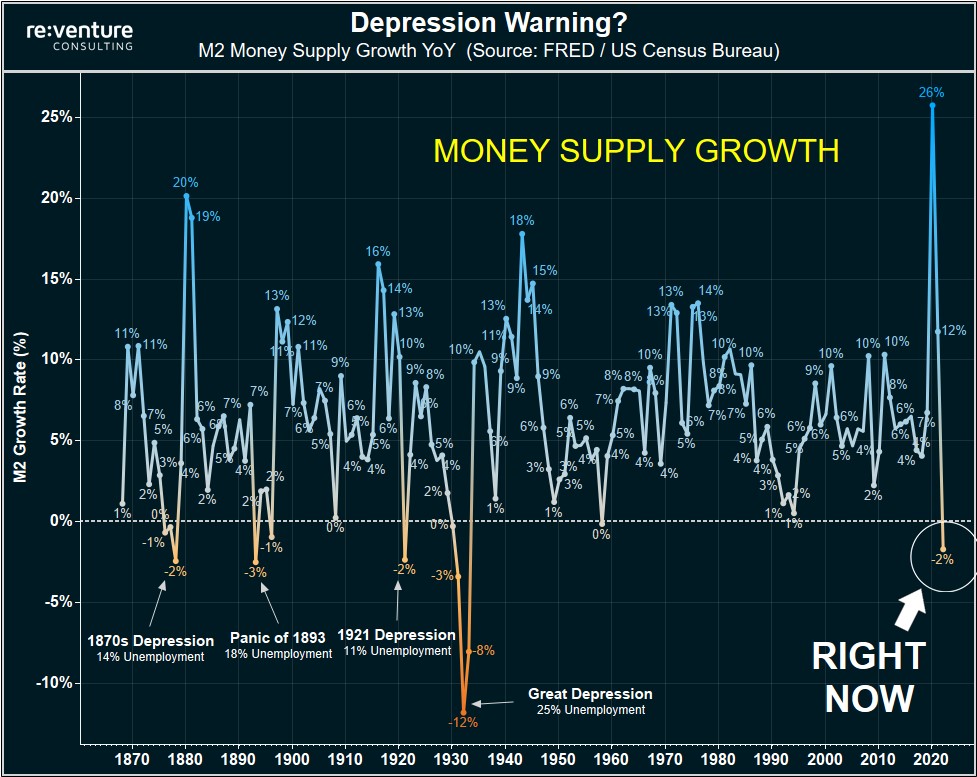

(USAGOLD – 12/04/2023)Gold prices are trading lower this morning after spot gold spiked to a new record high of $2,146.7 overnight. Gold is trading at $2,053.74, down $18.58. Silver is trading at $25.11, down 25 cents. Sean Williams, of The Motley Fool, recently pointed out the recent decline in the M2 money supply, the first significant contraction since the Great Depression, and its implications for the stock market and potential impact on gold prices. M2, which includes cash, coins, checking deposits, savings accounts, money market accounts, and CDs below $100,000, has fallen by 4.51% since its peak in July 2022. This decline is noteworthy as it’s the first notable drop in M2 in nearly 90 years.

Daily Gold Market Report

Breaking the Barrier

Gold’s Historic Monthly Rise Above $2000 and Its Economic Implications

(USAGOLD – 12/01/2023) Gold prices are trading flat amid some chart consolidation heading into the weekend. Gold is trading at $2,035.63, down 78 cents. Silver is trading at $25.17, down10 cents. The November monthly close of gold above $2000 per ounce is significant for several reasons. Firstly, it marks a notable psychological and financial threshold, often attracting increased attention from investors and the media. Such a high price can indicate strong investor interest in gold as a safe-haven asset. Secondly, crossing this price point might influence the strategies of both individual and institutional investors, potentially leading to increased demand and speculative trading. Finally, this milestone often leads to broader market analysis and speculation about the future of the global economy, as gold prices are frequently seen as a barometer for financial stability and investor sentiment.

Daily Gold Market Report

Reshaping Global Trade

UAE Joins BRICS in the Quest for De-Dollarization in Oil Markets

(USAGOLD – 11/30/2023) Gold prices have corrected following yesterday’s 6-month high. Gold is trading at $2,034.06, down $10.18. Silver is trading at $25.13, up 11 cents. The UAE’s shift from the US dollar to local currencies for oil trades reflects a strategic alignment with the BRICS alliance, marking a significant move away from dollar dominance in global oil markets. “Reports indicate that the UAE is eyeing potential oil and gas deals with up to 15 countries, including heavyweights like China, Russia, and Egypt, all of whom are members of the BRICS alliance and advocates of de-dollarization,” Jai Hamid reports. This decision, part of a broader trend towards de-dollarization, could reshape international trade dynamics, indicating the UAE’s role as a pivotal player in a diversifying global economy.

Daily Gold Market Report

Breakthrough in Hydrogen Fuel Cell Technology

Silver Substitutes for Expensive Metals

(USAGOLD – 11/29/2023) Gold prices have retreated from their overnight peaks above $2,050 per ounce, responding to unexpectedly robust economic activity in the third quarter. Gold is trading at $2,039.32, down $1.65. Silver is trading at $25.03, up 1 cent. SLAC National Accelerator Laboratory reported a significant advancement in making hydrogen fuel cells more affordable and practical earlier this month. Researchers from the Department of Energy’s SLAC National Accelerator Laboratory, Stanford University, and the Toyota Research Institute, in collaboration with Technion Israel Institute of Technology, have developed a new approach to fuel cell catalysts. They have successfully reduced the reliance on expensive platinum group metals (PGM) by partially substituting them with silver. This substitution not only lowers the cost but maintains the effectiveness of the fuel cells.

The key innovation lies in simplifying the catalyst’s application onto the cell’s electrodes. Traditionally, the catalyst is mixed into a liquid and spread onto the electrode, a process sensitive to varying lab conditions and challenging to replicate in real-world applications. The SLAC team overcame this by using a vacuum chamber for more controlled catalyst depositions. This method, tested and validated in practical fuel cell applications by Technion, ensures reproducibility and direct applicability to full-scale fuel cells. The partnership’s success in creating a cost-effective, efficient fuel cell opens new possibilities for future research, including the potential to develop entirely PGM-free catalysts. This advancement is crucial for the viability of fuel cells in heavy-duty transportation and clean energy storage, contingent on the continued reduction of manufacturing costs.

Daily Gold Market Report

Gold vs. Algorithm

Understanding Diverse Stablecoin Mechanisms in the Private Cryptocurrency Market

(USAGOLD – 11/28/2023) Gold prices continue to rise in early trading this morning. Gold is trading at $2,021.53, up $7.40. Silver is trading at $24.70, up 6 cents. A recent article written by Ruben Adeboy, delves into the contrasting mechanisms of gold-backed and algorithmic stablecoins, each offering a distinct approach to stability in the private cryptocurrency market. Gold-backed stablecoins derive their stability from the physical and historical value of gold, providing intrinsic value and attracting investors who appreciate the security of a tangible asset. However, they face challenges like scalability, centralized storage reliance, and regulatory complexities. Algorithmic stablecoins, in contrast, rely on smart contracts and dynamic algorithms to adjust supply based on market conditions, thus maintaining stability without direct linkage to physical assets. They offer flexibility and decentralization but face issues such as market volatility and governance complexities.

Daily Gold Market Report

Digital Currency Disruption

How Crypto Stablecoins Threaten U.S. Financial Supremacy

(USAGOLD – 11/27/2023) Gold prices continue to climb higher with no major geopolitical developments over the long U.S. Thanksgiving holiday weekend. Gold is trading at $2,012.60, up $11.78. Silver is trading at $24.84, up 51 cents. In a recent FT article, Jay Newman and Richard Carty discuss the growing concerns around the use of dollar-based digital instruments, stablecoins, and crypto exchanges, particularly in relation to their impact on the global financial system and U.S. economic policies. These instruments pose risks to the traditional dominance of the U.S. dollar in international finance and they could undermine the United States’ ability to enforce economic sanctions and monitor financial transactions. Crypto stablecoins and exchanges, especially those tied to the Chinese Communist Party (CCP), could challenge U.S. financial supremacy by providing alternative, stateless, and unregulated platforms for monetary transactions. These platforms, being outside the global regulatory net, could be used for both legitimate and illicit activities, making them risky assets with no underlying collateral. Large-scale acceptance of these tokens could weaken U.S. legislative tools like the Trading with the Enemy Act and the International Emergency Economic Powers Act. The authors suggest, “One solution could be for the US government to create its own crypto exchange or to issue its own crypto token, but the Fed or in Congress are dragging their feet. Ignoring a problem won’t make it go away.”

USAGOLD Comment: The calls for a US CBDC get louder and louder under the guise of the government’s need to enforce economic sanctions and monitor financial transactions.

Daily Gold Market Report

Daily Gold Market Report

The Digital Iron Curtain

Binance Chief Pleads Guilty To Breaking U.S. Anti-money Laundering Laws

(USAGOLD – 11/22/2023) Gold prices remained flat going in to the Thanksgiving holiday, hovering around $2,000. Gold is trading at $1,999.34, up $1.05. Silver is trading at $23.73, down 2 cents. Binance chief Changpeng Zhao stepped down and pleaded guilty to breaking U.S. anti-money laundering laws as part of a $4.3 billion settlement resolving a years-long probe into the world’s largest crypto exchange, Reuters reports. “Binance made it easy for criminals to move their stolen funds and illicit proceeds on its exchanges,” U.S. Attorney General Merrick Garland said on Tuesday. “Binance also did more than just fail to comply with federal law. It pretended to comply.”

In response to today’s DOJ and US Treasury press conference on the Federal charges against Binance, Balaji Srinivasan, famed angel investor and entrepreneur, suggests that a “Digital Iron Curtain” is descending over the Western world. This is marked by developments like the FedNow quasi-CBDC, increased surveillance, attacks on financial exchanges, and expanded civil forfeiture. This comes amid a backdrop of economic challenges, including a sovereign debt crisis and a crash in bond prices. The U.S. is deeply in debt, and central banks may need bailouts, making it difficult to exit to cryptocurrencies. He argues that those who remain unaware of these issues are living in an illusion, and advises positioning oneself away from financially and socially troubled areas. Balaji concludes, “Because if 2008 was about bank bailouts, soon we’re going to see central bank bailouts. Reverse bailouts, where your currency is debased to bail out the government. QE wasn’t free.”

Daily Gold Market Report

Shifting Global Trade Dynamics

China-Saudi $6.98 Billion Currency Swap Agreement

(USAGOLD – 11/21/2023) Gold prices popped higher to start the day, even surpassing $2,000 for a brief period during early trading this morning. Gold is trading at $1,997.73, up $19.77. Silver is also up, trading at $23.85, up 40 cents. Bloomberg reports The People’s Bank of China and the Saudi Central Bank have established a significant bilateral local currency swap agreement, valued at 50 billion yuan (approximately 6.98 billion U.S. dollars or 26 billion Saudi riyals). This agreement, valid for three years with the possibility of extension, marks a notable shift in the financial relationship between China and Saudi Arabia, indicating a move towards using local currencies in bilateral trade, including potentially in the oil sector. This step could signify a broader trend of reducing global reliance on the US dollar in international oil transactions.

Daily Gold Market Report

Digital Asset Week 2023

Major Financial Institutions Embrace Tokenization and Digital Assets

(USAGOLD – 11/20/2023) Gold is moderately down as we go into the holiday week. Gold is trading at $1,968.67, down $12.15. Silver is trading at $23.41, down 31 cents. The Digital Asset Week (DAW23) conference was held in London last week and marked a significant step in the adoption of digital assets by major financial institutions. Key players like JP Morgan, BNY Mellon, BlackRock, and others shared their strategies for transitioning from proof of concept to production applications in digital assets. The focus was on liquidity, operational efficiency, and the development of new products like tokenized ETFs, securities lending, and repo. The conference also highlighted the growing interest in the tokenization of various assets, including precious metals, property, and private markets, with an emphasis on private protocols and networks to comply with jurisdictional laws and regulations.

Daily Gold Market Report

The Shanghai Arbitrage

Unpacking China’s Shift in Global Financial Strategy

(USAGOLD – 11/17/2023) Gold is moderately higher and remaining stable going into the weekend. Gold is trading at $1,986.24, up $5.40. Silver is trading at $23.91, up 17 cents. China’s recent activities in the gold market point to a strategic shift in its approach to acquiring and managing gold reserves. The country has been actively purchasing gold, leading to a surge in global gold acquisitions, as it aims to reduce reliance on the U.S. dollar. This is evident from China’s central bank acquiring a significant amount of the total gold purchased by central banks worldwide. By July, China’s gold reserves were estimated to be the fifth-largest globally, amounting to 2,113 tonnes, representing 4% of its total declared assets.

Daily Gold Market Report

Gold Gains Momentum as U.S. Inflation Slows

Fed Rate Hikes Questioned

(USAGOLD – 11/16/2023) Gold is rallying following the recent release of employment data, which unexpectedly revealed significant weaknesses in the U.S. labor market. Gold is trading at $1,973.24, up $13.39. Silver is trading at $23.96, up 52 cents. Saxo Bank reports the unexpected slowdown in inflation raised expectations that the Federal Reserve might end its rate hiking cycle, leading to a surge in global stock markets and a decrease in the U.S. dollar’s value. “Having just found support near $1930, the news helped send gold higher,” says Ole Hansen, Head of Commodity Trading. Gold’s rally is supported by central bank purchases and investor demand, with further upside potential if interest rates peak and reduce the cost of holding non-interest-bearing metals like gold. Even hedge funds like famed David Einhorn’s Greenlight Capital, snaps up SPDR Gold Trust GLD as it cuts stake in top two holdings, U.S. homebuilder Green Brick Partners and Pennsylvania coal miner Consol Energy, Morningstar reports.

USAGOLD Comment: Gold ETF total holdings have been drawn down for close to 18 months. Will the total holdings increase from here with hedge funds jumping in now?

Ready to move from education to action?

DISCOVER THE

USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

3:10 pm Sun. May 12, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115