Daily Gold Market Report

Gold drifts sideways after yesterday’s Fed-inspired cross-markets rout

‘Gold is often highly sought after in periods of economic and financial uncertainty’

(USAGOLD – 3-8-2023) – Gold drifted sideways this morning as it attempted to regain its footing after yesterday’s Fed-inspired, cross-markets rout. It is level at $1816. Silver is up 2¢ at $20.16. Markets have been in a quandary as to how the Fed would respond to the recent run of robust economic data. Fed chairman Powell put an end to the speculation yesterday, promising an aggressive policy to fight inflation. In an analysis released this morning, Wisdom Tree, the Dublin-based investment firm, warns of headwinds for gold but reminds us that those same headwinds create the need for a safe haven.

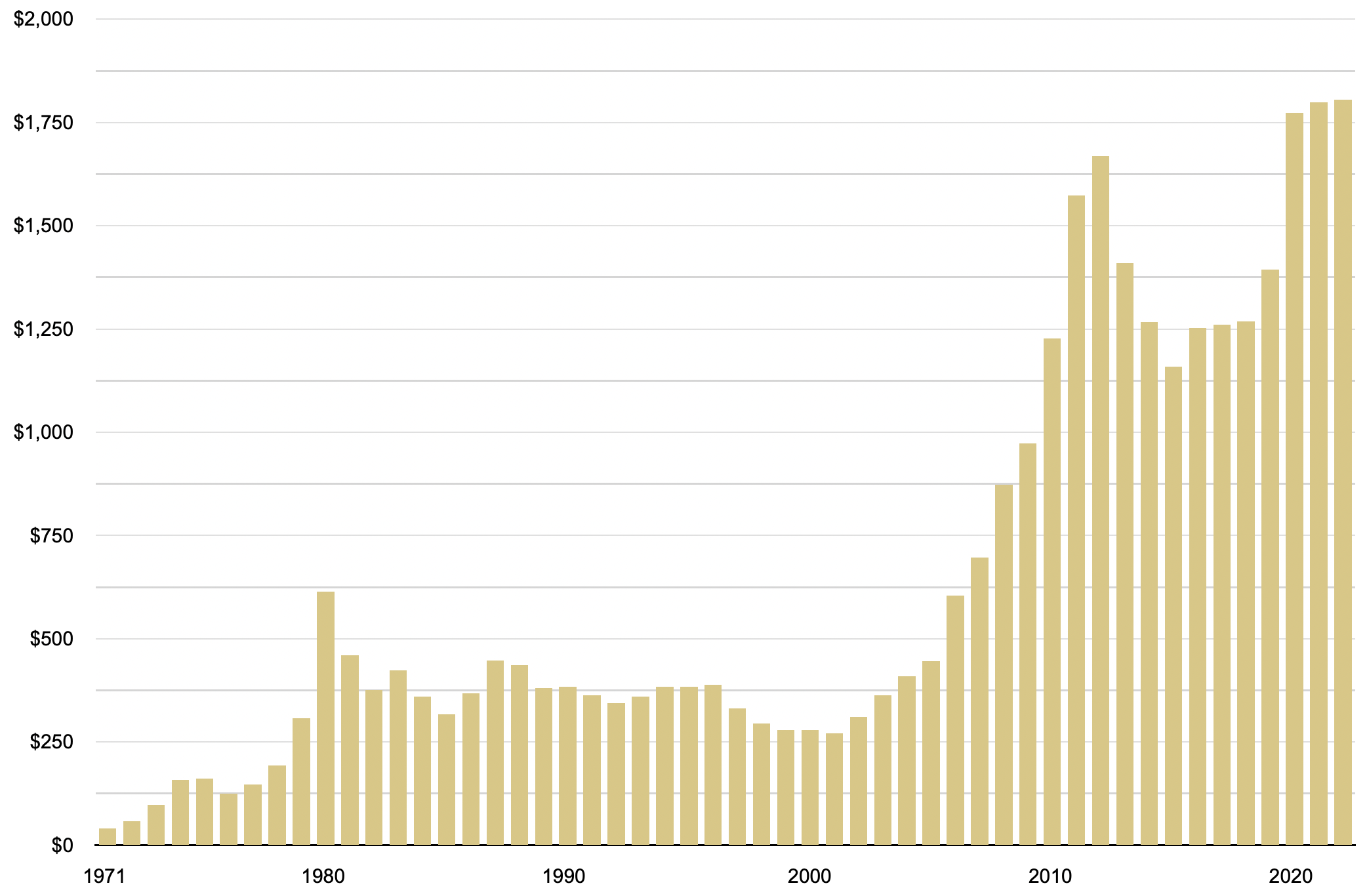

Gold average annual price

(1971-2022)