SVB’s collapse is what happens when an ‘everything bubble’ finally bursts

Markets Iinsider/Jennifer Sor/3-12-2023

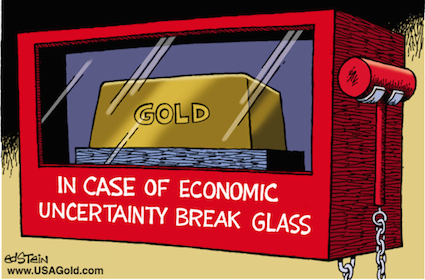

USAGOLD note: The problem with the “everything bubble” bursting is there is no is nowhere to turn, unless, of course, one understands the logic of safe haven portfolio insurance. This article does a good job of the depth of the problem confronting investors featuring insights from Deutschebank.

This entry was posted in Today's top gold news and opinion. Bookmark the permalink.