Daily Gold Market Report

Gold Prices in Focus:

How the Latest FOMC Decisions Could Influence the Market

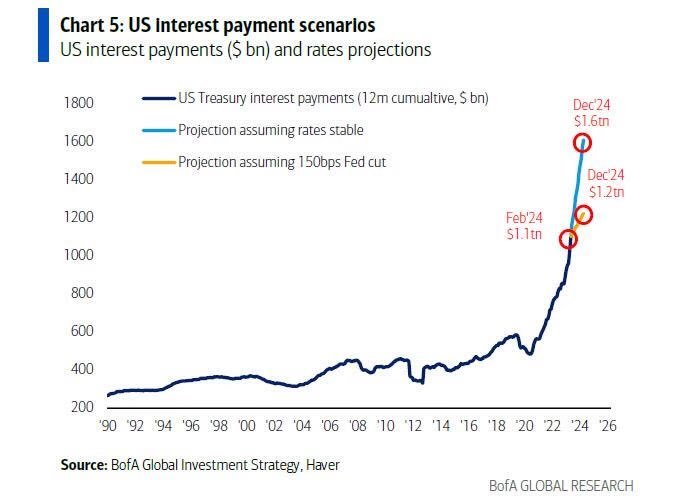

(USAGOLD – 5/2/2024) Gold prices are modestly down this morning post FOMC meeting. Gold is trading at $2294.37, down $25.19. Silver is trading at $26.32, down 33 cents. Yesterday’s Federal Open Market Committee (FOMC) meeting was a focal point for financial markets, particularly for its implications on gold prices. The FOMC’s decisions on interest rates directly influence the attractiveness of gold as an investment. Historically, lower interest rates decrease the opportunity cost of holding non-yielding assets like gold, making it more appealing. Conversely, higher rates typically strengthen the dollar and yield-bearing assets, diminishing gold’s allure. As of the latest updates, the Fed is expected to maintain its current interest rate, with a strong likelihood of rate cuts later in the year. This anticipation keeps gold prices on tenterhooks, as investors look for signals of future monetary policy easing, which could enhance gold’s position as a safe-haven asset. If the FOMC doesn’t cut rates this year, interest payments on the Federal Debt are set to surge to $1.6 trillion per yer.