Monthly Archives: April 2022

Here’s how the Fed raising interest rates can help get inflation lower, and why it could fail

“The Fed has been reasonably successful in convincing markets that they have their eye on the ball, and long-term inflation expectations have been held in check. As we look forward, that will continue to be the primary focus. It’s something that we’re watching very closely, to make sure that investors don’t lose faith in [the central bank’s] ability to keep a lid on long-term inflation.” – Jim Baird, Plante Moran Financial Advisors

USAGOLD note: At least for now, the Fed seems to have successfully lulled Wall Street into a false sense of security on what could become runaway inflation, but, as Baird suggests, that complacency could quickly turn to alarm.

Shocks ahead, warns Bank of America

Reuters/Julien Ponthus/4-8-2022

“‘Inflation shock’ worsening, ‘rates shock’ just beginning, ‘recession shock’ coming”, BofA chief investment strategist Michael Hartnett wrote in a note to clients, adding that in this context, cash, volatility, commodities, and cryptocurrencies could outperform bonds and stocks.”

USAGOLD note: Don’t know about the last rec. Thus far, as shown in the chart below, crypto’s pretty much followed the NASDAQ script – not really demonstrating any contrarian tendencies. In the past, Hartnett has warned we are headed for a period of 1970s-like stagflation

Bitcoin and NASDAQ

Chart courtesy of TradingEconomics.com

Steve Forbes’ ‘Inflation’ — In the Nick of Time

The New York Sun/Editorial/4-6-2022

USAGOLD note: A thorough review of the new book by Steve Forbes, Nathan Lewis and Elizabeth Ames – Inflation: What It Is, Why Its Bad, and How To Fix It. Forbes recommends “a sound dollar anchored by gold.” The New York Sun agrees saying “it’s past time to consider such a standard.”

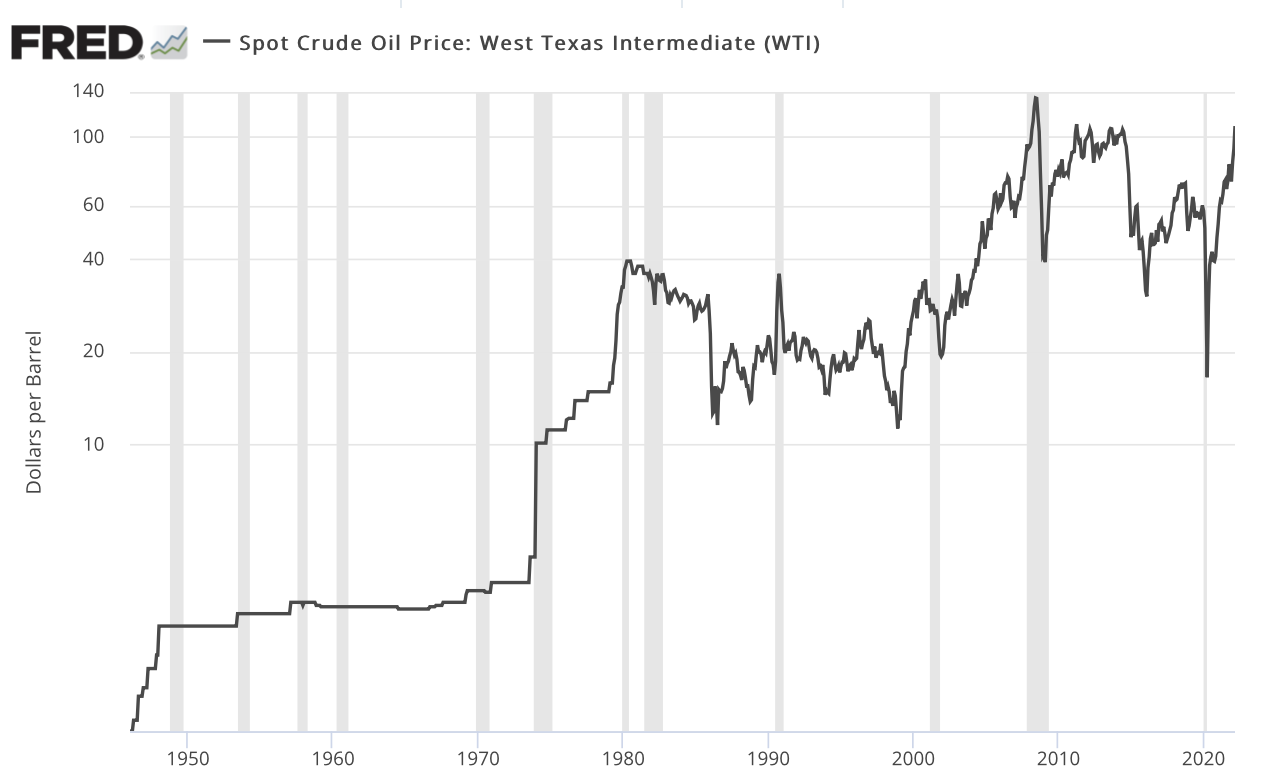

Grantham warns oil spikes this sever always trigger a recession

Bloomberg/Alex Wittenberg/4-7-2022

“Jeremy Grantham has a fresh warning about Russia’s invasion of Ukraine: oil-price spikes of this magnitude have always triggered recessions, and the global economy is at risk of much bigger challenges in the coming decades as finite commodities become scarce.”

USAGOLD note: Grantham’s assertion that a spike in the oil price always triggers a recession is bourne out in the accompanying chart. In this brief analysis, he makes an interesting philosophical observation: “Although we live on a finite planet, we have been attempting for the last 250 years to do the impossible: to generate perpetual compound growth.”

Source: St. Louis Federal Reserve [FRED] • • • Grey bars indicate recessions.

Gold is taking a breather this morning after past two days run-up

Lundin: ‘The macro-environment has turned solidly in favor of gold and silver.’

(USAGOLD –4/14/2022) – Gold is taking a breather this morning from the run-up of the past two days driven primarily by elevated inflation numbers and a threatened escalation in the Ukraine conflict. It is level at $1980.50. Silver is down 7¢ at $25.75. Both metals are mounting challenges of psychologically important price levels – $2000 for gold and $26 for silver.

“The macro-environment has turned solidly in the favor of gold and silver,” writes Gold Newsletter’s Brien Lundin in a client advisory yesterday. “Unlike the experience of the past few years, the metals are responding as they should. Imagine for a moment that you’re back in the gold of last year. Somebody tells you that in 12 months, the dollar Index would be over 100, the 10-year Treasury yield would be pushing 2.7%, the Fed is saying they’re going to hike a half-point at every meeting in the foreseeable future and the CPI just posted the highest inflation rate in 40 years. They then tell you to predict the price of gold in this scenario.”

“In the mindset of a year ago,” he continues, “most investors would have predicted that gold would be trading at the previous lows around $1,150 or so. That’s because all of the above metrics were, at that point in time, considered bearish for gold. The reason? The markets were obsessed with Fed policy rather than the actual economic drivers. Anything that hinted of a more-hawkish Fed sent the traders and algos selling the yellow metal. We’ve come a long way, baby. The transition in sentiment has been bumpy, as I predicted, but more and more we’re seeing investors regarding high inflation as bullish for gold. Just as important, they are rightly viewing the Fed’s rate-hike campaign as a positive.”

Source: tradingeconomics.com

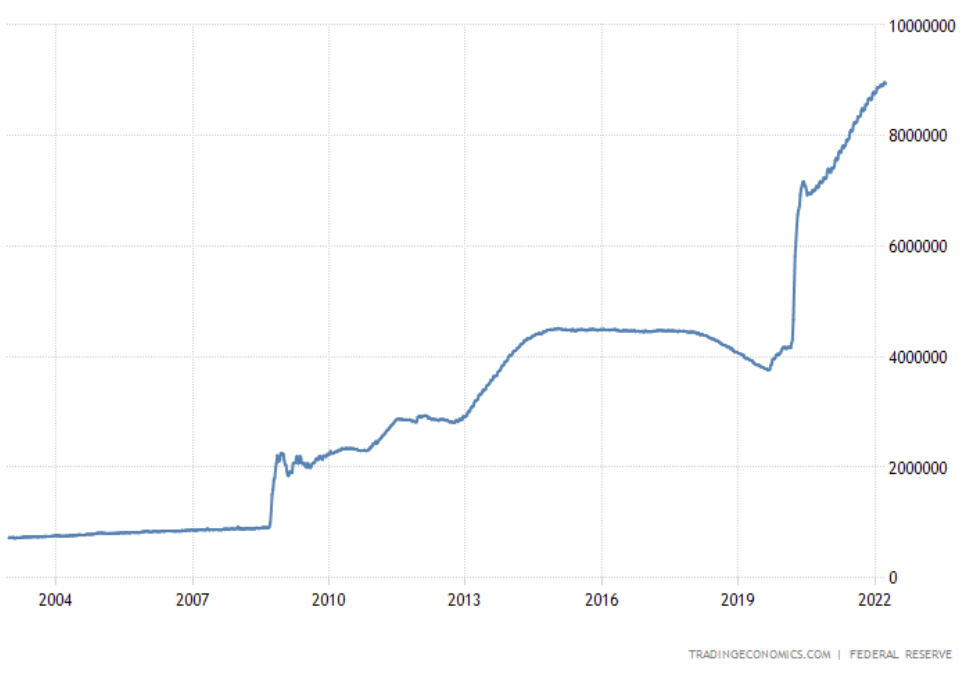

Fed officials weigh shrinking balance sheet by $95 billion/month

Bloomberg/Craig Torres/4-6-2022

“The Federal Reserve signaled it will reduce its massive bond holdings at a maximum pace of $95 billion a month, further tightening credit across the economy as the central bank raises interest rates to cool the hottest inflation in four decades. Minutes of their March meeting released Wednesday also showed that “many” officials viewed one or more half-percentage-point rate increases could be appropriate going forward if price pressures fail to moderate.”

Federal Reserve Balance Sheet

($, March 2022)

Chart courtesy of Tradingeconomics.com

USAGOLD note: Not to be the spoiled sport, but at the rate of reduction specified, it will take almost 9.5 years to reduce the Federal Reserve’s balance sheet to zero.

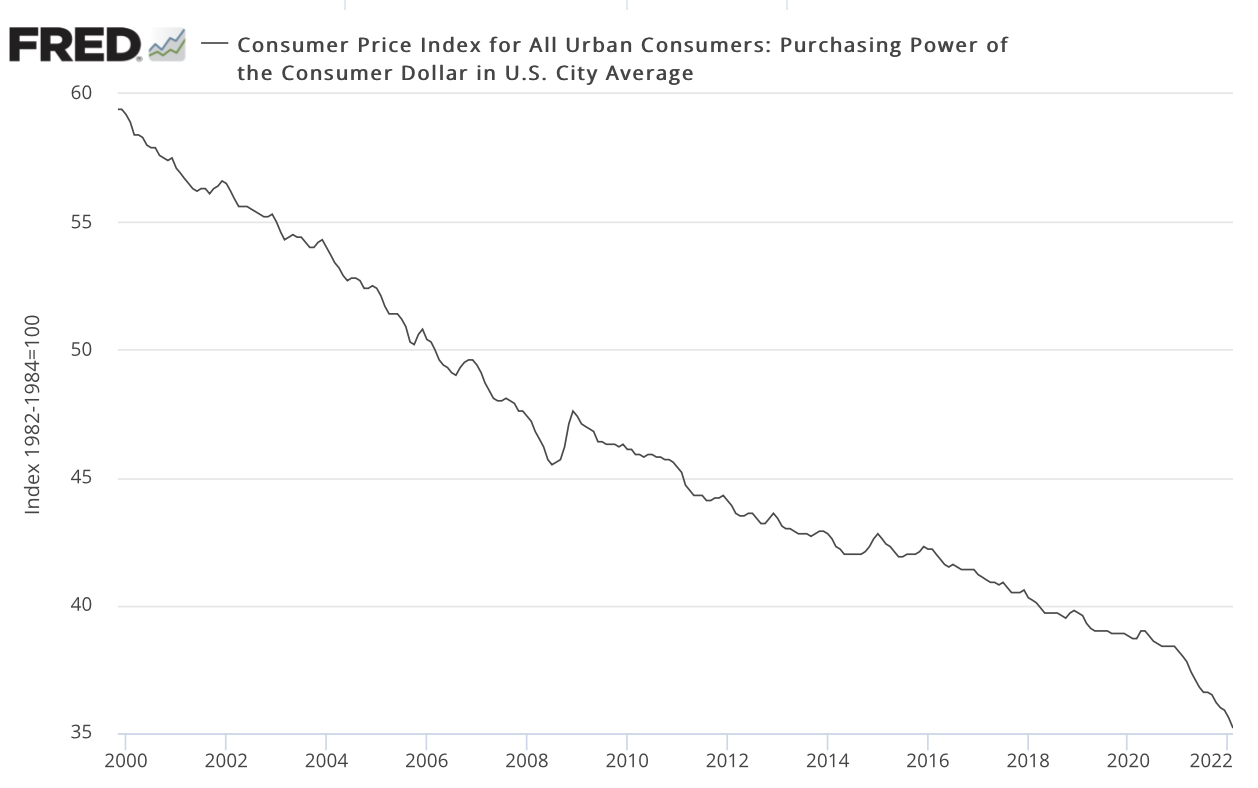

Does Russia’s move to price energy in roubles threaten the US dollar?

MoneyWeek/John Stepek/4-5-2022

“There’s been a lot of excitement (if that’s the right word) over the idea that Russia is no longer accepting dollars as payment for its energy. Overall, it would prefer gold (“hard currency”) or roubles, but it’ll take most other national currencies as long as they’re not greenbacks. Is this the beginning of the end for US dollar hegemony?The answer is ‘no.'”

USAGOLD note: Stepek goes on from there to offer some very cogent arguments why the dollar is unlikely to be replaced anytime soon as the world’s primary reserve currency, the most salient of which is that no other currency can adequately serve as an alternative. That argument, at the same time, does not stand in the way of further debasement of the dollar. In fact that debasement is gaining momentum even as you read this note.

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics

Inflationary forces spell long-term trouble for central banks, warns BIS head

Financial Times/Martin Arnold and Valentina Romel/4-5-2022

“Agustín Carstens, general manager of the BIS, the umbrella body for central banks, pointed to a ‘new inflationary era’ amid signs that price expectations of consumers and businesses are becoming ‘unmoored’ from their historically low levels.”

USAGOLD note: We referenced this report in Wednesday morning’s Daily Market Report and repost it now for those who may have missed it. A generation, says Carstens, is “learning that rapid price rises are not merely the stuff of history books.”

Fed must ‘inflict more losses’ on stock-market investors to tame inflation, says former central banker

MarketWatch/William Watts/4-6-2022

“It’s hard to know how much the U.S. Federal Reserve will need to do to get inflation under control. But one thing is certain: To be effective, it’ll have to inflict more losses on stock and bond investors than it has so far.” –

USAGOLD note: If Dudley is right that the Fed is likely to push the stock and bond markets over the cliff, would it not be prudent to stay diversified? To say the least, Dudley’s comments will not be welcome on Wall Street.

Precious metals extend inflation driven rally into second day

Goldman Sachs sees $2500 gold potential by end of 2022

(USAGOLD – 4/13/2022) – Precious metals extended yesterday’s inflation-driven rally into its second day as crude oil pushed over the $100 mark, the Japanese yen hit 20-year lows, and concern deepened about 1970s-style stagflation. Gold is up $12 at $1981. Silver is up 35¢ at $25.76. Both are knocking on the door of psychologically important levels – gold at $2000 and silver at $26. Goldman Sachs has been at the vanguard of Wall Street firms predicting a bull market in commodities, all the while giving special attention to gold. With commodities now on the march and gold up almost 10% year to date, we thought it might be a good time to revisit a recent Bloomberg interview of Jeff Currie, Goldman’s head of commodities research. In that interview, he predicted gold would hit $2500 by the end of 2022.

“It’s a perfect storm for gold right now,” he said. “There’s three legs to this story. One, you have strong investor demand for gold over concerns about inflation, recessions, and downturn in places like Europe. The second leg is central bank buying … and with the situation in Russia, they’re likely to accumulate dollars in reserves they can’t do anything with. What can they do with it? Buy gold. Then you have central banks in places like China and Turkey diversifying for de-dollarization reasons. Then you have diversification reasons in places like Brazil and India.”

Gold and silver price performances

(%, year to date)

Chart courtesy of TradingView.com

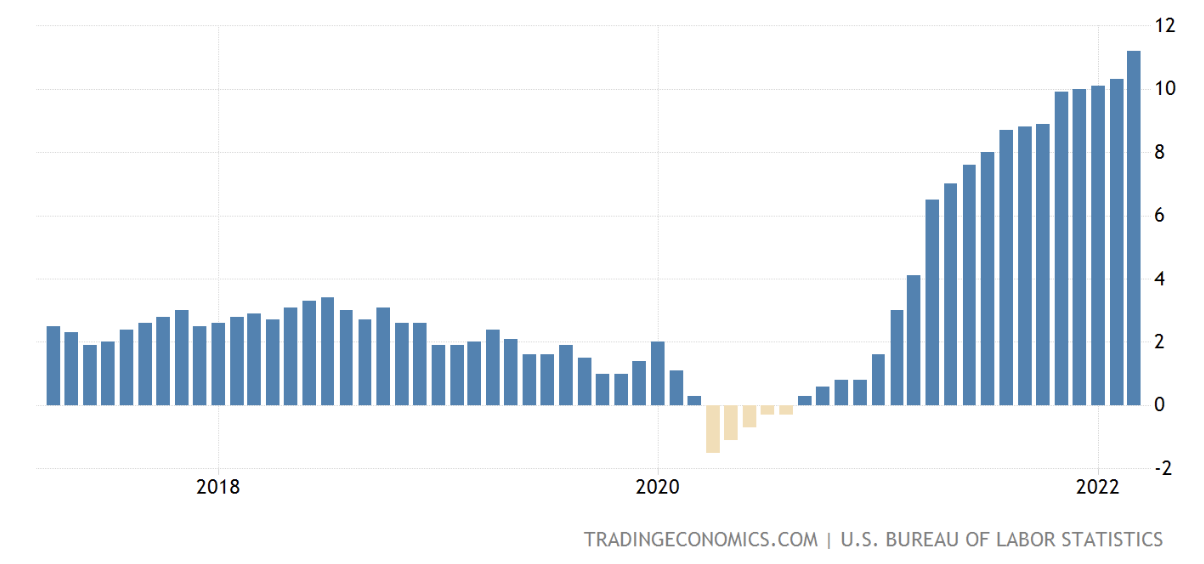

U.S. wholesale inflation records biggest increase in 40 years

TradingEconomics/Staff/4-13-2022

“Producer prices for final demand in the US increased 1.4% month-over-month in March of 2022, the biggest increase since at least December 2009 and above market forecasts of 1.1%. Main upward contribution came from diesel fuel prices (20.4%) and cost also went up for gasoline (4.9%), fresh and dry vegetables (42.4%), jet fuel (23%), iron and steel scrap (27.6%), and electric power (1.9%). In contrast, prices for beef and veal fell 7.3% and cost for residential natural gas (-0.4%) also declined. Prices of services increased 0.9%, mainly due to a 1.2% rise in margins for final demand trade services. Prices for final demand transportation and warehousing services (5.5%) and for final demand services less trade, transportation, and warehousing (0.3%) also moved higher. Compared to March 2021, producer prices were up 11.2%, the biggest increase since January of 1981.”

United States Producer Prices

(%, year over year)

Chart courtesy of TradingEconomics.com

Is the new stagflation policy-proof?

Project Syndicate/Noriel Roubini/3-30-2022

USAGOLD note: Roubini returns to an old theme in his latest – the no-win situation in which governments and central banks now find themselves. He says no matter which course they take, “households and consumers will feel the pinch.” If the new stagflation, which he sees as already in place, is truly policy-proof, history tells us that the investment options are limited. Stocks and bonds do not have a history of doing well during periods of stagflation – the 1970s being the prime example. Gold and silver, on the other hand, shone brightly during that time period. Citibank released an analysis last week in which it said that because of today’s “unique conditions,” it has “added tactical exposures to natural resources, oil services and gold.”

Cult of the Cossack helps explain Ukraine’s resistance

The New York Sun/James Brooke/3-25-2022

USAGOLD note: For those who would like some deep background on Ukraine’s history and culture, this will be a welcome read. Memorable quote near the article’s conclusion – “Into this hornet’s nest, Vladimir Putin has just stepped with his imperial boots.”

Metals world agonizes over war but keeps buying from Russia

Mining.com/Jack Farchy, Mark Burton and James Attwood –Bloomberg/4-4-2022

USAGOLD note: An in-depth look at the London Metals Exchange and the stresses imposed by the sanctions on Russia – an important source of the industrial metals it trades.

There’s a vibe shift happening in the economy as people freak out over inflation and a possible recession

MarketsInsider/Bertie Scott and Ben Winck/4-4-2022

USAGOLD note: This article resurrects a phrase we have not encountered since the dark days of the 1980s recession – economic malaise. The Fed’s view is that all is well. SocGen’s Albert Edwards calls such thinking “utter unadulterated bilge.”

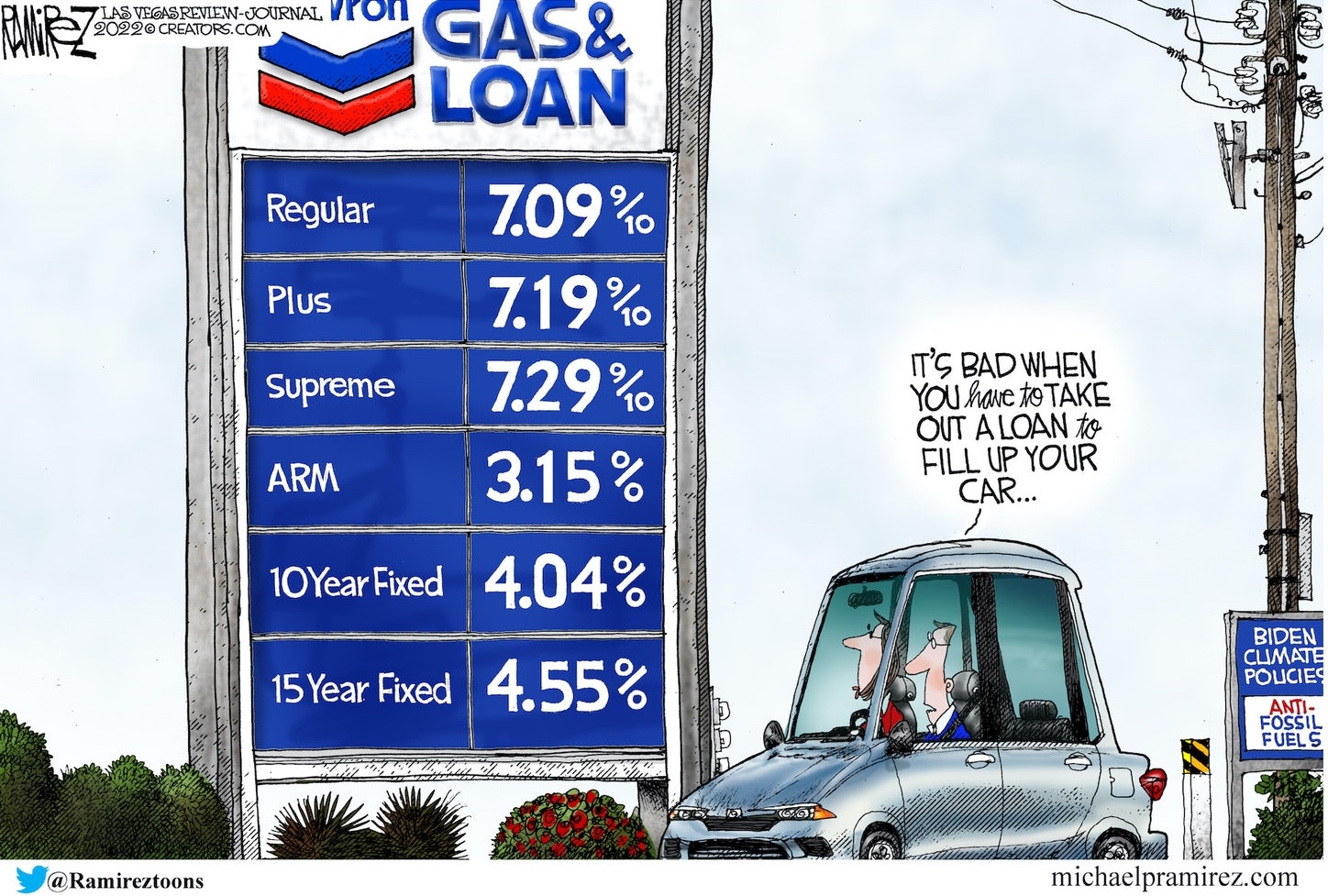

Gold surges on hot inflation report

‘Fed can print dollars, but it can’t print commodities and economic growth’

(USAGOLD – 4/12/2022) – Gold surged in early trading as the Labor Department reported consumer prices for March rising 8.5% – the highest inflation rate since the early 1980s. It is up $12 at $1968. Silver is up 14¢ at $25.31. With inflation now indisputably running near double-digit levels, investors have become skeptical of the Fed’s resolve to contain surging prices. “They (the Fed) can print dollars, but they can’t print commodities and economic growth in quite the way that they would like,” independent analyst Ross Norman told Reuters in a report released overnight. “The chance of a significant policy error in not responding quicker (to inflation) looks ever greater and that will feed into gold.”

In a Bloomberg report posted last week, JP Morgan said that commodity allocations could conceivably rise to 1% of global financial assets as investors look to hedge inflation. That would imply, says the firm, “another 30% to 40% upside for commodities from here.” According to Van Eck’s Ima Casanova, though gold has lagged the rest of the commodities complex as inflation has ratcheted up, that might be about to change.

“What we’ve seen in previous inflationary cycles,” she says in a recent interview at Seeking Alpha, “is that gold tends to underperform other commodities in the first part of the inflationary cycle. And then in the second part of the cycle, which we could be entering or closer to entering, gold then outperforms other commodities. So it’s almost like the markets take a little time to really digest inflation, to really believe that inflation is here, that it’s elevated and it’s going to be here for a while before it fully prices in and it reflects in gold’s performance.” If JPM is right that commodities have another 30%-40% upside potential, gold would need to travel a considerable distance to outperform the commodity indices.

Gold and the S&P Goldman Sachs Commodity Index

Chart courtesy of TradingView.com

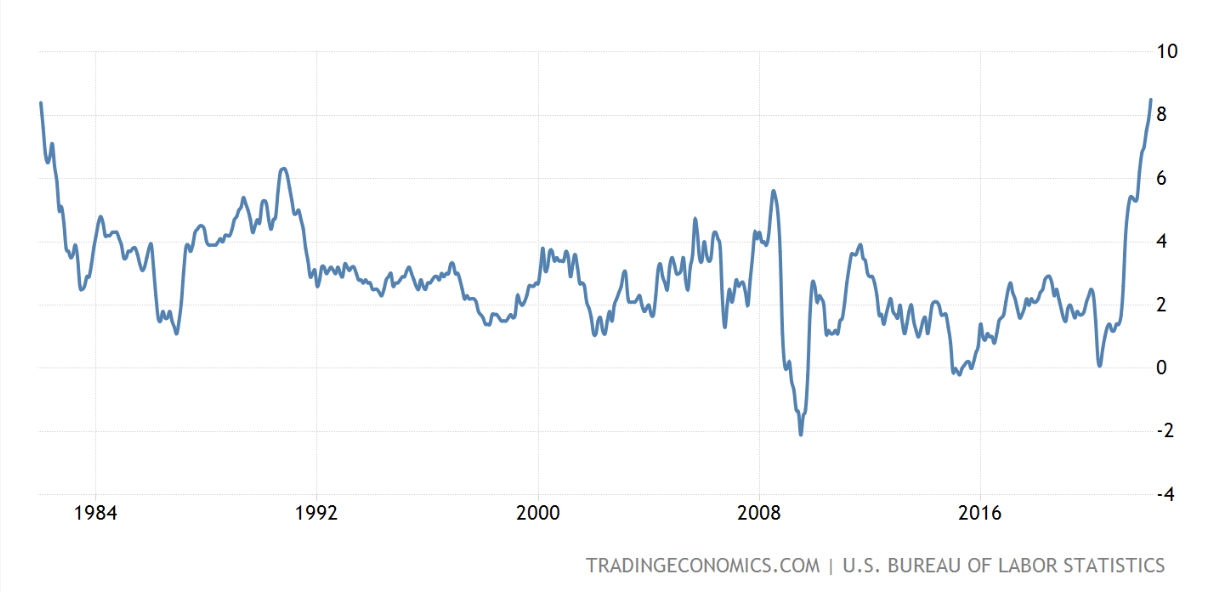

Inflation jumps 8.5% year over year – highest since 1981

TradingEconomics/Staff/4-12-2022

“Annual inflation rate in the US accelerated to 8.5% in March of 2022, the highest since December of 1981 from 7.9% in February. Figures compare with market forecasts of 8.4%. Energy prices increased 32%, namely gasoline (48%) and fuel oil (70.1%) in the wake of Russia’s invasion of Ukraine. Also, food prices jumped 8.8%, the most since May 1981. Meanwhile, inflation also accelerated for shelter (5% vs 4.7% in February) and new vehicles (12.5% vs 12.4%) but eased for used cars and trucks (35.3% vs 41.2%). On a monthly basis, consumer prices were up 1.2%, the biggest increase since September of 2005 and matching forecasts, with main contributions coming from gasoline, shelter, and food.”

USAGOLD note: If the 1.2% monthly increase were applied on an annualized basis, it would put the inflation rate well into double digits at 14.4%.

United States Inflation Rate

Source: tradingeconomics.com

Notable Quotable

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

“Gold has been around for thousands of years. Bitcoin has been around for 20 years.”

Dennis Gartman

Markets analyst

–––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Why the tanking Japanese yen should concern investors

Yahoo!Finance/Jared Blikre/3-31-2022

“The Bank of Japan (BOJ) was in a bind on Monday. Its currency, the yen, was crashing while yields on their government bonds were surging. The solution — four days of unbridled bond buying by the BOJ to stem the hemorrhaging and contain interest rates. While the gambit worked (for now), Wall Street is waking up to this potential canary in the coal mine.”

USAGOLD note: Quietly, while all eyes are on Ukraine, the rising inflation rate, and problems in the U.S. bond market, another bond market crisis has been brewing in the land of the rising sun. Inspired by deliberate Bank of Japan policies to save its bond market, the yen is dropping like a rock. The collapse could create reciprocal action to weaken other currencies, like the yuan. China devalued back in 2015, the “surprise move,” says Blikre, “upended global risk markets and sent many stock markets around the world plunging into bear territory.” As if the financial market did not have enough on its plate ……

Chart courtesy of Trading Economics.com

An inflection point for silver

Seeking Alpha/Money Show/3-25-2022

“I now expect inflationary psychology to kick in. That’s when people start to accept that inflation is going to remain at high levels, and for the next several years. As a result, they try to “get ahead” of inflation. So they buy more, and they buy some things sooner than planned to avoid even higher prices in the future. The thing is, this creates a feedback loop of even higher and faster rising prices; a vicious circle that becomes very difficult to break. What can you do about it? Well, silver crushes inflation. In the 1970s, we experienced an entire decade of high and rising inflation. Yet silver generated a gain of 3,700%.”

USAGOLD note: A counter-intuitive argument favoring silver in a recessionary environment……