Daily Gold Market Report

Historic M2 Decline and Its Impact on Gold Prices

A New Era for Investors?

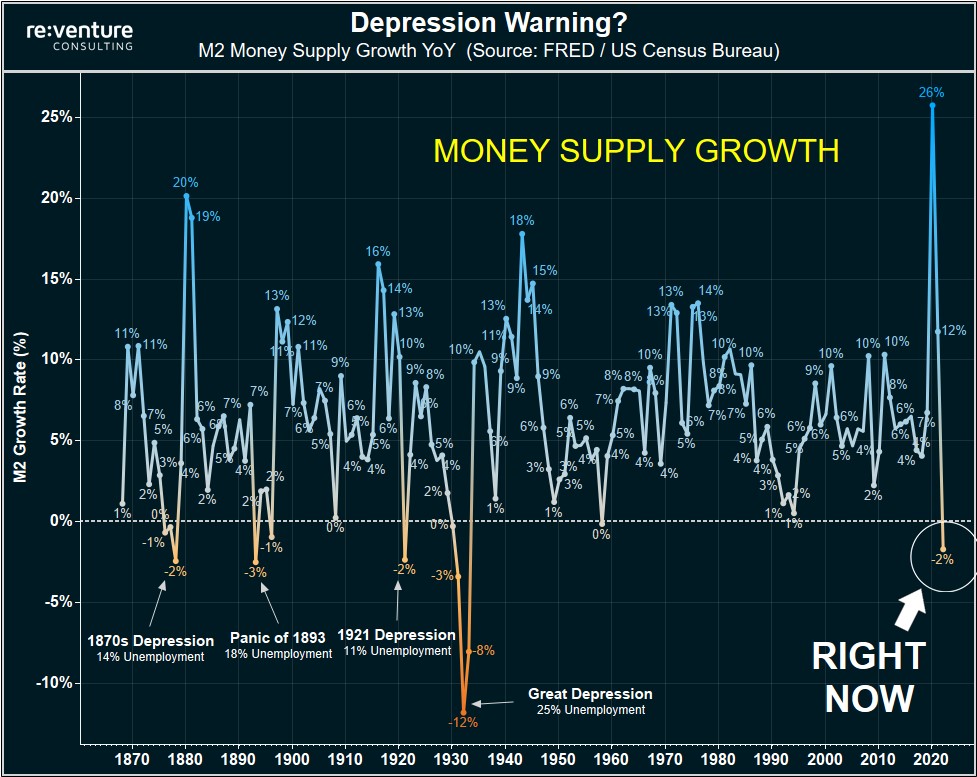

(USAGOLD – 12/04/2023)Gold prices are trading lower this morning after spot gold spiked to a new record high of $2,146.7 overnight. Gold is trading at $2,053.74, down $18.58. Silver is trading at $25.11, down 25 cents. Sean Williams, of The Motley Fool, recently pointed out the recent decline in the M2 money supply, the first significant contraction since the Great Depression, and its implications for the stock market and potential impact on gold prices. M2, which includes cash, coins, checking deposits, savings accounts, money market accounts, and CDs below $100,000, has fallen by 4.51% since its peak in July 2022. This decline is noteworthy as it’s the first notable drop in M2 in nearly 90 years.