The Shanghai Arbitrage

Unpacking China’s Shift in Global Financial Strategy

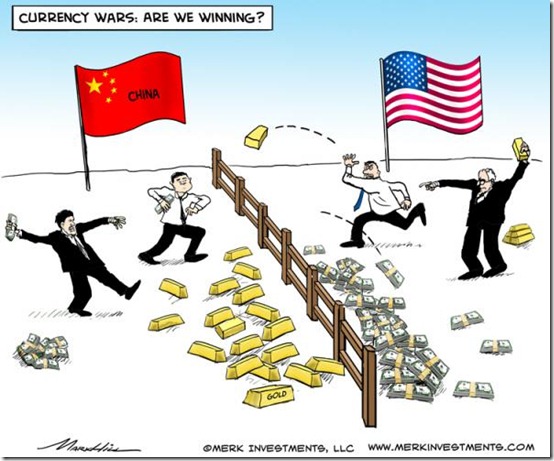

(USAGOLD – 11/17/2023) Gold is moderately higher and remaining stable going into the weekend. Gold is trading at $1,986.24, up $5.40. Silver is trading at $23.91, up 17 cents. China’s recent activities in the gold market point to a strategic shift in its approach to acquiring and managing gold reserves. The country has been actively purchasing gold, leading to a surge in global gold acquisitions, as it aims to reduce reliance on the U.S. dollar. This is evident from China’s central bank acquiring a significant amount of the total gold purchased by central banks worldwide. By July, China’s gold reserves were estimated to be the fifth-largest globally, amounting to 2,113 tonnes, representing 4% of its total declared assets.

China’s aggressive gold acquisitions are also interpreted as a prudent investment decision amid financial market fluctuations and post-pandemic inflation. In addition, there has been an increase in gold premiums on the Shanghai Gold Exchange compared to Comex gold futures, reaching a

record high of US$121/oz in September. This phenomenon has attracted significant attention and speculation. While there is significant discussion about China taking physical delivery from both the Comex and U.S. gold ETFs to import into China, concrete evidence of this specific strategy is not yet supported by available sources. But as long as there is a substantial premium difference between the US and other countries, anticipate that traders and nations will exploit this arbitrage opportunity. Through this mechanism, the Comex and U.S. gold ETFs serve as a transparent indicator of the US’s metal reserves. Any nation or foreign entity with metal stored in these entities will likely request its delivery.

Overall, China’s actions in the gold market reflect a multi-faceted strategy: reducing dependency on the U.S. dollar, diversifying its financial reserves, protecting against potential geopolitical risks, and possibly enhancing the yuan’s international standing. However, the broader context of China’s gold acquisition and its impact on the global gold market is clear.