Daily Gold Market Report

The Exodus of Gold:

How African and Middle Eastern Countries are Reacting to American Economic Uncertainties

(USAGOLD – 5/3/2024) Gold prices are flat this morning in the aftermath of a downbeat U.S. jobs report. Gold is trading at $2302.09, down $1.74. Silver is trading at $26.53, down 15 cents. 2024 has shown a significant trend where several African and Middle Eastern countries are repatriating their gold reserves from the United States. This action is driven by growing doubts about the stability of the American economy, characterized by persistent inflation, increasing debt levels, and uncertainties in U.S. monetary policy. Countries like Nigeria, South Africa, Ghana, Senegal, Cameroon, Algeria, Egypt, and Saudi Arabia are involved in this movement, reflecting a broader skepticism about the reliability of the US dollar as the world’s primary reserve currency. The repatriation of gold is seen not just as a protective economic measure but also as a strategic response to geopolitical tensions and trade uncertainties. This shift indicates a loss of confidence in the traditional structures of the global economic order and suggests a potential reconfiguration of international financial power dynamics.

Daily Gold Market Report

Gold Prices in Focus:

How the Latest FOMC Decisions Could Influence the Market

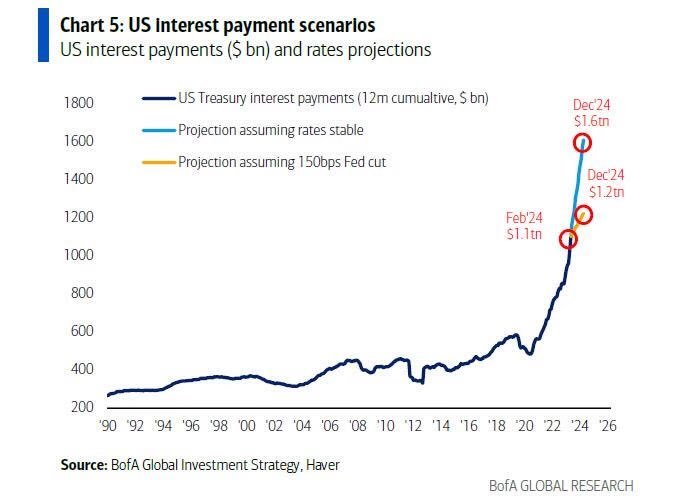

(USAGOLD – 5/2/2024) Gold prices are modestly down this morning post FOMC meeting. Gold is trading at $2294.37, down $25.19. Silver is trading at $26.32, down 33 cents. Yesterday’s Federal Open Market Committee (FOMC) meeting was a focal point for financial markets, particularly for its implications on gold prices. The FOMC’s decisions on interest rates directly influence the attractiveness of gold as an investment. Historically, lower interest rates decrease the opportunity cost of holding non-yielding assets like gold, making it more appealing. Conversely, higher rates typically strengthen the dollar and yield-bearing assets, diminishing gold’s allure. As of the latest updates, the Fed is expected to maintain its current interest rate, with a strong likelihood of rate cuts later in the year. This anticipation keeps gold prices on tenterhooks, as investors look for signals of future monetary policy easing, which could enhance gold’s position as a safe-haven asset. If the FOMC doesn’t cut rates this year, interest payments on the Federal Debt are set to surge to $1.6 trillion per yer.

Daily Gold Market Report

Nebraska’s New Financial Legislation:

Embracing Gold and Silver, Excluding Digital Currencies

(USAGOLD – 5/1/2024) Gold prices are are experiencing slight, corrective increases following significant losses earlier in the week, as many markets await the outcome of this afternoon’s FOMC meeting. Gold is trading at $2301.00, up $14.75. Silver is trading at $26.48, up 18 cents. Nebraska has recently taken a significant step in its financial legislation by ending capital gains taxes on gold and silver sales, making it the 12th state to do so. This move, facilitated by the signing of LB 1317 by Governor Jim Pillen, aims to encourage the use of gold and silver as a hedge against the dollar’s devaluation without the penalty of capital gains taxes. The legislation also includes a provision that explicitly excludes central bank digital currencies (CBDCs) from the state’s definition of lawful money. This decision reflects a growing concern over the potential risks associated with CBDCs, such as increased financial surveillance and control. Nebraska’s stance on gold, silver, and CBDCs aligns with actions taken by other states and is part of a broader movement towards reevaluating the role of traditional and digital currencies in the financial system. Nebraska joins Utah, Wisconsin, Kentucky, South Dakota, and Tennessee as states to have enacted pro-sound money legislation into law so far in 2024.

Daily Gold Market Report

Navigating the Stagflation Terrain:

Economic Indicators and Market Reactions

(USAGOLD – 4/30/2024) Gold prices are sharply lower in early US trading. The precious metals are under strain due to the anticipated hawkish stance of a major central bank meeting starting in just a few hours. Gold is trading at $2303.54, down $31.14. Silver is trading at $26.50, down 65 cents. This recent article from Rabobank, authored by Benjamin Picton, discusses the recent economic data indicating the U.S. might be entering a period of stagflation, characterized by lower growth and higher inflation, with Q1 GDP at +1.6% and core PCE at 3.7%. Despite strong employment figures and government spending, public sentiment towards President Biden’s handling of the economy and inflation is low. The Federal Reserve’s upcoming meeting is anticipated to focus on these national accounts, with expectations of rate cuts influenced by predictions of a recession later in 2024 and potential inflationary policies by Donald Trump if re-elected. Market reactions include a shift in gold prices, with Newmont Mining’s stock rising and a discussion on the return to dividend-paying stocks as an inflation hedge. The article also touches on global economic conditions, including Australia’s inflation and interest rate outlook, Japan’s monetary policy, and the broader implications of higher U.S. rates on global economies and banking solvency.

Daily Gold Market Report

First Bank Collapse of 2024:

Fulton Financial Rescues Republic First

(USAGOLD – 4/29/2024) Gold prices are flat in early US trading. Trading has subdued at the beginning of the work week, with market participants preparing for a highly active week of U.S. economic data that is expected to substantially impact the markets. Gold is trading at $2334.00, down $3.96. Silver is trading at $27.25, up 4 cents. Fulton Financial Corporation has acquired substantially all assets and deposits of Republic First Bancorp, marking the first U.S. bank failure of 2024. The acquisition was facilitated through an auction by the Federal Deposit Insurance Corp (FDIC) after Pennsylvania state banking regulators seized Republic First on Friday due to financial instability. Republic First, operating as Republic Bank with 32 branches across Pennsylvania, New Jersey, and New York, faced challenges from higher interest rates and a declining commercial real estate market. Fulton Financial, with approximately $27 billion in assets, has taken on about $6 billion in assets and $5.3 billion in liabilities from Republic First, including $4 billion in deposits. There are indications of more bank failures on the horizon. A report highlighted that 186 banks in the United States are at risk of failure or collapse due to rising interest rates and a high proportion of uninsured deposits.

Daily Gold Market Report

The Case for the Gold Standard:

Steve Forbes Suggests We Take A Closer Look at U.S. Monetary Policy Options

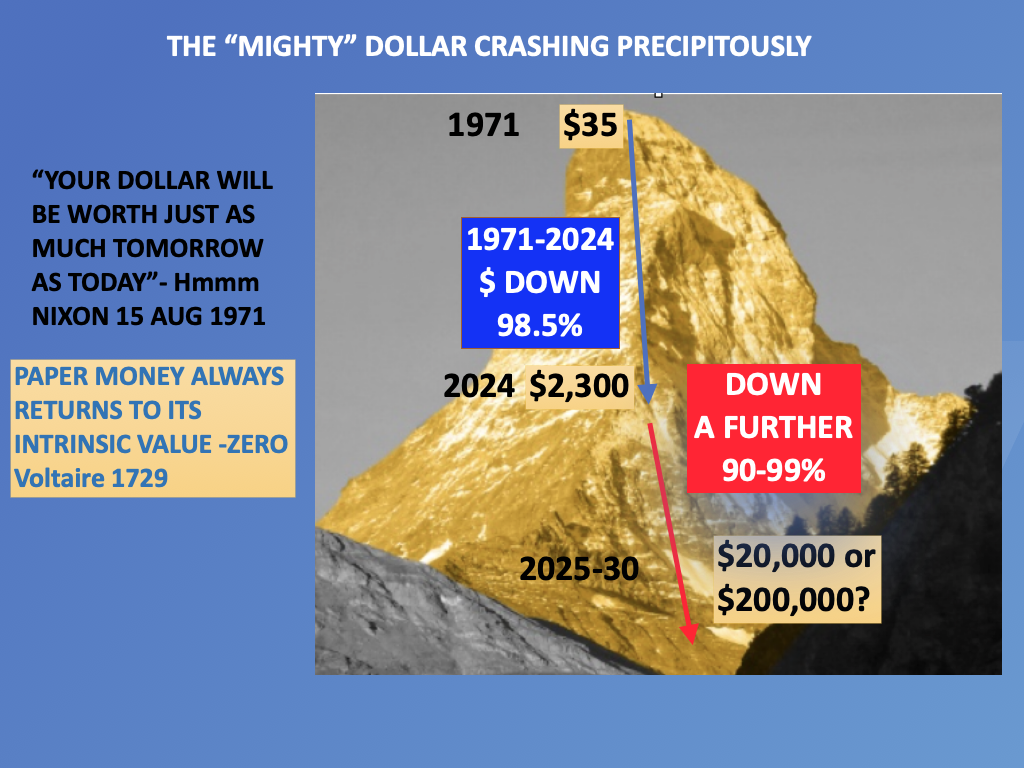

(USAGOLD – 4/26/2024) Gold prices are higher in early US trading. Gold showed very little reaction to another U.S. inflation report that came in a bit warmer than market expectations. Gold is trading at $2343.10, up $10.64. Silver is trading at $27.55, up 12 cents. Steve Forbes argues that the United States should consider returning to the gold standard monetary system, where the value of the dollar is backed by and can be redeemed for gold. He claims that going off the gold standard in 1971 allowed the government to print excessive amounts of money, leading to inflation and devaluation of the dollar. Forbes suggests that being on the gold standard would constrain the money supply, prevent inflation, and make the dollar a more stable and trusted currency globally. It portrays the gold standard as providing fiscal discipline and protecting against irresponsible government spending and debt accumulation. However, he does not address the potential downsides, challenges, and pain of reinstating a gold standard system.

Daily Gold Market Report

Gold’s Resilience Tested:

Technical Indicators Suggest Uptrend May Hold Despite Recent Losses

(USAGOLD – 4/25/2024) Gold prices are slightly positive in early US trading. The gold market has struggled to gain upward momentum despite a lackluster start to the year for the U.S. economy. Gold is trading at $2320.25, up $4.08. Silver is trading at $27.27, up 11 cents. Gold experienced its worst daily decline in nearly two years on April 22, 2024, with a drop of -2.7%, and continued to fall in the following session, accumulating a loss of -5.8% from its all-time high on April 12 to an intraday low of US$2,291. Despite this significant drop, several factors suggest the medium-term uptrend that began in mid-February 2024 may still be intact. The Gold/Copper ratio, which measures gold’s performance relative to copper and indicates economic growth trends, remains supported within a rising trend channel, suggesting continued demand for gold as a hedge against stagflation risk. Additionally, Gold’s price is still above its 50-day moving average, which aligns with a key medium-term support zone. The daily RSI momentum indicator also remains above a critical support level, indicating the uptrend’s resilience. If Gold breaks above US$2,420, it could target US$2,540, while a fall below US$2,210 could lead to a test of the long-term pivotal support zone at US$2,075/2,035, which coincides with the 200-day moving average.

Daily Gold Market Report

From Rate Cuts to Default Risks:

Navigating the Troubled Waters of U.S. Bonds

(USAGOLD – 4/24/2024) Gold prices are flat in early US trading. Gold is trading at $2322.54, up 52 cents. Silver is trading at $27.25, down 6 cents. The article “Inflation Reacceleration, Bond Deterioration” discusses the troubling dynamics in the U.S. bond market and the broader economic implications of rising interest rates and persistent inflation. It highlights the Federal Reserve’s (Fed) interventions, which included discussions of rate cuts despite inflation not reaching the target of 2.0%. These interventions led to a temporary decrease in yields, particularly for Treasuries, which was intended to manage the growing federal debt interest. However, the article criticizes these measures as short-term fixes to a deeper problem, noting that the interest on the debt is projected to surge dramatically, potentially reaching $1.6 trillion annually in the near future. The piece also points out the decreasing foreign investment in U.S. Treasuries, particularly from China and Russia, and suggests that the U.S. may face a default scenario, either directly or through inflationary devaluation of the currency. With a grim outlook on the U.S. financial situation, indicating a shift by some investors towards gold as a safer asset.

Daily Gold Market Report

Precious Metals Take a Hit:

Gold Sees Largest Daily Loss Since 2022

(USAGOLD – 4/23/2024) Gold prices are sharply lower again and hitting three week lows early this morning in US trading. Precious metals futures markets are experiencing pressure from profit-taking and weak long liquidation. Gold is trading at $2314.38, down $12.92. Silver is trading at $27.03, down 17 cents. Gold prices experienced a significant drop, marking their largest daily decline in two years with a 2.5% fall to approximately $2,350 per troy ounce. Despite this setback, gold remains a strong performer in 2024, still up about 14% for the year, significantly outpacing the S&P 500’s 5% return. The decline in gold prices, which are now nearly 4% below their recent peak of over $2,400, coincides with a broader selloff in precious metals, including a 5% drop in silver prices. Factors contributing to the selloff include profit-taking by investors after a historic rally and a shift towards slightly riskier assets amid a decrease in geopolitical tensions in the Middle East. This shift reflects a reduced demand for gold, traditionally viewed as a safe haven during times of turmoil and inflation.

Daily Gold Market Report

Utah’s Incremental Approach to Sound Money:

A Step-by-Step Strategy

(USAGOLD – 4/22/2024) Gold prices are sharply lower this morning in US trading. The perceived reduction in Middle East tensions has negatively impacted the demand for safe-haven metals. Gold is trading at $2336.16, down $55.77. Silver is trading at $27.34, down $1.35. The article “Utah’s Step-By-Step Strategy in Support of Sound Money” by Mike Maharrey, discusses Utah’s incremental approach to promoting gold and silver as legal tender and fostering a sound money system. Since 2011, Utah has passed a series of laws, starting with the Utah Legal Tender Act, which recognized gold and silver coins as legal tender and exempted them from certain taxes. The state has seen the development of a robust gold and silver market, the establishment of the United Precious Metal Association (UPMA) offering bank-like services using precious metals, and the creation of the Goldback, a local voluntary medium of exchange. In 2024, Utah further supported sound money by authorizing the state to hold precious metal reserves and excluding central bank digital currencies from the state’s definition of legal tender. Maharrey emphasizes the effectiveness of a step-by-step strategy, as advised by the Founders, in achieving monetary reform and establishing a sound money system.

Daily Gold Market Report

Economy On Life Support:

Uptick In Bankruptcies, Car Repossessions, and Credit-Card Delinquencies

(USAGOLD – 4/19/2024) Gold prices are slightly higher this morning but down from last night’s spike as Israel attacked Iran. Military and geopolitical analysts are saying Israel’s military action overnight was limited and meant to show Iran that Israel has the capability to do a major, devastating strike on Iran if it wants to do so. Gold is trading at $2381.74, up $2.70. Silver is trading at $28.45, up 20 cents. David Brady, a seasoned markets analyst and money manager, has issued a stark warning about the potential for a significant downturn in the S&P 500. On the “Thoughtful Money” podcast, he predicted that the index could drop by 30% from its current level of over 5,000 points to 3,500 points, marking an 18-month low. Brady attributes this forecast to the overvaluation of stocks and a higher risk of downside than potential upside. Despite anticipating a temporary rebound influenced by Federal Reserve interventions before the presidential election, Brady expects a subsequent severe crash, potentially reaching the lowest levels in 14 years. He cites multiple economic pressures, including rising inflation and increasing financial instabilities, as factors contributing to this grim outlook.”Still, it’s worth underscoring that the US economy and stocks have largely defied naysayers. Stocks hit record highs earlier this year, while inflation has cooled significantly, unemployment remains near historic lows, and growth has been robust.”

Daily Gold Market Report

Gold Defies Expectations with Rally:

Silver Struggles to Keep Pace

(USAGOLD – 4/18/2024) Gold prices are higher this morning. Safe-haven purchases of both precious metals persist as the market remains cautious towards the end of the week due to geopolitical worries. Gold is trading at $2377.82, up $16.20. Silver is trading at $28.44, up 22 cents. Gold prices have been hitting record highs, defying the usual relationship with interest rate expectations. Typically, gold rallies with the anticipation of rate cuts and falls with expectations of rate hikes. However, despite a reduction in the expected number of rate cuts for 2024, gold has continued to rally. This unusual behavior may be due to large investors taking long positions in gold, possibly in anticipation of unforecasted large rate cuts or increased geopolitical instability. Silver, on the other hand, has not seen a similar rally and remains far from its all-time high. This discrepancy might suggest that the gold rally could be overextended or that silver might soon catch up. The gold-to-silver ratio indicates that silver is currently much cheaper relative to gold than in the past, suggesting potential for silver to gain. However, silver’s extensive industrial use and the impact of slow growth in China and tighter central bank policies may be restraining its price.

Daily Gold Market Report

Gold Investment in China:

TA March 2024 Overview of Premiums, Demand, and Central Bank Activity

(USAGOLD – 4/17/2024) Gold prices are higher this morning. Federal Reserve Chairman Jerome Powell in remarks on Tuesday suggested interest rates may have to remain higher for longer, to get inflation back down to a level where the Fed feels more comfortable. Gold is trading at $2392.96, up $10.06. Silver is trading at $28.69, up 58 cents. In March 2024, Ray Jia of the World Gold Council reports China’s gold market witnessed several significant developments. The Shanghai Gold Benchmark PM (SHAUPM) in RMB experienced a 10% increase, and the LBMA Gold AM Price in USD rose by 8%, with gold prices reaching record highs due to factors like strong global investment demand and geopolitical risks. Despite a slight dip in wholesale demand, the first quarter saw the highest Q1 wholesale gold demand since 2019, totaling 522t. The People’s Bank of China (PBoC) continued its gold purchasing streak for the 17th consecutive month, adding 5t to its reserves, which now stand at 2,262t. Additionally, Chinese gold ETFs saw significant inflows, pushing total assets under management to a new high of RMB35bn (US$5bn). There was a retreat in China’s gold price premium in March, reflecting weakened local demand amidst rising gold prices, although the first quarter overall recorded the highest Q1 premium ever due to strong physical demand in the initial months.

Daily Gold Market Report

Decade of Stagnation:

Top Fund Manager Predicts ‘Dead Ball’ Era for Stocks Amid Inflation Fears

(USAGOLD – 4/16/2024) Gold prices slightly lower this morning after seeing some routine profit-taking pressure. The overall market continues to be somewhat uneasy due to increased geopolitical tensions. Gold is trading at $2374.39, down $8.75. Silver is trading at $28.28, down 59 cents. A top fund manager, Bill Smead, has warned that the stock market may be entering a “dead ball” era, potentially lasting a decade or more, with minimal returns and possible significant losses akin to those experienced during the dot-com bust and the 2008 financial crisis. Smead attributes this bleak outlook to the possibility of prolonged high inflation and interest rates, drawing parallels to the economic conditions of the 1970s. Despite the S&P 500’s 6.6% rally in 2024, Smead cautions against investing in overvalued sectors like AI and mega-cap stocks, which he believes are in a speculative bubble. Instead, he suggests that opportunities may lie in sectors that typically benefit from inflation, such as oil and gas, real estate, and gold. While Smead’s view is bearish, the consensus on Wall Street remains optimistic, with many investors bullish on stocks for the next six months.

Daily Gold Market Report

The Cantillon Effect in Action:

Federal Reserve Policies and the Widening Wealth Gap

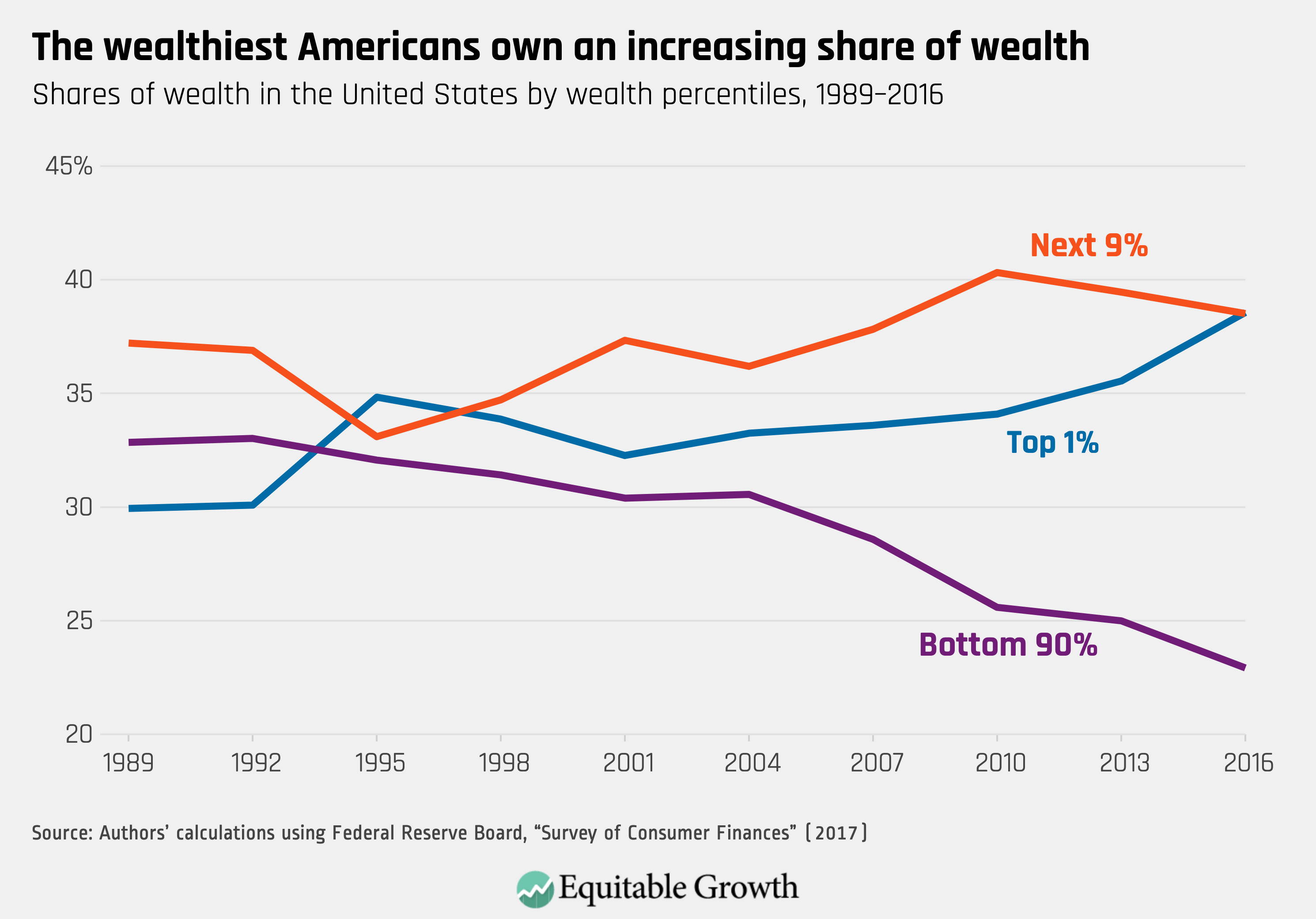

(USAGOLD – 4/15/2024) Gold prices are higher this morning after geopolitical tensions surged in the Middle East over the weekend. Gold is trading at $2350.29, up $5.92. Silver is trading at $28.61, up 73 cents. The recent article “The Rich get Richer. Thanks to the Fed.” from Peter St. Onge, discusses the significant increase in wealth among America’s richest due to Federal Reserve policies, particularly during the pandemic. The wealth of the top 1% in the U.S. reached an all-time high of $45 trillion, a 50% increase from 2020, largely fueled by the Fed’s massive money printing efforts amounting to $6 trillion in two years. This influx of new money primarily benefited financial markets and the wealthy, as the Fed’s method of increasing the money supply involves buying financial assets and subsidizing lending, a process known as Quantitative Easing. The article explains the Cantillon Effect, where new money benefits the rich first, with inflationary effects trickling down to impact the rest of the population, particularly harming those on fixed incomes like social security and pensioners. He concludes by stating that the Fed’s actions inherently drive inequality, serving the interests of the wealthy at the expense of the broader population.

Daily Gold Market Report

The Inevitable Decline of Fiat Currencies:

Why Gold Maintains Purchasing Power

(USAGOLD – 4/12/2024) Gold prices have hit another all time high this week of $2404/oz. The broader financial markets are exhibiting heightened uncertainty as we approach the weekend, with the recent escalation of geopolitical tensions fueling increased investor demand for safe-haven assets like gold and silver. Gold is trading at $2400.64, up $28.12. Silver is trading at $29.40, up 95 cents. The article titled “Gold and Silver Entering Exponential Phase” by Egon von Greyerz discusses the potential for gold and silver prices to rise significantly in the coming months and years, driven by a combination of technical and fundamental factors. He argues that gold maintains stable purchasing power over time, while fiat currencies inevitably decline in value. He suggests that gold and silver are currently undervalued relative to money supply and inflation, and that the financial system is on the verge of a major collapse. The article also touches on geopolitical tensions and the risk of global war, and recommends physical gold ownership as a form of wealth preservation and insurance against economic and political instability.

Credit: vongreyerz.gold

Daily Gold Market Report

Bullion Bounces Back:

Gold Prices Defy Economic Headwinds and Central Bank Moves

(USAGOLD – 4/10/2024) Gold prices have recovered some ground Thursday. The latest economic data indicates that various components of producer price inflation in the U.S. economy have cooled down more than anticipated. Gold is trading at $2343.56, up $9.52. Silver is trading at $28.15, up 20 cents. Following the release of stronger-than-expected US CPI data yesterday, the gold market experienced a brief dip, losing $30, but quickly rebounded, demonstrating resilience even as the US dollar and treasury yields rose. This behavior suggests that gold investors are eager to buy on any dips, indicating a strong conviction behind the current rally. Despite initial expectations that the rally might be driven by options trading and associated delta hedging, the market’s response to adverse economic data suggests otherwise. The possibility of a major sovereign state purchase was considered but seems unlikely given the lack of changes in London vault stocks and the absence of transactions through the LBMA benchmark, pointing towards over-the-counter trades. The resilience of gold in the face of market headwinds suggests a higher path of least resistance, urging investors to hold onto their positions.

Daily Gold Market Report

Surge in Silver:

India’s Imports Hit Record Levels with Increased Demand from UAE

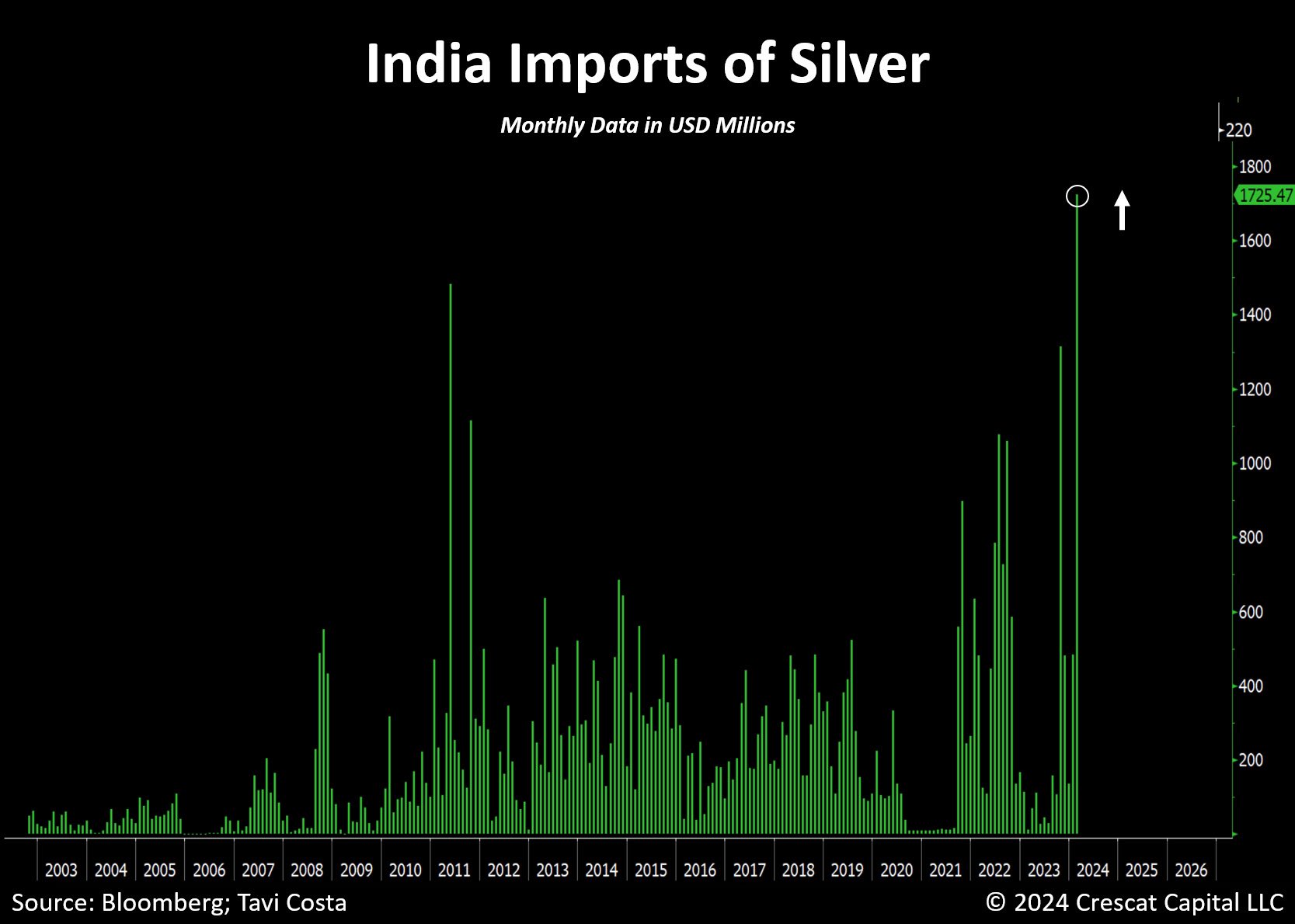

(USAGOLD – 4/10/2024) Gold prices are lower in early trading Wednesday and sold off over 1% following another U.S. inflation report that came in higher than expected. Gold is trading at $2327.87, down $24.91. Silver is trading at $27.70, down 45 cents. In February 2024, India’s silver imports reached a record high, with a 260% increase compared to the previous month, largely due to lower import duties and significant purchases from the UAE. The country, which is the world’s largest silver consumer, imported 2,295 metric tons of silver in February alone, with 939 tons coming from the UAE. This surge in imports is expected to contribute to a 66% increase in silver imports for the year, potentially supporting global silver prices. The high volume of imports in early 2024 has led to an oversupply that pushed local prices into a discount, causing banks to reduce imports in March. Industry experts suggest that the cyclical nature of India’s silver imports, which saw a decline in 2023 after a record high in 2022, indicates a potential increase in 2024, with estimates reaching 6,000 tons. This demand is driven by the fabrication and solar industries, as well as investment purposes, with silver being seen as potentially offering higher returns than gold.

Daily Gold Market Report

China’s Gold ETF Trading Halts:

Record Demand and Market Frenzy

(USAGOLD – 4/9/2024) Gold prices continue to hit all time highs, overnight reaching $2365.30/oz. Increasing numbers of traders across various markets are now joining the optimistic trend for gold and silver, indicating further potential for price increases in the short term. Gold is trading at $2355.39, up $16.46. Silver is trading at $28.30, up 45 cents. The China Gold-Buying Frenzy has led to significant disruptions in the trading of a gold company ETF, marking the second suspension in a week due to unprecedented demand. The ChinaAMC CSI SH-SZ-HK Gold Industry Equity ETF, managed by China Asset Management Co., saw its trading halted overnight after its price surged over 40% in four sessions, only to drop 10% upon resumption. This action was taken to safeguard investor interests as the ETF’s premium over its underlying assets soared beyond 30%. The frenzy reflects Chinese investors’ desperation for investment alternatives not tied to the struggling domestic economy, with gold ETFs attracting nearly $600 million in global net inflows in just the past week. Analysts suggest that the surge in gold and gold ETF demand is driven by investors seeking to diversify with commodities and foreign ETFs amidst China’s economic challenges, including property market woes and volatile stock markets.

Daily Gold Market Report

The East Rises in Gold Markets:

A Shift in Global Pricing Power

(USAGOLD – 4/8/2024) Gold prices once again hit an overnight all time high of $2354.04/oz but has since faded back this morning. Gold is trading at $2327.44, down $2.09 cents. Silver is trading at $27.64, up 14 cents. Henry Johnston of RT discusses the significant shift in the gold market, highlighting how the control of gold pricing is moving from the West to the East, particularly due to increased demand in China and central bank purchases. He outlines the historical context of gold as a store of value and its transition from being part of the Bretton Woods system to becoming a traded commodity through futures contracts. The breakdown of the correlation between U.S. real interest rates and gold prices, especially noticeable since the Ukraine conflict in 2022, indicates a profound change in the gold market dynamics. Western institutional investors have been net sellers, while Eastern demand, especially from China and central banks, has surged, driving gold prices to new highs. This shift is seen as part of a broader “hidden dedollarization” and a move towards gold as a neutral reserve asset amidst geopolitical tensions and financial instability.

Ready to move from education to action?

DISCOVER THE

USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

6:02 pm Sun. May 5, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115