No DMR today (2-15-2023). Below is yesterday’s report.

________________________________________________

Gold moves higher in tentative trading ahead of CPI release

Paulson says gold will appreciate this year and on a three, five, and ten year basis

(USAGOLD – 2/14/2023) – Gold moved higher in tentative trading ahead of today’s CPI release. It is up $7 at $1863. Silver is down 21¢ at $21.88. Trading Economics puts the consensus CPI number at 6.2% annualized, which would be a notable decline from December’s 6.5% reading. John Paulson, the New York-based hedge fund impresario, believes “inflation will be more persistent than the markets currently perceive, and that the Fed will raise rates another 50 to 100 basis points, “then hold it there until we get a severe economic shock.”

“We’re at the beginning of trends that are going to increase the demand for gold,” he says in a recent interview with Alain Elkann, “and inflation and geopolitical tensions will determine the rate at which gold increases. This year gold will appreciate versus the dollar, and also over a three, five and ten year basis.” He points out that central banks around the world are “looking for an alternative reserve currency” and that gold is on the rise again: “[I] t’s been the reserve currency of the world for thousands of years, a legitimate alternative to holding the dollar or other paper currencies.”

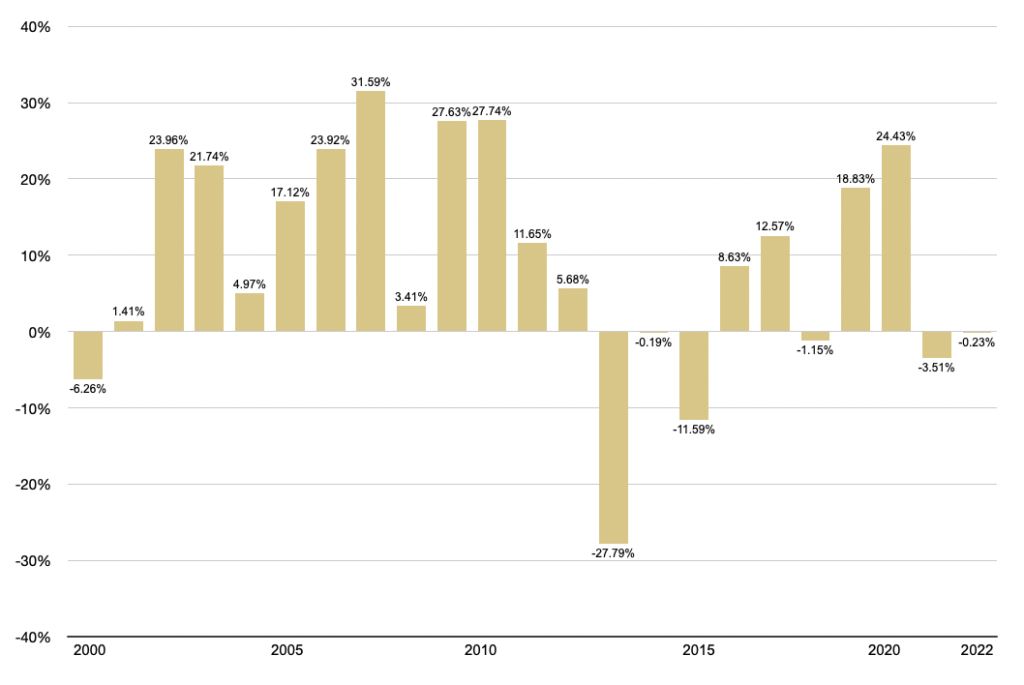

Gold annual returns

(2000-2022)

Chart by USAGOLD [All rights reserved] • • • Data source: Macrotrends.net • • • Click to enlarge