AFTERNOON UPDATE

Gold regains the momentum on Ukraine pullback doubts

Longer-term, inflation and Fed policies to combat it the more potent market drivers

(USAGOLD 2-16-2022 PM) – Gold regained the momentum today as Secretary of State Blinken expressed doubts about Russia’s claims of a pullback from Ukraine’s border, and financial markets reassessed yesterday’s false euphoria. It is up $15 at $1870. Silver is up 19¢ at $23.62. Still, the more potent underlying drivers in the gold market are the prospect of a sustained and rapidly rising inflation rate, and the dangers imposed by Fed policies intended to deal with it.

We recall that early in the inflation cycle, it was industry purchasing managers and CEO’s who provided early warning of inflation’s sudden arrival. It was with that in mind that we take special note of Heineken CEO Dolf van den Brink’s warning today that in his 24-years in the beer business he has never seen anything like the inflation the company is experiencing now. “Across the board,” he says, “we are faced with crazy increases.” (Financial Times, 2/16/2022)

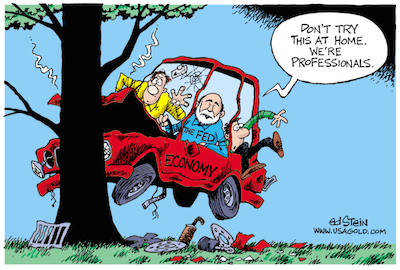

The Wall Street Journal’s Nick Timiraos focuses attention on a nettlesome problem posed by the Fed taming inflation through reduction of its massive $8 trillion balance sheet. “This could be especially treacherous for markets,” he writes in an article posted this morning, “accustomed to a central bank that for the past two decades mostly used just interest rates, and tried to telegraph how fast it would raise them. Fed officials warn they can’t provide that same predictability this time.” We are reminded in all this of the old Ed Stein cartoon (shown above) first posted here during Ben Bernanke’s tenure at the Fed.