Daily Gold Market Report

Gold drifts sideways in quiet summertime trading ahead of Powell testimony

UBS sees upside potential for gold to $2100 by year-end despite recent headwinds

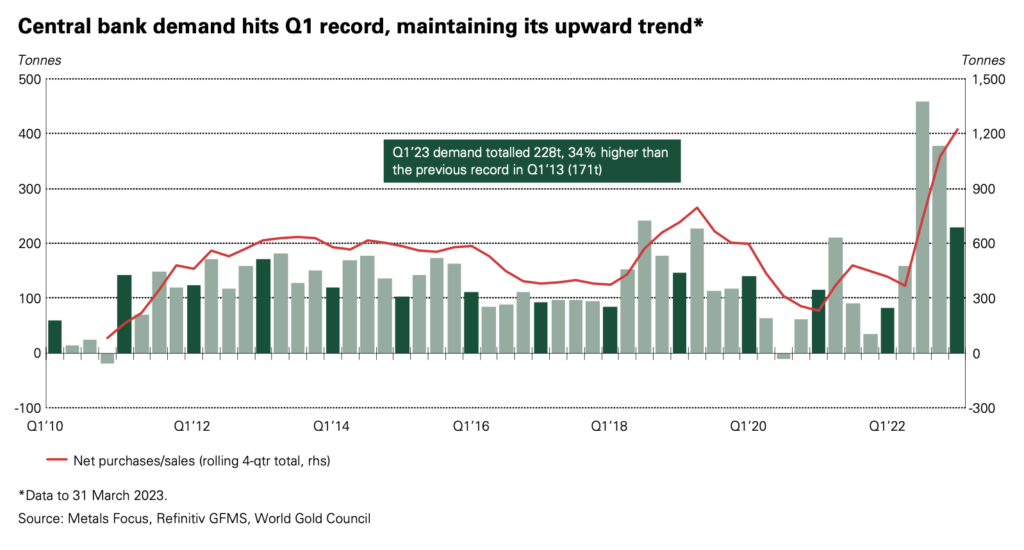

(USAGOLD – 6/21/2023) – Gold drifted sideways in quiet summertime trading ahead of Fed chairman Powell’s Congressional testimony later this morning. It is down $2 at $1936.50. Silver is down 10¢ at $23.11. Few expect much deviation from the post-FOMC meeting stance. Despite headwinds in the gold market of late including a 71-tonne reduction in central bank gold reserves in April (as reported by the IMF), UBS still sees upside potential for gold to $2,100 by year-end and $2,250 by mid-2024.

“Central bank demand for gold,” says the Swiss bank in a recent market update, “should remain healthy, despite the recent decline. The decline in official holdings reported by the IMF does not reflect a reduction in enthusiasm for gold among central bankers, in our view. The Turkish central bank was reported as the major seller, but the World Gold Council believes these sales were due to local dynamics rather than a change in the central bank’s long-term strategy.”

Chart courtesy of the World Gold Council • • • Click to enlarge