CPI comes in higher than expected at 6.4%

TradingEconomics/Staff/2-14-2023

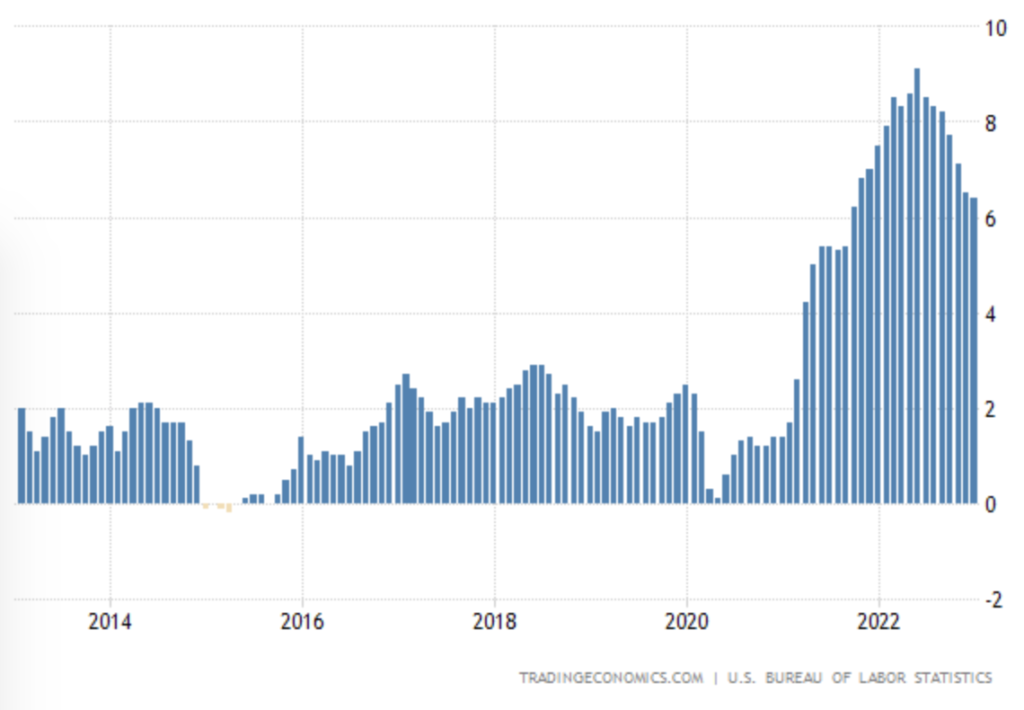

“The annual inflation rate in the US slowed only slightly to 6.4% in January of 2023 from 6.5% in December, less than market forecasts of 6.2%. Still, it is the lowest reading since October of 2021. A slowdown was seen in food prices (10.1% vs 10.4%) while cost of used cars and trucks continued to decline (-11.6% vs -8.8%). In contrast, the cost of shelter increased faster (7.9% vs 7.5%) as well as energy (8.7% vs 7.3%), with gasoline prices rising 1.5%, reversing from a 1.5% decline in December. On the other hand, both fuel oil (27.7% vs 41.5%) and electricity prices slowed (11.9% vs 14.3%). Although inflation has shown signs of peaking at 9.1% in June last year, it remains more than three times above the Fed’s 2% target and continues to point to a broad-based advance on the general price level, particularly services and housing. Compared to December, the CPI rose 0.5%, the most in three months, mostly due to the higher cost of shelter, food, gasoline, and natural gas.”

United States Consumer Price Index

(%, annual)

Chart courtesy of Tradingeconomics.com