Roubini says more war means more inflation

Project Syndicate/Nouriel Roubini/12-30-2022

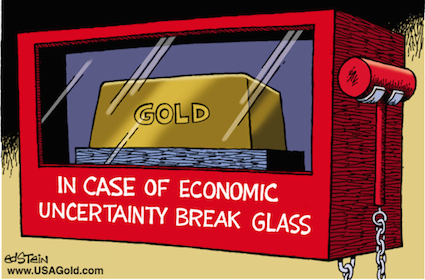

USAGOLD note: Roubini argues the opposite of Wall Street’s favored inflation scenario – not peak, not transitory, but in the ascendancy. He adds a new layer to his analysis in this essay – the disruptive effect of “globotics.” As more and more workers – white and blue collar – lose their jobs to globalization and automation, governments will be pressured “to help those left behind, whether through basic-income schemes, massive fiscal transfers, or vastly expanded public services.” He ends with a warning that “a great stagflationary debt crisis is upon us.” Though not always an advocate of gold ownership, Roubini has become one in recent years.