NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 47th year in the gold business

DECEMBER 2020

“[W]e are bearish on the money of overextended governments.

We are bullish on the alternatives enumerated in the Periodic table.”

James Grant, Grant’s Interest Rate Observer

The once and future Fourth Turning

Neil Howe predicted the financial crisis and pandemic.

What does he see coming next?

It has become our custom to annually post an update of Neil Howe’s thinking in advance of the new year. Howe, as many of you already know, is the co-author (along with William Strauss, now deceased) of The Fourth Turning – the prescient analysis of long-term, generational cycles that first hit the bookstores in 1997.

“The next Fourth Turning,” they wrote in that book, “is due to begin shortly after the new millennium, midway through the Oh-Oh decade. Around the year 2005, a sudden spark will catalyze a Crisis mood. Remnants of the old social order will disintegrate. Political and economic trust will implode. Real hardship will beset the land, with severe distress that could involve questions of class, race, nation, and empire.” Who can read that remarkable passage without thinking of the 2008 financial crisis?

In a recent interview featured at MarketWatch, Howe points out that several scenarios he and Strauss predicted in The Fourth Turning have already occurred, i.e., a terrorist attack on New York (2001), a credit crisis (2009), Russia invading a former Soviet Republic (2014) and, believe it or not, a supervirus forcing lockdowns and quarantines (2020) – all in all, a remarkable track record by any standard.

Howe was asked where we stand now along the fourth turning timeline. This was his response:

“The Fourth Turning began in 2009 with the Great Financial Crisis. It received its second blow with the COVID lockdown. The Fourth Turning is a generation-long era, so we expect it to last until around the year 2030. So right now we’re roughly halfway through it. Typically Fourth Turnings accelerate. Solutions are deferred, people start putting things off, and then people panic and insist that someone take charge.”

Now he says that a “secession crisis” is possible – “a red zone movement” in which red zone states “call the blue zone’s bluff.” (Hedge fund stalwart Jeff Gundlach made a similar prediction at about the same time.) He also warns of a potential conflict with China. Last, he says to be on the lookout for inflation. “Do not,” he says, “get stuck in nominal assets. The year 2020 has launched the United States into the era of Modern Monetary Theory.”

Howe ends on a hopeful note. “The Fourth Turning,” he says, “is a dangerous era, an era of rapid change and clashing group loyalties. But it’s also an era in which we solve enormous national or even global problems. They are eras of creative destruction in which we reinvent our national identity.” If we indeed have a date with happy destiny in 2030, let it be that we arrive there with our wealth intact – a mission for which gold and silver have proven thus far to be particularly well suited. In 2009, gold’s average price was $972 per ounce. For silver, it was $14.67 per ounce.

Since 2015, gold’s year-end lows have given way to new year rallies.

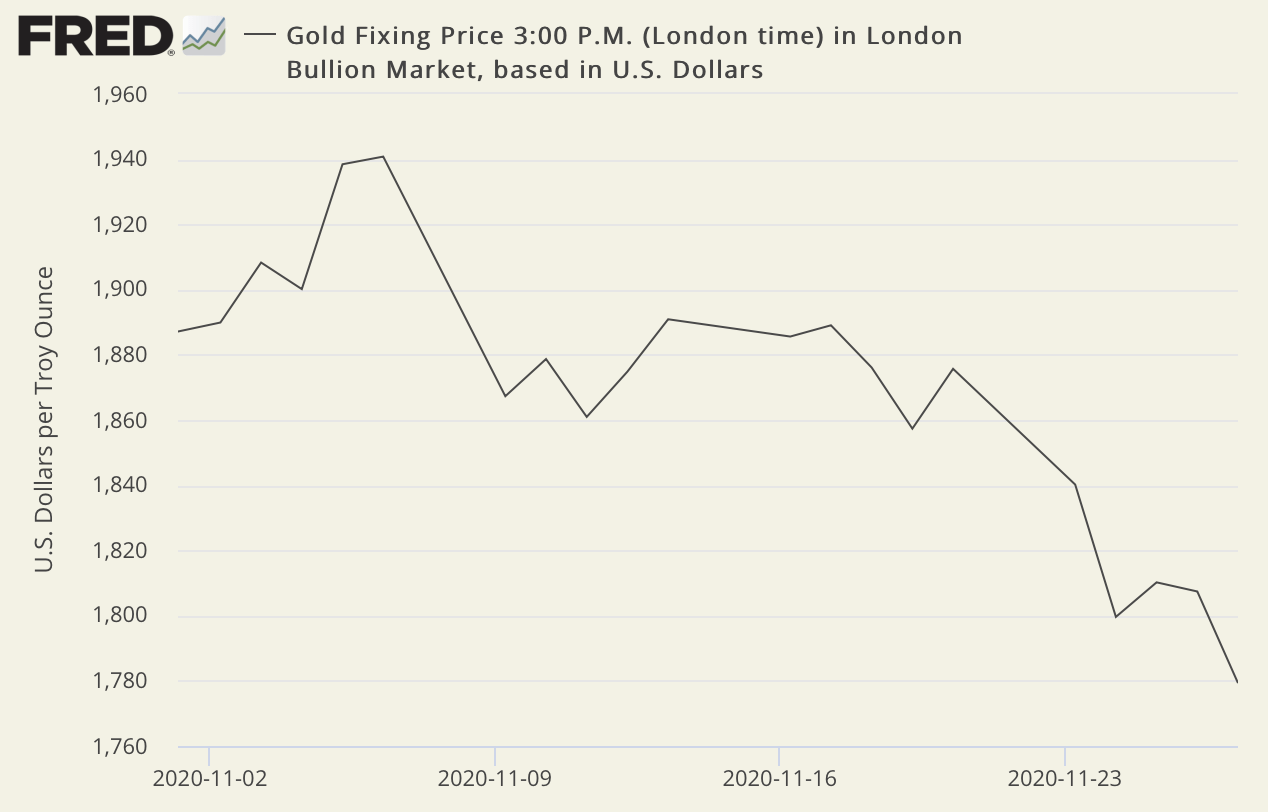

Long-term asset preservation investors who like to take advantage of price corrections might take note. Since 2015, year-end sell-offs in the gold market have morphed into new year rallies with noteworthy gains as shown in the table below – no guarantees, of course, but a pattern worth reviewing. True to form, gold is down about 8.25% since early November as this is written.

2015

Low in gold price: December 2nd – Price of gold: $1053.00

Price January 31st, 2016: $1118.00

Gain: 6.2%

2016

Low in gold price: December 15th – Price of gold: $1128

Price January 31st, 2017: $1210

Gain: 7.2%

2017

Low in gold price: December 11th – Price of gold: $1241.00

Price January 31st, 2018: $1345

Gain: 8.3%

2018

Low in gold price: October 8, but within $14 of the low on November 27th – Price of gold $1200 (Oct), $1214 (Nov)

Price January 31st, 2019: $1321

Gain: 8.8% (Nov), 10% (Oct)

2019

Low in gold price: November 25th – Price of gold: $1453.

Price January 31st, 2020: $1589.40

Gain: 9.4%

– Concept and research by Jonathan Kosares

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration [IBA]