Here are four reasons to be wary of holding cash

MarketsInsider/Carla Mozee/2-26-2023

“Cash is no longer trash as its appeal grows with yields spiking and this year’s stock rally losing steam, but there are reasons for investors to be careful about shoving the bulk of their funds into that asset class, said one veteran market strategist.”

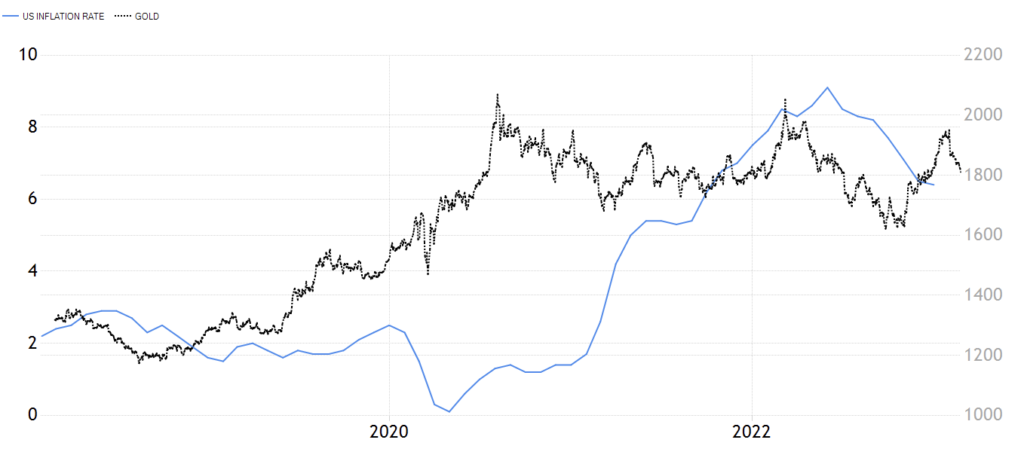

USAGOLD note: Most investors recognize cash’s vulnerability to inflation. RIverfront’s Sandler recommends stocks but is that a prudent alternative at a time when top-notch analysts are predicting a 30% (and in some cases more) decline from present levels? Traditionally, investors have turned to gold in an inflationary economy. It is routinely overlooked that since inflation achieved liftoff in mid-2020, gold has gone from the $1680 level to the $1800 level now (+7%) with a brief stop on two occasions near $2100. Over the same period, inflation has gone from zero percent to 6.4% now. (See chart below.) In short, gold thus far has kept pace with inflation. Note too, that gold may have anticipated inflation with its sharp rise from 2019 to August of 2020.

Gold and inflation

Chart courtesy of Trading Economics.com