Daily Gold Market Report

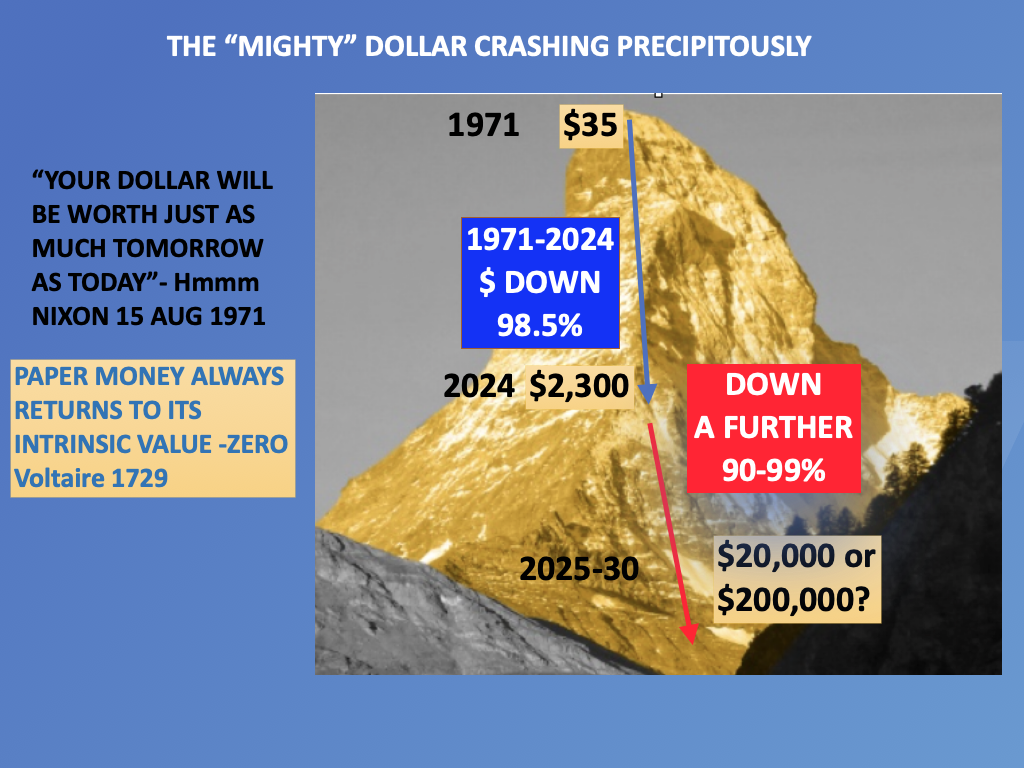

The Inevitable Decline of Fiat Currencies:

Why Gold Maintains Purchasing Power

(USAGOLD – 4/12/2024) Gold prices have hit another all time high this week of $2404/oz. The broader financial markets are exhibiting heightened uncertainty as we approach the weekend, with the recent escalation of geopolitical tensions fueling increased investor demand for safe-haven assets like gold and silver. Gold is trading at $2400.64, up $28.12. Silver is trading at $29.40, up 95 cents. The article titled “Gold and Silver Entering Exponential Phase” by Egon von Greyerz discusses the potential for gold and silver prices to rise significantly in the coming months and years, driven by a combination of technical and fundamental factors. He argues that gold maintains stable purchasing power over time, while fiat currencies inevitably decline in value. He suggests that gold and silver are currently undervalued relative to money supply and inflation, and that the financial system is on the verge of a major collapse. The article also touches on geopolitical tensions and the risk of global war, and recommends physical gold ownership as a form of wealth preservation and insurance against economic and political instability.

Credit: vongreyerz.gold