Daily Gold Market Report

Record Operating Loss for the Fed:

Interest Rate Hikes Lead to $114.3 Billion Shortfall

(USAGOLD – 3/27/2024) Gold prices are posting double digit gains early this morning. Gold is trading at $2190.38, up $11.58. Silver is trading at $24.55, up 9 cents. In 2023, the Federal Reserve experienced its largest operating loss ever, amounting to $114.3 billion, due to significantly elevated interest expenses, which forced it to halt remittances to the Treasury. The central bank’s interest expenses surged to $281.1 billion, nearly tripling from the previous year, while its interest income from its asset portfolio decreased slightly to $163.8 billion from around $170 billion in 2022. This financial situation arose as the Fed raised interest rates starting in March 2022 to combat inflation, leading to increased interest payments to banks for excess reserves, which reached a record $176.8 billion. To manage the shortfall, the Fed issued a “deferred asset” to the Treasury, which grew to a record $133.3 billion and has no impact on its monetary policy conduct.

USAGOLD Comment: The combination of potential lower interest rates, central bank demand, gold’s status as a safe-haven asset, its role as an inflation hedge, and market sentiment all contribute to a favorable environment for gold prices.

Daily Gold Market Report

From Experiment to Reality:

SWIFT’s Ambitious Plan for a CBDC-Connected Financial System

(USAGOLD – 3/26/2024) Gold prices are stronger in early trading on Tuesday. Gold is trading at $2188.03, up $16.20. Silver is trading at $24.0, up 2 cents. SWIFT, the global bank messaging network, is planning to launch a new platform within the next 12 to 24 months to integrate central bank digital currencies (CBDCs) with the existing financial system. This development is significant for the emerging CBDC ecosystem, as SWIFT plays a crucial role in global banking. With approximately 90% of the world’s central banks exploring digital currencies to keep pace with cryptocurrencies, SWIFT’s innovation head, Nick Kerigan, revealed that their recent trial, which included a diverse group of central banks and financial institutions, aimed to ensure interoperability of different CBDCs and reduce payment system fragmentation. The trial also explored the use of CBDCs in complex transactions and the potential for automation to enhance speed and reduce costs. The successful trial outcomes have set a timeline for SWIFT to move from experimental to practical application. SWIFT’s network, which connects over 11,500 banks and is used in over 200 countries, positions it advantageously for the CBDC rollout, despite the possibility of delays in major CBDC launches. The platform is expected to offer a scalable solution for digital asset payments, aligning with predictions that $16 trillion in assets could be tokenized by 2030.

Daily Gold Market Report

The Dynamics of Investment:

Gold and Bitcoin ETFs in the Post-Pandemic Era

(USAGOLD – 3/25/2024) In early trading on Monday in the U.S., gold prices strengthened, buoyed by positive external market factors, including a weaker U.S. dollar index and slightly increased crude oil prices. Gold is trading at $2177.82, up $12.38. Silver is trading at $24.79, up 11 cents. The Financial Times recently disscussed the relationship between the outflows from gold exchange-traded funds (ETFs) and the inflows into bitcoin ETFs, addressing the speculation that the rise of bitcoin ETFs might be causing a decline in gold ETF investments. JPMorgan’s research indicates that this is not the case; the outflows from gold ETFs began in April 2022 and have continued steadily, unrelated to the emergence of bitcoin ETFs. Despite the outflows, central banks and private investors continue to invest in physical gold, driven by a desire for privacy and tangibility, especially post-pandemic. While bitcoin ETFs have seen significant inflows, there has been a simultaneous sell-off of bitcoin held directly on exchanges, suggesting a shift rather than new investment. The overall demand for both gold and bitcoin appears to be influenced by momentum traders, and the World Gold Council and Morningstar analysts concur that investment in gold remains robust when considering all forms of investment, not just ETFs.

Daily Gold Market Report

From Smartwatches to AI:

The Surprising Connection Between Platinum and the Next Tech Boom

(USAGOLD – 3/22/2024) Gold prices are lower on Friday, after fading the all time high. Today, the U.S. Congress is making efforts to prevent another federal government shutdown, but the marketplace seems largely indifferent. Gold is trading at $2174.72, down $6.16. Silver is trading at $24.75, up 1 cent. A recent article from the World Platinum Investment Council discusses the increasing demand for platinum thin film coatings due to their critical role in semiconductor and sensor applications. With the generative AI market expected to grow to approximately $1.3 trillion over the next decade, the need for semiconductors, which are integral for AI functionalities like processing and data sensing, is also surging. Platinum, known for its conductivity and stability, is identified as an ideal material for sputtering targets used in creating these thin films. This technology is pivotal for advancements in microelectromechanical systems (MEMS), nanotechnologies, and in enhancing the efficiency of battery electric vehicles by improving battery life through precise temperature measurements. Additionally, platinum thin films are being used in the rapidly growing market for wearables, like smartwatches and health trackers, for continuous monitoring of vital signs. Bosch’s investment of three billion euros in its semiconductor and sensor business by 2026 underscores the importance and growth of this sector.

Daily Gold Market Report

Fed Holds Rates Steady:

Gold Rockets To New All Time High

(USAGOLD – 3/21/2024) Gold prices are sharply higher in early trading Thursday, with gold setting a record high of $2,222.91/oz overnight. Silver prices hit a 3.5-month high overnight at $25.77/oz. A dovish tone by the U.S. Federal Reserve has boosted the precious metals markets late this week. Gold is trading at $2200.25, up $13.86. Silver is trading at $25.23, down 35 cents. During the Federal Open Market Committee (FOMC) meeting, the Federal Reserve maintained interest rates at 5.25% to 5.50% and communicated a cautious stance on inflation, suggesting it was “Not terrible” and possibly seasonal. Despite the dot plot indicating three rate cuts for 2024, adjustments for 2025 and beyond hinted at a more hawkish outlook, suggesting a readiness to reduce the number of rate cuts if necessary. However, Fed Chair Powell’s press conference painted a less hawkish picture, downplaying the recent inflation spike as seasonal and indicating a slowdown in the pace of quantitative tightening (QT). This dovish tone during the press conference led to a bullish reaction in the markets, with assets rallying as Powell suggested the Fed would slow the offloading of Treasuries and other bonds, aligning with earlier plans. Powell also says the Federal Reserve is not working on a CBDC, and has no plans to propose one. “It’s wrong to say we’re working on a CBDC.” See Powell’s full answer on CBDCs below:

Daily Gold Market Report

Economic Forecasts and Inflation Monitoring:

Key Points from the March 2024 Federal Reserve Meeting

(USAGOLD – 3/20/2024) Gold prices are slightly lower this morning. The market has been relatively calm at the beginning of the week, with traders seemingly holding back in anticipation of the Federal Open Market Committee (FOMC) monetary policy meeting’s conclusion in the afternoon. Gold is trading at $2152.20, down $5.39. Silver is trading at $24.95, up 4 cents. The Federal Reserve is expected to maintain its benchmark interest rate at a range of 5.25% to 5.5% at its March 2024 meeting, while providing fresh clues on the path of future interest-rate cuts. Economists predict that the FOMC will pencil in three rate cuts for 2024, as policymakers discuss slowing the balance-sheet unwind. The Fed is focused on addressing stubborn inflation and monitoring a slowly rising jobless rate, with the “dot plot” of individual member’s interest rate expectations indicating three cuts in 2024, four in 2025, three more in 2026, and two more at some point to take the long-range federal funds rate down to around 2.5%. The FOMC will release its quarterly update on the economy, specifically for gross domestic product, inflation, and the unemployment rate, with a focus on inflation and its effect on expectations for rates. As oil prices continue to rise and with gold prices near all time highs the Fed has their hands full.

Daily Gold Market Report

State of Utah Rejects CBDCs:

Protects Sound Money

(USAGOLD – 3/19/2024) Gold prices are lower this morning. Gold is trading at $2154.50, down $5.86. Silver is trading at $24.88, down 16 cents. On March 14, 2024, Utah Governor Spencer Cox signed House Bill 164 into law, which excludes central bank digital currencies (CBDCs) from the state’s definition of legal tender and money. This legislation, introduced by Rep. Tyler Clancy and sponsored in the Senate by Sen. Michael Kennedy, amends the Utah Specie Legal Tender Act and the state’s Uniform Commercial Code to clarify that CBDCs are not considered specie legal tender nor legal tender in Utah. The bill was overwhelmingly passed by the state legislature, with the Senate voting 27-1 and the House approving it 68-0. The law is set to take effect on May 1, 2024.

“Government-issued digital currencies are sold on the promise of providing a safe, convenient, and more secure alternative to physical cash. We’re also told it will help stop dangerous criminals who like the intractability of cash. But there is a darker side – the promise of control. At the root of the move toward government digital currency is “the war on cash.” The elimination of cash creates the potential for the government to track and even control consumer spending,” Michael Boldin of the Tenth Amendment Center concludes.

Daily Gold Market Report

The Rising Importance of Hard Assets:

Protecting Wealth with Physical Gold Amidst Monetary Expansion

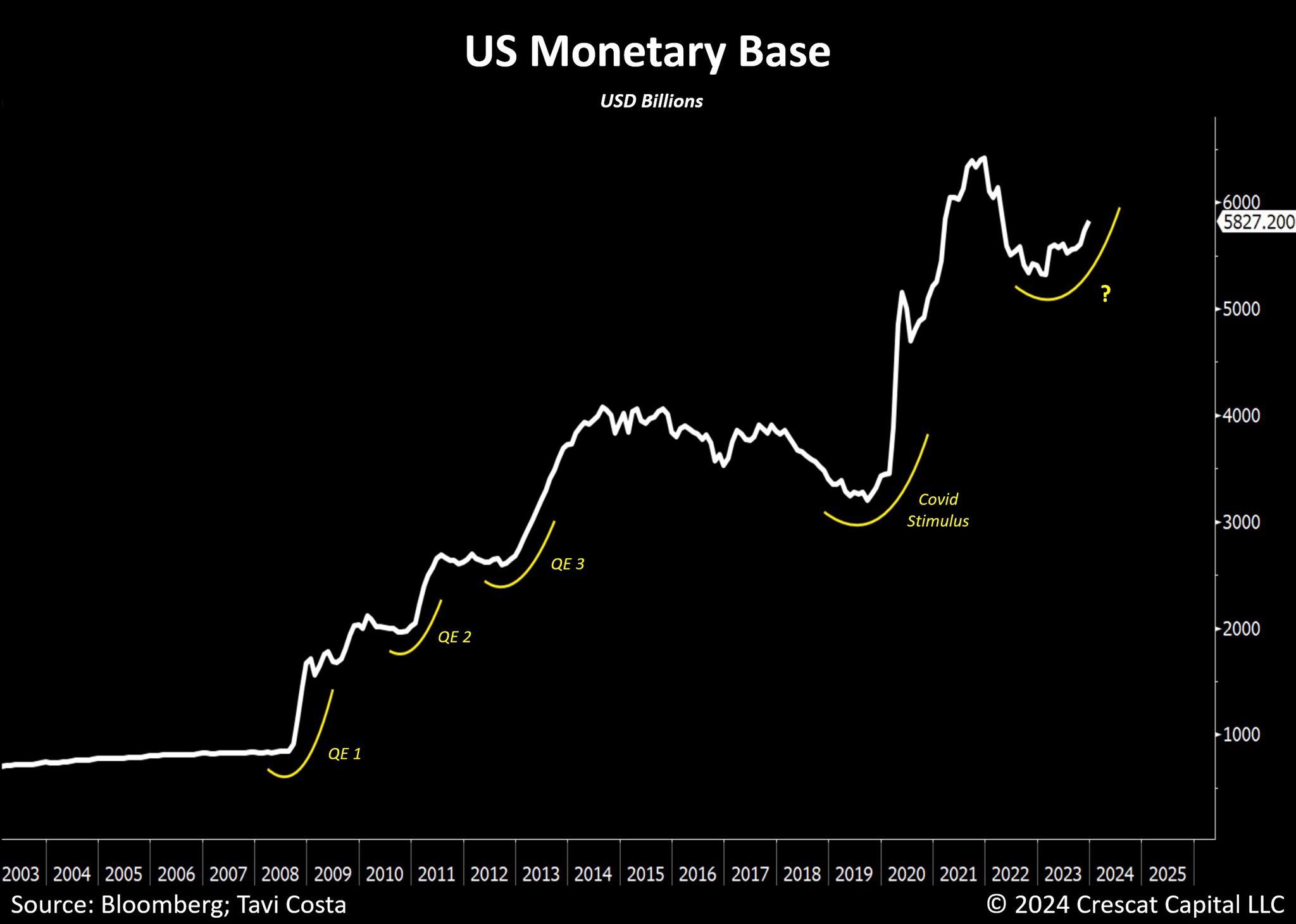

(USAGOLD – 3/18/2024) Gold prices are slightly higher this morning. This week’s significant U.S. economic event is the Federal Reserve’s Open Market Committee (FOMC) meeting, which starts on Tuesday morning and concludes on Wednesday afternoon. It will be followed by a statement and a press conference led by Fed Chairman Jerome Powell. Gold is trading at $2157.57, up $1.67. Silver is trading at $25.28, up 10 cents. Despite the implementation of what is described as one of the most restrictive monetary policies in history, the monetary base is still increasing. The situation suggests that in the event of a recession, traditional monetary policy tools may not be as effective in managing economic downturns. Tavi Costa, of Crestcat Capital suggests that with the potential for traditional fiat currencies to lose value or become less reliable in such uncertain economic times, the ownership of hard assets like physical gold becomes crucial. This perspective underscores the importance of diversifying one’s investment portfolio with tangible assets that can withstand economic fluctuations, offering a measure of financial security.

Daily Gold Market Report

Decentralized Blockchains vs. Permissioned Networks:

The Cybersecurity Debate in Asset Tokenization

(USAGOLD – 3/15/2024) Gold prices are lower this morning after manufacturing activity in the New York region collapsed this month. Gold is trading at $2160.16, down $2.03. Silver is trading at $25.15, up 33 cents. Regulators are moving towards allowing banks to tokenize financial assets on permissioned networks rather than decentralized, permissionless blockchains, raising concerns about cybersecurity vulnerabilities. The tokenization process involves creating digital representations of real-world assets on a blockchain, and while this trend is gaining momentum, the preference for permissioned networks could lead to significant risks. Permissioned networks, controlled by a few entities, are more susceptible to hacking compared to the robust security of decentralized blockchains, which are maintained by thousands of validators and have a strong track record of resisting cyber attacks. The push for tokenization on permissioned networks by regulators and financial institutions could potentially set the stage for unprecedented cybersecurity breaches in the financial system.

USAGOLD Comment: Owning physical offline assets (gold and silver) is essential for maintaining financial security and protecting one’s wealth from potential cyber threats and vulnerabilities in digital systems.

Daily Gold Market Report

The Undervalued Potential of Silver:

Market Experts Foresee a Breakthrough Beyond $30

(USAGOLD – 3/14/2024) Gold prices dropped to their lowest levels of the session following weaker-than-expected retail sales data for February and a significant downward revision of January’s figures. Concurrently, the Producer Price Index (PPI), a measure of inflation, increased by 0.6% in February, surpassing expectations and marking a more substantial rise than the 0.3% increase seen in January. This data suggests that inflationary pressures remain persistent, particularly in the wholesale sector, where energy prices notably surged. Gold is trading at $2163.77, down $10.64. Silver is trading at $25.03, up 3 cents. Interest is growing in the silver market as analysts predict it could be the next to rally, following gold’s surge to record highs. Despite its higher volatility, silver traditionally outperforms gold in both bear and bull markets, but has seen hesitancy from investors during rallies. Currently, silver futures are trading at $25.25 an ounce, with the gold/silver ratio remaining above its historical average, suggesting silver is undervalued compared to gold. Experts like Carley Garner and Dennis Gartman discuss silver’s potential for growth, despite its current underperformance, attributing it to factors such as market dynamics and central bank demand for gold. The global economy’s health and an expected economic rebound in China are seen as key drivers for silver’s bull market, with predictions of prices breaking through $30 and potentially reaching $50 an ounce.

Daily Gold Market Report

Market Reacts to CPI Surge:

Gold Retreats Amid Fed Rate Cut Speculation

(USAGOLD – 3/13/2024) Gold and silver prices are back higher on Wednesday. The marketplace has mostly digested Tuesday’s U.S. consumer price index for February it seems. Gold is trading at $2170.38, up $12.04. Silver is trading at $24.48, up 34 cents. Gold prices faced downward pressure following a U.S. inflation report that exceeded expectations, leading to doubts about an imminent Federal Reserve interest rate cut. The Consumer Price Index (CPI) rose by 0.4% in February, with an annual increase of 3.2%, surpassing the forecasted 3.1%. This data caused gold to drop over 1%, with spot gold falling to $2,153.05 per ounce. The market anticipates the next Fed meeting on March 20, with a focus on potential interest rate adjustments.

Daily Gold Market Report

Gold Glitters Amid Global Uncertainty:

Record Highs Despite Strong U.S. Economy

(USAGOLD – 3/12/2024) Gold and silver prices are lower and hitting fresh lows in early trading on Tuesday in response to a U.S. inflation report that slightly surpassed market forecasts, leading to some investors to take some profits. Gold is trading at $2160.08, down $22.67. Silver is trading at $24.03, down 44 cents. Despite a strong U.S. stock market and economy, gold prices have soared to a record high, trading at $2,195 per ounce on Friday, with significant gains both year-to-date and over the past 12 months. This rally is surprising given that gold typically spikes during economic crises, not periods of market strength. The surge in gold’s value is partly due to weaker economic growth and stock performance in non-U.S. markets, particularly in developed economies like Germany, Japan, and the United Kingdom. Chinese investors, facing a commercial real estate crisis, have shown “phenomenal” demand for gold as a hedge against economic instability. In the U.S., investors are turning to gold to bet against potential inflation, reposition portfolios after the stock surge, and protect against geopolitical instability, including conflicts involving Israel, Hamas, Russia, Ukraine, and uncertainties surrounding the U.S. presidential election.

Daily Gold Market Report

From Historical Peaks to Future Projections:

The Evolution of U.S. Debt-to-GDP Ratio

(USAGOLD – 3/11/2024) Gold prices continue to march higher but are below Friday’s high around $2,195 per ounce. The charts for both gold and silver remain bullish to suggest still more price upside in the near term as we await February inflation data tomorrow. Gold is trading at $2183.72, up $4.77. Silver is trading at $24.48, up 17 cents. Daniel Wilson and Brigid Meisenbacherat from the Economic Research Department at the Federal Reserve Bank of San Francisco recently discussed the long-term fiscal outlook of the United States, highlighting the concern that the federal debt as a percentage of GDP is approaching its historical peak last seen at the end of World War II. After WWII, the debt-to-GDP ratio decreased significantly due to a primary surplus, rapid economic growth, and low interest rates. However, current projections for the next three decades suggest a persistent primary deficit, with the debt-to-GDP ratio potentially reaching 172% by 2054 without major policy reforms. The primary deficit is driven by mandatory spending on programs like Social Security and Medicare, coupled with an aging population. The outlook for reducing the debt ratio appears challenging, requiring either significant policy reforms, such as tax increases or spending cuts, or a scenario where economic growth outpaces interest rates.

USAGOLD Comment: The projected fiscal challenges underscore the importance of including tangible assets like gold in one’s investment strategy to safeguard against the unpredictable impacts of high debt levels and the accompanying economic policies.

Daily Gold Market Report

Banking Sector Facing Mounting Risks:

FDIC Report Highlights Industry Trends

(USAGOLD – 3/8/2024) Gold prices to finish the week, are hovering slightly below session peaks around $2,185 per ounce following a weak jobs report. Gold is trading at $2170.89, up $11.18. Silver is trading at $24.28, down 5 cents. The FDIC’s Quarterly Banking Profile, released yesterday, revealed an increase in its “Problem Bank List” by eight banks to a total of 52, representing 1.1% of the institutions under its oversight and totaling $66.3 billion in assets. Noteworthy statistics from this report include a rise in the share of unprofitable institutions to 10.9%, the highest level since Q4 2017. Additionally, 70% of the quarterly profit decline was attributed to specific, non-recurring large bank expenses, such as a special assessment to recoup failed bank costs. US bank profits saw a significant drop of 44% in Q4 as major firms covered failed bank costs. Meanwhile, embattled lender NYCB secured a $1 billion investment to bolster its financial position. Real Estate RXR CEO Scott Rechler predicts hundreds of banks failing or being taken over by 2026, highlighting the potential risks and challenges facing the banking sector in the years ahead.

Daily Gold Market Report

The Stealth Gold Rally:

Unpacking the Unseen Forces Driving Prices Higher

(USAGOLD – 3/7/2024) Gold prices are hovering slightly below session peaks around $2,164 per ounce following a weekly initial jobless claims report that met forecasts for American workers. Gold is trading at $2155.36, up $7.18. Silver is trading at $24.28, up 12 cents. Ross Norman’s (CEO of Metals Daily Ltd) article discusses the recent, unexpected rally in gold prices, suggesting that understanding the buyers and their motivations could reveal the rally’s sustainability. Unlike event-driven or speculative gains, which are often short-lived, this rally could be of a higher quality, driven by strong conviction among buyers. Despite declining interest in gold in the West, with significant drops in ETFs and physical demand, China’s robust demand seems to be compensating, driving gold prices up in a “stealth rally.” Norman speculates that the rally may not be solely due to expectations of a Fed rate cut or declining US treasury yields, as traditional market indicators like the gold/silver ratio and ETF demand don’t fully support these explanations. Instead, he suggests that official sector buying, particularly by central banks diversifying away from dollar assets in response to geopolitical tensions and financial sanctions, might be a key driver, though this remains speculative. The increase in gold prices, now reaching new highs, underscores the potential significance of these under-recognized factors.

Daily Gold Market Report

Beyond the Numbers:

How Elections, Tariffs, and Geopolitical Tensions Shape Economic Forecasts

(USAGOLD – 3/6/2024) Gold prices continue to flirt with an all time high this morning. Gold is trading at $2142.94, up $14.90. Silver is trading at $23.99, up 32 cents. Michael Every of Rabobank recently wrote a article entitled “The End/Beginning of a Golden Age” that discusses the complex interplay of economic forecasts, political events, and global trade policies, focusing on recent comments from the Fed’s Bostic about potential rate cuts and their implications on inflation. He highlights the impact of the US election cycle, especially considering a potential Trump victory and its implications on trade tariffs and global economic dynamics. Every critiques economists’ tendencies to ignore political influences on economic outcomes, emphasizing the importance of understanding political, legal, and geopolitical factors in economic modeling and forecasts. The discussion also touches on global shifts such as China’s economic targets, BRICS’ financial strategies, and geopolitical tensions affecting economies worldwide.

Today’s top gold news and opinion

3/5/2024

COT: Underinvested speculators fuel gold’s latest surge (Saxo)

What’s next after gold hits record closing high?

Why Britain is still paying the price for Gordon Brown’s gold bullion blunder (Telegraph)

It has been considered one of the worst financial blunders the Government ever made…

Gold flirts with record high as investor demand surges (Commodities Journal)

Gold flirted with a record high, surging above USD2,100/oz, as investors continued to pour into the safe haven asset.

…

Daily Gold Market Report

Gold’s Latest Milestone:

Analyzing the Implications of Yesterday’s Closing Price

(USAGOLD – 3/5/2024) Spot gold prices hit an all time high this morning but has since faded. Gold is trading at $2130.70, up $16.22. Silver is trading at $24.02, up 14 cents. Yesterday’s historical daily close of gold is significant because it represents a continuation of a notable upward trend in gold prices, closing at $2,117.36. This price point is an indication of the current market dynamics, reflecting a relatively small increase from the previous close, which can be seen in the context of gold’s recent performance. This trend is indicative of broader economic factors at play, including market sentiment, inflation expectations, and global economic uncertainties, which often drive investors towards safe-haven assets like gold. The significance of today’s close, therefore, lies not just in the number itself but in what it represents about the current state of the global economy and investor behavior towards gold as a protective investment against volatility in other markets.

Daily Gold Market Report

U.S. National Debt Skyrockets:

$1 Trillion Increase Every 100 Days Signals Alarm

(USAGOLD – 3/4/2024) Gold prices are strong in early trading Monday, this is after recent gains that saw gold hit a two-month high Friday. The U.S. national debt is escalating rapidly, with a recent pattern of increasing by $1 trillion approximately every 100 days, pushing the current total to nearly $34.4 trillion. This quickened pace of debt accumulation has been observed since June, with the debt rising from $32 trillion in mid-June to over $34 trillion by January. The acceleration in debt growth, alongside high gold and bitcoin prices, reflects market concerns about debt debasement. Bank of America’s Michael Hartnett predicts this 100-day $1 trillion growth pattern will continue. Meanwhile, Moody’s Investors Service downgraded the U.S. government’s ratings outlook to negative, citing large fiscal deficits and weakened debt affordability, especially in the context of higher interest rates and the absence of effective fiscal measures to curb government spending or increase revenues.

Today’s top gold news and opinion

3/4/2024

Hotshot Wharton professor sees $34 trillion debt triggering 2025 meltdown as mortgage rates spike above 7%: ‘It could derail the next administration’ (Fortune)

“It’s bad across the board for the country but it’s hard to avoid exposure wherever you live in the world”

3 Reasons Why The Gold Price Breakout Will Continue To Make All-Time Highs In 2024 (Investing Haven)

“Inflation expectations, the Yen, and speculators”

Is Silver a Sleeping Giant? (Barchart)

The silver-gold ratio provides few clues…

Ready to move from education to action?

DISCOVER THE

USAGOLD DIFFERENCE

Contemporary precious metals services.

Traditional appeal.

1-800-869-5115

Extension #100

8:00 am to 7:00 pm MT weekdays

Prefer e-mail to get started?

[email protected]

ORDER DESK

Great prices. Quick delivery. All the time.

Modern gold and silver bullion coins

Historic fractional gold coins (bullion-related)

Historic U.S. gold coins

________

CURRENT PRICES

10:36 am Wed. April 24, 2024

Live Prices • Order Anytime

|

American Eagle

Please call or e-mail the Order Desk if you have questions. |

|

Want to learn more about investing in gold and silver? This solid, in-depth introduction offers the basic who, what, when, where, why and how of precious metals ownership you've been looking for.

And when it comes time to make your first or next precious metals purchase, we invite you to discover why thousands of discerning investors have chosen USAGOLD as their precious metals firm.

|

Top Gold News & Opinion Join us for our live daily newsletter LATEST POSTS

_________________________

|

A contemporary web-based client letter with a distinctively old-school feel. |

website support: [email protected] / general mail: [email protected]

Site Map - Risk Disclosure - Privacy Policy - Shipping Policy - Terms of Use - Accessibility

1-800-869-5115