Monthly Archives: March 2022

Five critical factors why prices will stay high for years

Sovereign Man/Simon Black/3-14-2022

“So, when the three key institutions charged with keeping inflation in check refuse to understand why there’s a problem, it’s hard to imagine they’re going to fix it. There are plenty of other lingering inflation factors as well; geopolitical conflict is obviously inflationary. COVID-19 continues to be very inflationary. Environmental fanaticism is inflationary. And just like the challenge of increased manufacturing costs, and labor market demographic trends, these issues cannot be magically fixed by politicians or central bankers. In essence, policymakers are completely powerless to do anything about inflation.”

USAGOLD note: A less than hopeful scenario on inflation …

OPINION: ‘Silver will stun investors by surging above $50 in 2022’

KingWorldNews/James Turk/3-17-2022

USAGOLD note: Turk’s analysis relies heavily on the gold-silver ratio which is now at 76-1. He believes the time has come for it to outperform gold. “My assessment,” he concludes, “is that both silver and gold are poised to make new record highs this year. And for this week, any pullbacks in price as the Federal Reserve announces its interest rate increase should be viewed as an opportunity to buy physical gold and physical silver.”

Guggenheim’s Minerd says Fed has ‘abandoned’ monetary orthodoxy

Bloomberg/Alex Wittenberg/3-16-2022

“The Fed has largely abandoned monetary orthodoxy. It’s trying to be too cute in how it’s managing this.” – Scott Minerd

USAGOLD note: Most would agree that the net result has been a marked increase in market uncertainty and volatility across the boards. He says the Fed risks an “accident” (presumably runaway inflation) by failing to control the money supply.

Gold drops sharply as investors mull over the prospect of an economic slowdown

Gold’s difficulty with ‘big numbers’

(USAGOLD – 3/27/2022) – Gold dropped sharply in overseas trading as investors weighed the inverting yield curve, Shanghai went into an Omicron-driven shutdown, and investors mulled over the prospect of a general economic slowdown. It is down $22 at $1939. Silver is down 45¢ at $25.18. A stronger dollar this morning is also weighing on gold market sentiment. Gold Newsletter’s Brien Lundin believes that there will be setbacks ahead for precious metals, even though they now have the wind at their back.

“Important to remember,” he writes in a recent advisory, “that these ‘big numbers’ usually take at least a few tries (and often many tries) to get through, as you can see in the chart below. Note how many attempts it took gold to clear the $1,700, $1,800, $1,900 and, yes, $2,000 levels. So clearly the next hurdle likely won’t be the last time gold bounces around $2,000. But the difference now is that not only has the technical picture cleaned up considerably, we also have the powerful fundamentals of inflation and the Fed’s doomed battle against it to support the gold uptrend.”

Gold price

Chart courtesy of TradingView.com per Brien Lundin-Gold Newsletter

– USAGOLD’s widely acclaimed monthly client letter –

NEWS &VIEWS

Forecasts, Commentary and Analysis on the Economy and Precious Metals

The contemporary, web-based version of our client letter traces its beginnings to the early 1990s as a hard-copy newsletter mailed to our clientele. Its principal objectives have always been the same – to keep our clients informed on important developments in the gold market, condense the available gold-based news and opinion into a brief, readable digest, and to counter the traditional anti-gold bias in the mainstream media. That formula has won it a five-figure subscription base. In addition to our regular newsletters, we occasionally publish in-depth special reports that focus on events and developments of interest to gold owners. Valued for their insight, accuracy and reliability, our publications are linked and reprinted by a large number of websites both in the United States and around the globe.

______________________________________________________________________________________

Looking to get informed and stay informed on the gold market?

TRY A FREE SUBSCRIPTION TO OUR MONTHLY CLIENT LETTER.

No strings attached. Prospective clients welcome!

Bretton Woods III

Credit Suisse/Zoltan Pozsar/3-7-2022

“We are witnessing the birth of Bretton Woods III – a new world (monetary) order centered around commodity-based currencies in the East that will likely weaken the Eurodollar system and also contribute to inflationary forces in the West. A crisis is unfolding. A crisis of commodities. Commodities are collateral, and collateral is money, and this crisis is about the rising allure of outside money over inside money. Bretton Woods II was built on inside money, and its foundations crumbled a week ago when the G7 seized Russia’s FX reserves…”

USAGOLD note: We referenced this important analysis in Friday’s Daily Market Report and repost the link here for those who may have missed it ……

Image attribution: Archives New Zealand, CC BY-SA 2.0 <https://creativecommons.org/licenses/by-sa/2.0>, via Wikimedia Commons

India explores ‘rupee-rouble’ exchange scheme to beat Russia sanctions

Financial Times/Chloe Cornish/3-16-2022

USAGOLD note: Financial Times observes that an India-Russia trade agreement that circumvents the dollar “risks provoking an angry response” from the U.S. and its allies. We are surprised that this article was sent to the back pages of Friday’s FT and not featured more prominently, but the article gives the impression that much is left to be negotiated within India itself before any agreement is enacted.

The economic weapon

The New York Sun/Seth Lipsky/3-13-2022

“There is the larger risk that the Russia sanctions, by in effect weaponizing finance and the greenback itself, might also damage the central role of the American dollar in the global finance system.”

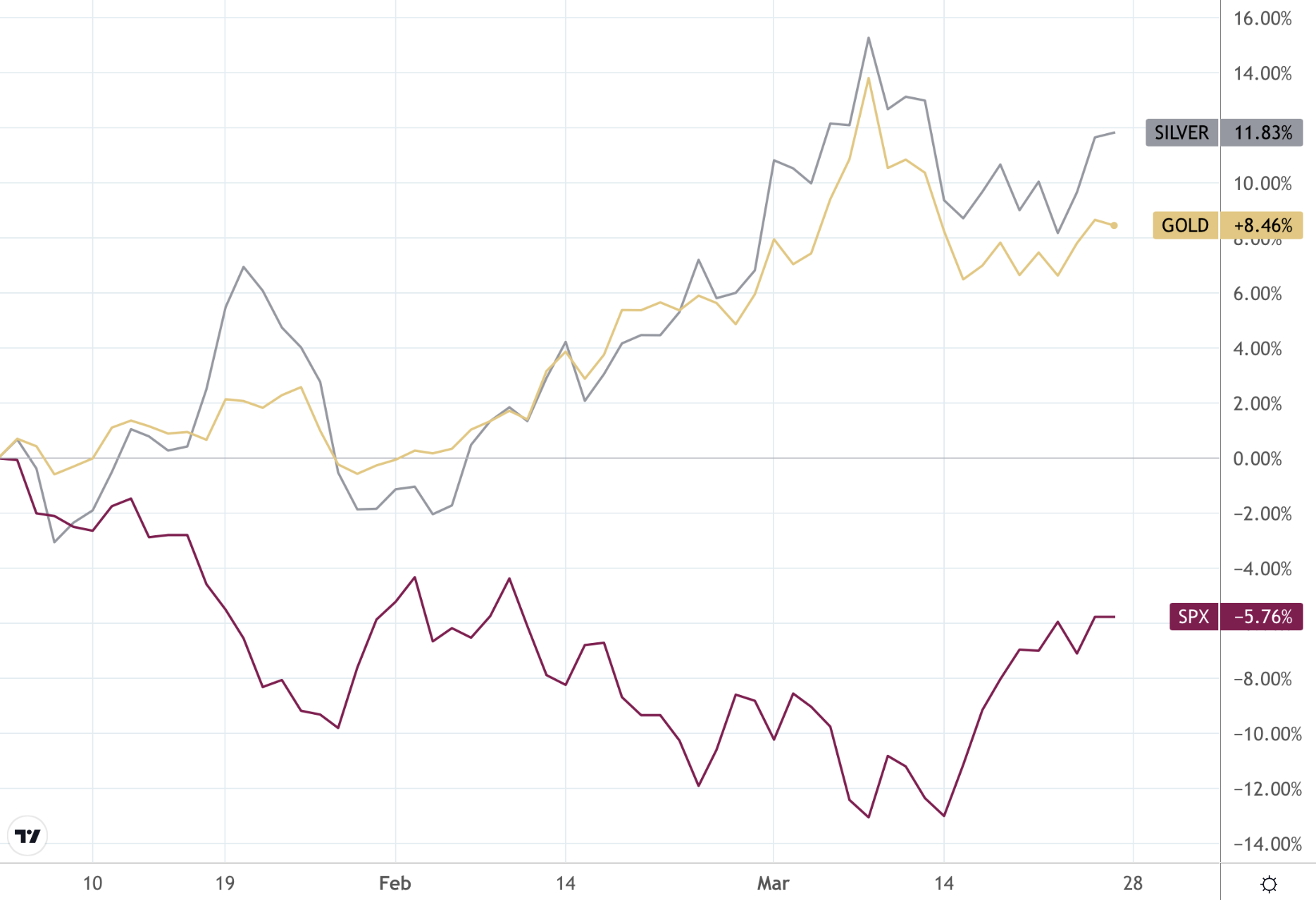

Gold takes a breather from renewed push toward $2000 mark

Interest Rate Observer’s James Grant says ‘it’s a terrific time’ to own gold

(USAGOLD 3/25/2022) – Gold is taking a bit of a breather from its renewed push toward the $2000 mark this morning as investors weigh the prospect of an inverting yield curve, building stagflationary pressures, and the likelihood of a protracted conflict in Ukraine. It is down $3 at $1958. Silver is up 6¢ at $25.73. Year to date, silver is up 11.83%; gold is up 8.46%, and stocks are down 5.76%.

James Grant, the erudite and widely followed editor of Grant’s Interest Rate Observer, believes the roughly minus 7% real rate of return on yield assets suggests “we are living through a time of truly unusual if not unique monetary events.” In an interview with Wealthion’s Adam Taggert posted yesterday, he says that history in this case “would counsel us to be humble, prepared to listen and to interpret correctly.” Pointing to the “free money” the Fed has cultivated for a dozen years, Grant says gold “is the future. An inveterate gold bug, I am. I do retain my conviction that gold will be the survivor among alternatives to favored currencies, … I think it is a terrific time [to own the metal]. Gold has put in a millennia of service as a monetary medium. … So gold is eternal.”

Gold, silver and stocks performance

(%, year to date)

Chart courtesy of TradingView.com

Is gold too expensive?

Eurasia Review/Claudio Grass/3-23-2022

USAGOLD note: Claudio Grass, a Swiss-based investment advisor who looks favorably upon gold, addresses a question he sometimes gets from first-time investors looking into gold: Is the metal simply too expensive at current prices? His standard reply, he says, is “expensive compared to what?” But then per above, he digs a bit deeper ……

Gold at $10,000? Death of the 40-year bull market in bonds?

MarketWatch/Steve Goldstein/3-17-2022

“The shockwaves are still being felt by the incredible Western sanctions that have rendered the $630 billion in reserves the Russian central bank accumulated virtually unusable. Can the current dollar-centered global financial system last if money can be summarily cancelled?”

USAGOLD note: Analysts interviewed for this article say that central banks will be looking to accumulate a lot more gold so that they are not in a position where what happened to Russia can happen to them. The net result, says one of the analysts, will be gold trading at over $10,000 per ounce. More at the link ……

Energy traders call for ‘emergency’ central bank intervention

Financial Times/Claire Jones, Neil Hume and Martin Arnold/3-16-2022

USAGOLD note: Those are some pretty hefty names asking to be thrown a lifeline. How much more of this sort of thing is roiling beneath the surface reluctant to call for help?

Elon Musk says own ‘physical things’ when inflation is high

USAGOLD note: What is the number one ‘physical asset’ the well-informed investor thinks of when inflation is high? Hint: It’s not stocks.

Pozsar’s ‘margin call doom loop’ prediction comes true as Tafigura faces billions in margin calls

ZeroHedge/Tyler Durden/3-16-2022

USAGOLD note: Volcanic rumblings below the placid surface…… Will the Fed be forced back to quantitative easing before quantitative tightening gets off the ground?

Gold suddenly bolts higher on war concerns

TD Securities says gold ‘incredibly resilient’ despite ‘explosive price action in rates markets’

(USAGOLD – 3/24/2022) – Gold suddenly bolted higher this morning as safe-haven investors weighed an escalation in the Ukraine conflict and the United States raised concerns before NATO about possible Russian deployment of chemical and nuclear weapons in the conflict. It is up $12 at $1959. Silver is up 17¢ at $25.37. “Amplified” concerns about stagflation are also fueling safe-haven interest, according to one analyst quoted by Reuters this morning.

TD Securities sees gold as benefiting from the current investor interest in safe havens, something we pointed out yesterday in this report. “Market participants are keenly watching US 10-year rates as they approach a trend-channel that has served multi-decade-long resistance,” it says in a report posted yesterday afternoon at FX Street. “In this context, gold prices have remained incredibly resilient despite the explosive price action in rates markets following Chair Powell’s comments. While rates markets are now penciling in higher odds for a 50bp hike in May, gold markets could be reflecting a growing cohort of participants interpreting the Fed’s hiking path as being behind the curve on inflation, as the Fed moves too slowly and cautiously to tame inflation.”

The $140 billion question: Can Russia sell its huge gold pile?

Bloomberg/Eddie Spence/3-16-2022

USAGOLD note: Though the headline above is an eye-catcher, it may be a moot point. We are relatively certain that China would be happy to buy any gold Russia would care to sell – without any fanfare. It might also be glad to take gold as collateral in a dollar loan – a currency well-represented in its national reserves. In short, there is no need for Russia to go through Western channels to utilize its gold, and as a result any sales (or other types of mobilization) are unlikely to have a market effect of any consequence.

Sanctioned Russia teeters on brink of historic default

“Moscow is due to pay $117 million in interest on two dollar-denominated sovereign bonds it sold in 2013. But the limits it now faces in making payments, and talk from the Kremlin that it might pay in roubles – triggering a default anyway – has left even veteran investors guessing at what might happen.”

USAGOLD note: Even if a ceasefire is agreed, we have no idea how it will affect the sanctions already imposed, and whether Russia would at that point reconsider paying its debts in roubles. As it stands, Russia’s creditors will face the prospect of default sometime within the next 30 days when the grace period on current interest payments ends. The possibility of a default and contagion also plays into the Fed’s ability to pursue a more hawkish tilt in monetary policy.

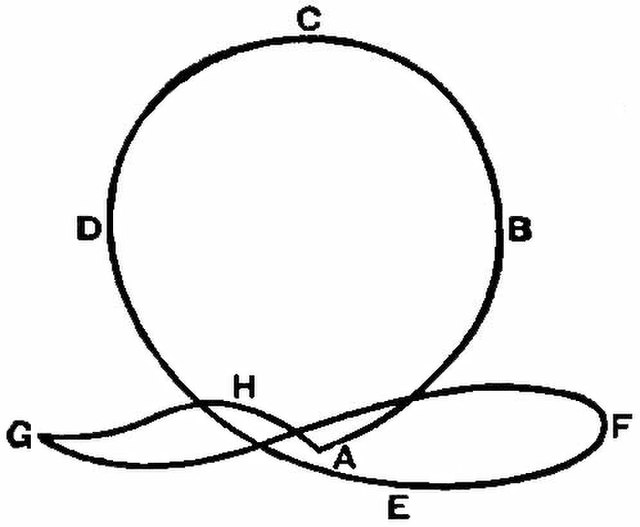

The west needs an off ramp from sanctions too

BloombergOpinion/John Authers/3-14-2022

USAGOLD note: Authers digs deep on the impact of war and sanctions on commodities’ trading (and markets) starting with nickel and ending with wheat. He correctly points out that the negatives on sanctions cut both ways, as shown persuasively by recent events at the London Metals Exhchange, i.e., the boomerang effect.

Image: Diagram of a boomerang flight path as seen from above.

World Food Price Index hits new all-time high

TradingEconomics/Staff/3-14-2022

“The FAO Food Price Index averaged 140.7 points in February 2022, a new all-time high, up 3.9% from January and as much as 20.7% above its level a year ago. The rise was led by large increases in vegetable oil and dairy price sub-indices. Cereals and meat prices were also up, while the sugar price sub-index fell for the third consecutive month. “Concerns over crop conditions and adequate export availabilities explain only a part of the current global food price increases. A much bigger push for food price inflation comes from outside food production, particularly the energy, fertilizer and feed sectors,” said FAO economist Upali Aratchilage. “All these factors tend to squeeze profit margins of food producers, discouraging them from investing and expanding production.” As the Food Price Index measures average prices over the month, the February reading only partly incorporates market effects stemming from the conflict in Ukraine.”

USAGOLD note: In short, the Russo-Ukraine war only partially accounts for rising food prices. The rest, we assume, is the result of the massive money printing operations just about everywhere to counter the negative economic effects of the pandemic. When food prices rise disproportionately, we will add, the possibility of social unrest rises with it.

World Food Price Inflation

Source: tradingeconomics.com

Gold pushes higher in continuation of post-Fed seesaw price performance

‘What is your peace of mind worth?’

(USAGOLD – 3/23/2022) – Gold pushed higher this morning in a continuation of its seesaw performance since the conclusion of last week’s Fed meeting. It is up $9 at $1933.50. Silver is up 24¢ at $25.11. This morning, Claudio Grass, a Swiss-based investment advisor who looks favorably upon gold, addresses a question he sometimes gets from first-time investors looking into gold: Is the metal simply too expensive at current prices? His standard reply, he says, is “expensive compared to what?”

“Now, while these are the sort of arguments I would usually bring up in conversations about ‘how high is too high’ when it comes to the gold price,” he says in a report posted at Eurasia Review, “the events of the last two years have made [me] realize that there [is] so much more to this question and led me to reconsider the way I answer these questions. It really does go a lot deeper than a comparison between gold and stocks, or considering the better ‘play’ for one’s portfolio performance. The real counter-question now is ‘what is your peace of mind worth’? I’ve always outlined this deeper way of thinking about this issue, and I’ve always found many who agreed with me among the rational, responsible, long-term gold investors.”

Editor’s note: Grass’ observations come on a day Bloomberg announces that the global bond market (gold’s chief competitor for strategic safe-haven capital flows) has “wiped out” $2.6 trillion in investor asset value, exceeding the losses incurred during the 2008 credit meltdown. As you can see in the chart below, gold is tracking higher with rising yields (a reflection of the sell-off in the bond market).

Gold and 10-year Treasury yields

(Six months)

Chart courtesy of TradingEconomics.com