Monthly Archives: June 2023

Gold stays gold, forever

HedgeNordic/Eugene Guzun/6-13-2023

USAGOLD note: Guzun adds that gold has returned 7.7% annually since 1971, the year the United States went off the gold standard.

Computer-driven trading firms fret over risks AI poses to their profits

Financial Times/George Steer and Laurence Fletcher/6-15-2023

USAGOLD note: An existential threat emerges for algo-based trading systems: Instantaneous reaction to fake news. Hedge funds say they’ve erected defenses but the fake Pentagon image and subsequent instantaneous plunge in stocks proves otherwise.

Wall Street isn’t buying what Powell, economists are forecasting

Bloomberg/Jess Menton, Alexandra Semenova and Elena Popina/6-15-2023

“Defying the odds, the world’s biggest stock market has recouped all losses caused by the most disruptive monetary-tightening campaign in a generation. And not even recession warnings or fresh monetary threats from Jerome Powell are stopping fund managers as they join the big artificial intelligence-fueled rally.”

USAGOLD note: Such is what happens when market participants know that the central bank is caught between a rock and a hard place. Powell has consistently chosen to fly like a dove when things go south – the stuff of reputation. As for Wall Street, with big bets in place on either side of the rate divide, someone is going to get burnt – perhaps badly.

Waller says bank failures may influence Fed on how much to raise interest rates

MarketWatch/Jeffry Bartash/6-16-2023

USAGOLD note: A solid indicator that problems still lurk in the banking system from an influential Fed governor.

Short and Sweet

We first introduced our readers to these nine lessons all the way back in 1999. They were passed along to us by the legendary commodity market analyst R.E. McMaster, formerly editor of The Reaper newsletter. The original source for the nine lessons was a highly regarded money manager who handled accounts for wealthy Greek and Mexican merchant families.

1. It is easier to make a fortune than keep it.

2. Intelligence is an inadequate substitute for wisdom. Wisdom fears, respects the unknown and fosters humility. Intelligence can lead to self-destructive arrogance and ultimate failure.

3. Risk must have premium, and we must understand it well.

4. There is no order. There is no formula. There is no equation that works all of the time. It works just long enough to fool just a few more of us just a little longer.

5. What we fail to remember is that a paper gain is just that. Paper. Worth nothing. Not until we say sell, and not until we get cash. Anything less is just that.

6. When the Bass Brothers in Texas write a check for real money, their money, to buy 25% of the Freeport McMoran Gold Series II, we take notice. When the Fidelity Magellan Fund buys a fifty-million in Dell computer, we yawn. So, should you. It is other people’s money.

7. Slick advertising budgets, powerful computers and few slabs of marble do not, by themselves, make a great financial institution.

8. Never invest in anything you do not feel comfortable with or understand well.

9. When a thousand people say a foolish thing, it is still a foolish thing.

Is the wisdom of a portfolio hedge in your future?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973

Forget a shooting match, economic warfare is enough to impoverish most of us

South China Morning Post/Alex Lo/6-13-2023

USAGOLD note: Lo goes on to say that the Center for Economic Policy Research the weaponization of the dollar and the introduction of a digital yuan “constitute the sharpest shock to the status quo since the collapse of the Brettonn Woods system 50 years ago.” What we present here is only a small portion of the analysis at the link.

Daily Gold Market Report

Gold marginally lower as summertime lull remains in full force

‘Gold’s price action less of an arrow and more of a feather’ – Ross Norman

(USAGOLD – 6/22/2023) – Gold is marginally lower this morning as markets continued to weigh the direction of Fed policy, and the summertime lull remained in full force. It is down $3 at $1931. Silver is down 2¢ at $22.70. Metals Daily’s Ross Norman offered an apt description of the current market in this morning’s Reuters gold report: “Gold’s price action is less of an arrow and more of a feather as it responds negatively to the latest hawkish tones coming from the Fed.” MKS Pamp’s Nicky Shiels told Ktco News yesterday that “[gold’s] been in no-man’s-land for too long, and the news cycle is simply slow, which usually implies a rerating lower in the near term.” She blames “predatory shorts” who entered after the last week’s strong housing report for gold’s recent $30 decline.

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“We have a distinctive philosophy around gold. We believe gold has unique risk/reward characteristics that enable it to help preserve real value over the long term. We use gold as a potential hedge and do not speculate on its price over the next six to 12 months. We believe it is not possible to forecast the price of gold or, for that matter, the price of other investment assets. This, in fact, is why we have a potential hedge …”

Thomas Kertsos

First Eagle Investment Management

Gold Hub interview

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Experts say the stock market is in a bull market. What bull market?

MarketWatch/Brett Arends/6-13-2023

USAGOLD note: Arends says financial economics is better compared to astrology than astronomy. A good read at the link……

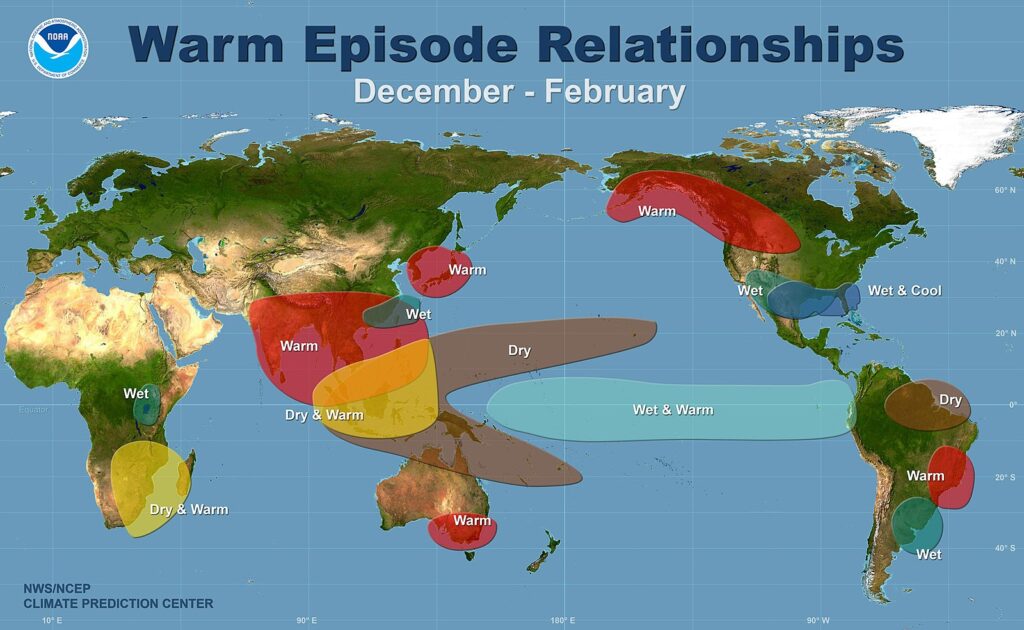

Return of El Nino threatens new levels of economic destruction

Bloomberg/Ben Sharples/Brian K Sullivan, Eric Roston and Adrian Leung/6-12-2023

“As the world struggles to recover from Covid-19 and Russia’s war in Ukraine grinds on, the arrival of the first El Niño in almost four years foreshadows new damage to an already fragile global economy.”

USAGOLD note: One economist says that with the world already dealing with inflation and recession risk, “El Nino comes at exactly the wrong time.” This article will bring you up to date on the economic impact of the El Nino weather pattern.

Short and Sweet

The more things change, the more they stay the same

The criticism leveled at gold over the past few months brings to mind an old Murray Rothbard quote from the early 1970s, when the internet was not around to challenge the constant stream of negative press on gold. He included it in the intriguingly titled pamphlet, What Has Government Done to Our Money:

Even when gold was trading at $35, its adversaries were predicting lower prices ($10 per ounce), and even then, under the flimsiest of arguments. Its ‘industrial” nonmonetary price? How is that different from its monetary price? Ultimately in that first leg of gold’s long-term secular bull market during the 1970s, it went well over $800 per ounce – a far (very far) cry from $10!

The lesson in all this? The more things change, the more they stay the same. Gold’s critics have not changed their tactics over the years, and they are not likely to anytime soon. But one thing has changed: Now there is a wealth of information available for you to make your own assessment beginning with this website.

Image courtesy of the Mises Institute

What Has Government Done To Our Money/Murray Rothbard/Mises.org/Pdf download

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Ready to defy predictions of gold’s demise?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

The Fed’s waiting game: Is the US economy finally starting to crack?

Financial Times/Colby Smith/6-11-2023

USAGOLD note: The danger to the economy of the Fed making another major policy mistake hangs like a dark cloud over Wall Street…… Charles Evans, former president of the Chicago Fed, asks, “What kind of policy mistakes are you most comfortable making?”

Daily Gold Market Report

Gold drifts sideways in quiet summertime trading ahead of Powell testimony

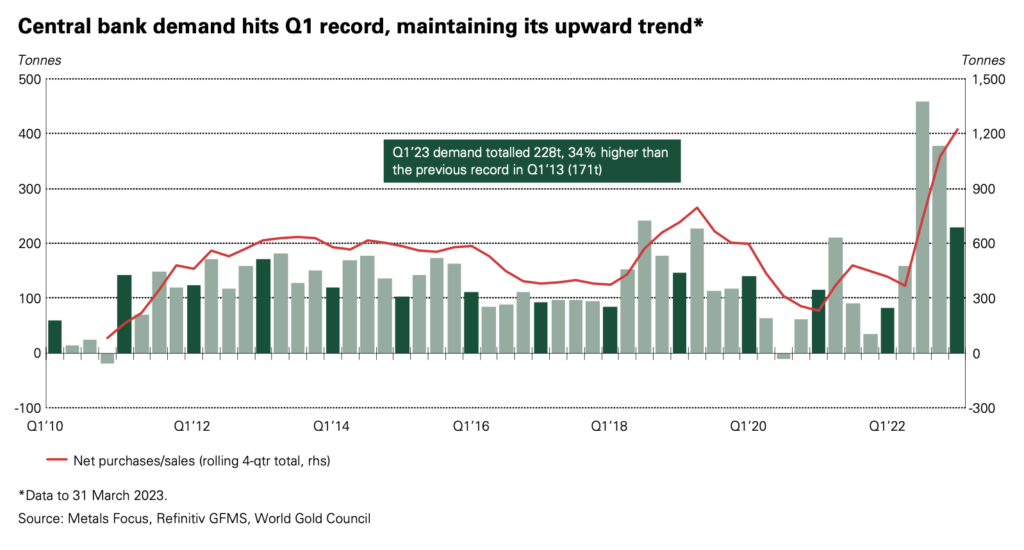

UBS sees upside potential for gold to $2100 by year-end despite recent headwinds

(USAGOLD – 6/21/2023) – Gold drifted sideways in quiet summertime trading ahead of Fed chairman Powell’s Congressional testimony later this morning. It is down $2 at $1936.50. Silver is down 10¢ at $23.11. Few expect much deviation from the post-FOMC meeting stance. Despite headwinds in the gold market of late including a 71-tonne reduction in central bank gold reserves in April (as reported by the IMF), UBS still sees upside potential for gold to $2,100 by year-end and $2,250 by mid-2024.

“Central bank demand for gold,” says the Swiss bank in a recent market update, “should remain healthy, despite the recent decline. The decline in official holdings reported by the IMF does not reflect a reduction in enthusiasm for gold among central bankers, in our view. The Turkish central bank was reported as the major seller, but the World Gold Council believes these sales were due to local dynamics rather than a change in the central bank’s long-term strategy.”

Chart courtesy of the World Gold Council • • • Click to enlarge

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“The ancient Egyptians believed their gods had shimmering skin made from gold. While the Aztec word for gold, teocuitlatl, literally translates as ‘excrement of the gods’. From ancient Rome to the California gold rush, this dense shimmering metal has been immutably connected with divine quality and the sense of opportunity. The reason for this is simple: gold is the most special element of them all.”

James Dacey

Physics World

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Credit Bubble Bulletin

Credit Bubble Bulletin/Doug Noland/6-18-2023

Selected quotes:

“Powell: ‘It’s reasonable. It’s common sense to go a little slower… Gives us more information to make decisions. We may try to make better decisions.” I’m all for the Fed trying to make better decisions. But such complex analysis must go much deeper than ‘common sense’. The so-called “hawkish skip” is both messy and problematic. It has left analysts confounded, while a highly speculative stock market couldn’t be happier. Loose conditions as far as the eye can see; latent fragilities safeguarding the ‘Fed put.'”

. . . . . . . . . . . . . . . . . . . . . . . . . . .

“Financial conditions remaining so loose in the face of aggressive Fed rate hikes has been a huge surprise. Importantly, when it comes to modern-day financial conditions and market structure, there’s a thin line between things ‘breaking’ and the intensification of Bubble excess. A major de-risking/deleveraging episode could bring this fragile boom to an abrupt conclusion. But it is this acute fragility that ensures policymakers respond quickly and forcefully against fledgling instability (BOE in September and Fed in March), ensuring that deeply entrenched speculative impulses are sustained. That which does not burst a Bubble only makes it stronger.”

. . . . . . . . . . . . . . . . . . . . . . . . . . .

“Historic monetary inflation has altered structures. Millions over the long bull market have become impassioned speculators – stocks, ETFs, options and derivatives, crypto – with the financial resources to stay in the game. Households have been granted Trillions of additional liquid assets and tens of Trillions of additional perceived wealth, while the Fed did exactly what it needed to avoid: its words and deeds further solidified the perception that the Fed is backstopping the markets.”

Dalio says US at beginning of ‘late, big-cycle debt crisis’

Yahoo!Finance-Bloomberg/Katherine Burton/6-7-2023

USAGOLD note: Dalio’s diagnosis amounts something akin to stagflation – a scenario that has been favorable for gold and silver in the past, and not so favorable for stocks and bonds.

Hedge fund bond bears are relentlessly shorting Treasuries

Yahoo!Finance-Bloomberg/Ruth Carson/6-12-2023

USAGOLD note: According to the Wall Street Journal, Fed officials have signaled they will hold rates now before raising them again later this summer. If so, one wonders what purpose is served by a pause. We will know more later today……

The surprising uses of gold throughout history

USAGOLD note: Gold is money, but through its long history it has been used in a wide variety of applications from the sacred to the practical.

Short and Sweet

Short & Sweet

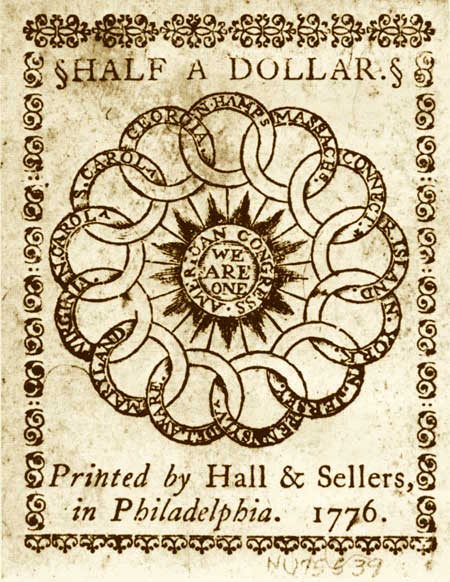

American colonists among the first to embrace MMT

Though, as Mihm explains, Massachusetts’ original paper currency introduced in 1690 functioned reasonably well in terms of holding its value, some of its successors did not do so well. Years later, a paper currency inflation during and after the American Revolutionary War gave a now-famous phrase a prominent place in the American lexicon – “not worth a Continental.” Mihm’s article refers to the period in Massachusetts around 1690 as a “crude forerunner” of Modern Monetary Theory, and it is an interesting read.

“The Congress issued six million dollars of continentals in 1775, and the issues increased each year. One hundred and forty millions were issued in 1779. As prices rose, the government found that it needed more and more dollars to finance its expenditures. More money was printed. This added supply of dollars led to further depreciation in the infamous spiral of inflation. At the outset, the continental had circulated at par with a dollar of specie. By 1780, over one hundred continental dollars were required to exchange for one specie dollar; Congress had printed continentals until they were worth almost nothing.” – Murray N. Rothbard, Faith and Freedom, (1950) as published at the Mises Institute,

Want to hedge the possibility of your savings becoming ‘not worth a Continental?’

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK:

1-800-869-5115 x100 • • • orderdesk@usagold.com • • • ONLINE ORDER DESK-24/7

Reliably serving physical gold and silver investors since 1973

Will Argentina ditch the peso for the dollar?

Bloomberg/Ignacio Olivera Doll/6-8-2023

“The front-runner in the presidential race says he would make the greenback the official currency and “blow up” the central bank.”

USAGOLD note: This isn’t the first Argentina has considered replacing the peso with the dollar. To do so, however, is to pull the plug on the printing press. Argentina could go from inflationary disaster to deflationary disaster overnight.

Argentina inflation and US dollar exchange rate

Source: TradingEconomics.com