Monthly Archives: January 2023

Trust the bond market, not the Fed, on interest rates, Gundlach says

MarketWatch/Steve Goldstein/1-11-2023

“Right now there’s a gap between where the bond market says interest rates are heading, and where Federal Reserve officials say they’re going — and the so-called bond king says investors should put their faith in markets.”

USAGOLD note: Obviously Gundlach is among Wall Street’s rebels…… He says his forty years experience in finance is telling him to trust what the bond market is telling him over what the Fed is telling him. The Fed’s Neil Kashkari takes the opposite view. “I’ve spent enough time around Wall Street to know that they are culturally, institutionally, optimistic,” he says. “They are going to lose the game of chicken, I can tell you that.” Gundlach, in short, believes interest rates are in for a period of decline. Kashkari believes they are headed higher. Looking at the chart, though, it is difficult to read what the bond market is telling us.

Chart courtesy of TradingEconomics.com

Wall Street split

The Fed will start cutting rates this summer, says UBS’ global chief economist [Link]

USAGOLD note: Headlines appearing simultaneously at the Markets Insider website……

‘Dr. Doom’ Nouriel Roubini says the Fed will wimp out on its inflation fight and gold is the best protection as volatility batters the economy

MarketInsider/Jennifer Sor/1-13-2023

“‘There is so much debt in the system that an attempt to reduce inflation not only causes an economic crash, it causes also a financial crisis,’ Roubini said. ‘They will feed on each other, and faced with an economic and financial crash, the Fed and other central banks are going to have to wimp out, blink, and not raise interest rates as much.'”

USAGOLD note: Roubini recommends gold as “the best bet” to hedge what he sees as an oncoming financial disaster. He says it has the potential to reach $3000 per ounce by 2028, and has become increasingly vocal about his gold recommendation in recent weeks.

Gold pushes higher in cautious trading ahead of Fed speeches

Investor cash holdings near record high; Somerset Webb warns ‘it is only a temporary king’

(USAGOLD – 1/19/2023) – Gold pushed higher in cautious trading ahead of speeches from several Fed officials today, including the St. Louis Fed’s influential James Bullard. It is up $11 at $1917.50. Silver is up 3¢ at $23.57. The dollar hit a seven-month low in overseas trading adding impetus to gold’s upside and leading some to believe that the dominant trend for 2022 might be reversing. CNBC reported yesterday that investors are now holding near-record levels of cash. Merryn Somerset Webb, a senior columnist at Bloomberg Opinion, thinks that might be another dead end for investors. “If you are holding cash,” she says, “it is only a temporary king.” She says that inflation, which erodes the value of cash, will be with us for the long haul and that investors should look to gold, as an alternative.

“As Alex Chartres of Ruffer recently said on my podcast,” she writes in a recent opinion piece, “there aren’t many other things you can turn to as a long-term safe haven in today’s markets. A year ago, some thought Bitcoin might be a rival – a digital gold even. The market has now ‘kneecapped’ that idea. These days, if you want gold, you will need to buy, well, gold. That being the case, the question is not have you too much, but have you enough — the very same question the head of the PBoC is clearly asking himself right now.

Inflation-adjusted price of gold

Chart courtesy of MacroTrends.net

Andurand: Oil prices could exceed $140 if China’s economy fully reopens

OilPrice.com/Julianne Geiger/1-6-2023

USAGOLD note: Oil would not be the only commodity to be energized should the Chinese economy kick into gear. At the same time, a sudden surge in commodity prices could wreak havoc with the Fed’s 2023 inflation modeling (with repercussions in financial markets).

Economists fret over perils ahead for global growth

Bloomberg/Rich Miller, Steve Matthews and Catarina Saraiva/1-8-2023

USAGOLD note: The economists, in short, see an economy in danger and capable of running off the rails. “We live in an era of many shocks,” say Harvard’s Kenneth Rogoff.

Americans largely pessimistic about US prospects in 2023

USAGOLD note: Gallup’s annual assessment of American sentiment…”Americans,” says the polling company, “are greeting 2023 with great skepticism and little expectation that the economic struggles that closed out 2022 will abate.”

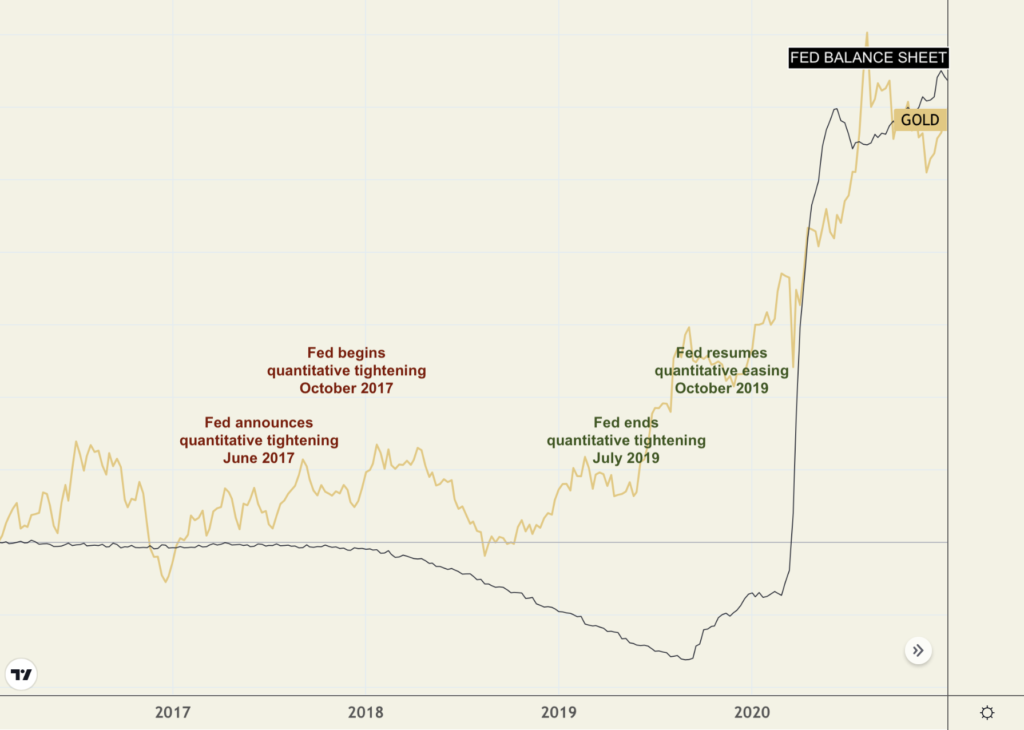

Fed will restart QE to stabilize Treasury market, Pozsar says

Bloomberg/Alex Harris/1-6-2023

“The Federal Reserve will be the backstop of the Treasury market this year to alleviate dysfunction resulting from its increasing size and the retreat of regular buyers. That’s the view of Credit Suisse Group AG analyst Zoltan Pozsar, who in a note to clients Friday, predicted the Fed will restart asset purchases during the summer of 2023.”

USAGOLD note: There is considerable logic in Pozsar’s view…… And keep in mind, if it did occur, it would not be the first-time that the Fed renounced QT and embraced QE in virtually the same breath, as shown in the chart below.

“When the creation of money sufficiently hurts the actual and prospective returns of cash and debt assets, it drives flows out of those assets and into inflation-hedge assets like gold, commodities, inflation-indexed bonds, and other currencies (including digital). This leads to a self-reinforcing decline in the value of money. At times when the central bank faces the choice between allowing real interest rates (i.e., the rate of interest minus the rate of inflation) to rise to the detriment of the economy (and the anger of most of the public) or preventing real interest rates from rising by printing money and buying those cash and debt assets, they will choose the second path. This reinforces the bad returns of holding cash and those debt assets.” – Ray Dalio (Bridgewater Associates), Where We Are in the Big Cycle of Money, Credit, Debt, and Economic Activity and the Changing Value of Money

Gold and the Fed Balance Sheet

(2016-2021)

No DMR today – 1/18/2023; Yesterday’s report follows.

________________________________________________________________

Gold tracks lower as recession, possible government shutdown dent sentiment

Roubini sees gold at $3000 by 2028 as Fed ‘wimps out’ on inflation

(USAGOLD – 1/17/2023) – Gold tracked to the downside this morning as recession and a possible federal government shutdown dented investor sentiment. It is down $6 at $1912.50. Silver is down 24¢ at $24.14. Nouriel Roubini, who has become increasingly vocal about investors including gold in their portfolio mix, believes that the Fed will “wimp out” on the inflation fight as it faces the possibility of an economic crash and a new financial crisis.

He says gold is the best protection for investors and predicts it will rise to $3000 by 2028, providing investors with an average annual return of 10% over the next five years. “If I am right, that we will have a hard landing, the inflation is going to be persistent, the central banks are in a dilemma, and therefore, both equities and bonds will do poorly … Gold should do better,” he said in a recent Kitco News interview.

A little Ramirez-style humor to start your week –

China extends gold buying with 30 tonne addition to holdings

Bloomberg/Sing Yee Ong/1-6-2023

“China reported an increase in its gold reserves for a second straight month, topping up holdings again after its first reported purchase in more than three years.”

USAGOLD note 1: Some gold market analysts believe that China’s true gold reserves are far higher than what is reported by the Peoples Bank of China. The Perth MInt’s Bron Suchecki believes the PBOC’s true holding is closer to 2400 metric tonnes with commercial banks holding another (state accessible) 2060 metric tonnes. He estimates 6490 tonnes in the hands of private buyers. (Source) It is interesting to note, though, that China would actually announce succeessive 32-tonne and 30-tonne purchases in November and December. The question is why? Is it signaling an interest in official gold ownership to other nation-states?

USAGOLD note 2: Preceding gold’s secular bull market rise in the 1970s, European central banks went on a gold-buying tear, similar in psychological impact, if not scope, to what emerging central banks are in the process of executing now. It preceded the formal devaluation of the dollar and the severance of the link between the dollar and gold. When central bank buyers are asked now why they have chosen to add gold to their reserves the answer usually comes back “as a diversification away from the dollar.”

USAGOLD note 3: Though the PBOC is mum on its rationale, Bloomberg suggests in its subhead the “move may be part of PBOC plans to diversify away from dollar.” To achieve the level of diversification that would actually impact its very large holding of US Treasuries, it would take considerably more real money than 62 tonnes – or 4460 tonnes (Suchecki’s number) for that matter, or its current holdings would need to be priced at a much higher level per ounce.

Gold out of the blocks quickly for 2023

Credit Bubble Bulletin/Doug Noland/1-7-2023

USAGOLD note: It is not just one, but many, bubbles we have to contend with, and the one’s that are deflating are doing so at different rates– crypto fast, China with “acute uncertainty” (for example). All” bubbles eventually burst he says. “The bigger and more prolonged the Bubble, the greater the systemic monetary disorder and associated price distortions, along with deepening financial and economic structural maladjustment. Accordingly, the more ingrained Bubble excess becomes, the more central bankers will be compelled to forestall collapse.” Obviously, he sees gold as the non-bubble.

Fed’s Powell won’t stop rate hikes until he ‘terrifies’ the wealthiest of investors

MarketWatch/Barbara Kollmeyer/1-9-2023

USAGOLD note: The observations above are from an unidentified chief investment officer, as reported by One River Asset Management’s Eric Peters to MarketWatch. We thought them worth passing along. Many are worried that 2023 is going to be a repeat of 2022 based on a stubbornly hawkish Fed. Others, like Zoltan Pozsar (Please see above), believe that the Fed will be forced to reintroduce QE this summer – an event that would likely send markets (including gold) on a tear to the upside.

Ruchir Sharma’s investor guide to 2023

Financial Times/Ruchir Sharma/1-7-2023

USAGOLD note: We think you will find this down-to earth foray into the future an entertaining and thought-provoking read……He offers ten focal points to monitor starting with the dollar’s peak and ending with a discussion about the possbility of” bluebirds” in 2023, i.e., the opposite of black swans. Sharma is the chair of Rockefeller International.

NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

“Wisdom is not a product of schooling but of the lifelong attempt to acquire it.”

Albert Einstein

We invite you to review past issues of our monthly newsletter. It’s worth the visit.

The death of traditional portfolio construction

Future Fund Position Paper – The death of traditional portfolio construction – Dec 2022

USAGOLD note: Linked above is the position statement from Future Fund, Australia’s Sovereign Wealth Fund, on the rationale behind its decision to purchase gold and commodities. We do not know to what extent other sovereign wealth funds are repositioning their assets along these lines. If the move to gold catches on at other SWFs, it will put even more pressure on existing physical supplies already stressed by demand from central banks and other highly capitalized financial institutions.

Also see: Australia’s sovereign wealth fund buys gold, commodities as shadow of 1970s looms/Reuters-USNews/12-18-2022

Why we shouldn’t underestimate China’s petro-yuan ambitions

OilPrice.com/Alex Kimani/1-5-2023

USAGOLD note: Might Kimani and others be underestimating the short-term ramifications of China’s petro-yuan ambitions? The level of involvement among oil producers already in motion is an attention-getter.

Summers sees ‘tumult’ in 2023 with reckoning for bond market

Bloomberg/Chris Antsey/1-6-2023

USAGOLD note: Many on Wall Street think the factors that held down inflation in the past will return. Summers says “those assumptions are likely to be wrong,” and explains why at the link. “I’m not sure that continued strength points to a softer landing, rather than pointing to even a harder landing when things re-equilibrate,” he says. Summers is a former secretary of the Treasury and White House economics advisor.

Jim Cramer reminds investors that market pain is needed to prevent endless price hikes

USAGOLD note: A painful dose of reality from Cramer……

Gold edges higher to close out productive week

Hathaway says gold built solid technical base in 2022, setting stage for strong advance in 2023

(USAGOLD – 1/13/2023) – Gold edged higher in early trading as it looks to finish out what’s been a productive week. It is up $3.50 at $1903. Silver is down 7¢ at $23.77. On the week, gold is up 1.84%, and silver is down .83%. It’s beginning to look like gold might be running into some resistance at the $1900 level. Long-time market analyst John Hathaway says that gold spent 2022 building “a solid base” in technical terms that has set the stage in 2023 for “a strong advance to new record highs against the supposedly invincible U.S. dollar.”

“2023 will reveal that the gross mispricing of financial assets that led to the worst performance of financial markets since 2008 has been only partially resolved,” says Hathaway in an analysis posted earlier this month. “We believe the bear market [in stocks and bonds] is far from over, even though investment sentiment is more negative than at the market lows of 2002 and 2008 (AAII Investor Sentiment Survey). With the economy likely to slump into a protracted recession, the Federal Reserve (‘Fed’) will be forced to abort its anti-inflation campaign. A Fed reversal could give temporary respite to financial assets. More importantly, it could underscore the dependency of public policy on money printing and provide a significant boost to the precious metals sector.”

Gold and silver price gains

(Five years)

Chart courtesy of TradingView.com

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“If you want to protect your savings, gold, and silver are important assets to own, especially the physical asset, not just financial instruments. Equities only help while monetary policy continues to create asset inflation, but that can stop abruptly when money supply growth coincides with nominal GDP growth, as the multiple expansion effect dies. Sovereign bonds are not a solution as both the price and the yield make them the most expensive asset.”

Daniel Lacalle, PhD, economist

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––