NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 48th year in the gold business

March 2021

“Men, it has been well said, think in herds; it will be seen that they go mad in herds,

while they only recover their senses slowly, one by one.”

Charles Mackay

Extraordinary Popular Delusions and the Madness of Crowds

Will the Ides of March bring a market panic?

‘Owning the wheelbarrow might be better than the worthless cash it’s carrying’

One week before the recent bond market meltdown, Financial Times columnist John Dizard warned his readers to beware the Ides of March – that “some sort of panic in the US Treasury and mortgage-backed securities market” might develop. The high level of government borrowing in progress and about to be augmented by the $1.9 trillion stimulus program could be enough to send rates and money printing careening higher. “If my guess is right,” said Dizard, “we have the makings of another event like we saw a year ago.” That “liquidity” problem, as Fed chairman Jerome Powell described it at the time, was later labeled what it really was – a crisis that nearly collapsed the financial system. (Please see this rendition of events from The Guardian.)

During testimony before a Congressional committee just before things got dicey in the bond market, Powell was especially careful not to undermine the perception that he would do whatever was necessary to keep the markets calm. To taper, or even hint at it, would have been to send interest rates on a tear – and stock market investors heading for the exits. Shrugging off those assurances of ultra-easy money, sellers immediately thereafter began dumping bond positions pushing the yield on the 10-year Treasury over the 1.5% level – a .5% add-on since early February. Stocks, the dollar, gold, silver – did, in fact, all head for the exits.

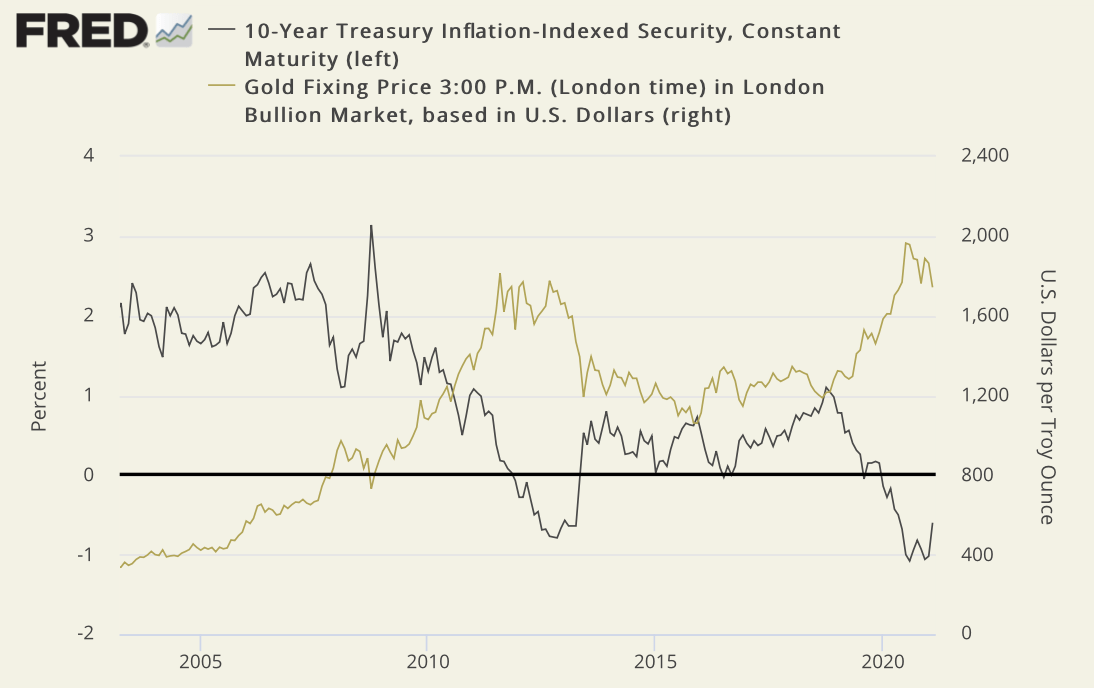

Sources: St. Louis Federal Reserve, Board of Governors, ICE Benchmark Administration

And so it is that we very well could be, as Dizard suggests, right back where we were this time last year. In the days ahead, the markets will be looking to the Fed to reassert itself as the bond buyer of last resort and keep a lid on the real rate of return, as shown in the chart above. If it fails in that respect, we might end up with a full extension of late February’s bond market panic. No one is more aware of what that could mean for the economy and financial markets than the Federal Reserve’s board of governors. As for gold, the chart clearly demonstrates that it has a propensity to rise when the real rate of return is in decline and decline when real rates are on the rise. Should inflation suddenly surge, or the Fed indeed become a more aggressive buyer of Treasuries (more QE), the current uptrend in the real rate could turn abruptly. As it is, the much-ballyhooed upward turn in real rates looks like a minor blip in a major overall downtrend.

At the moment, it does not appear that Fed liquidity operations are keeping up with an onslaught of bond selling that is pushing yields aggressively higher. That could change overnight. We should keep in mind that the Fed moved quickly and convincingly in money markets last March at the first signs of bond market weakness. Meanwhile, the central bank’s bond portfolio continues to expand at a record pace, and we haven’t even gotten around to the $1.9 trillion stimulus package.

Potential impact on the gold market

As Crescat Capital’s Kevin Smith and Tavi Costa point out in a recent client alert, the U.S. government issued $4.4 trillion of debt in 2020, and $2.4 trillion, or 54%, was purchased by the Federal Reserve. They believe that $300 billion per month in quantitative easing will be needed to cover the upcoming tab as opposed to the current $120 billion per month. “Global central bank money printing is one of the primary drivers of the gold price,” they say. “Our current valuation target for gold based on the level of central bank assets and the inelastic supply of above-ground gold is $3,200/oz. Note, this is a rising target.”

“Really smart investors,” says Morning Porridge’s Bill Blain, the London-based commentator, “are increasingly hedging their wealth created from financial assets (stocks and shares) by putting much of their allocations into Alternatives: outright real assets or cash flow driven assets, assets that are likely to retain value while still paying attractive returns. (The cost is lower liquidity). The idea is that if crisis ever comes, then owning the wheelbarrow might be better than owning the mountains of worthless cash it’s carrying (to cite the classic example of inflationary danger from Weimar Germany…)” If runaway inflation truly does materialize, a wheelbarrow full of gold and silver might be an even better option ……

Gold as portfolio ballast in a stormy financial sea

U.S. Mint posts biggest January so far this century for bullion coin sales

“I own gold,” says highly regarded market strategist David Rosenberg, “not to make a killing but as a ballast in the portfolio, a source of diversification and insurance policy against the gargantuan levels of outstanding liabilities… You hope your house doesn’t burn down, but you still have home insurance.” (The Market NZZ, February 2021) Since August, gold has been in a downtrend. Its descent, though, has not deterred demand, most likely for the reasons Rosenberg suggests. Investors of a like mind, in short, are taking the opportunity to stock up. In fact, an argument could be made that the price weakness only provoked even more demand, or at the very least sustained it, as the bond market imploded, stocks went into a skid, and the dollar plunged 12.5% from its April high.

The World Gold Council’s Louise Street reminds us that “Having languished at a relatively weak 20 metric tonnes in 2019, retail investment more than trebled to 66 tonnes in 2020. And while that remains some way below the levels seen during the Global Financial Crisis, bar and coin demand measured in value terms rocketed to almost $3.8 billion – the highest since 2011. According to recent data from the US Mint, this trend shows no sign of stopping so far in 2021. Sales of gold Eagle bullion coins topped 220,000 ounces in January (6 tonnes). That’s the highest monthly total since December 2009 and the strongest January sales so far this century.” [Emphasis added.] February Mint sales, we will add, were another 141,000 ounces – a healthy follow-up to traditionally strong January turnover.