Monthly Archives: March 2022

Judging from price movements on Monday, the Federal Reserve risks slipping further into a no-win interaction with markets that is more familiar to developing countries that lack policy credibility than to a systemically important central bank — let alone the world’s most powerful one.

MarketsInsider/Ben Winck/3-22-2022

“Shipping costs remain elevated, and it usually takes 12 to 18 months for those higher costs to made their way to the prices Americans pay, Nicholas Sly, an economist at the Kansas City Fed, told The New York Times in a story published Monday. That means pricey shipping could keep inflation at worryingly high levels well into 2023 even if container prices start to fall.”

USAGOLD note: Under what circumstances do the currently sky-high shipping costs reverse themselves, not to speak of the rapidly rising cost of the goods being shipped?

Russians are buying so much gold amid the ruble’s collapse that the central bank halted its own purchases from banks

MarketsInsider/Natasha Dailey/3-15-2022

USAGOLD note: Not sure how citizen demand for gold folds into Russia’s central bank suddenly deciding to curtail purchases for its reserves. We do understand, however, the connection between a rapidly deteriorating currency and private investor gold purchases. Abolition of the value-added tax greases the wheels. With sanctions no doubt inhibiting Russian imports of the yellow metal, the existing supply becomes all the more dear.

A BRIC house and an international dollar default by the United States

MishTalk/Mish Shedlock/3-15-2022

USAGOLD note: Quoting Munchau extensively, Shedlock raises concerns not vocalized in the mainstream media. He says that among the many unintended consequences, “the unprecedented actions may have just started a global currency crisis.”

AMC stuns investors with investment in gold and silver mine as it puts $1.8 billion war chest to work

MarketWatch/Ciarra Linane/3-15-2022

USAGOLD note: AMC’s interest in precious metals will turn more than a few heads in the investment business. One wonders if we are going to see more of this sort of thing as we move along the inflation highway.

Short and Sweet

Thinking in big numbers

“[T]hink of it [big numbers],” she says, “in terms of time, like Richard Panek, a professor at Goddard College in Vermont and a Guggenheim fellow in science writing. There are 1 million seconds in roughly 11½ days. There are 1 billion seconds in around 31 years. And there are 1 trillion seconds in around 31,000 years.”

Do you find the Biden administration’s approach to big numbers a bit unnerving?

Explosion in demand for gold as Ukraine smoulders

Moneyweb/Ciaran Ryan/3-14-2022

USAGOLD note: The explosion in physical gold demand was well underway long before the war began. The war made it headline material – likewise for silver. In our view, we have already seen the beginnings of the short-covering Ryan mentions.

Gold turns lower on Powell’s more aggressive rate tone

James Turk believes silver will break above $50 to join other soaring commodities

(USAGOLD – 3/22/2022) – Gold turned lower as investors balanced Fed chairman Powell’s more aggressive tone on rate hikes with worries of a prolonged war in Ukraine and its inflationary side effects. It is down $8 at $1931. Silver is down 13¢ at $25.17. Though silver’s reaction to Russia’s invasion of Ukraine has been muted thus far, James Turk, the long-time precious metals market analyst, believes that is all about to change.

“Given silver’s exceptional undervaluation at current prices,” he says in a recent report posted at King World News, “it appears to me that 2022 will be the year that silver completes the handle on this chart pattern by doubling in price from here. More importantly, 2022 is setting up to be the year that silver finally breaks above $50 per ounce to join the soaring prices we are seeing in so many other commodities because the dollar is being so badly debased. … Given silver’s exceptional undervaluation at current prices, it appears to me that 2022 will be the year that silver completes the handle on this chart pattern by doubling in price from here. More importantly, 2022 is setting up to be the year that silver finally breaks above $50 per ounce to join the soaring prices we are seeing in so many other commodities because the dollar is being so badly debased.”

Silver price

(Log scale, 1971-present)

Chart courtesy of TradingView.com

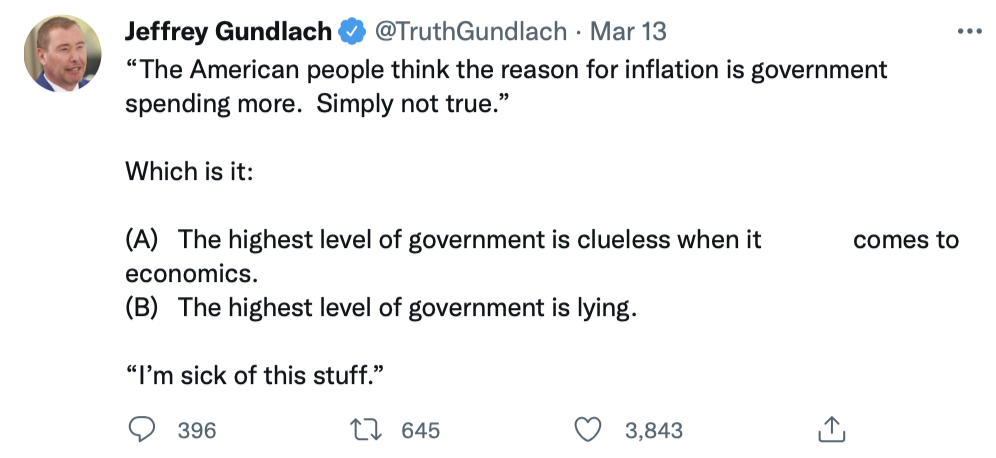

The reason for inflation is not that the government is spending more

Twitter/Jeffrey Gundlach/3-13-2022

USAGOLD note: The statements in quotes are from President Joe Biden.

Hedge funds walk away from LME after $3.9 billion in trades torn up

Yahoo!Finance/Mark Burton and Jack Farchy (Bloomberg)/3-10-2022

USAGOLD note: If traders are blackballing the LME, as this article chronicles, it will have a difficult time regaining its reputation after those 18 fateful minutes of chaos in the nickel market. Too, we do not know at this juncture what problems the “torn up trades” are causing with counterparties up and down the line – i.e., the rollover effect and consequent systemic risks. Given the reaction of traders like Sadrian, there could be considerably more turmoil in base metals markets before all is said and done.

Related: JPMorgan is the biggest counterparty for nickel tycoon’s short bets/Bloomberg/3-11-2022

Image attribution: Kreepin Deth, CC BY 3.0 <https://creativecommons.org/licenses/by/3.0>, via Wikimedia Commons

Russia threatens to make external debt payments in roubles

Financial Times/Max Seddon and Adam Samson/3-14-2022

USAGOLD note: This is how financial crises begin – quietly with few factoring in the unintended consequences in unexpected places. There are those on Wall Street who will remember the last Russian default in 1998 and the damage done a little-known hedge fund called Long-Term Capital Management.

The stunning truth about the FDIC and your bank deposits

ElliotWave.com/Bob Stokes/3-8-2022

USAGOLD note: The problem reduces to a matter of counter-party risk. Whenever an asset pays a yield or interest, the depositor (or investor) is depending upon the institution’s ability to pay – whether it be a corporation or government (in the case of a bond) or a bank (in the case of a deposit). Though the FDIC can cover losses when a bank or two fails, it cannot cover, as Stokes points out, a widespread banking system meltdown. Gold, on the other hand, is a stand-alone asset that does not rely on another party for value. It carries no counterparty risk. That is why some analysts portray it as the ideal defensive asset for the times.

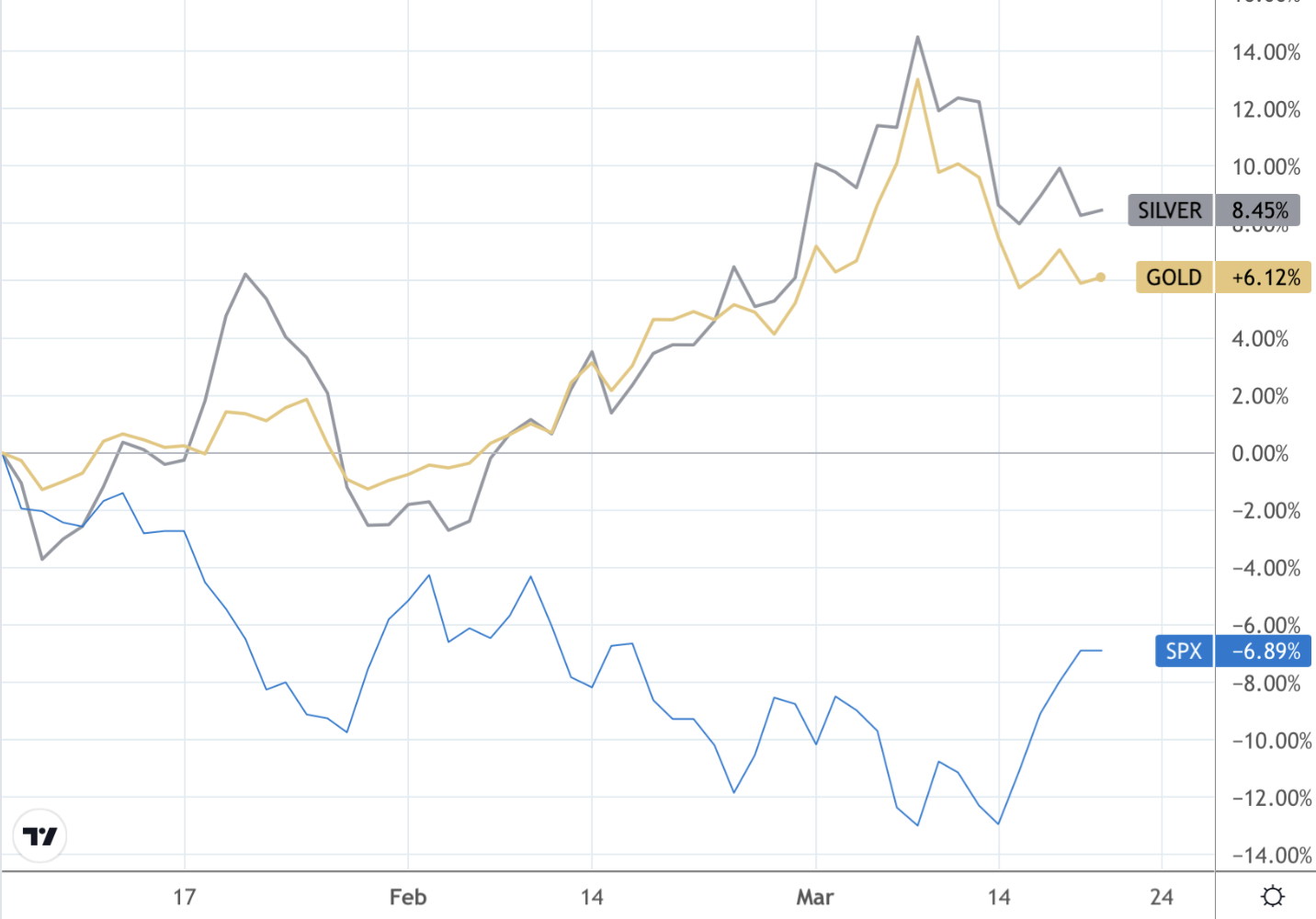

Gold tracking higher this morning as ceasefire, Fed concerns fade

Gold up 6.12% year to date. Silver up 8.45%. Stocks down 6.89%.

(USAGOLD – 3/21/2022) – Gold is tracking higher this morning as hopes for a Ukraine ceasefire faded, Europe signaled it might join the US embargo on Russian oil, and the Fed interest rate hike moved off the front burner. It is up $4.50 at $1930. Silver is up 5¢ at $25.13. Year to date, gold is up 6.12%; silver is up 8.45%, and the S&P 500 is down 6.89%. Saxo Bank’s Ole Hansen says that fund long liquidations may have now run their course in the gold futures market, while longer-term fund investors bought the recent dip, adding 122 tonnes to ETF stockpiles.

“We maintain our bullish outlook in the belief inflation will remain elevated,” he writes in a report released this morning, “while central banks may struggle to slam the brakes on hard enough amid the risk of an economic slowdown. We believe the Russia-Ukraine crisis will continue to support the prospect for higher precious metal prices, not only due to a potential short-term safe-haven bid which will ebb and flow, but more importantly due to what this tension will mean for inflation which is likely to remain persistently high as global growth slows, thereby eventually forcing central banks, especially the US Federal Reserve, to abandon further rate hikes and instead revert to a period of renewed stimulus.”

Gold, silver, and S&P 500

(%, year to date)

Chart courtesy of TradingView.com

Toppling the dollar as reserve currency risks harmful fragmentation

Financial Times/Robin Harding/3-10-2022

“Zoltan Pozsar of Credit Suisse argues that the central bank freeze marks the death of the post-Bretton Woods system, born after Richard Nixon took the US off the gold standard in 1971, and the start of a new monetary order ‘centred around commodity-based currencies in the east.’ If your dollars can vanish at the whim of the issuer, the logic runs, then a reserve must exist outside the dollar-based financial system.”

USAGOLD note: The gist of this article is that, despite Pozsar’s warning, nation-states have little choice but to stick with the dollar as the primary reserve currency, and that very well could turn out to be the case. At current prices, gold is too small a portion of most countries’ nominal reserves to serve as an effective defense mechanism. The fact of the matter is that the price would have to be substantially higher to meet that need. That said, the indigenous population must still find a means for protecting their own assets under such circumstances. That is where gold can serve a useful purpose.

Putin’s options

Daily Reckoning/James Rickards/3-8-2022

USAGOLD note: Rickards foresees a boomerang effect wherein sanctions on Russia could cause collateral damage on Wall Street …… Beware the black swan. Over the weekend, Financial Times reported billions in losses among funds and institutions including BlackRock, Pimco, Janus and others, and that is probably just the tip of the iceberg.

Treasury Secretary Janet Yellen says Americans will likely see another year of ‘very uncomfortably high’ inflation

“Treasury Secretary Janet Yellen said Thursday that Americans will likely see another year of ‘very uncomfortably high’ inflation as Russia’s invasion of Ukraine muddles her prior forecast that price acceleration would moderate in the months ahead.”

USAGOLD note: It wasn’t that long ago (about the time Ramirez drew the cartoon above in late November) that the Treasury Secretary was telling us that inflation was transitory – not something to worry about. Now she conveniently blames inflation on the war in Ukraine, trundling aside the inflationary effect of trillions being printed to fight the pandemic and coincident economic slowdown.

Russia has caused a ‘monetary earthquake,’ fiat currencies are going to ‘fail spectacularly’

QTR’s Fringe Finance/Lawrence Lepard via Zero Hedge/3-2022

“What just happened in the last two weeks is enormously important and misunderstood by many investors. The Russian invasion of Ukraine and the corresponding Western sanctions and seizure of Russian FX reserves are nothing short of a monetary earthquake. The last comparable event was Nixon’s abandonment of the gold standard in 1971.”

USAGOLD note: We try to present theory and opinion on this page ranging from mainstream sources to those who have a more nuanced, even radical, view. Lawrence Leopard presents a view of the Russo-Ukraine war definitively out of the mainstream. “Recall,” warns Lepard, “that post this event*, gold went from $35 per ounce to $800 per ounce (23x). Russia’s move will lead to a similar move in favor of gold.”

*French president Charles DeGaulle’s demanded in the late 1960s that the U.S. redeem France’s dollar holdings with gold. In the photo above, President Nixon meets with Secretary of Treasury George Schultz and economist Milton Friedman just before suspending gold redemptions in 1971.

Gold tracks quietly to the south as we end a tumultuous week

Pozsar warns ‘we are witnessing the birth of Bretton Woods III – a new world monetary order’

(USAGOLD – 3/18/2022) – Gold is tracking quietly to the south in early trading as Wall Street braces for stock options triple-witching today, and Russia presses its bombardment of key Ukrainian cities. It is down $3 at $1944. Silver is down 2¢ at $25.41. After all is said and done – another tumultuous week behind us – gold is down 3% on the week, and silver is down about 3.5%. One of the unintended consequences of Russian sanctions, including most notably immobilization of its central bank reserves, is the threat they unwittingly impose on the US dollar’s status as the world’s reserve currency.

In a report released earlier this month, Zoltan Pozsar, the widely followed Credit Suisse economist, warns that “we are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West. A crisis is unfolding. A crisis of commodities.” He concludes: “Do you see what I see? Do you see inflation in the West written all over this like I do? This crisis is not like anything we have seen since President Nixon took the US dollar off gold in 1971 – the end of the era of commodity-based money.”

Nickel plunges 5% and London Metal Exchange halts trading once again as chaos continues

MarketsInsider/Harry Robertson/3-166-2022

“The chaos in the nickel market resumed Wednesday, as prices instantly fell 5% and the London Metal Exchange was forced to suspend trading due to a glitch just minutes after reopening from a rare week-long break.”

USAGOLD note: Thursday morning, nickel opened down the 8% limit. Chaos, messy volatility, absolute craziness – all descriptions that apply to the situation in the nickel market. The LME is struggling to maintain confidence in its ability to host a market for some of industry’s most vital commodities.

Nickel price

(%, year to date)

Geopolitical strife bolsters case for gold

Seeking Alpha/Van Eck/3-10-2022

“Historically, geopolitical turmoil has been a short-term driver of gold prices. Geopolitical drivers rarely last in the longer term for gold as the world adjusts to new realities. However, the Ukraine war is having a greater impact on the global economy and financial system than any regional conflict in recent memory. Gold is now consolidating its break-out gains above the $1,900 level.”

USAGOLD note: If you are among the group watching gold’s breakout and wondering what is driving it, this article from VanEck offers a solid summary – a helpful starting point for newcomers.

‘Big Short’ investor Michael Burry returns to Twitter with a nod to the 1970s

MarketsInsider/Shalini Nagarajan/3-10-2022

USAGOLD note: It is difficult to separate gold from the 1970s stagflationary analysis. It was the top performer during the period while stocks languished. There is no guarantee history will repeat at this juncture, but gold’s rise in concert with stagflationary concerns over the past six months is worth noting. One wonders if Burry’s ‘Big Short’ has morphed to a ‘Big Long’ ??