NEWS &VIEWS

Forecasts, Commentary & Analysis on the Economy and Precious Metals

Celebrating our 47h year in the gold business

JUNE 2020

‘A mirror image of the early 1980s’

“To propose a return of inflation is to be inflammatory,” writes Lightman Investment Management’s Rob Burnett in an opinion piece for the Financial Times. “Investors are committed to a deflationary thesis — and such is their fervor that many believe inflation cannot return in any circumstance. Yet if we look beyond today’s demand shock from the Covid-19 crisis, the forces driving the disinflation of the past 40 years appear to be in retreat. … [T]oday appears like a mirror image of the early 1980s. We have moved from inflation peak to deflation trough.”

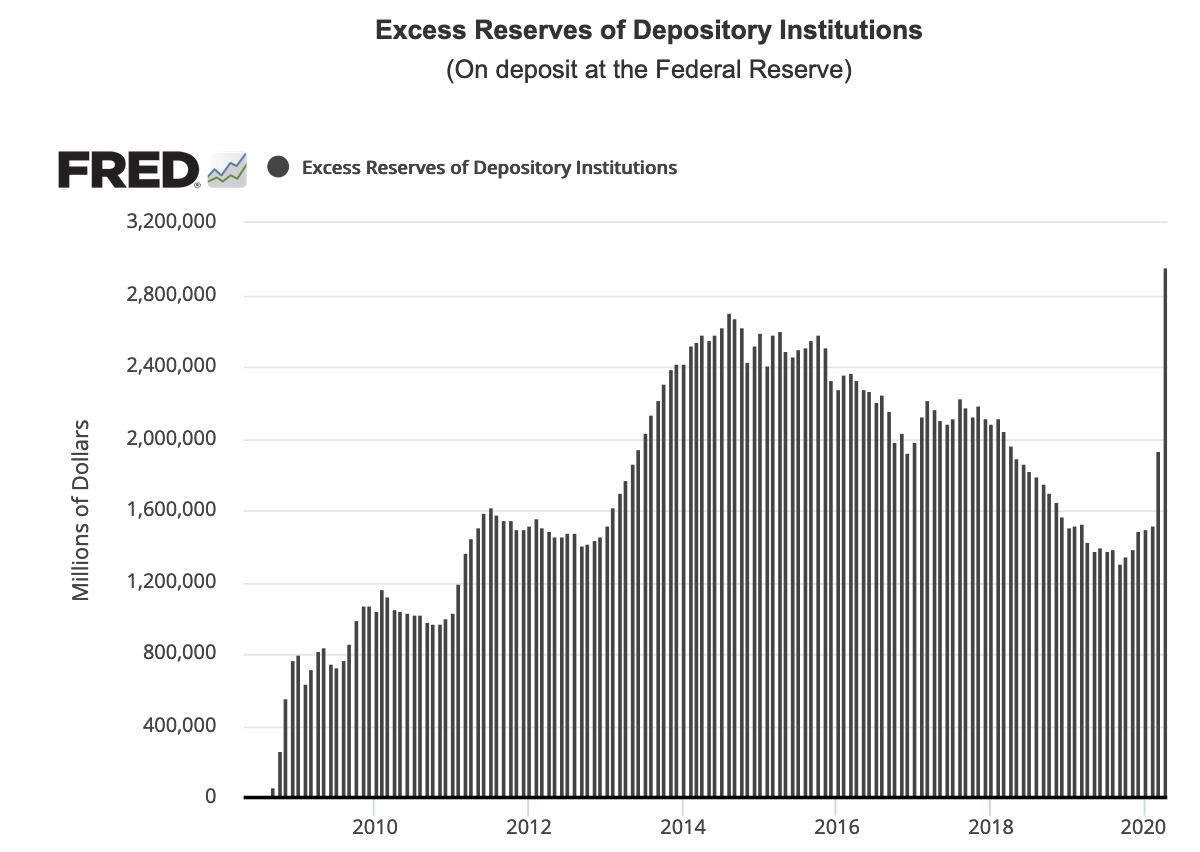

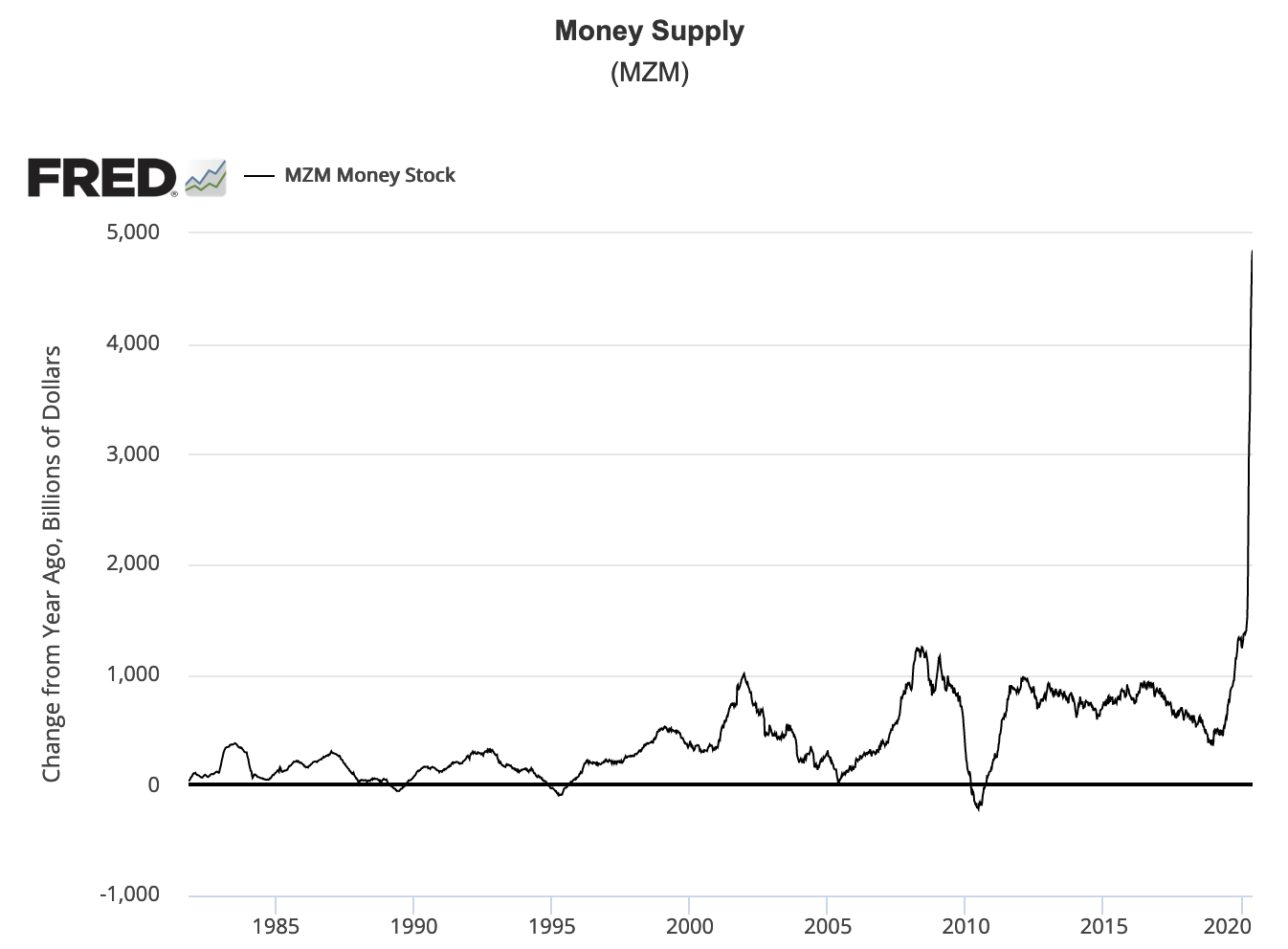

Evidence is beginning to mount that the new paradigm Burnett describes – moving from disinflation to inflation – might not be too far off the mark. During the financial crisis that began in 2008, the Fed sterilized its money creation by routing money back to its coffers in the form of commercial bank excess reserves – a strategy that kept the inflation rate from running out of control. As you can see in the first chart, the current level of sterilization, at least in the short term, is greater than what occurred in the 2008-2014 period. At the same time, as you can see in the second chart, the rapid growth in the money supply this time around goes beyond anything that occurred during the prior crisis. Whether or not Burnett is correct and the growth in the money supply translates to price inflation down the road remains to be seen. (Please take note that the growth in the money supply began roughly a year ago – well before the onslaught of the coronavirus pandemic.)

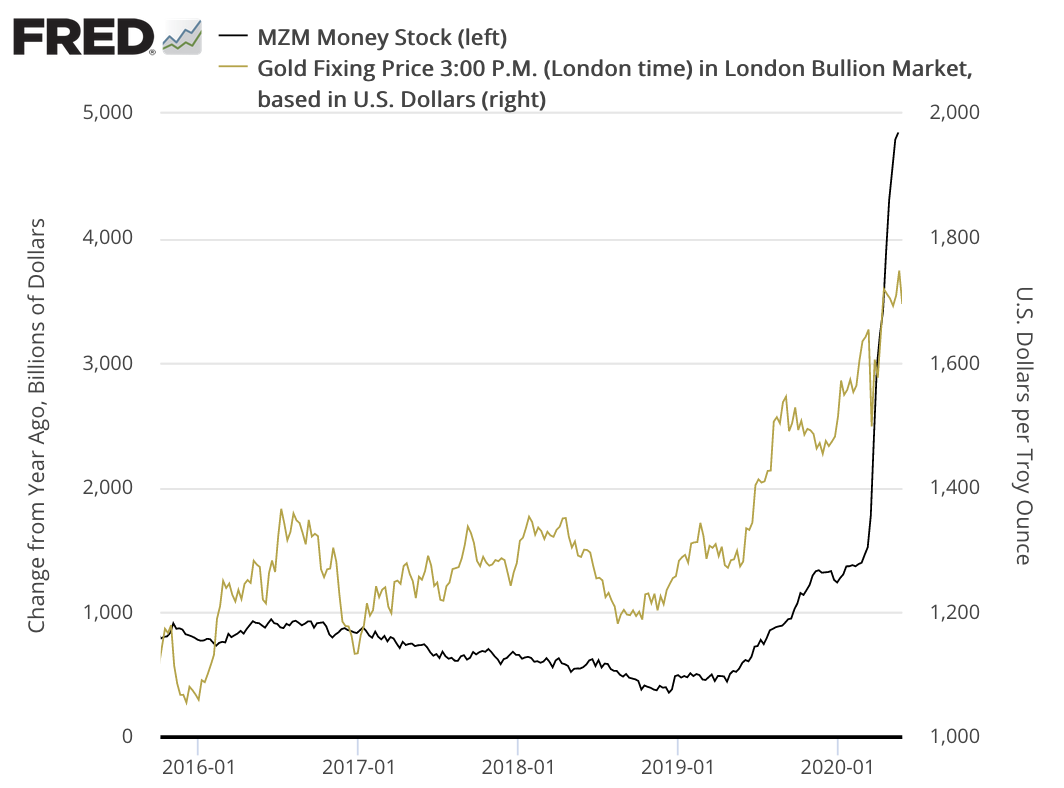

To understand what gold’s role might be in a historical shift of this magnitude, we turn to Atlantic House Fund Management’s Charlie Morris. “The point,” he says in a report published recently in The Alchemist quarterly review, “is that there is a rational framework from which you can understand the dynamics of the gold market. Owning gold does not mean you have to fly blind. The current gold premium is telling us that higher inflation is coming. The implications for asset classes are immense. Higher inflation implies a weaker dollar, which implies higher commodity prices and a surge in emerging market equities. It will make bonds unattractive and potentially drive down equity valuations in the developed world. The last time we saw this was in the 1970s. Those that thrived owned gold.”

The third chart in our grouping supports Morris’ thesis. Since late 2019, gold and the money supply have risen in tandem hinting that perhaps the inflation genie might yet escape the bottle.

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis

Source: Federal Reserve Bank of St. Louis, ICE Benchmark Administration (IBA)