Daily Gold Market Report

World Gold Council: Gold Outlook 2024

The Global Economy Faces Three Likely Scenarios In 2024

(USAGOLD – 12/08/2023) The gold market is experiencing significant downward pressure due to the U.S. economy’s unexpected surge in job creation, which is concurrently reducing the unemployment rate. Gold is trading at $2,010.15, down $18.32 cents. Silver is trading at $23.35, down 45 cents. The “Gold Outlook 2024” report by the World Gold Council presents three potential scenarios for the global economy in 2024: a soft landing with moderate economic slowdown and stable to slightly decreasing gold prices; a recession, where gold may rise in value as a safe-haven asset; and a less likely no landing scenario, with continued economic growth and persistent inflation, where gold’s behavior could vary based on inflation rates and investor sentiment. Each scenario reflects different impacts on gold prices, influenced by economic conditions and market responses.economic conditions and investor behavior.

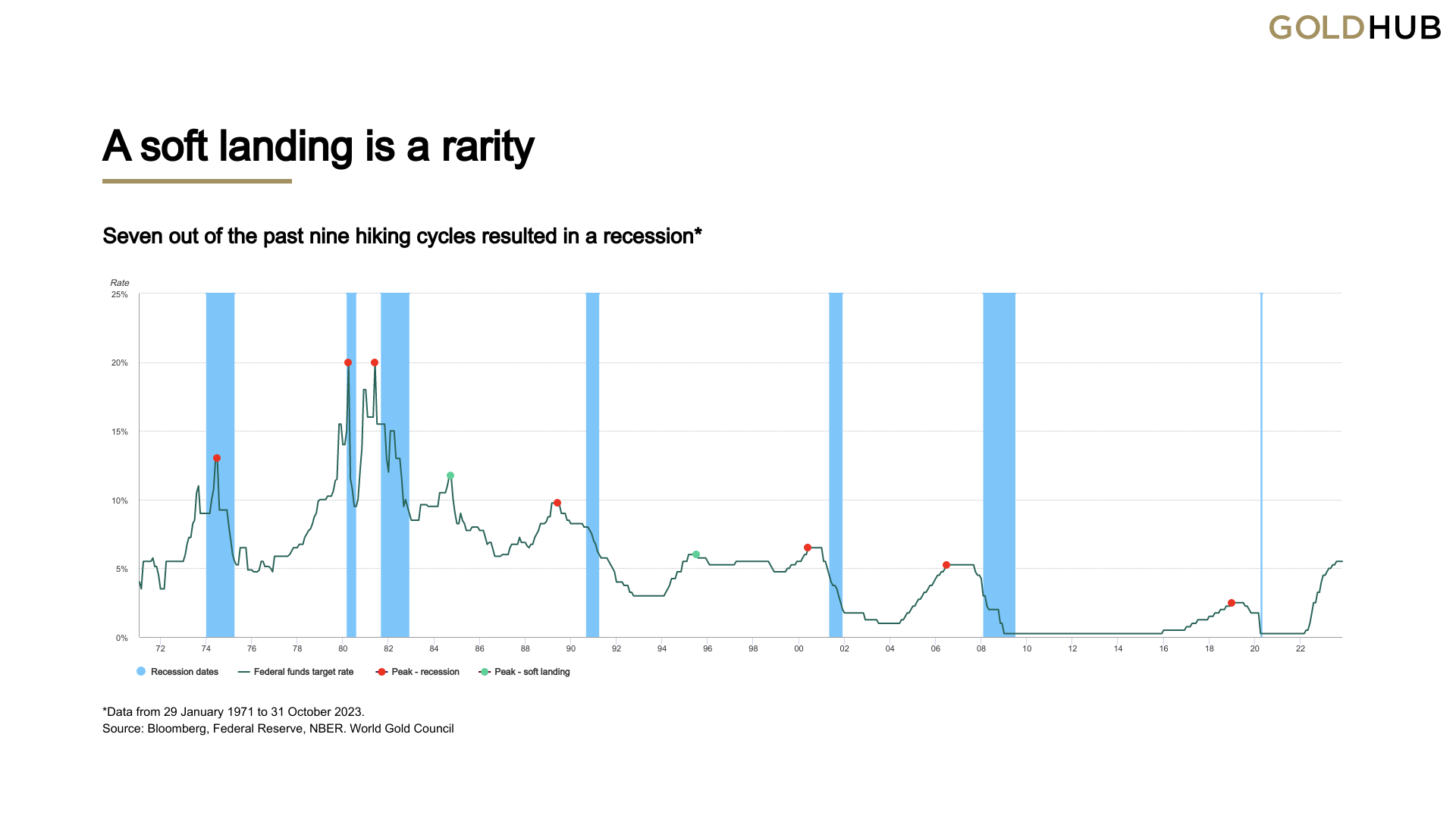

While the markets lean towards the Federal Reserve achieving a soft landing, this outcome is challenging to attain. In the past five decades, the Fed has only successfully managed a soft landing twice in nine tightening cycles, with the remaining seven leading to a recession. This trend is expected, as prolonged higher interest rates typically exert pressure on financial markets and the broader economy.