Monthly Archives: February 2024

Today’s top gold news and opinion

2/14/2024

The Myth of the Unchanging Value of Gold (Mises)

“They use gold as a measuring rod to keep the value of money stable. Why? Because the yellow metal keeps its intrinsic value better than anything on the planet.”

Gold slides below $2,000/oz for first time in two months after US inflation data (Reuters)

Traders bet Fed will not cut rates until June

Tokenization of Gold (Rooba.Finance)

Blockchain technology emerges as a game-changer, simplifying processes, reducing formalities, and ensuring the secure recording of investment data.

Daily Gold Market Report

US Inflation Challenges Persist:

But Gold Prices Fall Below $2000/oz!?

(USAGOLD – 2/14/2024) Gold prices have continued to decline due to continued selling pressure following significant losses on Tuesday, triggered by the release of a higher-than-expected U.S. inflation report. Gold is trading at $1990.83, down $2.32. Silver is trading at $22.12, up 1 cent. Both headline and core inflation rates for January exceeded expectations, with significant increases in services, particularly in medical care and insurance costs. Despite a decrease in energy prices, food and dining out remain expensive, with notable price jumps in full service and quick service meals. Rent and owner-equivalent rent prices continue to rise, along with auto insurance and travel costs, indicating that inflation is not easing as quickly as hoped. Core goods prices are showing signs of deflation, with notable drops in used car prices. Achieving a 2% inflation target is challenging, with various sectors experiencing different rates of price changes. Treasury yields are increasing, with the 10-year yield expected to test 5% again this year, reflecting a decrease in expectations for Federal Reserve rate cuts.

Today’s top gold news and opinion

2/13/2024

Gold Monthly: Assessing Fed policy and geopolitical risks (ING)

Gold has been trading in a narrow range so far this year amid a lack of clarity surrounding the timing of the US Federal Reserve’s monetary policy easing cycle.

Year of the Dragon: ‘dragon baby’ frenzy to drive up gold jewellery sales by 30%, gold prices to hit record highs, industry players say (SCMP)

“Gold jewellery sales are expected to increase by at least 30 per cent in the Year of the Dragon because of the “dragon baby” rush and gold prices are expected to hit record highs”

Silver Set To Rise To $30 This Year, But Where Is Momentum? (Investing Haven)

A recent research on the physical silver market revealed a growing supply deficit, suggesting a silver price of $30 in 2024.

Daily Gold Market Report

Economic Crossroads:

The US’s Path to Preserving its Living Standards

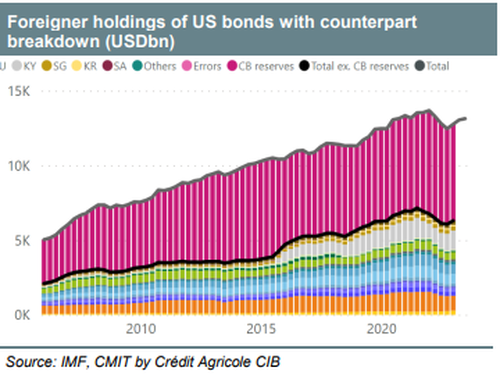

(USAGOLD – 2/13/2024) Gold and silver prices are lower, following a higher-than-expected U.S. inflation report. The still-high core CPI puts Fed May rate-cut hopes in doubt. Gold is trading at $2000.63, down $19.42. Silver is trading at $22.30, down 40 cents. In a recent podcast, VBL of GoldFix outlines the precarious position of the U.S. economy due to its reliance on external financing through U.S. Treasuries to sustain its standard of living. It explores the necessity of nationalizing foreign-held debt and enticing foreign investment with alternatives to U.S. Treasuries to maintain economic stability. He discusses the diminishing global appetite for U.S. Treasuries due to various factors, including geopolitical tensions and the need for countries to invest domestically. Valentin Giust Global Macro Strategist of Credit Agricole, also warns, “The US features a large Capital Accounts deficit, driven by a structural trade deficit [We spend too much] and despite a positive income balance. In other words, the US is structurally living beyond its means.”

Today’s top gold news and opinion

2/12/2024

Asia Gold India flips to premium, Lunar New Year sparks buying in other hubs (Reuters)

China premiums at $36-$48/oz range this week

BRICS: 159 Countries Eyeing Russia’s New Payment System (Watcher Guru)

“Russia has a System for Transmitting Financial Messages (SPFS), which is an alternative to SWIFT. Similar infrastructure exists in some other countries. We are holding discussions on the interaction of such platforms, but here the interest and technical readiness of our partners are important”

Tech companies axe 34,000 jobs since start of year in pivot to AI (FT)

Microsoft, eBay and PayPal have each cut thousands of jobs since the start of the year

Daily Gold Market Report

Unrealistic Optimism:

A Critical Look at CBO’s Economic Projections

(USAGOLD – 2/12/2024) Gold prices are modestly down and silver prices solidly up in early trading Monday. Gold is trading at $2018.79, down $5.47. Silver is trading at $22.79, up 17 cents. The latest Congressional Budget Office (CBO) projections are overly optimistic, even deeming them unrealistic in light of the current economic challenges. The CBO’s forecasts rely on assumptions that appear disconnected from reality, such as an unemployment rate peaking at 4.4%, inflation reducing to 2% and falling further within five years, 200 basis points of interest rate cuts in the next 10 months, and a continuous influx of immigration contributing $7 trillion to GDP. These projections overlook critical factors like the actual unemployment rate being higher when accounting for those not in the labor force, the unrealistic expectations of no recessions, and the overlooked impacts of government borrowing on interest rates. These projections may misguide fiscal and monetary policies, suggesting that savvy investors and the public should prepare for a less optimistic economic future. The expectation of no recessions and the disregard for ongoing financial crises, suggests a need for more realistic fiscal and monetary policies.

Daily Gold Market Report

China’s Economic Slowdown:

A Catalyst for Global Deflationary Trends

(USAGOLD – 2/08/2024) Gold prices experienced a slight decline in subdued early trading on Friday, as the unexpected news of deflation from China continued to exert downward pressure on the metals markets, concluding the trading week on a bearish note. Gold is trading at $2027.74, down $6.78. Silver is trading at $22.57, down 1 cent. As China’s economy slows, global investors anticipate that falling prices within the country will contribute to lower inflation rates worldwide due to excess capacity prompting Chinese exporters to reduce prices on international goods. This trend reported by Financial Times, marking the fastest decline in Chinese export prices since the 2008 financial crisis, signals potential deflationary pressures exported from the world’s largest exporter. China experienced its fastest annual drop in consumer prices in 15 years and a decrease in its producer price index, with significant implications expected for emerging markets closely tied to Chinese trade. Some analysts predict this could lead central banks in these markets to cut interest rates. Despite varying opinions on the impact of Chinese deflation on global prices, the situation highlights concerns over unfair competition for Western manufacturers and the strategic choices facing countries regarding their reliance on Chinese imports amidst potential trade protectionism.

Today’s top gold news and opinion

2/092024

Digging into the Future: The Role of Precious Metals and Sustainable Industry Practices (NASDAQ)

Nornickel has engineered a prototype that has created quite a buzz: It’s a catalyst – a substance that can speed up chemical reactions without getting used up. The catalyst is based on palladium.

Palladium price drops below platinum for the first time since 2018 (Reuters)

Palladium demand hugely driven by the auto sector. Auto industry has been replacing palladium with cheaper platinum.

Perth Mint’s gold sales hit nearly four-year low in January, silver sales up (NASDAQ)

Sales of silver products last month stood at 769,326 ounces, their highest level since October 2023, but were still down 38% year-on-year.

Daily Gold Market Report

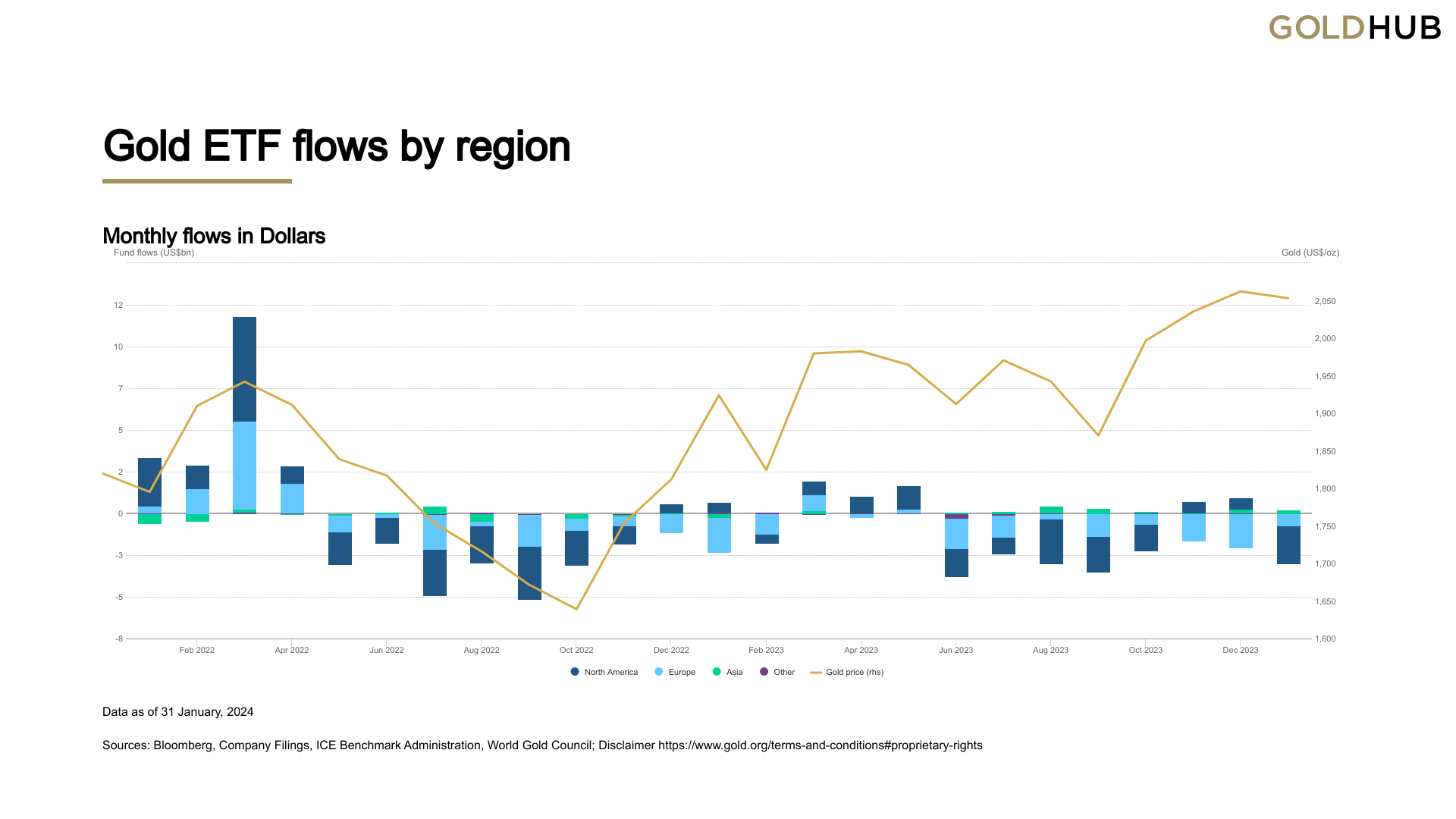

Mixed Fortunes for Gold ETFs:

North America and Europe See Declines, Asia Invests More

(USAGOLD – 2/08/2024) The gold market is facing ongoing challenges due to persistent selling pressure, as there has been little to no change in the U.S. labor market activities compared to last week. Gold is trading at $2033.67, down $1.69. Silver is trading at $22.53, up 31 cents. In January 2024, global gold-backed ETFs saw a significant outflow of 51 tonnes, marking the eighth consecutive month of net redemptions, predominantly in North America, as reported by the World Gold Council. This outflow amounted to a $2.8 billion reduction in value, decreasing the total gold ETF holdings to 3,175 tonnes and assets under administration to $210 billion. The decline was primarily attributed to a market pushback against early central bank rate cuts, which led to a decrease in gold prices and dimmed investor interest in gold ETFs. North American ETF holdings notably dropped to a four-year low, with a 36-tonne decrease to 1,606 tonnes, while European ETFs also experienced a decline, and Asian ETFs saw a modest increase in investor interest due to a demand for safe-haven assets amidst a fall in local equities and a weaker currency.

Today’s top gold news and opinion

2/08/2024

Treasury secretary won’t say whether dept surveils Americans’ purchases: ‘Concerning’ (National Desk)

“Increasingly, we are hearing the federal government is suggesting banks search private financial transactions using highly partisan political terms or check to see if customers made purchases that could be associated with legal sales of firearms or even religious texts,” Rep. Wagner remarked.

Gold sales boom before Spring Festival despite price hike (China Daily)

In the Xi’an Tumen branch of China Minsheng Bank, sales of gold bars increased by 50 percent in January 2024 compared with the monthly average of the second half of 2023.

MAS third-largest buyer of gold globally in 2023 (CNA)

Singapore’s central bank is the third-largest buyer of gold globally last year, adding more than 77 tonnes of the yellow metal to its reserves.

Today’s top gold news and opinion

2/07/2024

Silver set for a ‘terrific year’ and could outperform gold to hit a 10-year high (CNBC)

Global silver demand is forecast to reach 1.2 billion ounces in 2024, which would mark the second-highest level on record…

Gold and silver turn defensive on reduced Fed rate-cut optimism (Saxo)

During the past week, the short-term rates market has gone from pricing in more than six 25 basis points US rate cuts this year to less than five.

Correlation Breakdown x 3 in Gold (Bullion Vault)

Over the 20 years to 2023, gold prices rose in 14 Januarys

Daily Gold Market Report

Advocating for Silver’s Recognition:

A Call to Classify it as a Critical Mineral in Canada

(USAGOLD – 2/07/2024) Gold prices are holding steady in early trading on Wednesday, with no new fundamental developments to significantly influence the markets. Gold is trading at $2036.80, up 66 cents. Silver is trading at $22.36, down 6 cents. In a recent open letter, signed by executives from Canadian and international silver mining companies, advocates for the recognition of silver as a critical mineral in Canada. It outlines silver’s historical significance, its resurgence due to demand in electronics and renewable energy, and its vital role in the transition to a low-carbon economy including nuclear energy:

Today’s top gold news and opinion

2/06/2024

Gold still set for all-time highs once this ‘tailwind’ kicks in, analysts say (Market Watch)

Yellow metal pulls back to one-week low as dollar strengthens

13 Reasons Why A Recession Is (Still) Around The Corner (Forbes)

“There’s no way you could read that Beige Book and not come to the conclusion that the economy isn’t already starting a recession”

Chinese investors buy gold as property and stock markets fall (FT)

‘Blistering’ demand from central banks also helps keep yellow metal above $2,000 per troy ounce

Daily Gold Market Report

China’s Golden Refuge:

Households Turn to Precious Metal Amid Property and Stock Market Woes

(USAGOLD – 2/06/2024) Gold prices are holding steady in early trading on Tuesday, with no significant new developments to influence daily price movements. Gold is trading at $2028.51, up $3.40. Silver is trading at $22.32, down 4 cents. In the face of a declining residential property market and failing developers like Evergrande, Chinese households are turning to gold as a safer investment option, marking a significant shift in their saving and investment strategies. The property bust and falling stock prices, exemplified by the Shanghai CSI 300 index’s near five-year lows (down 30% YTD), have eroded confidence in traditional investment avenues. With low yields on deposits and government bonds, gold has emerged as an attractive alternative. The increase in savings among Chinese households, now preferring to save rather than invest, has led to a surge in gold purchases, including jewellery, bars, and ETFs. This trend is bolstered by the People’s Bank of China’s steady gold buying, weak local asset markets, and a global political climate fostering uncertainty. Despite China being the world’s largest producer and consumer of gold, the persistent premium of Shanghai gold prices over international benchmarks and a spike in gold imports highlight a growing demand and a potential shift towards gold as a protective investment against asset deflation and economic instability in China.

Today’s top gold news and opinion

2/05/2024

Gold prices to hit $2,200 and a ‘dramatic’ outperformance awaits silver in 2024, says UBS (CNBC)

As interest rates dip, gold becomes more appealing compared to alternative investments like bonds.

A truly disruptive idea’: should we keep gold in the ground? (The Guardian)

There is enough gold in circulation today that we could stop targeted industrial gold mining and it would not affect the supply we need for its practical applications.

FBI warns of in-person precious metals scam (WTXL Tallahassee)

The scammers reportedly pose as U.S. government officials or tech support, claiming a person’s account has been hacked.

Daily Gold Market Report

The Fed’s Policy Shift:

A Death Knell for Small Banks?

(USAGOLD – 2/05/2024) Gold and silver prices are sharply lower in early trading Monday, as most markets are bearish including a significant drop in the Chinese stock market. Gold is trading at $2017.39, down $22.37. Silver is trading at $22.37, down 32 cents. FX Hedge recently critiqued the Federal Reserve’s decision to impose an interest rate floor on the Bank Term Funding Program (BTFP) loans, equal to the interest rate on reserves. This move, intended to curb arbitrage that favored big banks, has inadvertently placed regional banks in jeopardy by increasing their borrowing costs and potentially leading to insolvency due to their reliance on the BTFP for credit. The piece argues that this policy change disadvantages small banks, exacerbates existing financial vulnerabilities, and may drive them into the arms of larger banks, effectively consolidating financial power.

Just last week, the stock of New York Community Bank, which took over the failed Signature Bank last year, plunged by 40% following its earnings report. Contrary to the anticipated profit of $260 million, the bank disclosed a loss of the same amount for the fourth quarter. Several smaller banks are significantly exposed to commercial real estate loans. Should defaults on these CRE projects persist, it might lead to increased stress on the banking sector.

Daily Gold Market Report

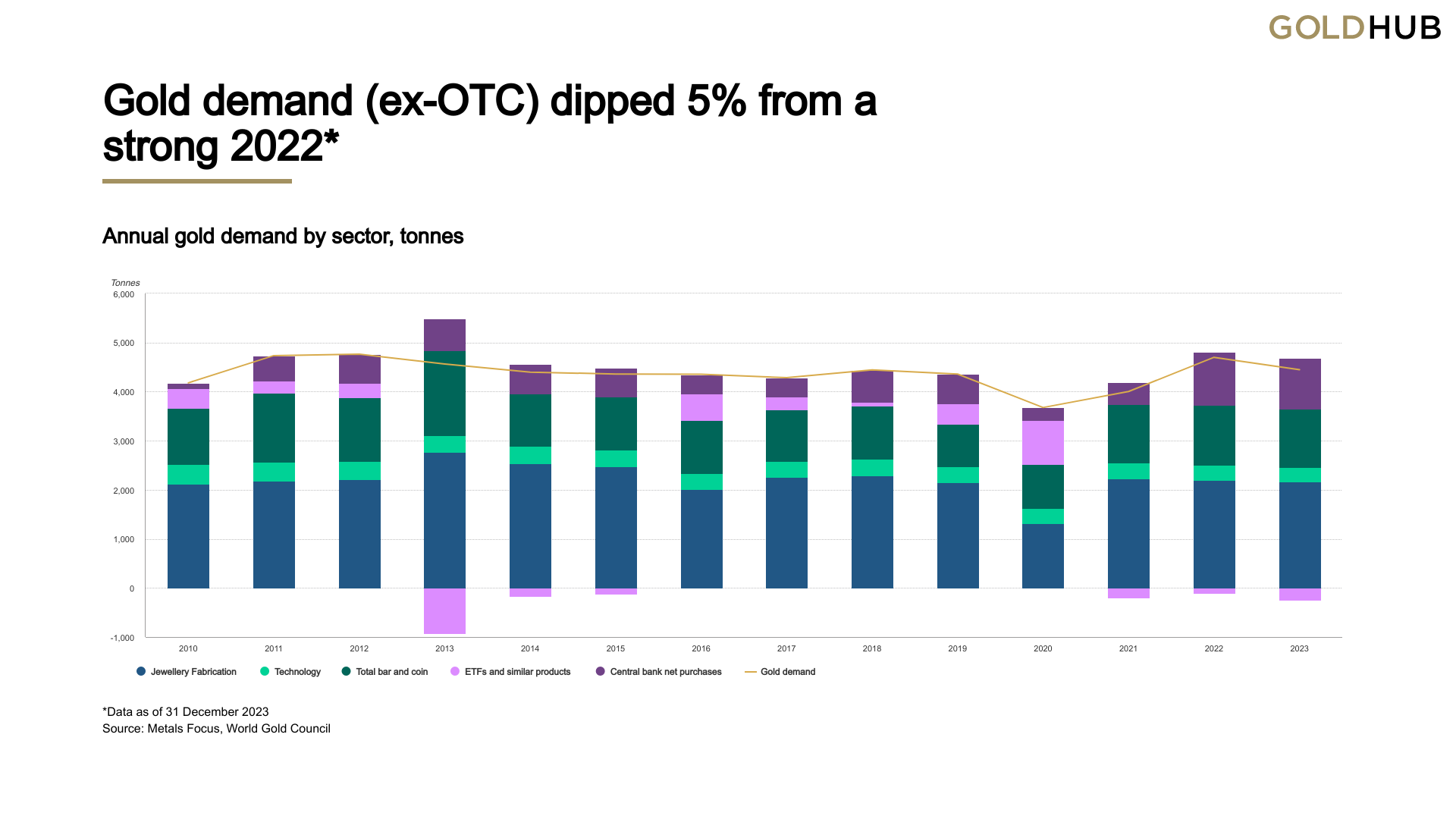

Gold Market Review 2023:

Surge in Demand, Record Prices, and Central Bank Influence

(USAGOLD – 2/02/2024) Gold and silver prices are sharply lower in early trading Friday, after strong U.S. jobs data shows solid gains. Gold is trading at $2031.90, down $23.09. Silver is trading at $22.57, down 61 cents. The World Gold Council reports that in 2023, total gold demand reached a record high of 4,899t, driven by strong central bank buying, steady jewelry consumption, and significant OTC and stock flows, despite a 5% decrease from 2022’s demand and substantial ETF outflows. Central banks nearly matched their 2022 record purchases, with annual net purchases of 1,037t. Global gold ETFs experienced a third year of net outflows, losing 244t, while annual bar and coin investment slightly contracted. Jewelry consumption remained robust at 2,093t, supported by China’s recovery, even amid high gold prices. However, the use of gold in technology fell below 300t for the first time. The LBMA gold price closed 2023 at a record high of US$2,078.4/oz, reflecting a 15% annual return and an 8% increase over the 2022 average price. Q4 gold demand was 8% above the five-year average but 12% lower year-over-year compared to Q4’22. Overall, annual mine production increased slightly, while recycling rose due to high gold prices, leading to a 3% increase in total gold supply.

Today’s top gold news and opinion

2/02/2024

2024 Precious Metals Forecast Survey (LBMA)

Analysts reveal their insights behind their forecasts for highs, lows, and average prices for gold, silver, platinum and palladium.

Gold Outlook to Q4 2024: From one high to the next (Wisdomtree)

Looking at economists’ median expectations for 2024, the first rate cuts are likely to be delivered in Q2 2024 and we could see a total of 100 bps reduction by the year end

China gold purchases soar 30% on economic anxiety (Nikkei)

The People’s Bank of China’s 2023 net purchases totaled 225 tonnes, the highest since 1977..

Daily Gold Market Report

Fed Chair Powell Signals Caution:

No Immediate Rate Cuts Despite Inflation Ease

(USAGOLD – 2/01/2024) Gold prices have dipped slightly in Thursday’s early trading session, following outcomes from the recent Federal Reserve’s FOMC meeting, which leaned towards a more hawkish stance on U.S. monetary policy. Gold is trading at $2049.71, up $10.19. Silver is trading at $22.94, down 2 cents. The Federal Reserve decided to maintain the current interest rate range and signaled a cautious approach towards future rate cuts at thier policy meeting yesterday. Jerome Powell emphasized the need for more data to confirm a sustained downward trend in inflation before considering a rate reduction, particularly ruling out a cut in March. Despite a favorable pullback in inflation and a still-solid economy, Powell and the Federal Open Market Committee (FOMC) showed reluctance to quickly lower rates. The FOMC unanimously voted to keep the benchmark rate at a 22-year high of 5.25%-5.5% for the fourth consecutive meeting, removing a previous reference to further policy “firming”. Market expectations for a March rate cut decreased following Powell’s comments, affecting the S&P 500 and Treasury yields. Powell also addressed concerns about premature rate cuts and reiterated the Fed’s commitment to a gradual approach, waiting for clearer signs of inflation moving sustainably toward the 2% target. The article also notes concerns about an upcoming revision to inflation figures and the Fed’s ongoing asset portfolio reduction. Powell indicated that discussions about the balance sheet would begin in March, with decisions expected by mid-year.

USAGOLD Comment: Gold prices briefly shot up to $2050/oz during the meeting but have since faded. Gold is suspected to remain rangebound until the Fed ultimately decides to cut rates.

Today’s top gold news and opinion

2/01/2024

Gold: Can the UAE outshine Switzerland? (Swiss Info)

While Switzerland offers a well-established financial system and an orderly, regulated market, the UAE provides a dynamic and forward-looking environment with a strong emphasis on innovation

Metals Sanctions Are Dividing the Biggest Traders and Banks (Bloomberg)

Russian aluminum now accounts for more than 90% of the live metal inventories for LME

Pundi X and Scoin Collaborate to Integrate Pax Gold (PAXG) from Paxos on XPOS, Facilitating Seamless Purchasing and Transition Between Physical and Digital Gold in the South African market (EQS News)

Users now have the unprecedented ability to effortlessly transition between the digital representation of gold and tangible gold coins on the XPOS platform