NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 46th year in the gold business

APRIL 2020

The crisis ready investment portfolio

In a recent essay published at Project Syndicate, Harvard economics professor Kenneth Rogoff sets an ominous tone. Humanity, he says “is facing something akin to alien invasion” – an apt analogy, we thought. “With each passing day,” he goes on, “the 2008 global financial crisis increasingly looks like a mere dry run for today’s economic catastrophe. The short-term collapse in global output now underway already seems likely to rival or exceed that of any recession in the last 150 years.”

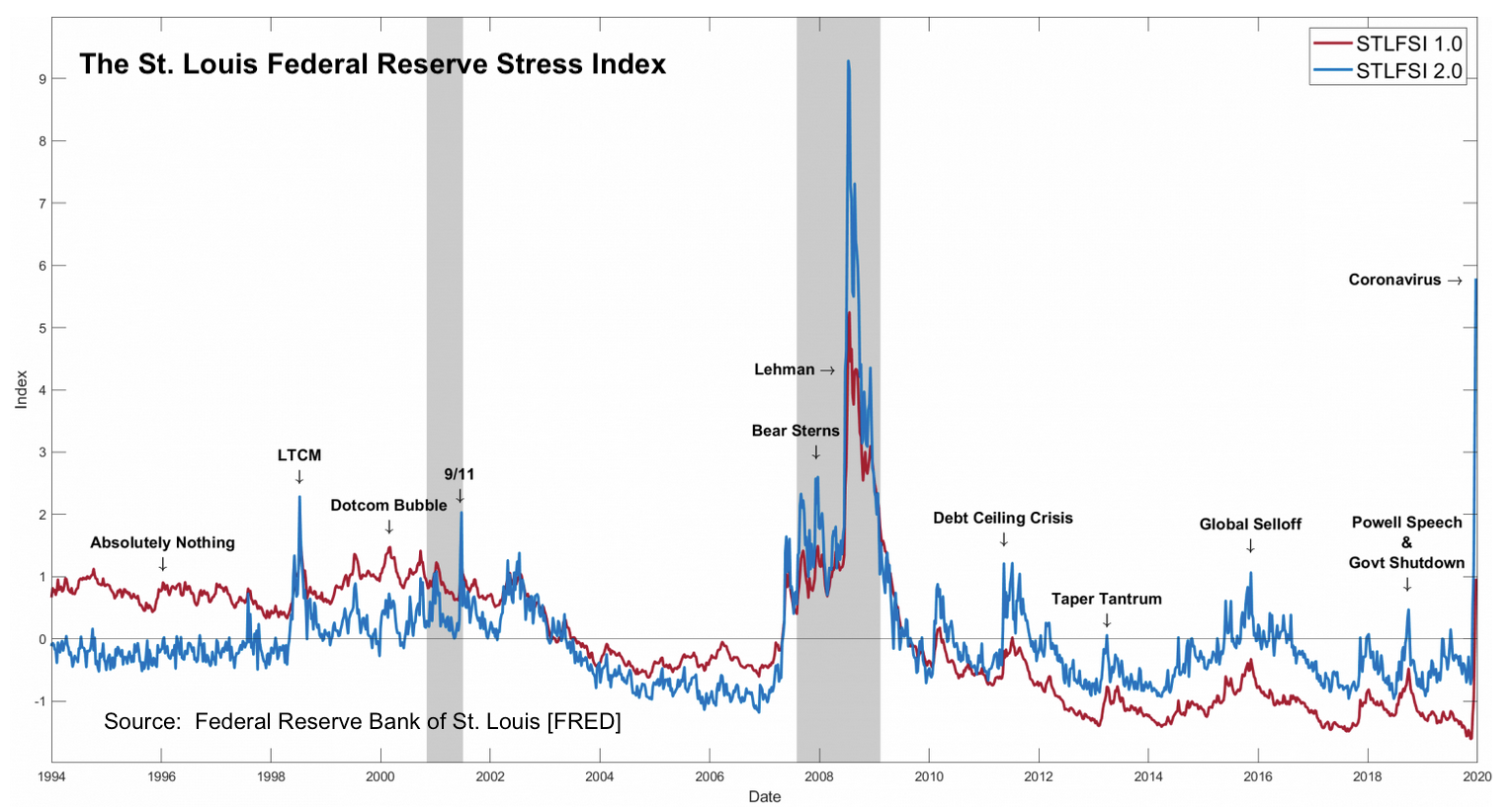

At the moment, as shown in the chart below, the level of stress in financial markets is at its highest point since the credit crisis of 2008. Keep in mind the current high reading is without the impetus of any financial institution or fund of consequence reporting serious difficulties and/or requesting a bailout. Note with that in mind the acceleration in the index after the Bear Stearns and Lehman failures in 2008.

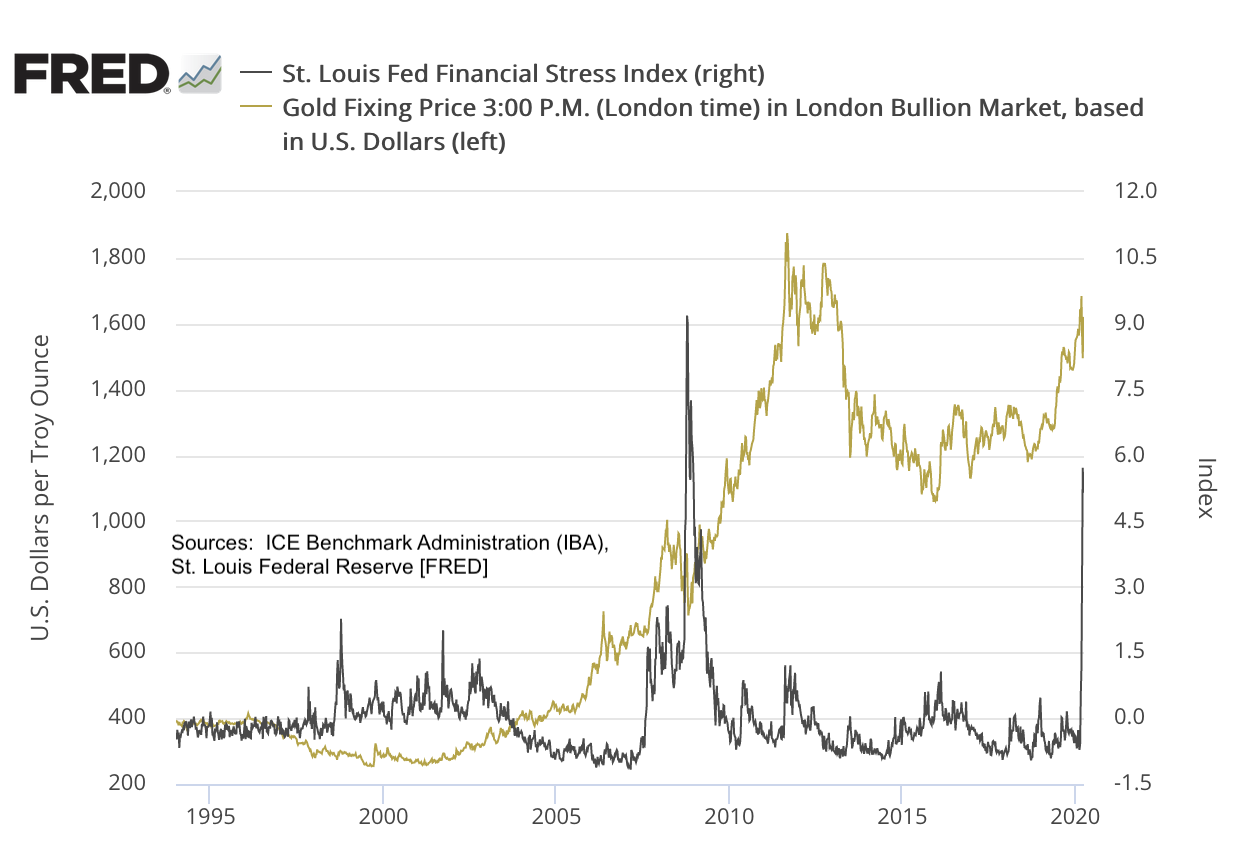

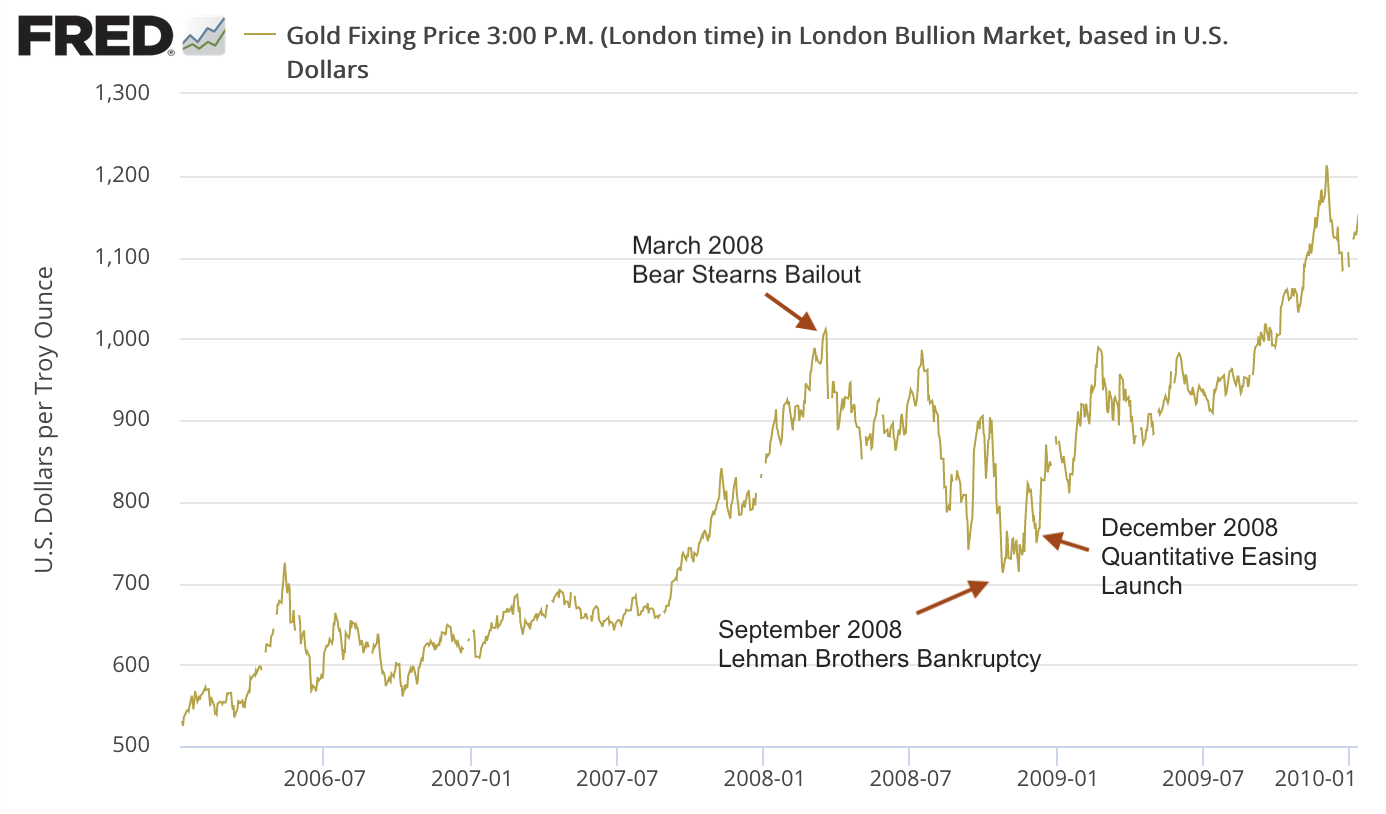

Below we have reconstructed the same chart only with the price of gold superimposed. As you can see, gold responds directly to stresses indicated in financial markets and that the effect can persist even after the initial threat dissipates. Gold ownership, in short, is a way to make one’s portfolio crisis ready on a permanent basis – a means to batten down the hatches against recurring financial storms and, for the minority who own it, an effective and ever-ready defense.

“If you look at the history of currency, gold has a unique role and I don’t think it’s accidental,” writes Rogoff in his latest book, The Curse of Cash which predates the coronavirus crisis. “Some people say that if gold hadn’t been selected as a currency thousands of years ago, it would not have a role today. I don’t agree. Gold has a lot of useful properties and unique features so I don’t think its status is in any way accidental. It’s a monetary asset and I think if you replayed history another way, you would come out with gold again.”

Please see Mapping the COVID-19 Recession by Kenneth Rogoff, Project Syndicate

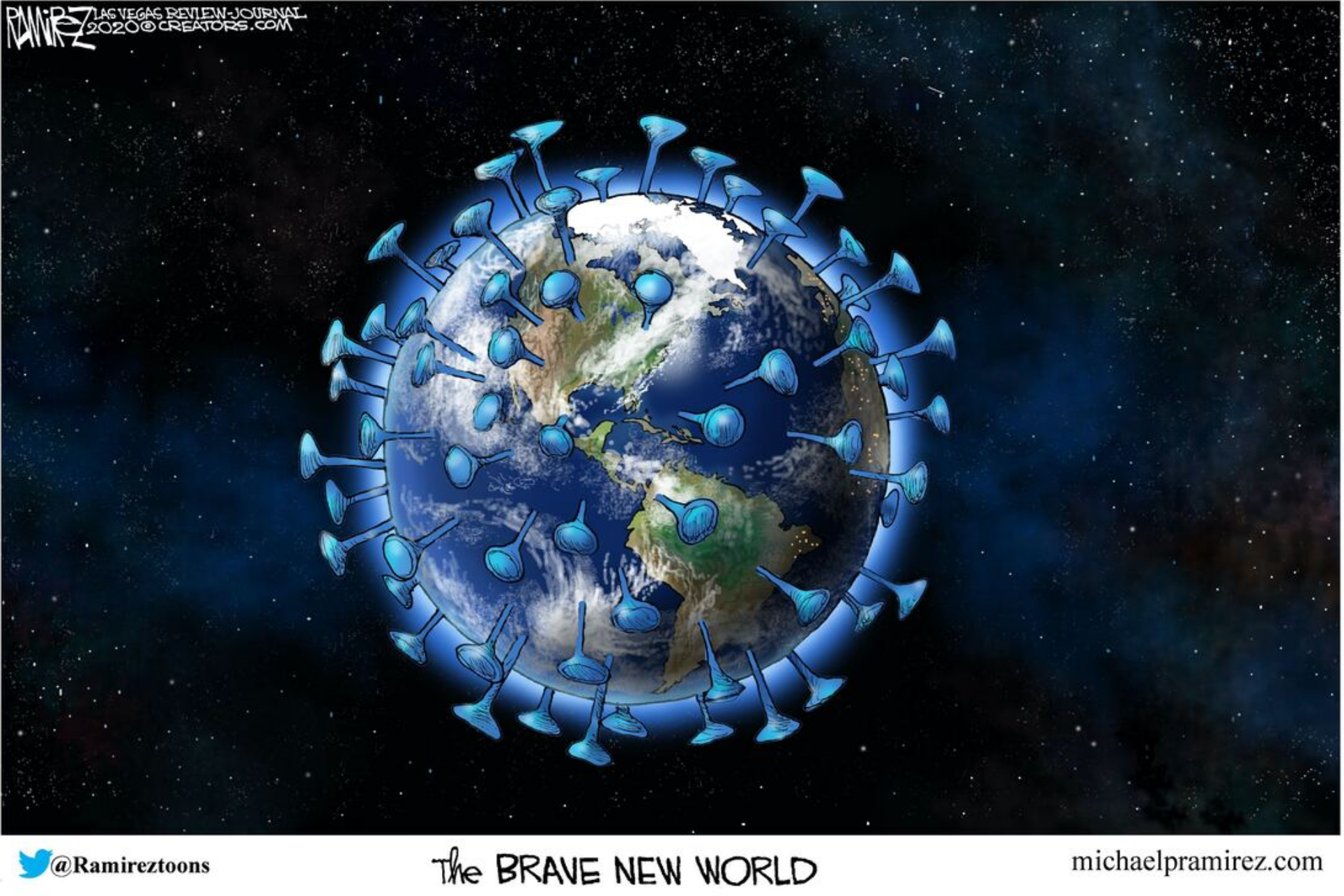

The coronavirus pandemic will forever alter the world order

Former Secretary of State Henry Kissinger says the world is in danger of “political and economic upheaval that could last for generations” as a result of the coronavirus pandemic and that this economic crisis is even more complex than the one that began in 2008. If global authorities – governments and, in this case, central banks – will be perceived as having failed, then what will be the knock-on effect in financial markets that have relied on their largesse for value over the past few decades – and particularly since 2008? The new normal may be in the process of being replaced by a “new” new normal. “When the COVID-19 pandemic is over,” says Kissinger, “many countries’ institutions will be perceived as having failed. Whether this judgement is objectively fair is irrelevant. The reality is the world will never be the same after the coronavirus.”

Cartoon courtesy of MichaelPRamirez.com

Gundlach sounds alarm on ‘paper gold’ ETFs raking in billions

DoubleLine Capital’s Jeffrey Gundlach raised the caution flag on gold ETF’s yesterday during an interview with Bloomberg. “While ETFs such as GLD are backed by physical gold,” reads the article, “the process for an individual investor to acquire the actual bullion isn’t as simple as selling shares of the ETF.” Calling ETFs “paper gold,” he goes on to ask “What happens if physical gold is in short supply and everyone wants to take delivery of their paper gold? They can’t squeeze blood out of a stone.”

Along these lines, ABN Amro recently informed holders of one of its bullion funds that the bank was exercising its option to close the fund and pay account holders in currency rather than the precious metal. About 2000 customers were told they no longer owned the gold they thought they did – a situation which illustrates with a high degree of clarity why it is important to take seriously the warnings of market experts like Mr. Gundlach.

We cannot help but note that ABN Amro’s closure of paper gold fund comes at a time when bullion is in short supply and owners of the fund are likely to have a stronger than average desire to take delivery of their positions. Investors of the fund, instead, were forced to sell at a time when it is very difficult to find replacement metal in the open market. There is another aphorism to go along with Gundlach’s allusion of squeezing blood from a stone: “A bird in the hand is worth two in the bush.”

‘Want to buy gold coins or bars? Good luck finding any’ ……

Unless you happen to be a client of USAGOLD

We first warned that the coronavirus could translate to a supply problem in the gold market in last month’s newsletter. “At the moment,” we wrote, “the supply lines in the precious metals business are still functioning smoothly. There could come a time, though, when they are not – a possibility, by the way, that has received scant attention in the context of the coronavirus contagion”.

That said, due to our long-standing relationships with key market-makers and our own inventory planning, we are still working from a strong inventory position and are able to deliver, as of publication date, most of the standard gold and silver bullion items – American Eagles, Canadian Maple Leafs and Krugerrands. Even our sources though are strained under the circumstances and our inventory, of course, is finite. We do not know, as a result, how long the supply will hold up. All deliveries are running on schedule with occasional minor delays due to the order and shipping volume, and we think you will find our pricing as advantageous when compared to most sources. The one thing we have no control over is rising premiums which, unfortunately, we have no choice but to pass along.

“First, if you can buy physical gold and silver, do so. Yes, you’ll have to pay significant premiums, if you can find anything. And yes, those premiums should decrease if/when the current supply disruptions abate. But gold and silver prices are headed much higher and should well overcome the current premiums. For the record, I’m buying bag silver now at considerable premiums over the spot price, so I’m putting my money where my mouth is on this.” – Brien Lundin, Gold Newsletter

APRIL SPECIAL OFFER

Dutch Trade Ducats

Minted 1814-1932

.1106 troy ounces, net fine gold content

1000 coins remain / 3500 already sold

Low premium, beautiful coins

First-come, first-served

Your interest is welcome! Ready to be shipped.

See details / Order online HERE.

Or please call 800-869-5115 x 100

Dr. Moneywise says: History teaches that under the crushing pressure of a financial meltdown gold hardens the portfolio, makes it more resilient!

Physical gold demand at record levels, paper gold price disconnects

“Given that international gold price discovery takes place on derivatives markets which have little or no connection to the physical gold market,” writes Bullion Star’s Ronan Manly, “and that the prices are merely blips on a screen (screen gold), we can, therefore, say that the gold price plunge last Friday was driven by trading in these markets, led by the COMEX, and also that the gold price fall last Friday was unconnected to the physical gold market.”

“While the mainstream financial press will never question gold price discovery or the difference between screen gold and physical gold,” he goes on, “they do predictably try to come up with reasons to explain price movements. Unfortunately, most of these reasons are often not based on anything other than off-the-cuff the remarks of stockbrokers, trading desks, and buy side investment bank analysts. Unfortunately also, by not explicitly distinguishing between prices derived in an electronic casino and the real physical safe haven asset of tangible gold, the reasons provided by these reporters will fall into the trap of jumbling up two different things.”

Editor note 1: The tail wags the dog and quite often, as the cartoon above suggests, to the surprise of the dog or, better put, to the surprise of the dog’s owners. In this piece, Manly makes a distinction between the price “taker” (physical gold) and the price “maker” (the paper gold markets). That dichotomy has been the centerpiece discussion in the gold market for the past quarter-century. Though a source of great frustration to speculators in the short run, big price drops like the one we had this past Friday create opportunities for knowledgeable, strong-handed buyers to accumulate physical metal. Asia comes to mind. So do American professional money managers who have joined them in loading up on the dips.

Editor note 2: Sooner or later, demand for the physical metal translates to the paper markets, even if cause and effect do not always match-up precisely on the timeline. If that were not the case, the price of gold would still be at $35 per ounce and physical supplies would have disappeared from the face of the earth long ago.

With thanks to Ronan Manly, Bullion Star, Singapore

Annotated Gold Chart

2008-2009 – The first years of the financial crisis

Chart courtesy of the St. Louis Federal Reserve [FRED]

Source: ICE Benchmark Administration (IBA)

Annotations by USAGOLD

– Presented without comment –